Library for easy and quick development of MetaTrader programs (part XVII): Interactivity of library objects

In this article, we are going to finish the development of the base object of all library objects, so that any library object based on it is able to interact with a user. For example, users will be able to set the maximum acceptable size of a spread for opening a position and a price level, upon reaching which an event from a symbol object is sent to the program with the spread or price level-based signal.

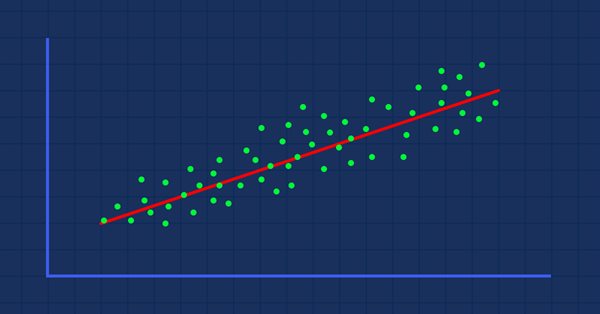

Data Science and Machine Learning (Part 01): Linear Regression

It's time for us as traders to train our systems and ourselves to make decisions based on what number says. Not on our eyes, and what our guts make us believe, this is where the world is heading so, let us move perpendicular to the direction of the wave.

Bi-Directional Trading and Hedging of Positions in MetaTrader 5 Using the HedgeTerminal API, Part 2

This article describes a new approach to hedging of positions and draws the line in the debates between users of MetaTrader 4 and MetaTrader 5 about this matter. It is a continuation of the first part: "Bi-Directional Trading and Hedging of Positions in MetaTrader 5 Using the HedgeTerminal Panel, Part 1". In the second part, we discuss integration of custom Expert Advisors with HedgeTerminalAPI, which is a special visualization library designed for bi-directional trading in a comfortable software environment providing tools for convenient position management.

Modeling time series using custom symbols according to specified distribution laws

The article provides an overview of the terminal's capabilities for creating and working with custom symbols, offers options for simulating a trading history using custom symbols, trend and various chart patterns.

Tips for Selecting a Trading Signal to Subscribe. Step-By-Step Guide

This step-by-step guide is dedicated to the Signals service, examination of trading signals, a system approach to the search of a required signal which would satisfy criteria of profitability, risk, trading ambitions, working on various types of accounts and financial instruments.

Fundamentals of Statistics

Every trader works using certain statistical calculations, even if being a supporter of fundamental analysis. This article walks you through the fundamentals of statistics, its basic elements and shows the importance of statistics in decision making.

Self-adapting algorithm (Part IV): Additional functionality and tests

I continue filling the algorithm with the minimum necessary functionality and testing the results. The profitability is quite low but the articles demonstrate the model of the fully automated profitable trading on completely different instruments traded on fundamentally different markets.

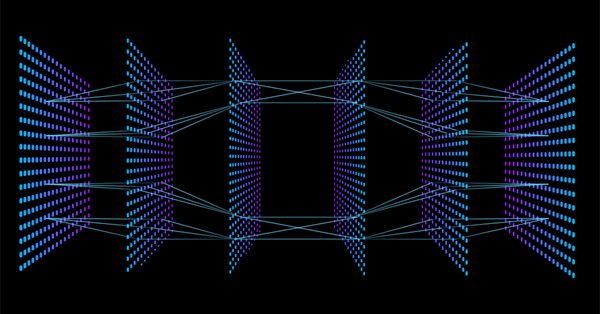

Multilayer perceptron and backpropagation algorithm (Part II): Implementation in Python and integration with MQL5

There is a Python package available for developing integrations with MQL, which enables a plethora of opportunities such as data exploration, creation and use of machine learning models. The built in Python integration in MQL5 enables the creation of various solutions, from simple linear regression to deep learning models. Let's take a look at how to set up and prepare a development environment and how to use use some of the machine learning libraries.

The correct way to choose an Expert Advisor from the Market

In this article, we will consider some of the essential points you should pay attention to when purchasing an Expert Advisor. We will also look for ways to increase profit, to spend money wisely, and to earn from this spending. Also, after reading the article, you will see that it is possible to earn even using simple and free products.

MQL5-RPC. Remote Procedure Calls from MQL5: Web Service Access and XML-RPC ATC Analyzer for Fun and Profit

This article describes MQL5-RPC framework that enables Remote Procedure Calls from MQL5. It starts with XML-RPC basics, MQL5 implementation and follows with two real usage examples. First example is using external web service and the second one is a client to simple XML-RPC ATC 2011 Analyzer service. If you are interested on how to implement and analyze different statistics from ATC 2011 in real time, this article is just for you.

MetaTrader 4 and MetaTrader 5 Trading Signals Widgets

Recently MetaTrader 4 and MetaTrader 5 user received an opportunity to become a Signals Provider and earn additional profit. Now, you can display your trading success on your web site, blog or social network page using the new widgets. The benefits of using widgets are obvious: they increase the Signals Providers' popularity, establish their reputation as successful traders, as well as attract new Subscribers. All traders placing widgets on other web sites can enjoy these benefits.

Probability theory and mathematical statistics with examples (part I): Fundamentals and elementary theory

Trading is always about making decisions in the face of uncertainty. This means that the results of the decisions are not quite obvious at the time these decisions are made. This entails the importance of theoretical approaches to the construction of mathematical models allowing us to describe such cases in meaningful manner.

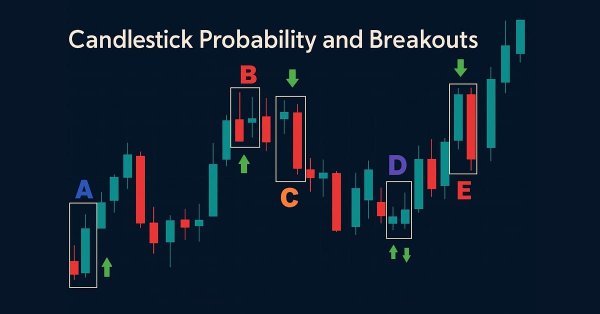

Price Action Analysis Toolkit Development (Part 43): Candlestick Probability and Breakouts

Enhance your market analysis with the MQL5-native Candlestick Probability EA, a lightweight tool that transforms raw price bars into real-time, instrument-specific probability insights. It classifies Pinbars, Engulfing, and Doji patterns at bar close, uses ATR-aware filtering, and optional breakout confirmation. The EA calculates raw and volume-weighted follow-through percentages, helping you understand each pattern's typical outcome on specific symbols and timeframes. On-chart markers, a compact dashboard, and interactive toggles allow easy validation and focus. Export detailed CSV logs for offline testing. Use it to develop probability profiles, optimize strategies, and turn pattern recognition into a measurable edge.

What is a trend and is the market structure based on trend or flat?

Traders often talk about trends and flats but very few of them really understand what a trend/flat really is and even fewer are able to clearly explain these concepts. Discussing these basic terms is often beset by a solid set of prejudices and misconceptions. However, if we want to make profit, we need to understand the mathematical and logical meaning of these concepts. In this article, I will take a closer look at the essence of trend and flat, as well as try to define whether the market structure is based on trend, flat or something else. I will also consider the most optimal strategies for making profit on trend and flat markets.

Modified Grid-Hedge EA in MQL5 (Part I): Making a Simple Hedge EA

We will be creating a simple hedge EA as a base for our more advanced Grid-Hedge EA, which will be a mixture of classic grid and classic hedge strategies. By the end of this article, you will know how to create a simple hedge strategy, and you will also get to know what people say about whether this strategy is truly 100% profitable.

Library for easy and quick development of MetaTrader programs (part II). Collection of historical orders and deals

In the first part, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. We created the COrder abstract object which is a base object for storing data on history orders and deals, as well as on market orders and positions. Now we will develop all the necessary objects for storing account history data in collections.

Combination scalping: analyzing trades from the past to increase the performance of future trades

The article provides the description of the technology aimed at increasing the effectiveness of any automated trading system. It provides a brief explanation of the idea, as well as its underlying basics, possibilities and disadvantages.

Timeseries in DoEasy library (part 35): Bar object and symbol timeseries list

This article starts a new series about the creation of the DoEasy library for easy and fast program development. In the current article, we will implement the library functionality for accessing and working with symbol timeseries data. We are going to create the Bar object storing the main and extended timeseries bar data, and place bar objects to the timeseries list for convenient search and sorting of the objects.

Prices and Signals in DoEasy library (Part 65): Depth of Market collection and the class for working with MQL5.com Signals

In this article, I will create the collection class of Depths of Market of all symbols and start developing the functionality for working with the MQL5.com Signals service by creating the signal object class.

Neural Networks Cheap and Cheerful - Link NeuroPro with MetaTrader 5

If specific neural network programs for trading seem expensive and complex or, on the contrary, too simple, try NeuroPro. It is free and contains the optimal set of functionalities for amateurs. This article will tell you how to use it in conjunction with MetaTrader 5.

Sorting methods and their visualization using MQL5

The Graphic.mqh library has been designed to work with graphics in MQL5. The article provides an example of its practical application and explains the idea of sorting. The general concept of sorting is described here since each type of sorting already has at least one separate article, while some of sorting types are objects of detailed studies.

Applying OLAP in trading (part 3): Analyzing quotes for the development of trading strategies

In this article we will continue dealing with the OLAP technology applied to trading. We will expand the functionality presented in the first two articles. This time we will consider the operational analysis of quotes. We will put forward and test the hypotheses on trading strategies based on aggregated historical data. The article presents Expert Advisors for studying bar patterns and adaptive trading.

Finding seasonal patterns in the forex market using the CatBoost algorithm

The article considers the creation of machine learning models with time filters and discusses the effectiveness of this approach. The human factor can be eliminated now by simply instructing the model to trade at a certain hour of a certain day of the week. Pattern search can be provided by a separate algorithm.

Neural networks made easy (Part 10): Multi-Head Attention

We have previously considered the mechanism of self-attention in neural networks. In practice, modern neural network architectures use several parallel self-attention threads to find various dependencies between the elements of a sequence. Let us consider the implementation of such an approach and evaluate its impact on the overall network performance.

Developing the symbol selection and navigation utility in MQL5 and MQL4

Experienced traders are well aware of the fact that most time-consuming things in trading are not opening and tracking positions but selecting symbols and looking for entry points. In this article, we will develop an EA simplifying the search for entry points on trading instruments provided by your broker.

Risk and capital management using Expert Advisors

This article is about what you can not see in a backtest report, what you should expect using automated trading software, how to manage your money if you are using expert advisors, and how to cover a significant loss to remain in the trading activity when you are using automated procedures.

Deep Neural Networks (Part II). Working out and selecting predictors

The second article of the series about deep neural networks will consider the transformation and choice of predictors during the process of preparing data for training a model.

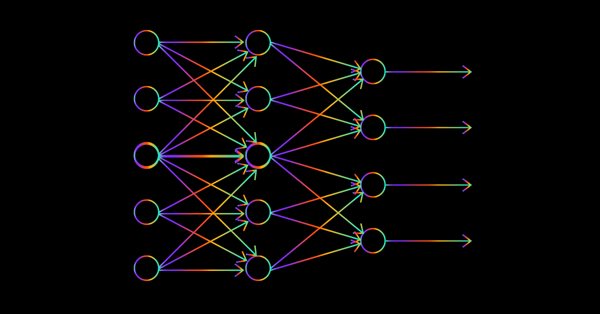

Data Science and Machine Learning — Neural Network (Part 01): Feed Forward Neural Network demystified

Many people love them but a few understand the whole operations behind Neural Networks. In this article I will try to explain everything that goes behind closed doors of a feed-forward multi-layer perception in plain English.

Analysis of the Main Characteristics of Time Series

This article introduces a class designed to give a quick preliminary estimate of characteristics of various time series. As this takes place, statistical parameters and autocorrelation function are estimated, a spectral estimation of time series is carried out and a histogram is built.

Selection and navigation utility in MQL5 and MQL4: Adding auto search for patterns and displaying detected symbols

In this article, we continue expanding the features of the utility for collecting and navigating through symbols. This time, we will create new tabs displaying only the symbols that satisfy some of the necessary parameters and find out how to easily add custom tabs with the necessary sorting rules.

An Analysis of Why Expert Advisors Fail

This article presents an analysis of currency data to better understand why expert advisors can have good performance in some regions of time and poor performance in other regions of time.

Naive Bayes classifier for signals of a set of indicators

The article analyzes the application of the Bayes' formula for increasing the reliability of trading systems by means of using signals from multiple independent indicators. Theoretical calculations are verified with a simple universal EA, configured to work with arbitrary indicators.

Social Trading. Can a profitable signal be made even better?

Most subscribers choose a trade signal by the beauty of the balance curve and by the number of subscribers. This is why many today's providers care of beautiful statistics rather than of real signal quality, often playing with lot sizes and artificially reducing the balance curve to an ideal appearance. This paper deals with the reliability criteria and the methods a provider may use to enhance its signal quality. An exemplary analysis of a specific signal history is presented, as well as methods that would help a provider to make it more profitable and less risky.

Data Science and Machine Learning — Neural Network (Part 02): Feed forward NN Architectures Design

There are minor things to cover on the feed-forward neural network before we are through, the design being one of them. Let's see how we can build and design a flexible neural network to our inputs, the number of hidden layers, and the nodes for each of the network.

Neural networks made easy (Part 11): A take on GPT

Perhaps one of the most advanced models among currently existing language neural networks is GPT-3, the maximal variant of which contains 175 billion parameters. Of course, we are not going to create such a monster on our home PCs. However, we can view which architectural solutions can be used in our work and how we can benefit from them.

MQL Parsing by Means of MQL

The article describes a preprocessor, a scanner, and a parser to be used in parsing the MQL-based source codes. MQL implementation is attached.

Universal Regression Model for Market Price Prediction

The market price is formed out of a stable balance between demand and supply which, in turn, depend on a variety of economic, political and psychological factors. Differences in nature as well as causes of influence of these factors make it difficult to directly consider all the components. This article sets forth an attempt to predict the market price on the basis of an elaborated regression model.

Library for easy and quick development of MetaTrader programs (part XVI): Symbol collection events

In this article, we will create a new base class of all library objects adding the event functionality to all its descendants and develop the class for tracking symbol collection events based on the new base class. We will also change account and account event classes for developing the new base object functionality.

How to build and optimize a cycle-based trading system (Detrended Price Oscillator - DPO)

This article explains how to design and optimise a trading system using the Detrended Price Oscillator (DPO) in MQL5. It outlines the indicator's core logic, demonstrating how it identifies short-term cycles by filtering out long-term trends. Through a series of step-by-step examples and simple strategies, readers will learn how to code it, define entry and exit signals, and conduct backtesting. Finally, the article presents practical optimization methods to enhance performance and adapt the system to changing market conditions.

Statistical Carry Trade Strategy

An algorithm of statistical protection of open positive swap positions from unwanted price movements. This article features a variant of the carry trade protection strategy that allows to compensate for potential risk of the price movement in the direction opposite to that of the open position.