Global Currency Index MT4

- Indicators

- Suvashish Halder

- Version: 1.0

- Activations: 10

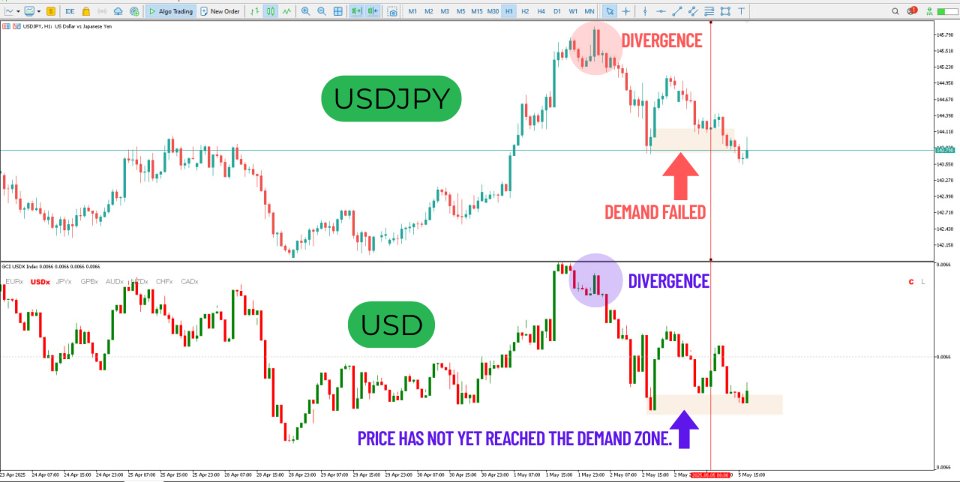

Have you ever asked yourself why your supply and demand zones fail, even when everything looks “perfect”? The truth is, you're not wrong — you're just watching the reaction, not the reason.

It's not like those random currency strength meters that rely on lagging indicators like RSI, CCI, or similar tools mashed together to guess strength or weakness. That approach reacts to the past — not the cause.

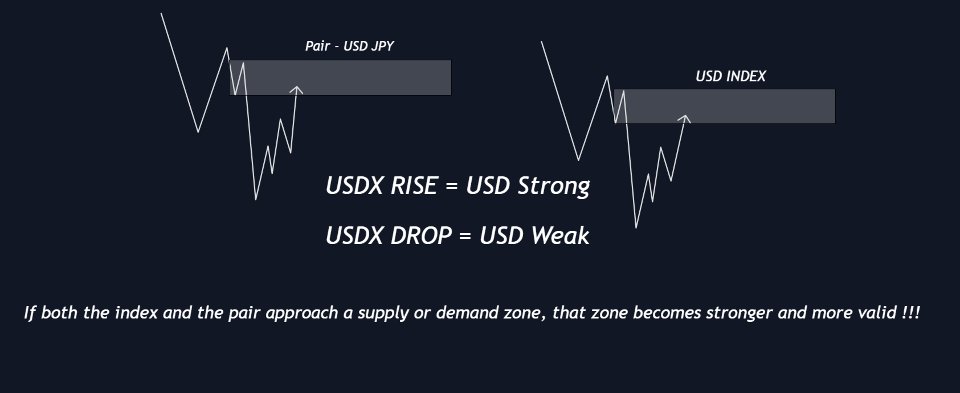

Pairs like EURUSD or USDJPY are just the outcomes. The real drivers? Currency indices and institutional volume flow.

When the USD Index (USDX) is hitting a demand zone and the EUR Index (EURX) is reaching supply — and it's backed by real volume — the direction of EURUSD is already locked in. Long before your usual strategy even blinks.

💡 That’s why we built the Global Currency Index.

MT5 Version - https://www.mql5.com/en/market/product/136117/

What Is It?

A synthetic, broker-independent currency index tool that replicates institutional logic with volume-weighted directional flow.

It tracks 8 major currencies across a balanced formula — so you’re no longer trading in the dark.

Key Features

-

Tracks real-time macro strength for: USD, EUR, JPY, GBP, AUD, NZD, CAD, CHF

-

Find our Real Time Strength vs Weakness

-

Works at any timeframe and any currency pairs including Gold.

-

Built on index logic (DXY-style)

-

Volume-backed movement for directional confirmation

-

Works on MT4 & MT5

-

Designed to align with smart money flows, not retail noise

-

Filters out fake breakouts, CHOCH/BOS traps, and non-validated zones

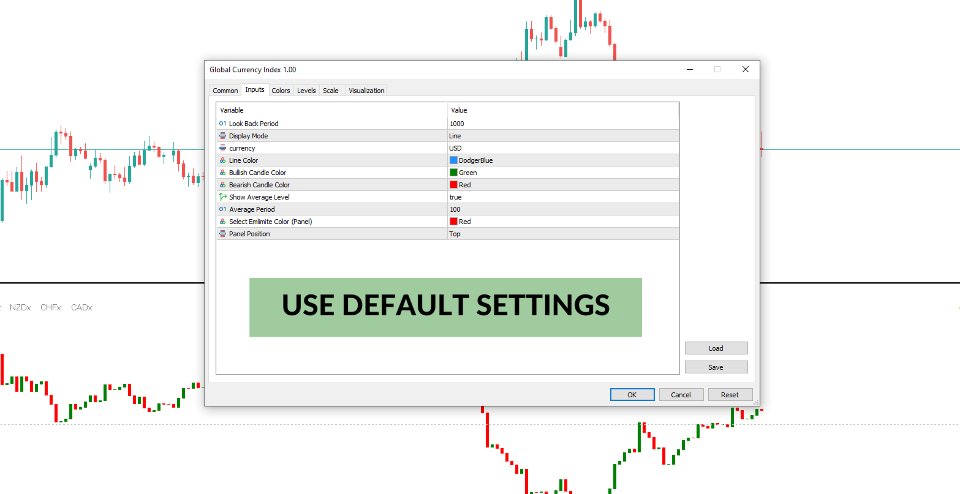

🔧 Input Settings (Customizable)

| Variable | Description |

|---|---|

| look_back | How many candles to calculate (e.g. 1000) |

| d_mode__ | Display mode ( Line or Candles ) |

| currency | Currency index to track (e.g. USD, EUR) |

| line | Color of the index line |

| bull_cand | Bullish candle color |

| bear_cand | Bearish candle color |

| mid_level | Show 50% mid level (true/false) |

| avt_per | Period used to calculate average strength |

| selected | Highlighted index color |

| p_pos | Display position (Top/Bottom) |

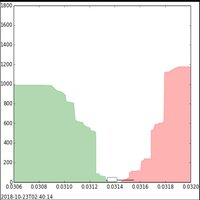

Why Volume Matters

-

Volume reflects actual market participation behind price

-

Our logic detects if index moves are backed by real strength or just liquidity grabs

-

It helps avoid false entries caused by weak volume pullbacks

-

Volume + Index = the most powerful directional filter you’ve ever used

Why It Works

-

❌ Supply/demand zones fail when the index or volume disagrees

-

✅ Now you trade with macro confirmation — not chart patterns alone

-

🎯 This tool reveals the cause, not the symptom

Trade the source.

Trade with volume clarity.

Trade with the Global Currency Index.