Ichimoku Strategies EA MT4

- Experts

- Biswarup Banerjee

- Version: 16.0

- Updated: 24 November 2025

- Activations: 20

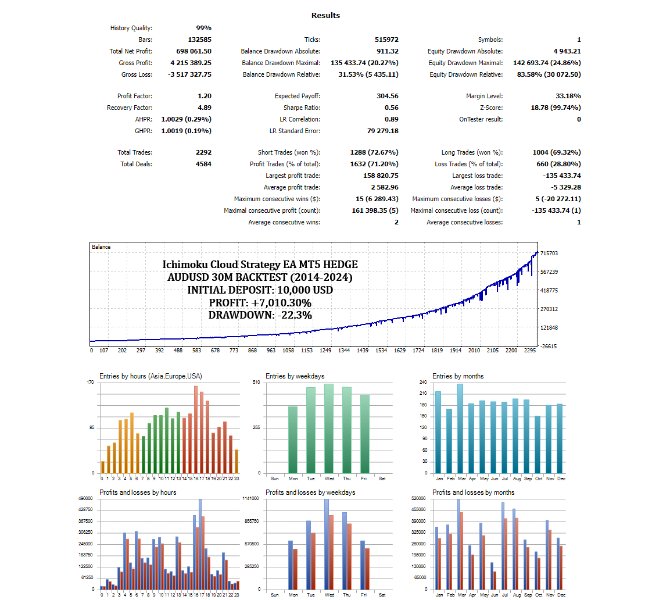

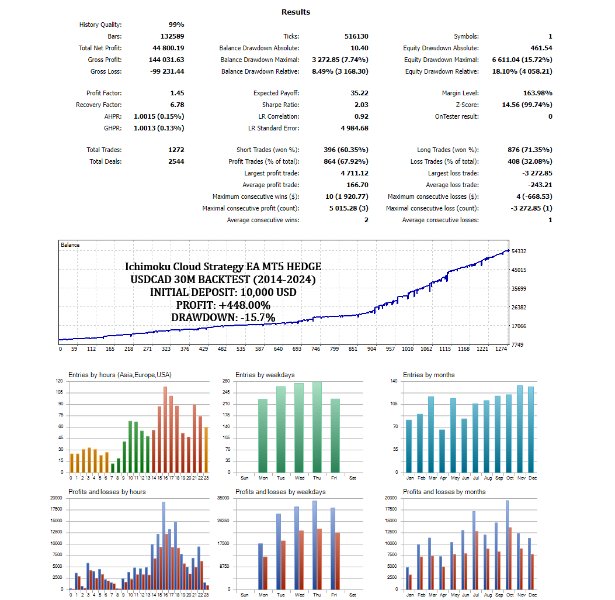

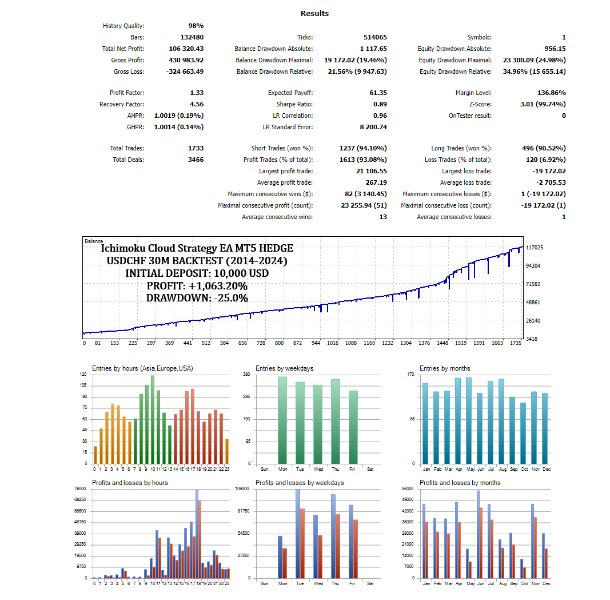

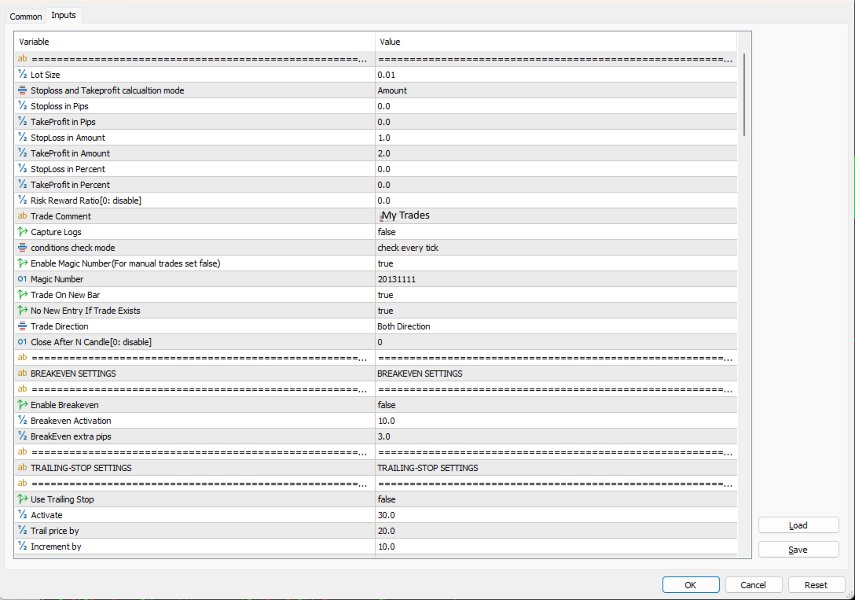

Ichimoku Cloud Strategy EA MT4 is an advanced tool designed exclusively for MetaTrader 4, streamlining trading by leveraging the Ichimoku Cloud indicator to automate trade entries and exits based on six distinct strategies. The EA supports reverse trading setups within key zones, offering versatility in trade management. Extensively back-tested, it provides precise entry methods, flexible exit rules, and advanced risk management, consuming minimal system resources for efficient trade execution.

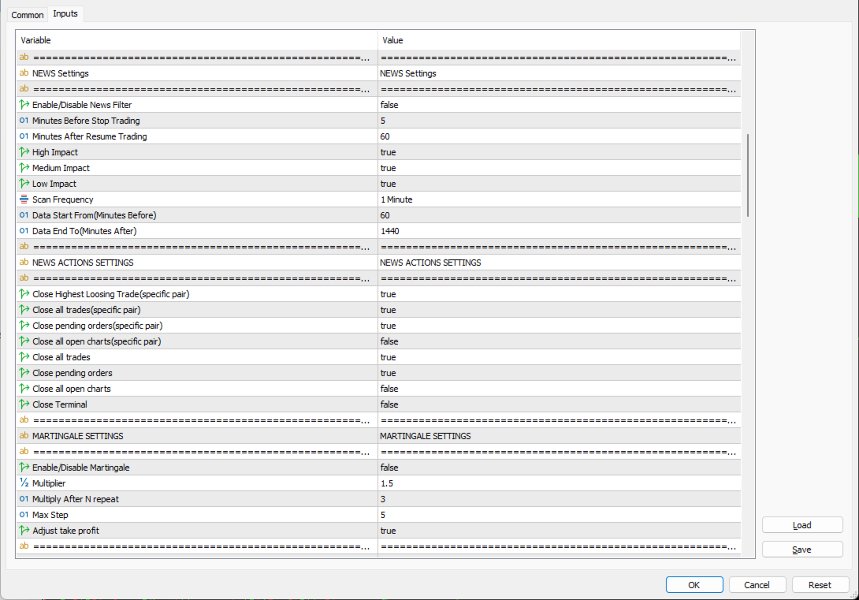

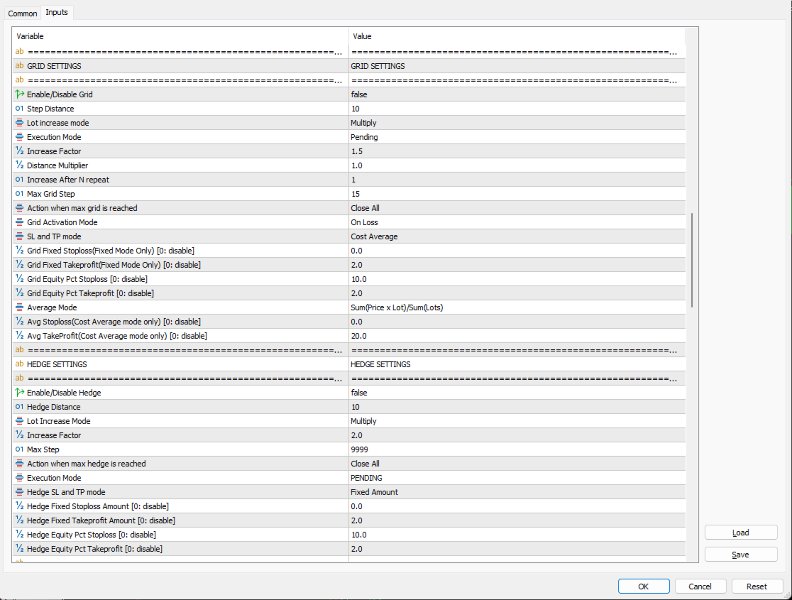

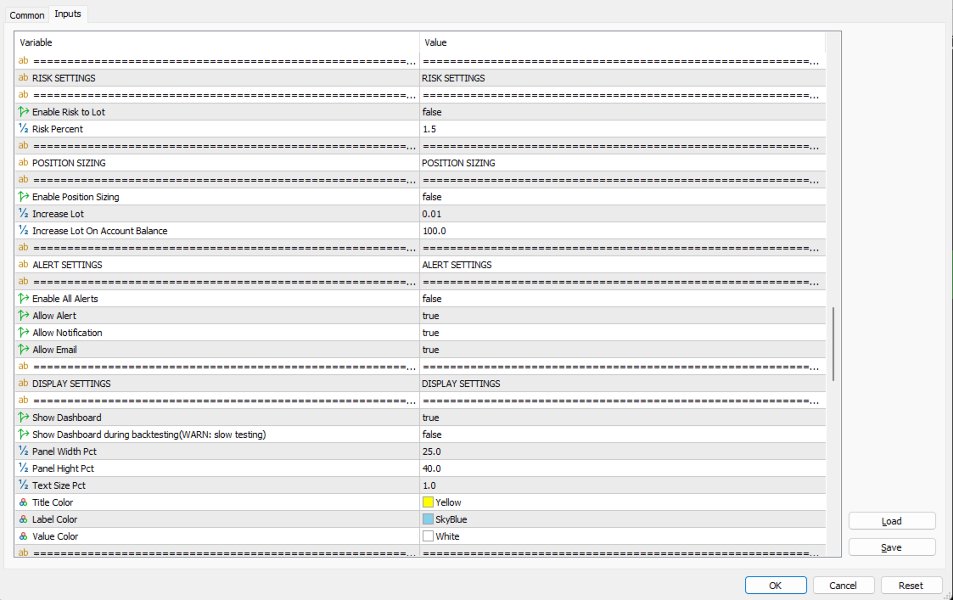

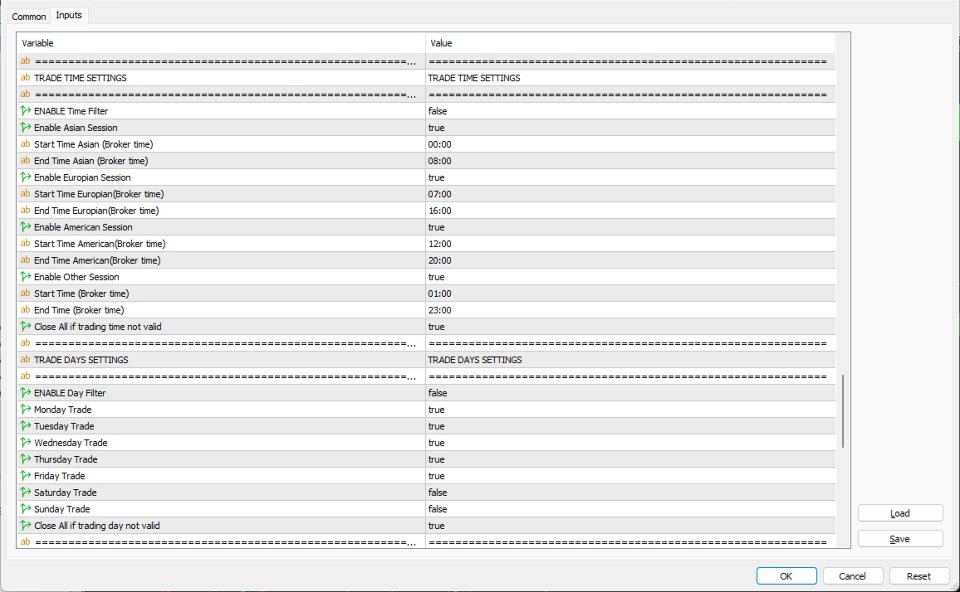

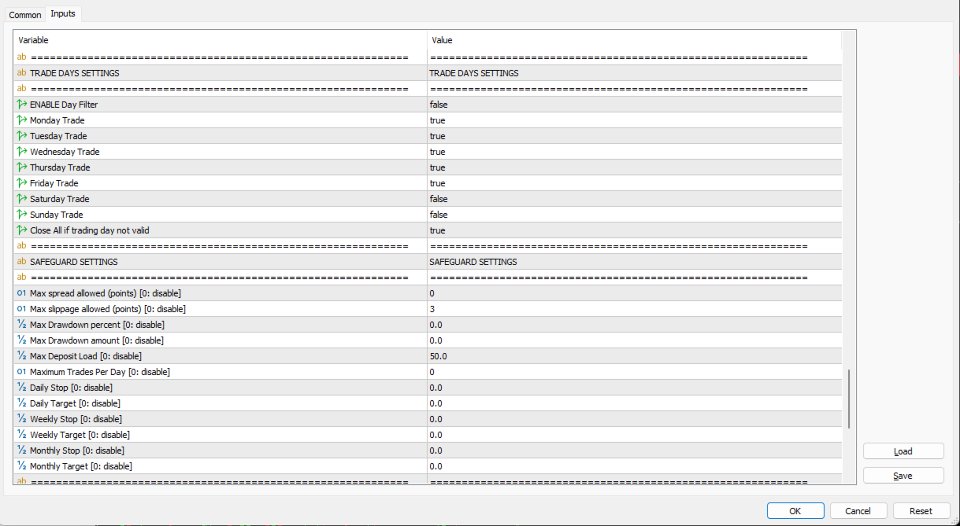

The system includes day/time filters for session control and supports historical data testing for performance validation. A real-time dashboard displays open trades, account equity, and system metrics, while intuitive input menus simplify configuration. Detailed documentation is provided for all settings.

For detailed documentation: General Settings/Input Guide | Indicator Settings/Input Guide | Backtests and Set Files

You can download the MT5 version here: Ichimoku Cloud Strategy EA MT5

Key Features:

- 5 Different strategies for entry and exit

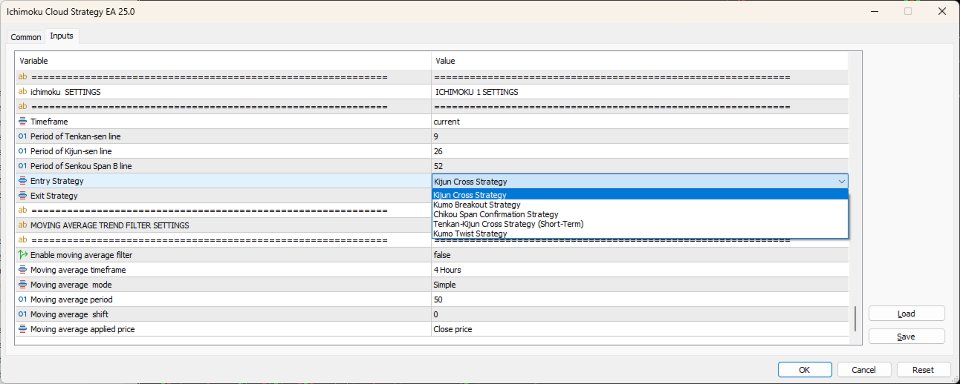

- Ichimoku Cloud trading system with customizable parameters (Tenkan-sen, Kijun-sen, Senkou Span)

- Supports multiple timeframes for flexible trading

- Multiple risk management options: Stop-Loss, Take-Profit, trailing stops

- Advanced position sizing and drawdown protection

- Time/day filters for controlled trading sessions

- Real-time monitoring dashboard

- Pop-up, email, and push notifications

- MQL5 VPS compatible for 24/7 operation

Ichimoku Strategies:

- Kijun Cross Strategy: Buy signal when price crosses above Kijun-sen, Tenkan-sen is above Kijun-sen, and price is above Kumo. Sell signal when price crosses below Kijun-sen, Tenkan-sen is below Kijun-sen, and price is below Kumo.

- Kumo Breakout Strategy: Buy signal when price breaks above Kumo with Senkou Span A above Senkou Span B (bullish Kumo). Sell signal when price breaks below Kumo with Senkou Span B above Senkou Span A (bearish Kumo).

- Chikou Span Confirmation Strategy: Buy signal when Chikou Span crosses above price and Kumo, with Tenkan-sen above Kijun-sen. Sell signal when Chikou Span crosses below price and Kumo, with Tenkan-sen below Kijun-sen.

- Tenkan-Kijun Cross Strategy (Short-Term): Buy signal when Tenkan-sen crosses above Kijun-sen, price above Kumo. Sell signal when Tenkan-sen crosses below Kijun-sen, price below Kumo.

- Kumo Twist Strategy: Buy signal when Kumo twists from bearish to bullish (Senkou Span A crosses above Senkou Span B). Sell signal when Kumo twists from bullish to bearish (Senkou Span B crosses above Senkou Span A).

- Senkou Span Cross Strategy: Buy signal when Senkou Span A crosses above Senkou Span B, with price above Kumo. Sell signal when Senkou Span B crosses above Senkou Span A, with price below Kumo.

Note: The Ichimoku Cloud Strategy EA MT4 is an essential tool for traders using Ichimoku-based strategies, offering actionable insights and a user-friendly interface. It is designed to execute trades based on configured strategies but does not guarantee profits.

Important Advice:

This is a professional trading tool, not a guaranteed profit system. Expect normal market fluctuations:

- Always test in a demo account first

- Start with small risk (0.5-1% per trade)

- Use only the capital you can afford to lose

- Regular updates and optimized set files are released quarterly. For the latest recommendations, check the MQL5 Blog in the documentation section above.

Check all my products: https://www.mql5.com/en/users/biswait50/seller

Contact me for support: https://www.mql5.com/en/users/biswait50

Interested in a free 7-day trial? Feel free to reach out to me via my profile section.