Metamodels in machine learning and trading: Original timing of trading orders

Metamodels in machine learning: Auto creation of trading systems with little or no human intervention — The model decides when and how to trade on its own.

The price movement model and its main provisions (Part 2): Probabilistic price field evolution equation and the occurrence of the observed random walk

The article considers the probabilistic price field evolution equation and the upcoming price spike criterion. It also reveals the essence of price values on charts and the mechanism for the occurrence of a random walk of these values.

Continuous futures contracts in MetaTrader 5

A short life span of futures contracts complicates their technical analysis. It is difficult to technically analyze short charts. For example, number of bars on the day chart of the UX-9.13 Ukrainian Stock index future is more than 100. Therefore, trader creates synthetic long futures contracts. This article explains how to splice futures contracts with different dates in the MetaTrader 5 terminal.

Developing a trading Expert Advisor from scratch (Part 16): Accessing data on the web (II)

Knowing how to input data from the Web into an Expert Advisor is not so obvious. It is not so easy to do without understanding all the possibilities offered by MetaTrader 5.

Developing a trading Expert Advisor from scratch (Part 15): Accessing data on the web (I)

How to access online data via MetaTrader 5? There are a lot of websites and places on the web, featuring a huge amount information. What you need to know is where to look and how best to use this information.

Timeseries in DoEasy library (part 49): Multi-period multi-symbol multi-buffer standard indicators

In the current article, I will improve the library classes to implement the ability to develop multi-symbol multi-period standard indicators requiring several indicator buffers to display their data.

Other classes in DoEasy library (Part 68): Chart window object class and indicator object classes in the chart window

In this article, I will continue the development of the chart object class. I will add the list of chart window objects featuring the lists of available indicators.

Mountain or Iceberg charts

How do you like the idea of adding a new chart type to the MetaTrader 5 platform? Some people say it lacks a few things that other platforms offer. But the truth is, MetaTrader 5 is a very practical platform as it allows you to do things that can't be done (or at least can't be done easily) in many other platforms.

The price movement model and its main provisions. (Part 3): Calculating optimal parameters of stock exchange speculations

Within the framework of the engineering approach developed by the author based on the probability theory, the conditions for opening a profitable position are found and the optimal (profit-maximizing) take profit and stop loss values are calculated.

Price Action Analysis Toolkit Development (Part 26): Pin Bar, Engulfing Patterns and RSI Divergence (Multi-Pattern) Tool

Aligned with our goal of developing practical price-action tools, this article explores the creation of an EA that detects pin bar and engulfing patterns, using RSI divergence as a confirmation trigger before generating any trading signals.

Other classes in DoEasy library (Part 71): Chart object collection events

In this article, I will create the functionality for tracking some chart object events — adding/removing symbol charts and chart subwindows, as well as adding/removing/changing indicators in chart windows.

From Novice to Expert: Demystifying Hidden Fibonacci Retracement Levels

In this article, we explore a data-driven approach to discovering and validating non-standard Fibonacci retracement levels that markets may respect. We present a complete workflow tailored for implementation in MQL5, beginning with data collection and bar or swing detection, and extending through clustering, statistical hypothesis testing, backtesting, and integration into an MetaTrader 5 Fibonacci tool. The goal is to create a reproducible pipeline that transforms anecdotal observations into statistically defensible trading signals.

Mastering Fair Value Gaps: Formation, Logic, and Automated Trading with Breakers and Market Structure Shifts

This is an article that I have written aimed to expound and explain Fair Value Gaps, their formation logic for occurring, and automated trading with breakers and market structure shifts.

Forecasting with ARIMA models in MQL5

In this article we continue the development of the CArima class for building ARIMA models by adding intuitive methods that enable forecasting.

Developing a robot in Python and MQL5 (Part 1): Data preprocessing

Developing a trading robot based on machine learning: A detailed guide. The first article in the series deals with collecting and preparing data and features. The project is implemented using the Python programming language and libraries, as well as the MetaTrader 5 platform.

Timeseries in DoEasy library (part 44): Collection class of indicator buffer objects

The article deals with creating a collection class of indicator buffer objects. I am going to test the ability to create and work with any number of buffers for indicators (the maximum number of buffers that can be created in MQL indicators is 512).

Other classes in DoEasy library (Part 69): Chart object collection class

With this article, I start the development of the chart object collection class. The class will store the collection list of chart objects with their subwindows and indicators providing the ability to work with any selected charts and their subwindows or with a list of several charts at once.

The Kalman Filter for Forex Mean-Reversion Strategies

The Kalman filter is a recursive algorithm used in algorithmic trading to estimate the true state of a financial time series by filtering out noise from price movements. It dynamically updates predictions based on new market data, making it valuable for adaptive strategies like mean reversion. This article first introduces the Kalman filter, covering its calculation and implementation. Next, we apply the filter to a classic mean-reversion forex strategy as an example. Finally, we conduct various statistical analyses by comparing the filter with a moving average across different forex pairs.

Neural networks made easy (Part 19): Association rules using MQL5

We continue considering association rules. In the previous article, we have discussed theoretical aspect of this type of problem. In this article, I will show the implementation of the FP Growth method using MQL5. We will also test the implemented solution using real data.

Reimagining Classic Strategies (Part 18): Searching For Candlestick Patterns

This article helps new community members search for and discover their own candlestick patterns. Describing these patterns can be daunting, as it requires manually searching and creatively identifying improvements. Here, we introduce the engulfing candlestick pattern and show how it can be enhanced for more profitable trading applications.

Population optimization algorithms: Bacterial Foraging Optimization (BFO)

E. coli bacterium foraging strategy inspired scientists to create the BFO optimization algorithm. The algorithm contains original ideas and promising approaches to optimization and is worthy of further study.

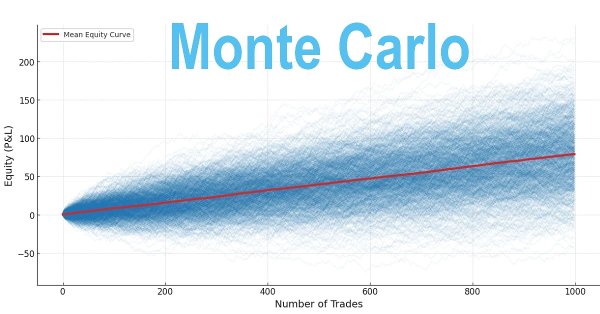

Building a Trading System (Part 1): A Quantitative Approach

Many traders evaluate strategies based on short-term performance, often abandoning profitable systems too early. Long-term profitability, however, depends on positive expectancy through optimized win rate and risk-reward ratio, along with disciplined position sizing. These principles can be validated using Monte Carlo simulation in Python with back-tested metrics to assess whether a strategy is robust or likely to fail over time.

Price Action Analysis Toolkit Development (Part 13): RSI Sentinel Tool

Price action can be effectively analyzed by identifying divergences, with technical indicators such as the RSI providing crucial confirmation signals. In the article below, we explain how automated RSI divergence analysis can identify trend continuations and reversals, thereby offering valuable insights into market sentiment.

Selection and navigation utility in MQL5 and MQL4: Adding "homework" tabs and saving graphical objects

In this article, we are going to expand the capabilities of the previously created utility by adding tabs for selecting the symbols we need. We will also learn how to save graphical objects we have created on the specific symbol chart, so that we do not have to constantly create them again. Besides, we will find out how to work only with symbols that have been preliminarily selected using a specific website.

Prices in DoEasy library (part 61): Collection of symbol tick series

Since a program may use different symbols in its work, a separate list should be created for each of them. In this article, I will combine such lists into a tick data collection. In fact, this will be a regular list based on the class of dynamic array of pointers to instances of CObject class and its descendants of the Standard library.

Category Theory in MQL5 (Part 1)

Category Theory is a diverse and expanding branch of Mathematics which as of yet is relatively uncovered in the MQL community. These series of articles look to introduce and examine some of its concepts with the overall goal of establishing an open library that attracts comments and discussion while hopefully furthering the use of this remarkable field in Traders' strategy development.

Marvel Your MQL5 Customers with a Usable Cocktail of Technologies!

MQL5 provides programmers with a very complete set of functions and object-oriented API thanks to which they can do everything they want within the MetaTrader environment. However, Web Technology is an extremely versatile tool nowadays that may come to the rescue in some situations when you need to do something very specific, want to marvel your customers with something different or simply you do not have enough time to master a specific part of MT5 Standard Library. Today's exercise walks you through a practical example about how you can manage your development time at the same time as you also create an amazing tech cocktail.

Creating a mean-reversion strategy based on machine learning

This article proposes another original approach to creating trading systems based on machine learning, using clustering and trade labeling for mean reversion strategies.

Developing a Replay System — Market simulation (Part 02): First experiments (II)

This time, let's try a different approach to achieve the 1 minute goal. However, this task is not as simple as one might think.

Data Science and Machine Learning (Part 07): Polynomial Regression

Unlike linear regression, polynomial regression is a flexible model aimed to perform better at tasks the linear regression model could not handle, Let's find out how to make polynomial models in MQL5 and make something positive out of it.

Parallel Particle Swarm Optimization

The article describes a method of fast optimization using the particle swarm algorithm. It also presents the method implementation in MQL, which is ready for use both in single-threaded mode inside an Expert Advisor and in a parallel multi-threaded mode as an add-on that runs on local tester agents.

Neural networks made easy (Part 16): Practical use of clustering

In the previous article, we have created a class for data clustering. In this article, I want to share variants of the possible application of obtained results in solving practical trading tasks.

Prices in DoEasy library (part 59): Object to store data of one tick

From this article on, start creating library functionality to work with price data. Today, create an object class which will store all price data which arrived with yet another tick.

Data Science and Machine Learning (Part 06): Gradient Descent

The gradient descent plays a significant role in training neural networks and many machine learning algorithms. It is a quick and intelligent algorithm despite its impressive work it is still misunderstood by a lot of data scientists let's see what it is all about.

Data label for time series mining(Part 1):Make a dataset with trend markers through the EA operation chart

This series of articles introduces several time series labeling methods, which can create data that meets most artificial intelligence models, and targeted data labeling according to needs can make the trained artificial intelligence model more in line with the expected design, improve the accuracy of our model, and even help the model make a qualitative leap!

Neural networks made easy (Part 21): Variational autoencoders (VAE)

In the last article, we got acquainted with the Autoencoder algorithm. Like any other algorithm, it has its advantages and disadvantages. In its original implementation, the autoenctoder is used to separate the objects from the training sample as much as possible. This time we will talk about how to deal with some of its disadvantages.

Advanced resampling and selection of CatBoost models by brute-force method

This article describes one of the possible approaches to data transformation aimed at improving the generalizability of the model, and also discusses sampling and selection of CatBoost models.

Neural networks made easy (Part 15): Data clustering using MQL5

We continue to consider the clustering method. In this article, we will create a new CKmeans class to implement one of the most common k-means clustering methods. During tests, the model managed to identify about 500 patterns.

Developing an Expert Advisor from scratch (Part 30): CHART TRADE as an indicator?

Today we are going to use Chart Trade again, but this time it will be an on-chart indicator which may or may not be present on the chart.

Price Action Analysis Toolkit Development (Part 42): Interactive Chart Testing with Button Logic and Statistical Levels

In a world where speed and precision matter, analysis tools need to be as smart as the markets we trade. This article presents an EA built on button logic—an interactive system that instantly transforms raw price data into meaningful statistical levels. With a single click, it calculates and displays mean, deviation, percentiles, and more, turning advanced analytics into clear on-chart signals. It highlights the zones where price is most likely to bounce, retrace, or break, making analysis both faster and more practical.