Bestsellers in the Market:

New publications in CodeBase

- OHLC Candles with extreme tick price tracking This is an OHLC candlestick chart which records the highest ask and lowest bid on each new bar

- MT5 to Telegram - Professional Trading Notifications Library Complete Telegram integration for MT5. Send trading signals, screenshots, reports & alerts to Telegram channels. Includes queue system, multi-channel support & risk management.

- OHLC Candles with Ask and Bid A candlestick chart which connects the ask price and bid price to the high and low of the candles

- Assisted position closing tool This is an auxiliary take profit and stop loss tool, which can help you to tight stop loss and dynamic take profit. Updated

Published article "Moving to MQL5 Algo Forge (Part 4): Working with Versions and Releases".

We'll continue developing the Simple Candles and Adwizard projects, while also describing the finer aspects of using the MQL5 Algo Forge version control system and repository.

Published article "Introduction to MQL5 (Part 22): Building an Expert Advisor for the 5-0 Harmonic Pattern".

This article explains how to detect and trade the 5-0 harmonic pattern in MQL5, validate it using Fibonacci levels, and display it on the chart.

Published article "From Novice to Expert: Market Periods Synchronizer".

In this discussion, we introduce a Higher-to-Lower Timeframe Synchronizer tool designed to solve the problem of analyzing market patterns that span across higher timeframe periods. The built-in period markers in MetaTrader 5 are often limited, rigid, and not easily customizable for non-standard timeframes. Our solution leverages the MQL5 language to develop an indicator that provides a dynamic and visual way to align higher timeframe structures within lower timeframe charts. This tool can be highly valuable for detailed market analysis. To learn more about its features and implementation, I invite you to join the discussion.

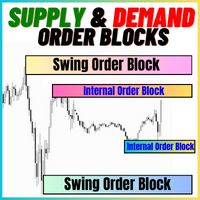

Published article "Reusing Invalidated Orderblocks As Mitigation Blocks (SMC)".

In this article, we explore how previously invalidated orderblocks can be reused as mitigation blocks within Smart Money Concepts (SMC). These zones reveal where institutional traders re-enter the market after a failed orderblock, providing high-probability areas for trade continuation in the dominant trend.

Published article "Market Simulation (Part 03): A Matter of Performance".

Often we have to take a step back and then move forward. In this article, we will show all the changes necessary to ensure that the Mouse and Chart Trade indicators do not break. As a bonus, we'll also cover other changes that have occurred in other header files that will be widely used in the future.

The most downloaded free products:

The most popular forum topics:

- MetaTrader 5 Platform build 5326: Improvements and fixes 26 new comments

- Libraries: CBitBuffer Class - Data Serialization in MQL5 14 new comments

- Indicator purchased in market will not load in my MT4 chart 13 new comments

Bestsellers in the Market:

Published article "How to publish code to CodeBase: A practical guide".

In this article, we will use real-life examples to illustrate posting various types of terminal programs in the MQL5 source code base.

Published article "Price Action Analysis Toolkit Development (Part 44): Building a VWMA Crossover Signal EA in MQL5".

This article introduces a VWMA crossover signal tool for MetaTrader 5, designed to help traders identify potential bullish and bearish reversals by combining price action with trading volume. The EA generates clear buy and sell signals directly on the chart, features an informative panel, and allows for full user customization, making it a practical addition to your trading strategy.

Published article "Building AI-Powered Trading Systems in MQL5 (Part 4): Overcoming Multiline Input, Ensuring Chat Persistence, and Generating Signals".

In this article, we enhance the ChatGPT-integrated program in MQL5 overcoming multiline input limitations with improved text rendering, introducing a sidebar for navigating persistent chat storage using AES256 encryption and ZIP compression, and generating initial trade signals through chart data integration.

The most downloaded free products:

Bestsellers in the Market:

Published article "Time Evolution Travel Algorithm (TETA)".

This is my own algorithm. The article presents the Time Evolution Travel Algorithm (TETA) inspired by the concept of parallel universes and time streams. The basic idea of the algorithm is that, although time travel in the conventional sense is impossible, we can choose a sequence of events that lead to different realities.

Published article "Neural Networks in Trading: Models Using Wavelet Transform and Multi-Task Attention (Final Part)".

In the previous article, we explored the theoretical foundations and began implementing the approaches of the Multitask-Stockformer framework, which combines the wavelet transform and the Self-Attention multitask model. We continue to implement the algorithms of this framework and evaluate their effectiveness on real historical data.

Published article "Building a Trading System (Part 4): How Random Exits Influence Trading Expectancy".

Many traders have experienced this situation, often stick to their entry criteria but struggle with trade management. Even with the right setups, emotional decision-making—such as panic exits before trades reach their take-profit or stop-loss levels—can lead to a declining equity curve. How can traders overcome this issue and improve their results? This article will address these questions by examining random win-rates and demonstrating, through Monte Carlo simulation, how traders can refine their strategies by taking profits at reasonable levels before the original target is reached.

Published article "MQL5 Wizard Techniques you should know (Part 82): Using Patterns of TRIX and the WPR with DQN Reinforcement Learning".

In the last article, we examined the pairing of Ichimoku and the ADX under an Inference Learning framework. For this piece we revisit, Reinforcement Learning when used with an indicator pairing we considered last in ‘Part 68’. The TRIX and Williams Percent Range. Our algorithm for this review will be the Quantile Regression DQN. As usual, we present this as a custom signal class designed for implementation with the MQL5 Wizard.

The most downloaded free products:

Most downloaded source codes this month

- ZigZag WaveSize Modified standard ZigZag indicator with the addition of information about wavelength in pips, levels and different alerts logic

- Supertrend A SuperTrend indicator that plots trend direction using ATR volatility to create dynamic support/resistance levels for MetaTrader 5.

- HedgeCover EA Intelligent position protection with one-hedge-per-position logic. Features magic number separation, cooldown timer, and max hedges limit. Prevents infinite hedging loops. Free MIT license.

Most read articles this month

In this article, we demonstrate an easy way to install MetaTrader 5 on popular Linux versions — Ubuntu and Debian. These systems are widely used on server hardware as well as on traders’ personal computers.

How to purchase a trading robot from the MetaTrader Market and to install it?

A product from the MetaTrader Market can be purchased on the MQL5.com website or straight from the MetaTrader 4 and MetaTrader 5 trading platforms. Choose a desired product that suits your trading style, pay for it using your preferred payment method, and activate the product.

How to Test a Trading Robot Before Buying

Buying a trading robot on MQL5 Market has a distinct benefit over all other similar options - an automated system offered can be thoroughly tested directly in the MetaTrader 5 terminal. Before buying, an Expert Advisor can and should be carefully run in all unfavorable modes in the built-in Strategy Tester to get a complete grasp of the system.

Bestsellers in the Market:

New publications in CodeBase

- Trading Session Mapping A tool to align the trading sessions names with broker server time, and local time

- Renko_Subwindow_ATRTrend A combination of many known indicators

- Ichimoku Edge MT4 EA Ichimoku Edge is based on the standard Ichimoku Kinko Hyo indicator with default settings. It generates Buy and Sell signals from the cross of the Chikou Span with the price, confirmed by the position of price and Chikou Span relative to the Kumo (cloud).

Published article "Evolutionary trading algorithm with reinforcement learning and extinction of feeble individuals (ETARE)".

In this article, I introduce an innovative trading algorithm that combines evolutionary algorithms with deep reinforcement learning for Forex trading. The algorithm uses the mechanism of extinction of inefficient individuals to optimize the trading strategy.

Published article "Neural Networks in Trading: Models Using Wavelet Transform and Multi-Task Attention".

We invite you to explore a framework that combines wavelet transforms and a multi-task self-attention model, aimed at improving the responsiveness and accuracy of forecasting in volatile market conditions. The wavelet transform allows asset returns to be decomposed into high and low frequencies, carefully capturing long-term market trends and short-term fluctuations.

Published article "From Novice to Expert: Demystifying Hidden Fibonacci Retracement Levels".

In this article, we explore a data-driven approach to discovering and validating non-standard Fibonacci retracement levels that markets may respect. We present a complete workflow tailored for implementation in MQL5, beginning with data collection and bar or swing detection, and extending through clustering, statistical hypothesis testing, backtesting, and integration into an MetaTrader 5 Fibonacci tool. The goal is to create a reproducible pipeline that transforms anecdotal observations into statistically defensible trading signals.

The most downloaded free products:

Bestsellers in the Market:

The most popular forum topics:

- Discussion of article "Payments and payment methods" 11 new comments

- Preventing unreasonable losses in an EA 11 new comments

- Features of the mql5 language, subtleties and tricks 9 new comments

Published article "Post-Factum trading analysis: Selecting trailing stops and new stop levels in the strategy tester".

We continue the topic of analyzing completed deals in the strategy tester to improve the quality of trading. Let's see how using different trailing stops can change our existing trading results.

Published article "Market Simulation (Part 02): Cross Orders (II)".

Unlike what was done in the previous article, here we will test the selection option using an Expert Advisor. Although this is not a final solution yet, it will be enough for now. With the help of this article, you will be able to understand how to implement one of the possible solutions.