TimeLS LightSpeed

- Experts

- Kaloyan Ivanov

- Version: 1.2

- Updated: 20 June 2025

- Activations: 5

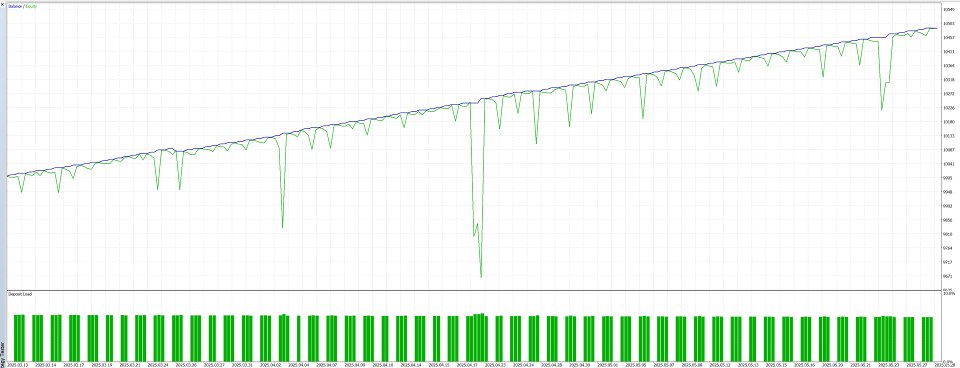

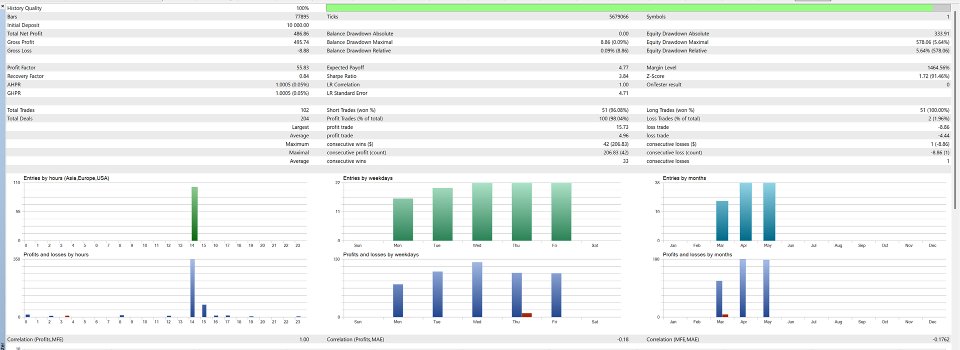

TimeLS_LightSpeed is a time-based expert advisor (EA) for MetaTrader 5, designed to execute and manage trades with precision at specific moments in time. It offers highly configurable inputs to control trading windows, position types, and exclusive scheduled deals with individual parameters.

Message me if any questions, I have some predefined .set`s for some markets.

Main Functionalities and Settings

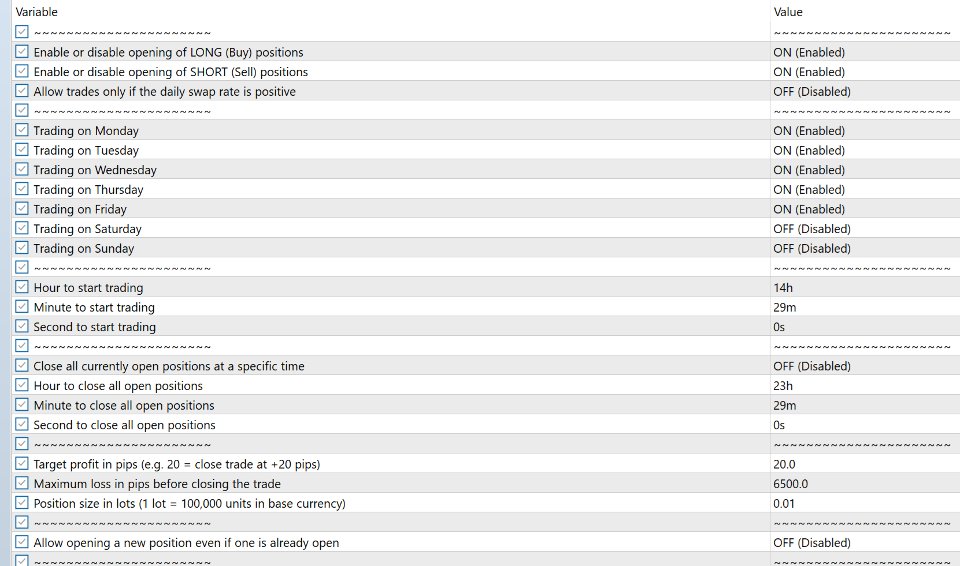

Trade Permissions

Enable or disable opening of LONG (Buy) or SHORT (Sell) positions individually.

Option to allow trades only if the daily swap rate is positive, providing cost-efficiency in overnight holding strategies.

Day-Based Trading Control

Choose specific days of the week (Monday to Sunday) when trading is allowed.

This helps align the EA with market volatility cycles, news schedules, or personal strategy preferences.

Start Time for General Trading

Define hour, minute, and second when the EA is allowed to begin opening trades.

Ensures trades only occur during preferred time windows, such as high liquidity periods (e.g., London or New York sessions).

Timed Position Closure (Optional)

An option to automatically close all open positions at a specific time.

Set exact hour, minute, and second for position closure.

Useful for avoiding overnight exposure or closing before major news events.

Default Trading Parameters

Target profit in pips.

Maximum allowed loss in pips.

Trade volume in lots.

Option to allow or block opening new trades when one is already open, which can help avoid overtrading.

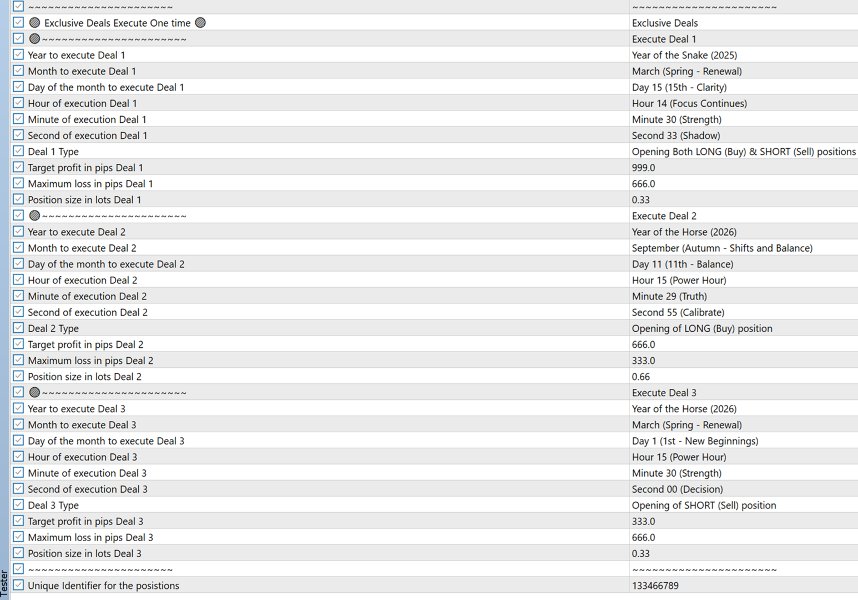

Exclusive Deal Execution Module

This EA also supports up to three one-time scheduled trades, called Exclusive Deals.

Each deal has:

A specific year, month, day, hour, minute, and second for execution.

Selection of trade type: LONG, SHORT, or BOTH simultaneously.

Independent take profit, stop loss, and lot size parameters per deal.

These scheduled deals are ideal for:

Planned economic events or releases.

High-impact trading strategies executed once with precision.

Combining manual backtesting logic with automated timed entries.

Usage Scenarios

Trade only during specific sessions (e.g., London open).

Automate reaction to time-specific events (e.g., NFP, CPI releases).

Plan ahead and execute trades precisely during holidays, gaps, or low-volume transitions.

Maintain full control over exposure by disabling specific trade types or enforcing single-trade logic.