RSI Momentum Shift Detector MQL4

- Indicators

- German Pablo Gori

- Version: 1.7

- Activations: 20

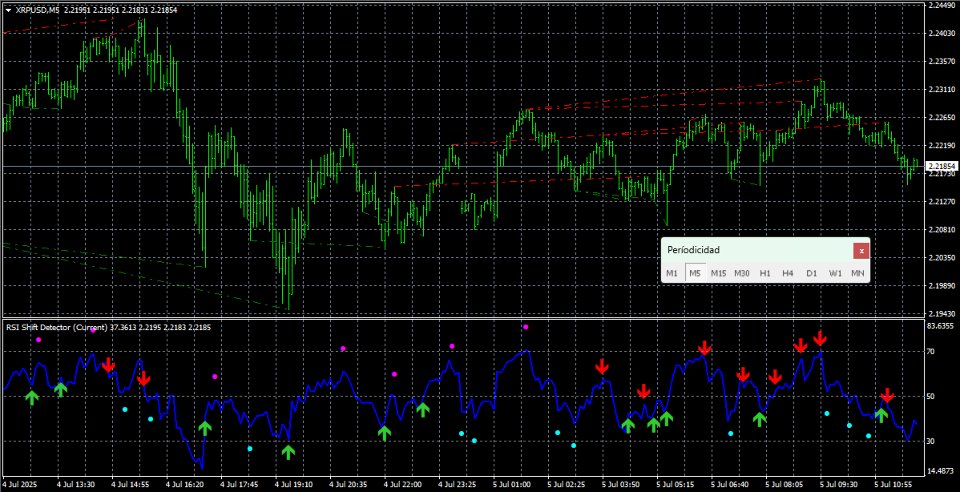

RSI Momentum Shift Detector is designed to detect significant changes in price momentum using the Relative Strength Index (RSI) and divergence patterns, with the goal of providing visual signals and useful alerts for trading in financial markets.

📌 Main Features

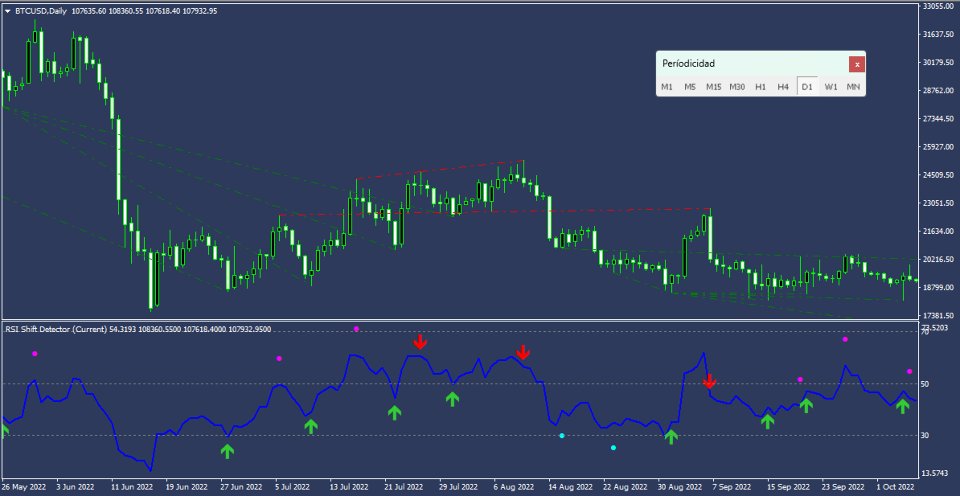

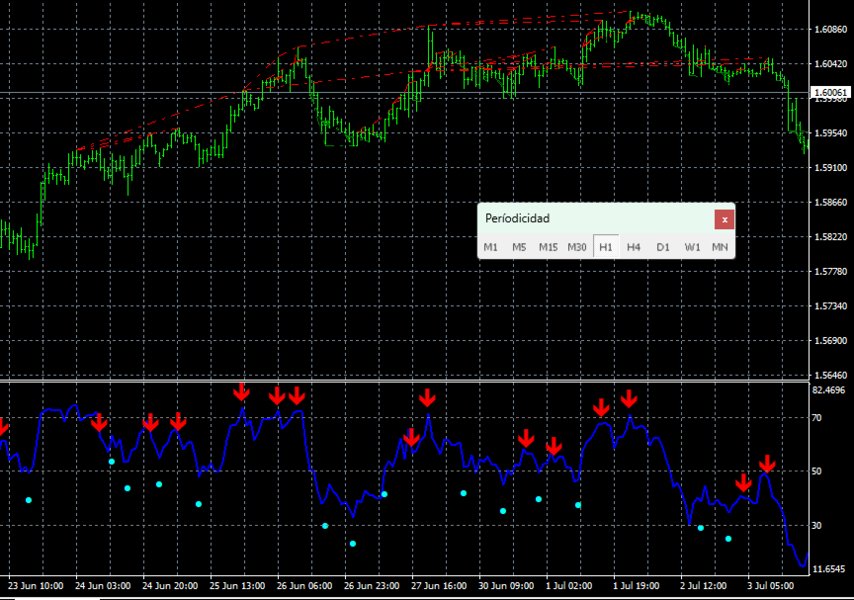

RSI Divergence Detection:

Identifies four types of divergence:

- Regular Bullish Divergence: when price makes a lower low, but RSI makes a higher low.

- Regular Bearish Divergence: when price makes a higher high, but RSI makes a lower high.

- Hidden Bullish Divergence: when price makes a higher low, and RSI makes a lower low.

- Hidden Bearish Divergence: when price makes a lower high, and RSI makes a higher high.

These divergences are represented by colored arrows on the chart:

- Green: Regular Bullish Divergence

- Red: Regular Bearish Divergence

- Cyan: Hidden Bullish Divergence

- Magenta: Hidden Bearish Divergence

Customizable Settings:

Allows adjustment of parameters such as RSI period (default 14), price type used (e.g., close), number of bars to review ( Lookback_Bars ), and left/right bars to identify pivots.

Supports multi-timeframe analysis (MTF ) allowing the use of higher timeframes to improve signal detection .

Dynamic Support and Resistance Lines:

Optionally draws trend lines between divergence points to better visualize key support and resistance levels.

Line color, style, and thickness are customizable.

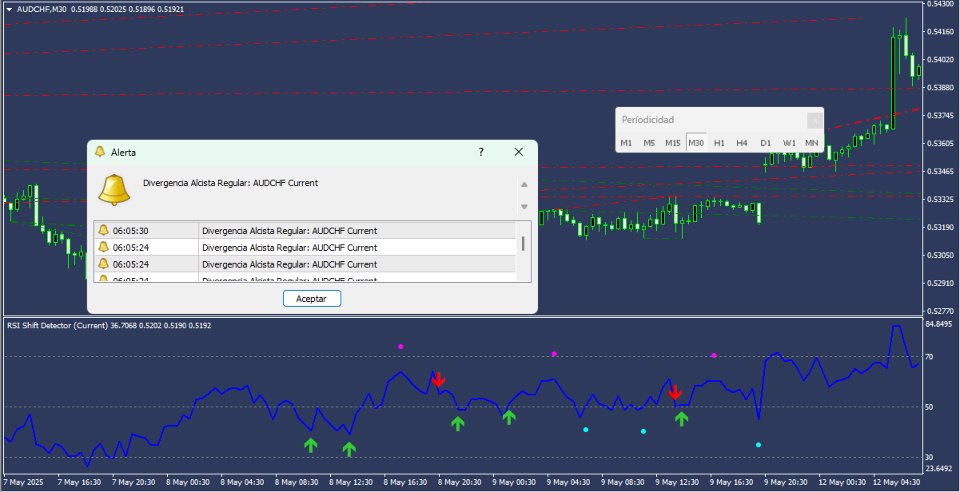

Real-Time Alerts:

Generates visual or sound alerts whenever a divergence is detected, helping traders react quickly without constant market monitoring.

Predefined RSI Levels:

Includes standard RSI levels (70, 50, and 30), with customizable colors to facilitate interpretation of overbought/oversold conditions.

🧠 Ideal Use

This indicator is ideal for traders who use RSI-based strategies, especially those seeking early entries in market reversal movements. It can be applied to both intraday timeframes (M1, M5, H1) and daily (D1), making it a useful tool for both scalping and swing trading.

It is particularly effective in clearly trending or consolidating markets, where divergences often predict major shifts in price direction.

✅ Key Benefits

- Automated Divergence Detection: Saves time and reduces human error in manually identifying signals.

- Clear Visualization: Arrows and lines help make quick and precise decisions.

- Fully Flexible: Configurable according to individual trading styles.

- Alert Integration: Ideal for busy traders or those working with multiple assets.

🛠️ Conclusion

The "RSI Momentum Shift Detector" is an advanced and highly configurable tool that enables traders to detect investment opportunities based on RSI dynamics and divergences. It is perfect for both intermediate and advanced users who want to incorporate clear, automated technical signals into their real-time decision-making process.

If you're looking for a precise and visual way to identify shifts in market momentum, this indicator can become a key part of your trading strategy.