Alvora

- Experts

- ALGOECLIPSE LTD

- Version: 1.0

- Activations: 5

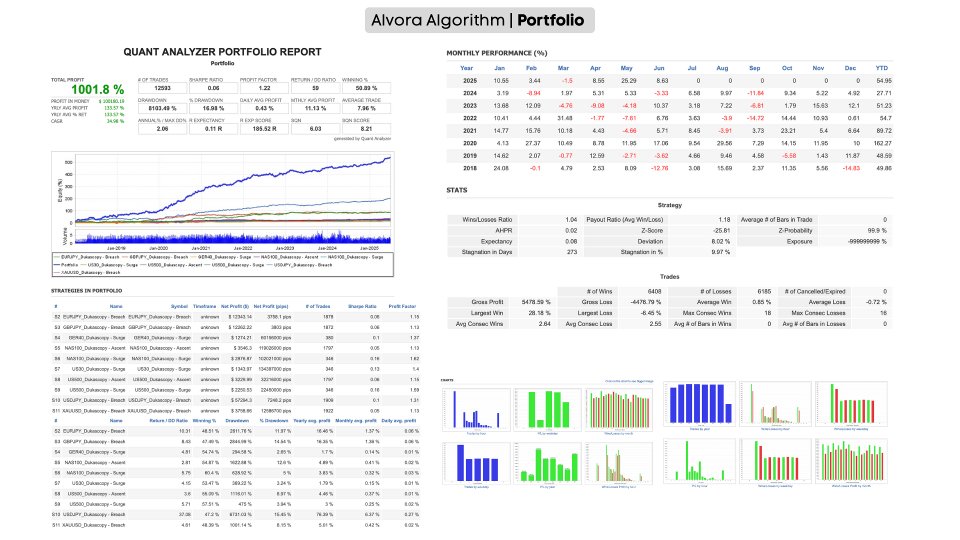

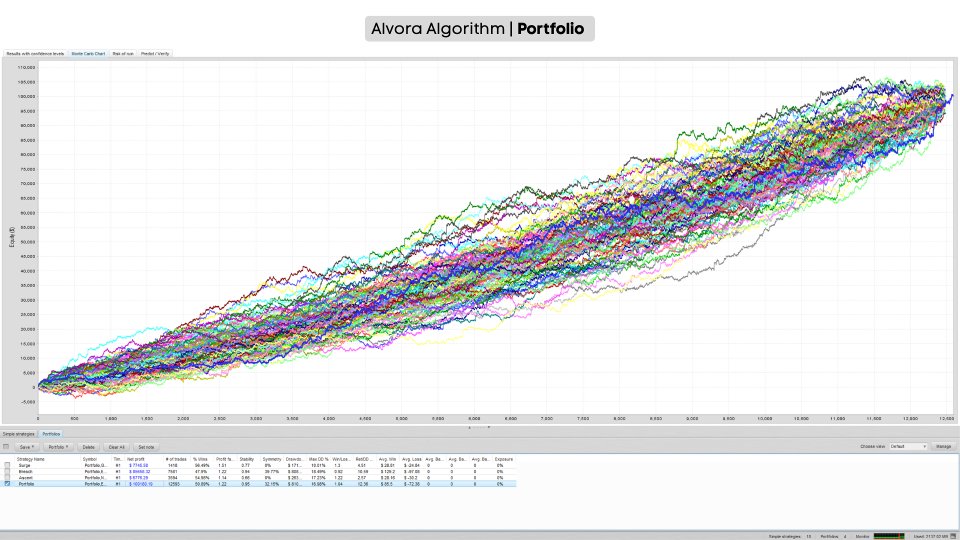

Alvora Algorithm is a portfolio-style trading system built for traders who value structure, clarity, and long-term consistency. It applies proven rule-based strategies, originally traded manually and later automated for efficiency and scalability.

View Signal: Darwinex 100K Account

The Expert Advisor combines three complementary strategies, each designed to perform in different market conditions:

-

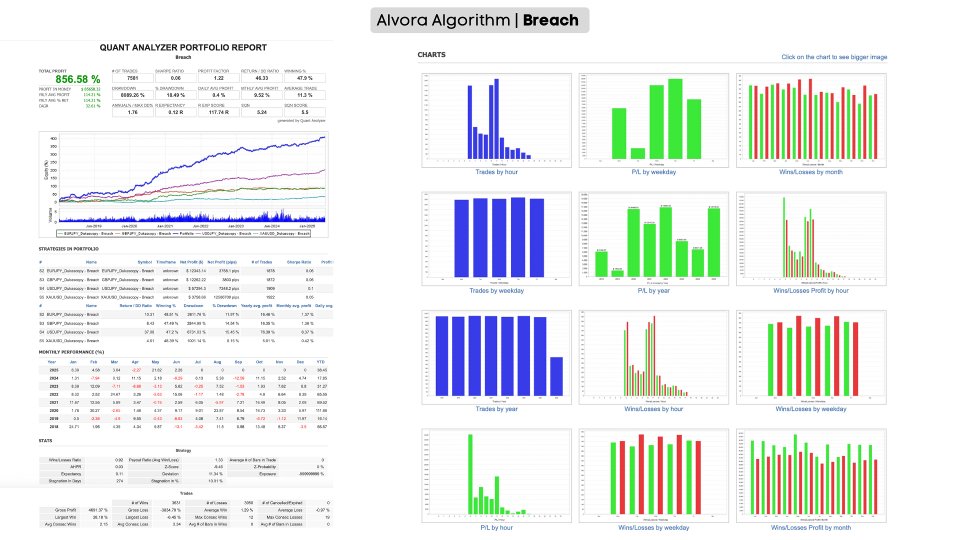

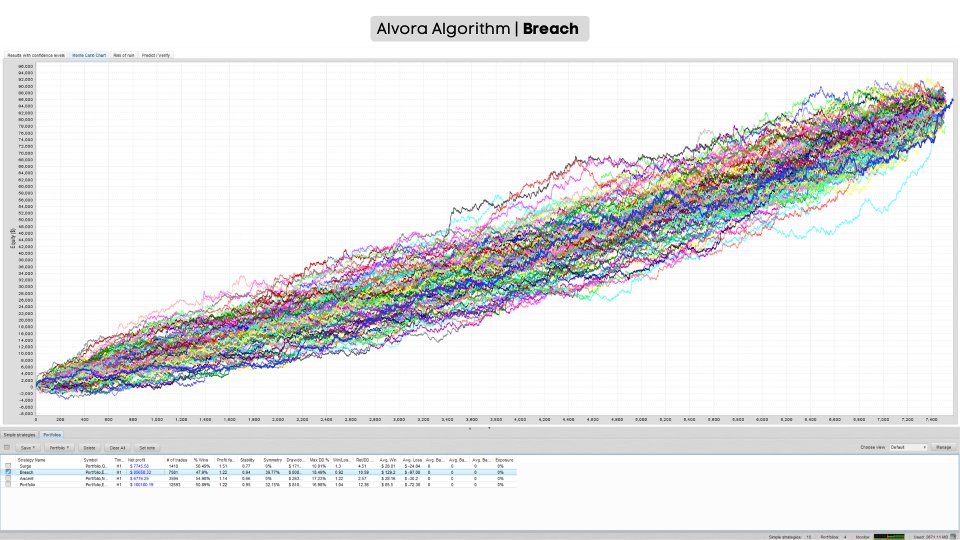

Strategy 1: Breach – Targets breakouts from consolidation zones, capturing momentum as markets move out of tight ranges.

-

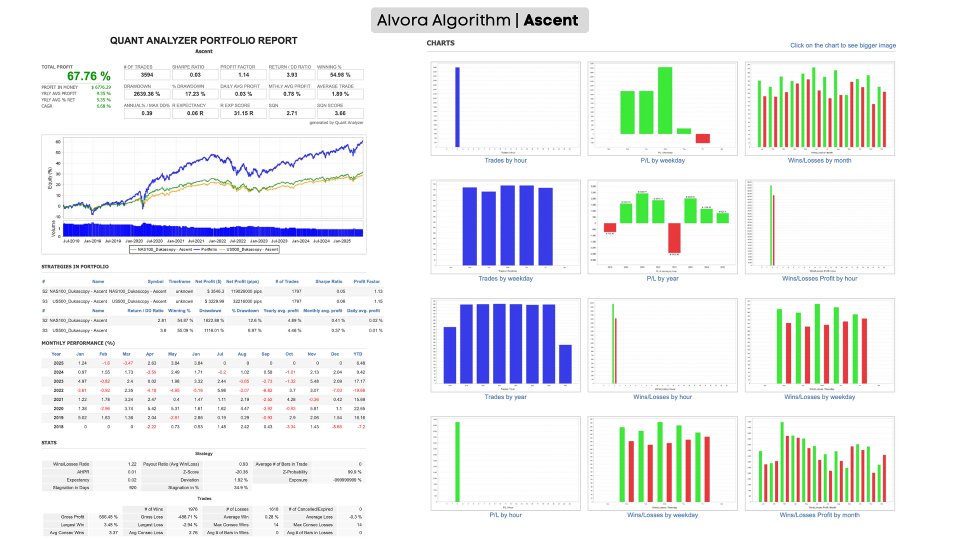

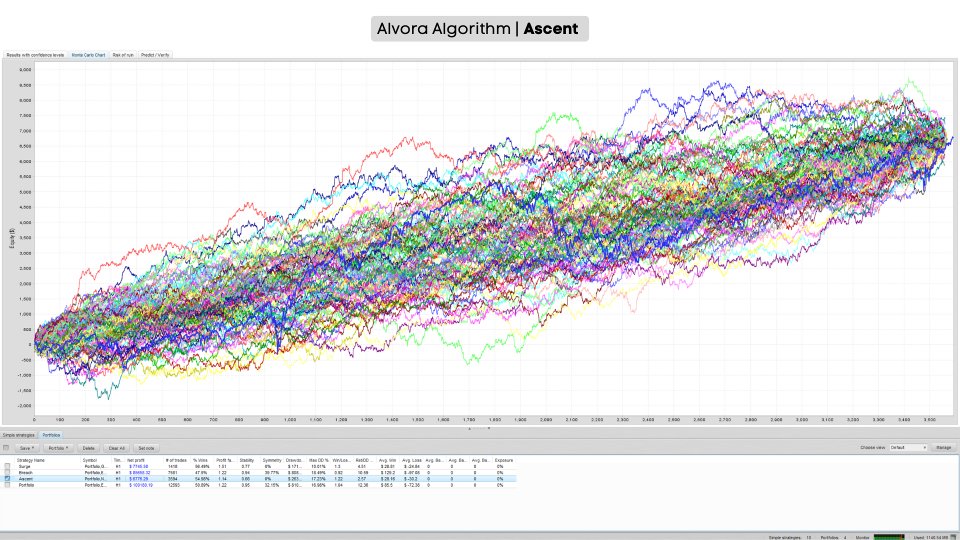

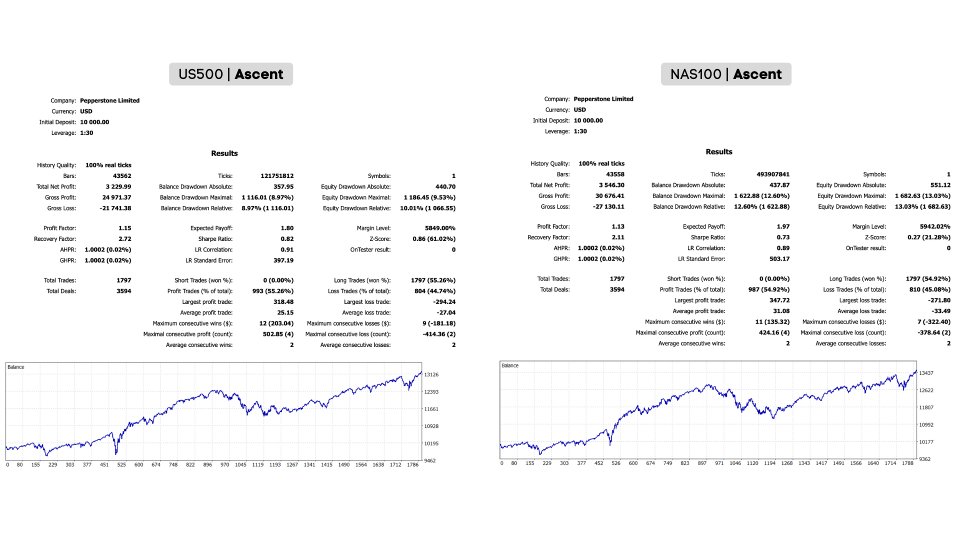

Strategy 2: Ascent – A long-only approach to index markets with historical upward trends, entering on clear, repeatable signals aligned with long-term equity behavior.

-

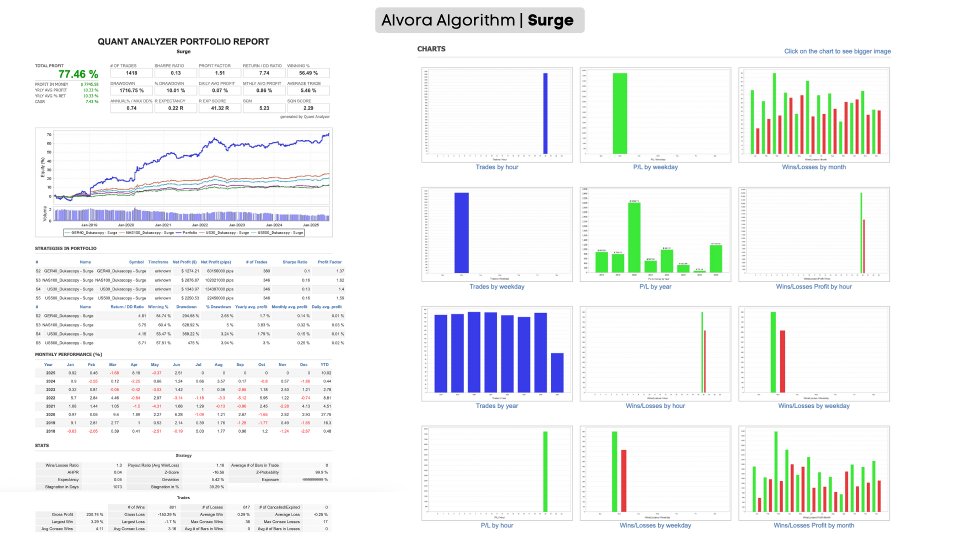

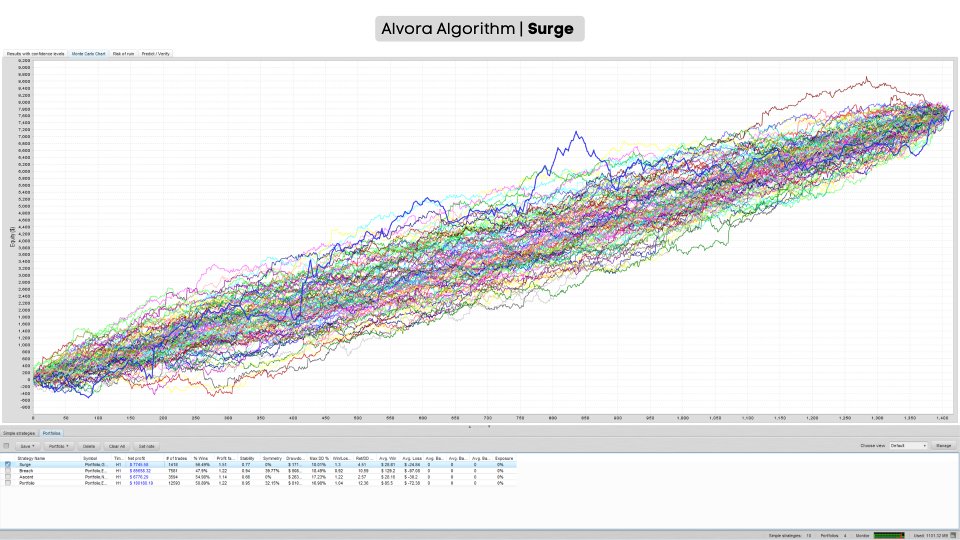

Strategy 3: Surge – Automates a recurring institutional concept: buying select indices early in the week and closing by Tuesday’s end.

Together, these strategies form a structured portfolio approach that trades across eight instruments and ten charts, achieving both strategic and asset-level diversification.

Key Features

-

Three complementary strategies

-

Multi-asset and multi-timeframe operation

-

Rule-based logic with disciplined risk controls

-

No martingale, no grid, no AI

-

Tested on 100% Quality Real Tick Data (Source: Dukascopy)

Recommended Instruments

USDJPY, GBPJPY, EURJPY, XAUUSD, NAS100, US500, US30, DE40

Design Philosophy

Alvora emphasizes simplicity and robustness over complexity. It avoids over-optimization, instead relying on clear market logic and structured risk management. Trade execution is systematic and disciplined — with no martingale, grid, or artificial intelligence.

This EA has been refined over time and is intended for traders who prioritize long-term performance and systematic consistency over short-term excitement.

Important:

For optimal results, please use the provided set files available under the “Comments” tab.