Deriv Karma Project EA

- Experts

- Kwaku Bondzie Ghartey

- Version: 2.1

- Updated: 9 October 2025

- Activations: 10

Enjoy 30% off until 15th december 2025,

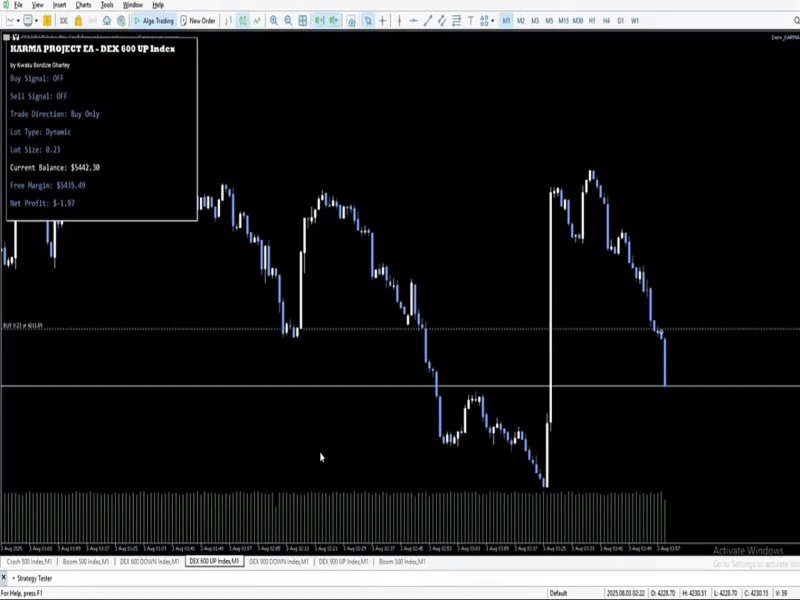

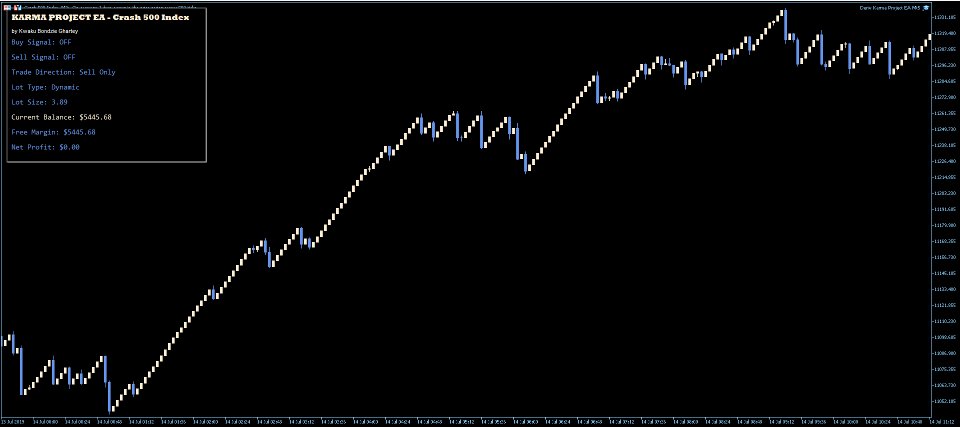

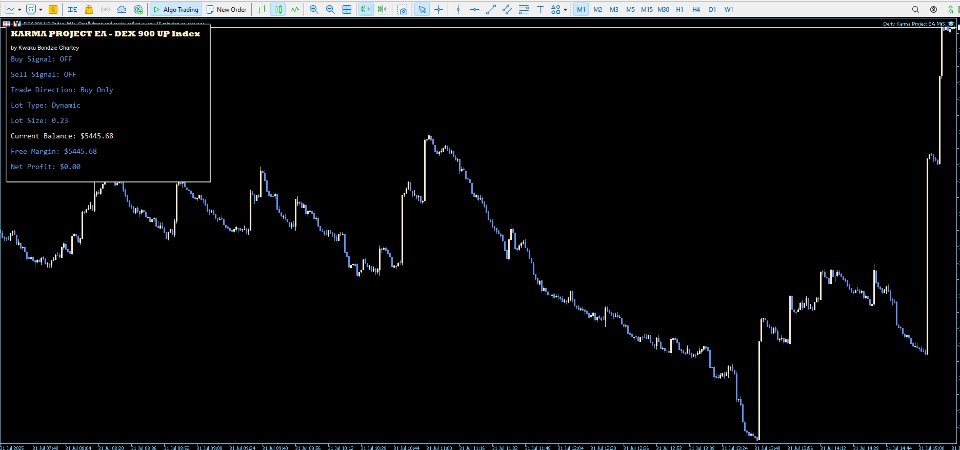

Karma Project EA is an automated trading system for MetaTrader 5. The system uses technical analysis with adaptive risk management features. It has been developed and tested on Deriv synthetic indices with optimized settings for multiple instruments.

The EA was created after extensive research into recovery-based trading systems and combines traditional technical indicators with position management strategies. Development focused on creating a system that works across different market conditions while maintaining controlled risk exposure.

Compatible Instruments

The EA includes optimized settings for these Deriv synthetic indices:

- Range Break 100 Index

- Range Break 200 Index

- Boom 500 Index

- Boom 1000 Index

- Crash 500 Index

- Crash 1000 Index

The system can also be used on other symbols including forex pairs, commodities, and cryptocurrency pairs. Performance may vary depending on the instrument characteristics.

Download optimized setfiles: https://drive.google.com/drive/folders/1UYEJ7zCTBIoVBjgHtozDc6VJUQxhB64J?usp=sharing

Technical Approach

The EA uses multiple technical indicators to identify trade entry points. The entry system analyzes Stochastic oscillator crossovers, RSI levels for momentum confirmation, Parabolic SAR for trend direction, and moving average envelopes for price channel analysis. A higher timeframe filter is applied to assess overall market structure.

When trades are opened, the system includes two optional recovery mechanisms. The first approach uses alternating position entries with progressive spacing. The second approach implements fixed take profit and stop loss levels with scaled position sizing. Users can select which recovery method to enable based on their risk tolerance.

Risk Management Features

The EA includes several risk control parameters. Dynamic lot sizing calculates position size based on account balance percentage. Maximum position limits can be set per direction and in total. Drawdown protection can be configured using both USD values and percentage of account balance.

Position spacing controls determine the distance between entries in the recovery system. A zone width parameter limits the maximum spread of open positions. The basket profit target allows closing all positions when a specified profit level is reached.

Installation and Setup

After purchasing the EA from MQL5 Market, install it in MetaTrader 5. Open any of the compactible charts on m1 timeframe only and drag the EA onto it. Enable automated trading in the MT5 Tools menu and activate the AutoTrading button in the toolbar.

For optimized performance on Deriv indices, load the appropriate setfile for your chosen instrument. The setfiles contain tested parameter combinations for each supported index.

Setfiles download link: https://drive.google.com/drive/folders/1UYEJ7zCTBIoVBjgHtozDc6VJUQxhB64J?usp=sharing

Input Parameters

Main strategy inputs include pulse period for trend analysis, SAR step and maximum values, volume levels for overbought and oversold conditions, higher timeframe selection, envelope MA period and deviation values.

Core trading parameters cover base lot size, adaptive sizing toggle, risk percentage per trade, and minimum interval between trades in seconds.

Recovery system settings include enable recovery toggle, recovery mode selection between adaptive grid and momentum approaches, trigger distance for opposite direction entries, progression gap for same direction spacing, lot multiplier for position scaling, and maximum position limits.

Risk protection inputs include max zone width in pips, max floating loss in USD, and max drawdown as account percentage.

Profit optimization parameters cover basket profit target percentage and emergency breakeven level.

Dashboard settings control the information panel display, corner position, and offset values.

Recommended Configuration

Conservative approach uses 0.5 to 1.0 percent risk, recovery disabled, both trade directions, and small base lot sizes.

Moderate approach uses 1.0 to 2.0 percent risk, adaptive grid recovery enabled, limited positions per side, and medium lot sizes.

Active approach uses 2.0 to 3.0 percent risk, momentum recovery enabled, progressive lots activated, and larger position limits.

All approaches should be tested on demo accounts before live deployment. Start with the provided setfiles and adjust parameters gradually based on your account size and risk tolerance.

Get started with optimized settings: https://drive.google.com/drive/folders/1UYEJ7zCTBIoVBjgHtozDc6VJUQxhB64J?usp=sharing

Testing Recommendations

Use the Strategy Tester in MetaTrader 5 for backtesting. Select the EA from the Expert dropdown and choose your symbol. Set the timeframe to M1 for faster testing. Use Every tick based on real ticks model for accurate results.

For optimization, use the genetic algorithm method. Test with at least 6 months of historical data. Set realistic spread values matching your broker specifications.

Before live trading, run forward tests on demo accounts for minimum two weeks. Monitor the first trades closely to verify proper EA behavior. Check that risk management functions work as expected and maintain sufficient account margin.

Symbol-Specific Performance Notes

Range Break indices respond well to the adaptive grid recovery with moderate trigger distances. Boom indices work with buy-only direction and higher timeframe filters. Crash indices perform with sell-only direction and adjusted envelope deviations.

Each setfile contains optimized parameters based on testing specific to that instrument. Results will vary based on broker spreads, execution speed, and market conditions during the trading period.

Load the appropriate setfile when switching between different instruments to ensure optimal parameter configuration.

Access all optimized setfiles here: https://drive.google.com/drive/folders/1UYEJ7zCTBIoVBjgHtozDc6VJUQxhB64J?usp=sharing

Dashboard Information

When enabled, the dashboard displays current recovery system status, active positions by direction, floating profit and loss, risk protection levels, signal status for buy and sell, session statistics, and performance metrics.

The dashboard updates in real-time and can be positioned in any screen corner with adjustable offset values.

Important Trading Notes

All trading involves risk of capital loss. This EA is a tool for automated trade execution based on technical analysis. It does not guarantee profitable results. Past performance in backtesting or demo trading does not indicate future outcomes.

The recovery systems may open multiple positions during drawdown periods. Ensure adequate account balance to support position scaling if recovery features are enabled. Regular monitoring is recommended even when using automated systems.

Market conditions change over time. Parameters that perform well in one period may require adjustment in different market environments. Consider re-testing and re-optimizing periodically based on recent market data.

Always start with demo accounts to learn EA behavior and verify proper functionality. Begin with conservative settings and small position sizes. Gradually increase exposure only after confirming stable performance over extended testing periods.

Support Information

Product support is available through the MQL5 Market comments section and MQL5.com messaging system. Updates to the EA are provided at no additional cost to purchasers.

When requesting assistance, include your broker name, account type, symbol being traded, EA input parameters used, and detailed description of any issues. Screenshots help in troubleshooting technical problems.

Developer Background

The development of Karma Project EA began after several years of trading synthetic indices and studying various recovery-based strategies. The focus was on creating a system that balances trade frequency with risk control, using technical indicators that respond well to the unique characteristics of Deriv instruments.

Testing involved analyzing thousands of historical trades across different market periods to refine the entry logic and recovery mechanisms. The goal was to develop parameter sets that maintain consistent behavior across various market conditions while providing users with flexibility to adjust risk levels.

Version Information

Version 2.00 represents a complete rebuild of the trading system with universal symbol compatibility, dual recovery mechanisms, enhanced entry filtering, improved lot sizing algorithms, and professional dashboard interface.

Download complete setfile package: https://drive.google.com/drive/folders/1UYEJ7zCTBIoVBjgHtozDc6VJUQxhB64J?usp=sharing

Disclaimer: Trading financial instruments involves substantial risk of loss. Never trade with money you cannot afford to lose. This EA is provided as a tool for automated trading based on technical analysis. The developer makes no representations regarding future profitability. Users are responsible for testing thoroughly and understanding all risk factors before live deployment. Results vary based on broker conditions, market volatility, and parameter configuration.