You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

Sergey Golubev, 2013.02.20 16:24

Some usefull links, and for now - about the signals:

Forum on trading, automated trading systems and testing trading strategies

PriceChannel Parabolic system

Sergey Golubev, 2013.03.22 14:04

PriceChannel Parabolic system

PriceChannel Parabolic system basic edition

Latest version of the system with latest EAs to download

How to trade

The settingas for EAs: optimization and backtesting

Trading examples

Metaquotes demo

GoMarkets broker, initial deposit is 1,000

Alpari UK broker initial deposit is 1,000

RoboForex broker initial deposit is 1,000

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

Sergey Golubev, 2013.09.20 08:21

Summaries :

====

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

Sergey Golubev, 2014.05.07 18:18

Just a reminderThere is good article concerning to fundamental trading (for creation of the EAs related to News Trading) :

============

Building an Automatic News Trader

As Investopedia states, a news trader is "a trader or investor who makes trading or investing decisions based on news announcements". Indeed, economic reports such as a country's GDP, consumer confidence indexes and employment data of countries, amongst others, often produce significant movements in the currency markets. Have you ever attended a U.S. Non-Farm Payrolls release? If so, you already know that these reports may determine currencies' recent future and act as catalysts for trends reversals.

Forum on trading, automated trading systems and testing trading strategies

Libraries: The Moving Average Class

Sergey Golubev, 2014.05.01 09:53

Three Ways to Trade with Moving Averages

Indicators can be tricky tools. Knowing which ones to use and how to use them can be complicated enough; but finding out how to properly employ an entire strategy in the right market environment can be the most difficult question for traders to address.

The Moving Average is simply the last x period’s closing prices added together, and divided by the number of observed periods (x). And it’s in its simplicity lies its beauty. When prices are trending higher, the moving average will reflect this by also moving higher. And when prices are trending lower, these new lower prices will begin to be factored into the moving average and it too will begin moving lower.

While this averaging effect brings on an element of lag, it also allows the trader an ideal way of categorizing trends and trending conditions. In this article, we’re going to discuss three different ways this utilitarian indicator can be employed by the trader.

As a Trend-Filter

Because the moving average does such a great job of identifying the trend, it can be readily used to offer traders a trend-side bias in their strategies. So if price action is above a moving average, only long positions are looked at while price action below the moving average mandates that only short positions are taken.

For this trend-filtering effect, longer-term moving averages generally work better as faster-period settings may be too active for the desired filtering effect. The 200 Day Moving Average is a common example, which is simply the last 200 day’s closing prices added together and divided by 200.

After a bias has been obtained and traders know which direction they want to look to trade in a market, positions can be triggered in a variety of ways. An oscillator such as RSI or CCI can help traders catch retracements by identifying short-term overbought or oversold situations.

In the picture below, we show an example of a CCI (Commodity Channel Index) Entry with the 200 day moving average as a trend filter.

As a trigger to initiate positions

Taking the idea of strategy development a step further, the logic of the moving average can also be used to actually open new positions.

After all, if price action is showing a trending state just by residing above a moving average, doesn’t logic dictate that the very action of crossing that moving average can have trending connotations as well?

So traders can also use the price/moving average crossover as a trigger into new positions, as shown below.

The Moving Average can also be used to initiate positions in the direction of the trend

The downside to the moving average trigger is that choppy or trend-less markets can invite sloppy entries as congested prices meander back and forth around a specific MA. So it’s highly suggested to avoid using a moving average trigger in isolation without any other filters or limitations. Doing so could mean massive losses if markets congest or range for prolonged periods of time.

As a Crossover Trigger

The third and final way that moving averages can be implemented is with the moving average crossover. This is an extremely common way of triggering trades, but has the undesired impact of being especially ‘laggy’ by introducing two different lagging indicators rather than just one (as is the case of using the MA as a filter or a trigger individually).

Common examples of moving average crossovers are the 20 and 50 period crossovers, the 20 and 100 period crossover, the 20 and 200 period crossover, and the 50 and 200 period crossover (commonly called ‘the death cross’ when the 50 goes below the 200, or the ‘golden cross’ when the 50 goes above the 200).

The 50 Day/200 Day Moving Average Crossover :

This can be taken a step further with multiple time frame analysis. Traders can look to a longer-term chart to use a moving average filter as we had outlined in the (1) part of this article, and then the crossover can be used as a trigger in the direction of the trend on the shorter time frame.

While no indicator is going to be perfect, these three methods show the utility that can be brought to the table with the moving average, and how easily traders can use this versatile tool to trigger trades ahead and in front of very large, outsized moves in the market.

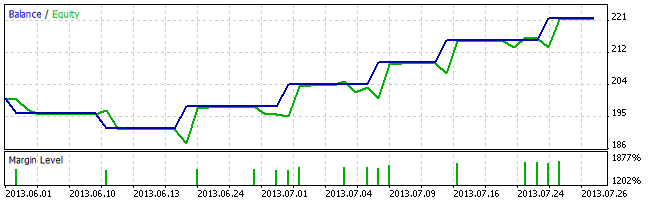

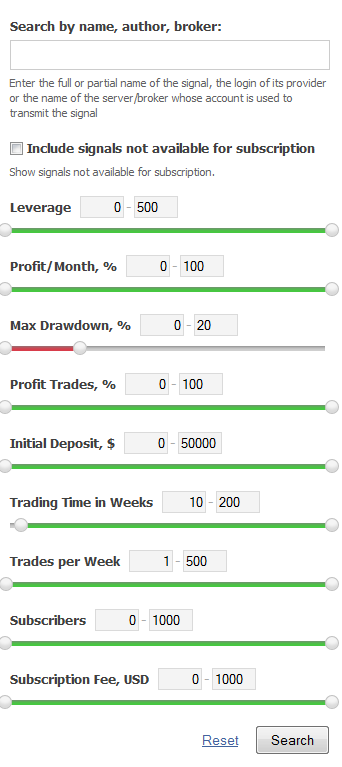

Good article: Tips for Selecting a Trading Signal to Subscribe. Step-By-Step Guide

"Trading on financial markets is a pretty large sphere which involves a lot of people and a lot of valuable assets. Successful trading in your preferred market sector requires its deep analysis, further development of your own trading system and, of course, acquisition of steel hard discipline and composure. Some people do not have time for this, but they have an aspiration to make their financial means work and provide a benefit. The Signals service of the MQL5.com site helps to solve this problem. This article is dedicated to the system approach to the search of a required signal which would satisfy criteria of profitability, risk, trading ambitions, working on various types of accounts and financial instruments."

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

Sergey Golubev, 2013.02.15 16:50

Just found good article about us - Who Is Who in MQL5.community?

Just good new article: Identifying Trade Setups by Support, Resistance and Price Action

Table of ContentsConclusion

Introduction

This article covers a trading methodology that can be used in any Forex, stock, or commodity market, as well as MQL4 code examples that can be used in an Expert Advisor based on this methodology.

Price action and the determination of support and resistance levels are the key components of the system. Market entry is entirely based on those two components. Reference price levels will be explained along with effective ways of choosing them. The MQL4 examples include parameters for minimizing risk. This is done by keeping market exit references and stops relatively close to the entry prices.

There is an additional benefit of allowing higher volume trades, regardless of account size. Lastly, options for determining profit targets are discussed, accompanied by MQL4 code that enables profitable market exit during a variety of conditions.

Forum on trading, automated trading systems and testing trading strategies

All (not yet) about Strategy Tester, Optimization and Cloud

Alain Verleyen, 2013.08.20 19:47

A must ! Before using it or asking any question : please read the Online Help (Also accessible by F1 on your MT5 platform)

Strategy Tester

Optimization

Running optimization from command line : https://www.mql5.com/en/forum/13468

Cloud

Work in progress, stay tuned !

We are not in deal or no deal here metaquotes should implement mt4 like trading option in mt5 so brokers can choose which one they like for their clients i.e. non us brokers