Published article "Automating Trading Strategies in MQL5 (Part 36): Supply and Demand Trading with Retest and Impulse Model".

In this article, we create a supply and demand trading system in MQL5 that identifies supply and demand zones through consolidation ranges, validates them with impulsive moves, and trades retests with trend confirmation and customizable risk parameters. The system visualizes zones with dynamic labels and colors, supporting trailing stops for risk management.

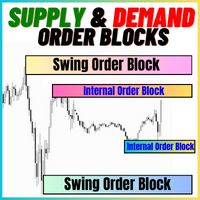

Published article "Developing Advanced ICT Trading Systems: Implementing Signals in the Order Blocks Indicator".

In this article, you will learn how to develop an Order Blocks indicator based on order book volume (market depth) and optimize it using buffers to improve accuracy. This concludes the current stage of the project and prepares for the next phase, which will include the implementation of a risk management class and a trading bot that uses signals generated by the indicator.

Published article "Price Action Analysis Toolkit Development (Part 43): Candlestick Probability and Breakouts".

Enhance your market analysis with the MQL5-native Candlestick Probability EA, a lightweight tool that transforms raw price bars into real-time, instrument-specific probability insights. It classifies Pinbars, Engulfing, and Doji patterns at bar close, uses ATR-aware filtering, and optional breakout confirmation. The EA calculates raw and volume-weighted follow-through percentages, helping you understand each pattern's typical outcome on specific symbols and timeframes. On-chart markers, a compact dashboard, and interactive toggles allow easy validation and focus. Export detailed CSV logs for offline testing. Use it to develop probability profiles, optimize strategies, and turn pattern recognition into a measurable edge.

Published article "Building AI-Powered Trading Systems in MQL5 (Part 3): Upgrading to a Scrollable Single Chat-Oriented UI".

In this article, we upgrade the ChatGPT-integrated program in MQL5 to a scrollable single chat-oriented UI, enhancing conversation history display with timestamps and dynamic scrolling. The system builds on JSON parsing to manage multi-turn messages, supporting customizable scrollbar modes and hover effects for improved user interaction.

The most downloaded free products:

Bestsellers in the Market:

Published article "Price movement discretization methods in Python".

We will look at price discretization methods using Python + MQL5. In this article, I will share my practical experience developing a Python library that implements a wide range of approaches to bar formation — from classic Volume and Range bars to more exotic methods like Renko and Kagi. We will consider three-line breakout candles and range bars analyzing their statistics and trying to define how else the prices can be represented discretely.

Published article "Building a Professional Trading System with Heikin Ashi (Part 2): Developing an EA".

This article explains how to develop a professional Heikin Ashi-based Expert Advisor (EA) in MQL5. You will learn how to set up input parameters, enumerations, indicators, global variables, and implement the core trading logic. You will also be able to run a backtest on gold to validate your work.

Published article "Reimagining Classic Strategies (Part 16): Double Bollinger Band Breakouts".

This article walks the reader through a reimagined version of the classical Bollinger Band breakout strategy. It identifies key weaknesses in the original approach, such as its well-known susceptibility to false breakouts. The article aims to introduce a possible solution: the Double Bollinger Band trading strategy. This relatively lesser known approach supplements the weaknesses of the classical version and offers a more dynamic perspective on financial markets. It helps us overcome the old limitations defined by the original rules, providing traders with a stronger and more adaptive framework.

Published article "Visual assessment and adjustment of trading in MetaTrader 5".

The strategy tester allows you to do more than just optimize your trading robot's parameters. I will show how to evaluate your account's trading history post-factum and make adjustments to your trading in the tester by changing the stop-losses of your open positions.

The most downloaded free products:

Bestsellers in the Market:

The most popular forum topics:

- Questions from Beginners MQL5 MT5 MetaTrader 5 14 new comments

- function to close open trades with current profit. 14 new comments

- check pointer by "!" 13 new comments

New publications in CodeBase

- Volatility Step Channel A channel which calculates local highs and local lows with volatility-adjusted lines

- Simple_Grid Simple_Grid is the simplest "grid" EA.

- RSI Alert - Multi Timeframe Overbought/Oversold Detector A simple yet effective RSI indicator that monitors overbought and oversold conditions on any symbol and timeframe. Sends instant alerts via pop-up and mobile notifications when RSI crosses your defined thresholds.

- Quantum Gold Silver Trader Quantum System - Uses quantum states and probabilities to make decisions.

- CrossFire Alert - Fast alerts. Smarter entries. It’s a powerful moving average crossover indicator that instantly notifies you when two MAs cross, so you never miss a signal.

The most downloaded free products:

Bestsellers in the Market:

Most downloaded source codes this month

- SUPERMACBOT The SUPERMACBOT is a fully automated trading robot that combines the power of the Moving Average Crossover strategy with the MACD Indicator to deliver precise and reliable trade signals. This Expert Advisor is designed to work seamlessly on all symbols and timeframes, offering versatility and adaptability for traders across various market conditions.

- Seven strategies in One expert Name of expert is 'MultiStrategyEA'

- Candle Pattern Recognition Unit An indicator to detect and mark all popular candle patterns

Most read articles this month

In this article, we demonstrate an easy way to install MetaTrader 5 on popular Linux versions — Ubuntu and Debian. These systems are widely used on server hardware as well as on traders’ personal computers.

How to purchase a trading robot from the MetaTrader Market and to install it?

A product from the MetaTrader Market can be purchased on the MQL5.com website or straight from the MetaTrader 4 and MetaTrader 5 trading platforms. Choose a desired product that suits your trading style, pay for it using your preferred payment method, and activate the product.

How to Test a Trading Robot Before Buying

Buying a trading robot on MQL5 Market has a distinct benefit over all other similar options - an automated system offered can be thoroughly tested directly in the MetaTrader 5 terminal. Before buying, an Expert Advisor can and should be carefully run in all unfavorable modes in the built-in Strategy Tester to get a complete grasp of the system.

Published article "Automating Trading Strategies in MQL5 (Part 35): Creating a Breaker Block Trading System".

In this article, we create a Breaker Block Trading System in MQL5 that identifies consolidation ranges, detects breakouts, and validates breaker blocks with swing points to trade retests with defined risk parameters. The system visualizes order and breaker blocks with dynamic labels and arrows, supporting automated trading and trailing stops.

Published article "From Novice to Expert: Backend Operations Monitor using MQL5".

Using a ready-made solution in trading without concerning yourself with the internal workings of the system may sound comforting, but this is not always the case for developers. Eventually, an upgrade, misperformance, or unexpected error will arise, and it becomes essential to trace exactly where the issue originates to diagnose and resolve it quickly. Today’s discussion focuses on uncovering what normally happens behind the scenes of a trading Expert Advisor, and on developing a custom dedicated class for displaying and logging backend processes using MQL5. This gives both developers and traders the ability to quickly locate errors, monitor behavior, and access diagnostic information specific to each EA.

Published article "MQL5 Trading Tools (Part 9): Developing a First Run User Setup Wizard for Expert Advisors with Scrollable Guide".

In this article, we develop an MQL5 First Run User Setup Wizard for Expert Advisors, featuring a scrollable guide with an interactive dashboard, dynamic text formatting, and visual controls like buttons and a checkbox allowing users to navigate instructions and configure trading parameters efficiently. Users of the program get to have insight of what the program is all about and what to do on the first run, more like an orientation model.

Published article "Price Action Analysis Toolkit Development (Part 42): Interactive Chart Testing with Button Logic and Statistical Levels".

In a world where speed and precision matter, analysis tools need to be as smart as the markets we trade. This article presents an EA built on button logic—an interactive system that instantly transforms raw price data into meaningful statistical levels. With a single click, it calculates and displays mean, deviation, percentiles, and more, turning advanced analytics into clear on-chart signals. It highlights the zones where price is most likely to bounce, retrace, or break, making analysis both faster and more practical.

The most downloaded free products:

Bestsellers in the Market:

New publications in CodeBase

- PriceVar PriceVar% is an indicator designed to measure the percentage difference between the price and a moving average, highlighting the strength of the market movement in relation to a reference value.

- Trade By Retail Sentiment This Expert Advisor uses retail trader sentiment from the Ziwox API to implement a contrarian trading strategy, taking trades opposite to the majority of retail positions. By combining sentiment data with a moving average trend filter, it identifies potential market reversals and avoids crowded trades. The EA automatically fetches and parses sentiment in real-time, executes buy or sell orders based on contrarian logic, and displays clear visual indicators of retail long and short ratios directly on the chart, providing traders with both actionable signals and market insight.

- Dollar Index Tracker - See the Dollar Index right below your chart. Dollar Index Tracker displays the US Dollar Index (USDX / DXY) directly below the chart of your current trading pair. This makes it easy to compare the strength of the US Dollar against a basket of major currencies while analyzing your pair at the same time.

Published article "Cyclic Parthenogenesis Algorithm (CPA)".

The article considers a new population optimization algorithm - Cyclic Parthenogenesis Algorithm (CPA), inspired by the unique reproductive strategy of aphids. The algorithm combines two reproduction mechanisms — parthenogenesis and sexual reproduction — and also utilizes the colonial structure of the population with the possibility of migration between colonies. The key features of the algorithm are adaptive switching between different reproductive strategies and a system of information exchange between colonies through the flight mechanism.

Bestsellers in the Market:

The most downloaded free products:

Most downloaded source codes this week

- The RSI Engine The RSI Engine EA is a highly versatile automated trading robot for MetaTrader 5, designed to execute trades based on signals from the popular Relative Strength Index (RSI) indicator. Version 2.1 features optimized signal processing and enhanced stability. The EA provides a flexible framework with multiple RSI-based strategies, confirmation filters, and comprehensive trade management settings, making it suitable for both novice and experienced traders.

- Pinbar Detector This MQL5 indicator identifies Upward (Bullish) and Downward (Bearish) Pinbars, displayed with customizable arrows (lime for upward, red for downward). It allows fine-tuning of detection parameters like tail body ratio and protrusion. Pop-up and push notification alerts signal new pinbars. Ideal for traders seeking precise reversal pattern detection.

- EMA_RSI_RISK-EA Expert Advisor for MetaTrader 5 that combines Exponential Moving Averages (EMA) and Relative Strength Index (RSI) to generate trading signals. Includes risk management features and trading time filter.

Most read articles this week

In this article, we demonstrate an easy way to install MetaTrader 5 on popular Linux versions — Ubuntu and Debian. These systems are widely used on server hardware as well as on traders’ personal computers.

How to purchase a trading robot from the MetaTrader Market and to install it?

A product from the MetaTrader Market can be purchased on the MQL5.com website or straight from the MetaTrader 4 and MetaTrader 5 trading platforms. Choose a desired product that suits your trading style, pay for it using your preferred payment method, and activate the product.

A New Approach to Interpreting Classic and Hidden Divergence

The article considers the classic method for divergence construction and provides an additional divergence interpretation method. A trading strategy was developed based on this new interpretation method. This strategy is also described in the article.

The most popular forum topics:

- Did Structs Change with the last MT5 Update? 57 new comments

- check pointer by "!" 52 new comments

- RSI + 1-period EMA “auto jump” inside RSI window after April 2025 update 8 new comments