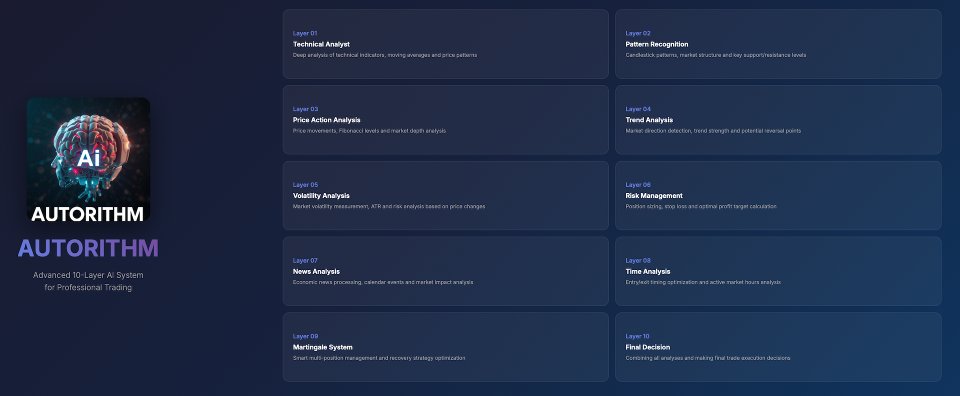

Autorithm AI

AUTORITHM is an advanced AI-powered trading system designed for MetaTrader 5 that implements 10 specialized artificial intelligence layers for comprehensive market analysis. The Expert Advisor utilizes sophisticated AI algorithms that work in harmony to process market data, identify trading opportunities, and execute trades with intelligent risk management protocols.

Core Features

The system utilizes 10 distinct AI layers that work together to analyze market conditions and execute trades. Each AI layer specializes in different aspects of market analysis including technical analysis, pattern recognition, price action analysis, trend analysis, volatility analysis, risk management, news analysis, time analysis, martingale system management, and final decision making. The EA includes configurable time-based trading sessions, news event filtering, and volatility protection mechanisms with AI-driven decision processes.

10 AI Intelligence Layers

Layer 1: Technical Analyst AI

Processes multiple technical indicators and oscillators to identify market momentum, overbought/oversold conditions, and potential reversal points using advanced pattern recognition algorithms.

Layer 2: Pattern Recognition AI

Identifies and analyzes chart patterns, candlestick formations, and price structures using machine learning algorithms trained on historical market data.

Layer 3: Price Action Analysis AI

Analyzes raw price movements, support and resistance levels, and market structure changes without relying on traditional indicators.

Layer 4: Trend Analysis AI

Determines market direction, trend strength, and potential trend changes using sophisticated algorithms that process multiple timeframe data.

Layer 5: Volatility Analysis AI

Monitors market volatility patterns, identifies unusual market conditions, and adjusts trading parameters accordingly to protect capital.

Layer 6: Risk Management AI

Calculates optimal position sizes, manages stop-loss levels, and implements dynamic risk controls based on current market conditions and account equity.

Layer 7: News Analysis AI

Processes economic calendar events, filters news impact levels, and adjusts trading behavior during high-impact news releases to minimize risk.

Layer 8: Time Analysis AI

Analyzes optimal trading sessions, market opening/closing times, and time-based market behavior patterns to maximize trading efficiency.

Layer 9: Martingale System AI

Intelligently manages position scaling, calculates optimal entry points for additional positions, and determines when to close the entire position sequence.

Layer 10: Final Decision Making AI

Synthesizes inputs from all previous layers, weighs different signals, and makes the final trading decision using advanced decision-tree algorithms.

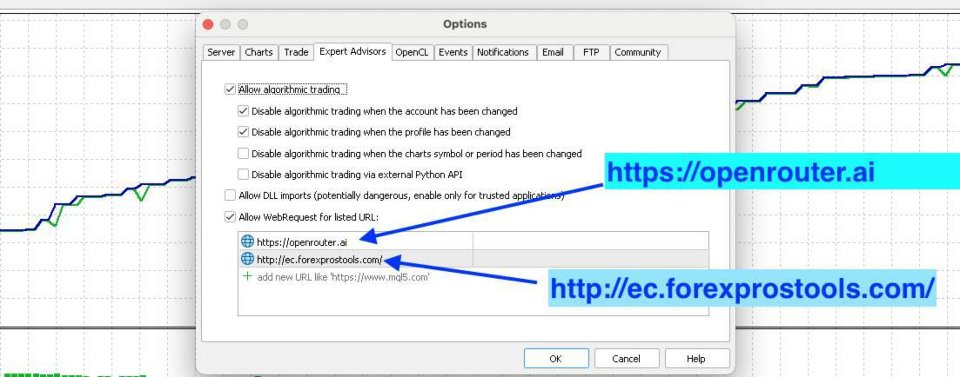

System Requirements

| Requirement | Specification |

|---|---|

| Minimum Balance | $500 USD |

| Account Type | Standard or ECN |

| Minimum Leverage | 1:100 |

| Recommended Broker | Low spread, reliable execution |

| Platform | MetaTrader 5 |

Input Parameters Configuration

Smart Schedule Manager

AUTORITHM Core Engine

AUTORITHM Trading Engine

Weekend Protection System

Intelligent News Filter

Dynamic Trailing System

Capital Protection Shield

Market Volatility Protection

Advanced AI Martingale System

Parameter Modification Guidelines

All input parameters can be modified before attaching the EA to a chart. It is recommended to test different parameter combinations in the Strategy Tester before live trading. Risk management parameters should be adjusted according to account size and risk tolerance. The martingale system parameters require careful consideration as they directly affect position sizing and risk exposure.

Important: This EA implements algorithmic trading strategies that involve market risk. Past performance does not indicate future results. Users should thoroughly understand all parameters and test the system before live deployment.