Dynamic Swing VWAP

- Indicators

- Guillermo Pineda

- Version: 1.0

- Activations: 10

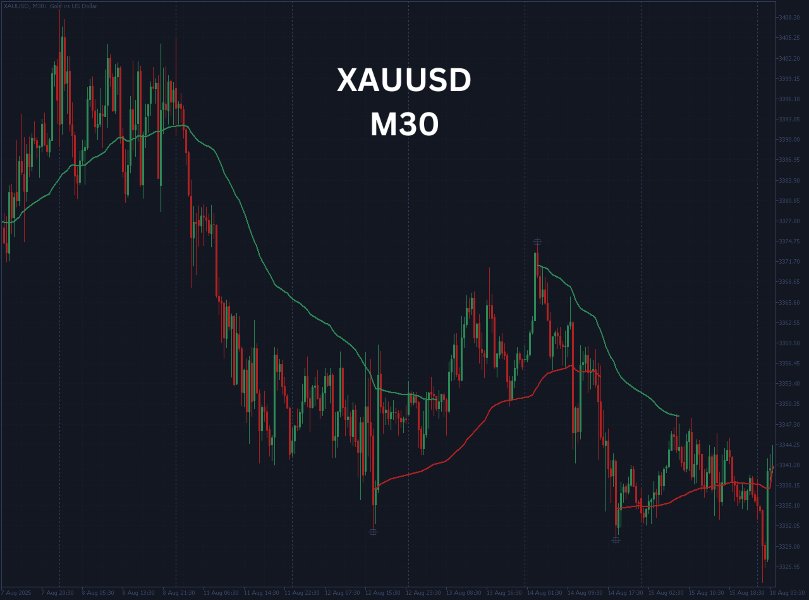

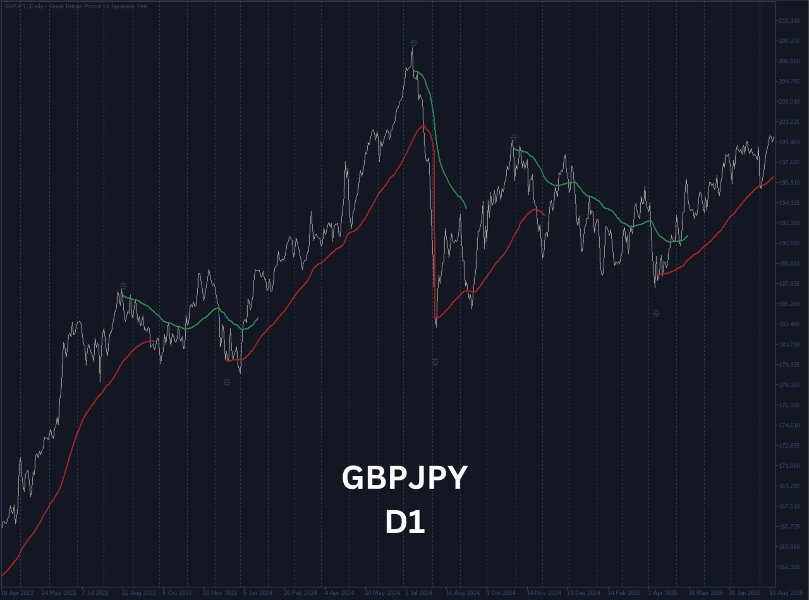

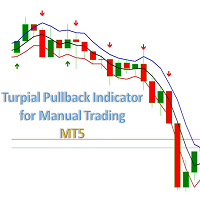

Dynamic Swing Anchored VWAP is a precision price–volume tool designed to stay relevant to live market conditions. Instead of a static VWAP that drifts further away as sessions progress, this indicator anchors VWAP to fresh swing highs and lows and adapts its responsiveness as volatility changes.

The result is a fair-value path that follows price more closely, making pullbacks, retests, and mean-reversion opportunities easier to identify and trade.

CORE FEATURES

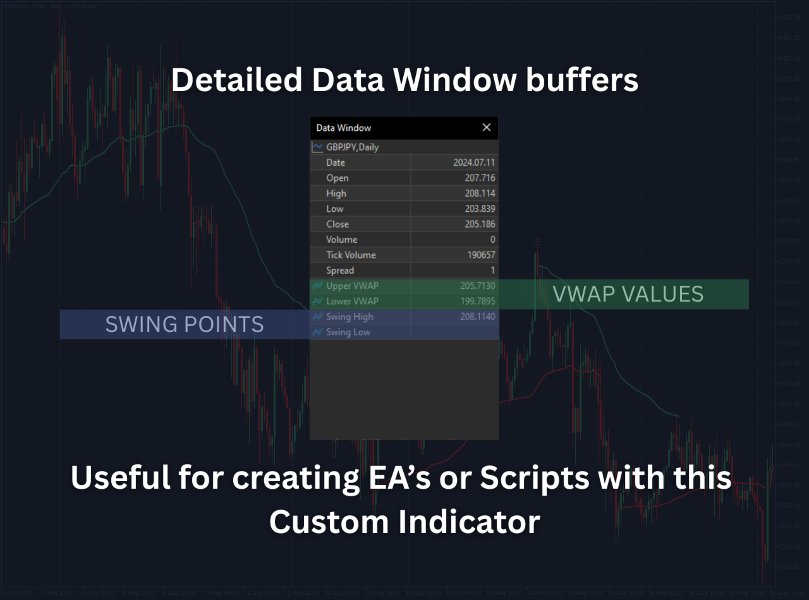

🔹 Swing Anchoring

- Automatically detects swing highs and lows using your chosen Swing Period.

- Each time a new pivot is confirmed, VWAP re-anchors from that point, ensuring the reference stays in line with current structure.

🔹 Adaptive VWAP Engine

-

VWAP is recalculated with a decay model: recent price×volume carries more weight, while older data fades out.Base responsiveness is controlled via the Adaptive Price Tracking (APT) setting.

-

With volatility adjustment enabled, APT automatically speeds up during spikes and slows down in quiet phases, keeping the VWAP relevant in all conditions.

🔹 Volatility-Aware Tracking

-

High volatility → VWAP tightens, hugging price for closer pullback opportunities.

-

Low volatility → VWAP smooths out, filtering market noise while still showing fair value.

WHY THIS BEATS A SIMPLE VWAP

Traditional VWAP drifts as volume accumulates, often losing touch with price after long moves. Retests become rare and unreliable.

Dynamic Swing Anchored VWAP solves this with:

-

Event-Driven Anchoring: VWAP restarts at every major pivot, keeping reference levels near the current market action.

-

Adaptive Responsiveness: Adjusts speed automatically to volatility, avoiding the lag of fixed VWAPs in fast markets and the overreaction in slow ones.

Result → A VWAP that follows the real rhythm of the market, creating more credible retests and dependable trade signals.

HOW TO TRADE WITH IT

📌 Swing-Aware Fair Value

Treat the anchored VWAP as a dynamic fair-value guide. Pullbacks into it after impulsive moves often mark high-probability retest zones.

📌 Trend Trading:

In trending conditions, the adaptive VWAP rides closer to price, offering smoother continuation pullbacks that align with momentum.

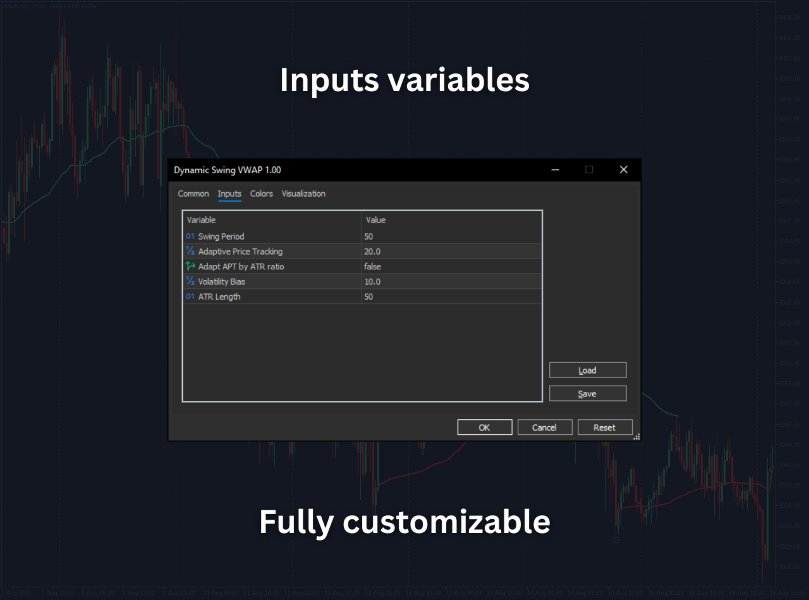

INPUTS

-

Swing Period: Number of bars for confirming swing highs/lows. Higher = cleaner pivots, lower = more frequent signals.

-

Adaptive Price Tracking (APT): Base responsiveness in bars. Lower = faster, tighter to price; higher = smoother.

-

Adapt APT by ATR Ratio: Auto-adjusts responsiveness with volatility (on/off).

-

Volatility Bias: Scales the influence of volatility (>1 stronger effect, <1 softer).

✅ Perfect for traders who rely on fair value, retests, and structure-based trading setups.

✅ Designed for scalpers, swing traders, and intraday trend followers.