Deep Neural Networks (Part III). Sample selection and dimensionality reduction

This article is a continuation of the series of articles about deep neural networks. Here we will consider selecting samples (removing noise), reducing the dimensionality of input data and dividing the data set into the train/val/test sets during data preparation for training the neural network.

Automating Trading Strategies in MQL5 (Part 44): Change of Character (CHoCH) Detection with Swing High/Low Breaks

In this article, we develop a Change of Character (CHoCH) detection system in MQL5 that identifies swing highs and lows over a user-defined bar length, labels them as HH/LH for highs or LL/HL for lows to determine trend direction, and triggers trades on breaks of these swing points, indicating a potential reversal, and trades the breaks when the structure changes.

Matrix and Vector operations in MQL5

Matrices and vectors have been introduced in MQL5 for efficient operations with mathematical solutions. The new types offer built-in methods for creating concise and understandable code that is close to mathematical notation. Arrays provide extensive capabilities, but there are many cases in which matrices are much more efficient.

Brute force approach to pattern search (Part III): New horizons

This article provides a continuation to the brute force topic, and it introduces new opportunities for market analysis into the program algorithm, thereby accelerating the speed of analysis and improving the quality of results. New additions enable the highest-quality view of global patterns within this approach.

Price Action Analysis Toolkit Development (Part 27): Liquidity Sweep With MA Filter Tool

Understanding the subtle dynamics behind price movements can give you a critical edge. One such phenomenon is the liquidity sweep, a deliberate strategy that large traders, especially institutions, use to push prices through key support or resistance levels. These levels often coincide with clusters of retail stop-loss orders, creating pockets of liquidity that big players can exploit to enter or exit sizeable positions with minimal slippage.

Neural networks made easy (Part 5): Multithreaded calculations in OpenCL

We have earlier discussed some types of neural network implementations. In the considered networks, the same operations are repeated for each neuron. A logical further step is to utilize multithreaded computing capabilities provided by modern technology in an effort to speed up the neural network learning process. One of the possible implementations is described in this article.

Checking the Myth: The Whole Day Trading Depends on How the Asian Session Is Traded

In this article we will check the well-known statement that "The whole day trading depends on how the Asian session is traded".

Optimal approach to the development and analysis of trading systems

In this article, I will show the criteria to be used when selecting a system or a signal for investing your funds, as well as describe the optimal approach to the development of trading systems and highlight the importance of this matter in Forex trading.

Neural networks made easy (Part 27): Deep Q-Learning (DQN)

We continue to study reinforcement learning. In this article, we will get acquainted with the Deep Q-Learning method. The use of this method has enabled the DeepMind team to create a model that can outperform a human when playing Atari computer games. I think it will be useful to evaluate the possibilities of the technology for solving trading problems.

Mastering ONNX: The Game-Changer for MQL5 Traders

Dive into the world of ONNX, the powerful open-standard format for exchanging machine learning models. Discover how leveraging ONNX can revolutionize algorithmic trading in MQL5, allowing traders to seamlessly integrate cutting-edge AI models and elevate their strategies to new heights. Uncover the secrets to cross-platform compatibility and learn how to unlock the full potential of ONNX in your MQL5 trading endeavors. Elevate your trading game with this comprehensive guide to Mastering ONNX

Regression Analysis of the Influence of Macroeconomic Data on Currency Prices Fluctuation

This article considers the application of multiple regression analysis to macroeconomic statistics. It also gives an insight into the evaluation of the statistics impact on the currency exchange rate fluctuation based on the example of the currency pair EURUSD. Such evaluation allows automating the fundamental analysis which becomes available to even novice traders.

Multiple Null Bar Re-Count in Some Indicators

The article is concerned with the problem of re-counting of the indicator value in the MetaTrader 4 Client Terminal when the null bar changes. It outlines general idea of how to add to the indicator code some extra program items that allow to restore program code saved before multiple re-counting.

Neural networks made easy (Part 6): Experimenting with the neural network learning rate

We have previously considered various types of neural networks along with their implementations. In all cases, the neural networks were trained using the gradient decent method, for which we need to choose a learning rate. In this article, I want to show the importance of a correctly selected rate and its impact on the neural network training, using examples.

Algorithmic Trading With MetaTrader 5 And R For Beginners

Embark on a compelling exploration where financial analysis meets algorithmic trading as we unravel the art of seamlessly uniting R and MetaTrader 5. This article is your guide to bridging the realms of analytical finesse in R with the formidable trading capabilities of MetaTrader 5.

Library for easy and quick development of MetaTrader programs (part VII): StopLimit order activation events, preparing the functionality for order and position modification events

In the previous articles, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. In the sixth part, we trained the library to work with positions on netting accounts. Here we will implement tracking StopLimit orders activation and prepare the functionality to track order and position modification events.

Price Action Analysis Toolkit Development (Part 32): Python Candlestick Recognition Engine (II) — Detection Using Ta-Lib

In this article, we’ve transitioned from manually coding candlestick‑pattern detection in Python to leveraging TA‑Lib, a library that recognizes over sixty distinct patterns. These formations offer valuable insights into potential market reversals and trend continuations. Follow along to learn more.

Practical Use of Kohonen Neural Networks in Algorithmic Trading. Part I. Tools

The present article develops the idea of using Kohonen Maps in MetaTrader 5, covered in some previous publications. The improved and enhanced classes provide tools to solve application tasks.

Understand and Use MQL5 Strategy Tester Effectively

There is an essential need for MQL5 programmers or developers to master important and valuable tools. One of these tools is the Strategy Tester, this article is a practical guide to understanding and using the strategy tester of MQL5.

Prices in DoEasy library (part 63): Depth of Market and its abstract request class

In the article, I will start developing the functionality for working with the Depth of Market. I will also create the class of the Depth of Market abstract order object and its descendants.

Timeseries in DoEasy library (part 46): Multi-period multi-symbol indicator buffers

In this article, I am going to improve the classes of indicator buffer objects to work in the multi-symbol mode. This will pave the way for creating multi-symbol multi-period indicators in custom programs. I will add the missing functionality to the calculated buffer objects allowing us to create multi-symbol multi-period standard indicators.

Price Action Analysis Toolkit Development (Part 51): Revolutionary Chart Search Technology for Candlestick Pattern Discovery

This article is intended for algorithmic traders, quantitative analysts, and MQL5 developers interested in enhancing their understanding of candlestick pattern recognition through practical implementation. It provides an in‑depth exploration of the CandlePatternSearch.mq5 Expert Advisor—a complete framework for detecting, visualizing, and monitoring classical candlestick formations in MetaTrader 5. Beyond a line‑by‑line review of the code, the article discusses architectural design, pattern detection logic, GUI integration, and alert mechanisms, illustrating how traditional price‑action analysis can be automated efficiently.

MetaTrader AppStore Results for Q3 2013

Another quarter of the year has passed and we have decided to sum up its results for MetaTrader AppStore - the largest store of trading robots and technical indicators for MetaTrader platforms. More than 500 developers have placed over 1 200 products in the Market by the end of the reported quarter.

Other classes in DoEasy library (Part 72): Tracking and recording chart object parameters in the collection

In this article, I will complete working with chart object classes and their collection. I will also implement auto tracking of changes in chart properties and their windows, as well as saving new parameters to the object properties. Such a revision allows the future implementation of an event functionality for the entire chart collection.

Price Action Analysis Toolkit Development (Part 3): Analytics Master — EA

Moving from a simple trading script to a fully functioning Expert Advisor (EA) can significantly enhance your trading experience. Imagine having a system that automatically monitors your charts, performs essential calculations in the background, and provides regular updates every two hours. This EA would be equipped to analyze key metrics that are crucial for making informed trading decisions, ensuring that you have access to the most current information to adjust your strategies effectively.

Price Action Analysis Toolkit Development (Part 1): Chart Projector

This project aims to leverage the MQL5 algorithm to develop a comprehensive set of analysis tools for MetaTrader 5. These tools—ranging from scripts and indicators to AI models and expert advisors—will automate the market analysis process. At times, this development will yield tools capable of performing advanced analyses with no human involvement and forecasting outcomes to appropriate platforms. No opportunity will ever be missed. Join me as we explore the process of building a robust market analysis custom tools' chest. We will begin by developing a simple MQL5 program that I have named, Chart Projector.

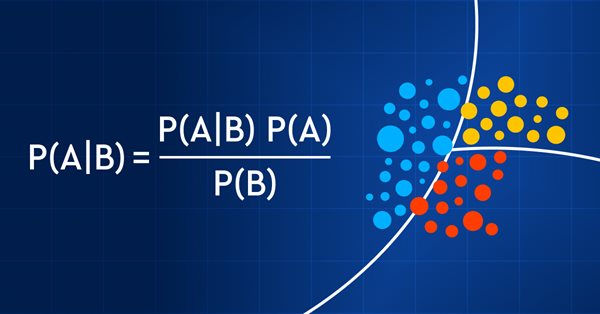

Data Science and Machine Learning (Part 11): Naïve Bayes, Probability theory in Trading

Trading with probability is like walking on a tightrope - it requires precision, balance, and a keen understanding of risk. In the world of trading, the probability is everything. It's the difference between success and failure, profit and loss. By leveraging the power of probability, traders can make informed decisions, manage risk effectively, and achieve their financial goals. So, whether you're a seasoned investor or a novice trader, understanding probability is the key to unlocking your trading potential. In this article, we'll explore the exciting world of trading with probability and show you how to take your trading game to the next level.

Price series discretization, random component and noise

We usually analyze the market using candlesticks or bars that slice the price series into regular intervals. Doesn't such discretization method distort the real structure of market movements? Discretization of an audio signal at regular intervals is an acceptable solution because an audio signal is a function that changes over time. The signal itself is an amplitude which depends on time. This signal property is fundamental.

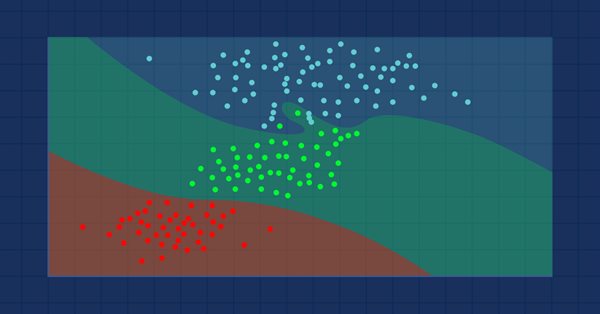

Data Science and Machine Learning (Part 09): The K-Nearest Neighbors Algorithm (KNN)

This is a lazy algorithm that doesn't learn from the training dataset, it stores the dataset instead and acts immediately when it's given a new sample. As simple as it is, it is used in a variety of real-world applications.

Multi-module trading robot in Python and MQL5 (Part I): Creating basic architecture and first modules

We are going to develop a modular trading system that combines Python for data analysis with MQL5 for trade execution. Four independent modules monitor different market aspects in parallel: volumes, arbitrage, economics and risks, and use RandomForest with 400 trees for analysis. Particular emphasis is placed on risk management, since even the most advanced trading algorithms are useless without proper risk management.

Timeseries in DoEasy library (part 45): Multi-period indicator buffers

In this article, I will start the improvement of the indicator buffer objects and collection class for working in multi-period and multi-symbol modes. I am going to consider the operation of buffer objects for receiving and displaying data from any timeframe on the current symbol chart.

Building a Spectrum Analyzer

This article is intended to get its readers acquainted with a possible variant of using graphical objects of the MQL5 language. It analyses an indicator, which implements a panel of managing a simple spectrum analyzer using the graphical objects. The article is meant for readers acquianted with basics of MQL5.

Price Action Analysis Toolkit Development (Part 25): Dual EMA Fractal Breaker

Price action is a fundamental approach for identifying profitable trading setups. However, manually monitoring price movements and patterns can be challenging and time-consuming. To address this, we are developing tools that analyze price action automatically, providing timely signals whenever potential opportunities are detected. This article introduces a robust tool that leverages fractal breakouts alongside EMA 14 and EMA 200 to generate reliable trading signals, helping traders make informed decisions with greater confidence.

Statistical Estimations

Estimation of statistical parameters of a sequence is very important, since most of mathematical models and methods are based on different assumptions. For example, normality of distribution law or dispersion value, or other parameters. Thus, when analyzing and forecasting of time series we need a simple and convenient tool that allows quickly and clearly estimating the main statistical parameters. The article shortly describes the simplest statistical parameters of a random sequence and several methods of its visual analysis. It offers the implementation of these methods in MQL5 and the methods of visualization of the result of calculations using the Gnuplot application.

Library for easy and quick development of MetaTrader programs (part VI): Netting account events

In the previous articles, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. In the fifth part of the article series, we created trading event classes and the event collection, from which the events are sent to the base object of the Engine library and the control program chart. In this part, we will let the library to work on netting accounts.

Using Discriminant Analysis to Develop Trading Systems

When developing a trading system, there usually arises a problem of selecting the best combination of indicators and their signals. Discriminant analysis is one of the methods to find such combinations. The article gives an example of developing an EA for market data collection and illustrates the use of the discriminant analysis for building prognostic models for the FOREX market in Statistica software.

Growing Neural Gas: Implementation in MQL5

The article shows an example of how to develop an MQL5-program implementing the adaptive algorithm of clustering called Growing neural gas (GNG). The article is intended for the users who have studied the language documentation and have certain programming skills and basic knowledge in the area of neuroinformatics.

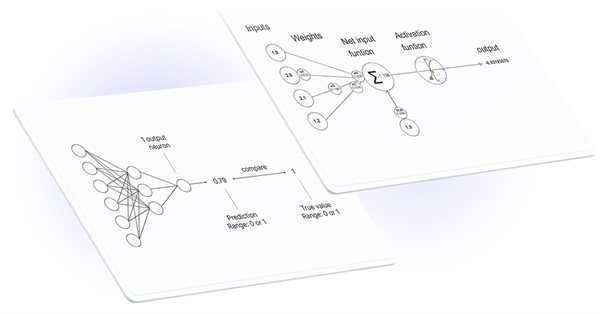

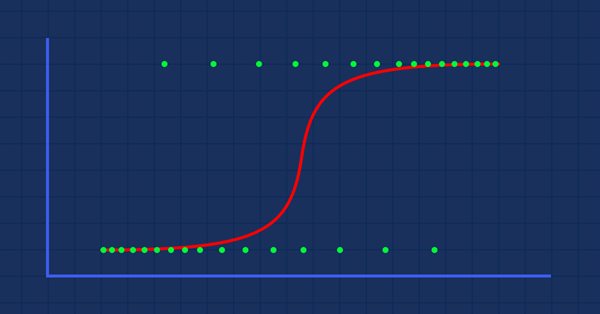

Data Science and Machine Learning (Part 04): Predicting Current Stock Market Crash

In this article I am going to attempt to use our logistic model to predict the stock market crash based upon the fundamentals of the US economy, the NETFLIX and APPLE are the stocks we are going to focus on, Using the previous market crashes of 2019 and 2020 let's see how our model will perform in the current dooms and glooms.

Algorithmic trading based on 3D reversal patterns

Discovering a new world of automated trading on 3D bars. What does a trading robot look like on multidimensional price bars? Are "yellow" clusters of 3D bars able to predict trend reversals? What does multidimensional trading look like?

Data Science and Machine Learning (Part 02): Logistic Regression

Data Classification is a crucial thing for an algo trader and a programmer. In this article, we are going to focus on one of classification logistic algorithms that can probability help us identify the Yes's or No's, the Ups and Downs, Buys and Sells.

Developing a Replay System — Market simulation (Part 01): First experiments (I)

How about creating a system that would allow us to study the market when it is closed or even to simulate market situations? Here we are going to start a new series of articles in which we will deal with this topic.