Risk Evaluation in the Sequence of Deals with One Asset

This article describes the use of methods of the theory of probability and mathematical statistics in the analysis of trading systems.

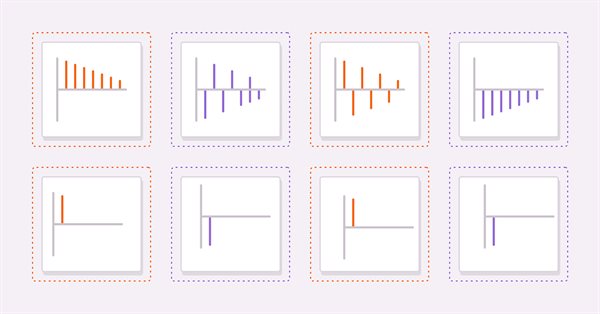

Applying OLAP in trading (part 2): Visualizing the interactive multidimensional data analysis results

In this article, we consider the creation of an interactive graphical interface for an MQL program, which is designed for the processing of account history and trading reports using OLAP techniques. To obtain a visual result, we will use maximizable and scalable windows, an adaptive layout of rubber controls and a new control for displaying diagrams. To provide the visualization functionality, we will implement a GUI with the selection of variables along coordinate axes, as well as with the selection of aggregate functions, diagram types and sorting options.

Modified Grid-Hedge EA in MQL5 (Part II): Making a Simple Grid EA

In this article, we explored the classic grid strategy, detailing its automation using an Expert Advisor in MQL5 and analyzing initial backtest results. We highlighted the strategy's need for high holding capacity and outlined plans for optimizing key parameters like distance, takeProfit, and lot sizes in future installments. The series aims to enhance trading strategy efficiency and adaptability to different market conditions.

Visualizing trading strategy optimization in MetaTrader 5

The article implements an MQL application with a graphical interface for extended visualization of the optimization process. The graphical interface applies the last version of EasyAndFast library. Many users may ask why they need graphical interfaces in MQL applications. This article demonstrates one of multiple cases where they can be useful for traders.

Combinatorics and probability theory for trading (Part III): The first mathematical model

A logical continuation of the earlier discussed topic would be the development of multifunctional mathematical models for trading tasks. In this article, I will describe the entire process related to the development of the first mathematical model describing fractals, from scratch. This model should become an important building block and be multifunctional and universal. It will build up our theoretical basis for further development of this idea.

Statistical Probability Distributions in MQL5

The article addresses probability distributions (normal, log-normal, binomial, logistic, exponential, Cauchy distribution, Student's t-distribution, Laplace distribution, Poisson distribution, Hyperbolic Secant distribution, Beta and Gamma distribution) of random variables used in Applied Statistics. It also features classes for handling these distributions.

Library for easy and quick development of MetaTrader programs (part XII): Account object class and collection of account objects

In the previous article, we defined position closure events for MQL4 in the library and got rid of the unused order properties. Here we will consider the creation of the Account object, develop the collection of account objects and prepare the functionality for tracking account events.

Neural networks made easy (Part 8): Attention mechanisms

In previous articles, we have already tested various options for organizing neural networks. We also considered convolutional networks borrowed from image processing algorithms. In this article, I suggest considering Attention Mechanisms, the appearance of which gave impetus to the development of language models.

Decoding Opening Range Breakout Intraday Trading Strategies

Opening Range Breakout (ORB) strategies are built on the idea that the initial trading range established shortly after the market opens reflects significant price levels where buyers and sellers agree on value. By identifying breakouts above or below a certain range, traders can capitalize on the momentum that often follows as the market direction becomes clearer. In this article, we will explore three ORB strategies adapted from the Concretum Group.

Library for easy and quick development of MetaTrader programs (part X): Compatibility with MQL4 - Events of opening a position and activating pending orders

In the previous articles, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. In the ninth part, we started improving the library classes for working with MQL4. Here we will continue improving the library to ensure its full compatibility with MQL4.

The market and the physics of its global patterns

In this article, I will try to test the assumption that any system with even a small understanding of the market can operate on a global scale. I will not invent any theories or patterns, but I will only use known facts, gradually translating these facts into the language of mathematical analysis.

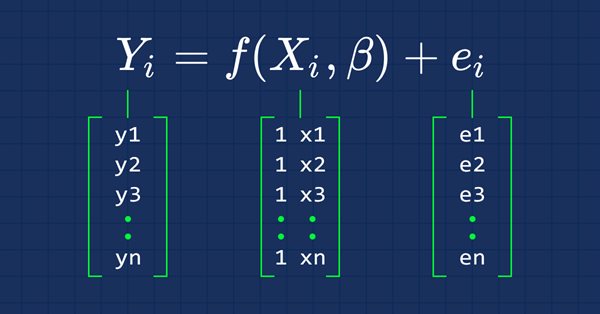

Data Science and Machine Learning (Part 03): Matrix Regressions

This time our models are being made by matrices, which allows flexibility while it allows us to make powerful models that can handle not only five independent variables but also many variables as long as we stay within the calculations limits of a computer, this article is going to be an interesting read, that's for sure.

Information Storage and View

The article deals with convenient and efficient methods of information storage and viewing. Alternatives to the terminal standard log file and the Comment() function are considered here.

Separate optimization of a strategy on trend and flat conditions

The article considers applying the separate optimization method during various market conditions. Separate optimization means defining trading system's optimal parameters by optimizing for an uptrend and downtrend separately. To reduce the effect of false signals and improve profitability, the systems are made flexible, meaning they have some specific set of settings or input data, which is justified because the market behavior is constantly changing.

Library for easy and quick development of MetaTrader programs (part VIII): Order and position modification events

In the previous articles, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. In the seventh part, we added tracking StopLimit orders activation and prepared the functionality for tracking other events involving orders and positions. In this article, we will develop the class for tracking order and position modification events.

Neural networks made easy (Part 3): Convolutional networks

As a continuation of the neural network topic, I propose considering convolutional neural networks. This type of neural network are usually applied to analyzing visual imagery. In this article, we will consider the application of these networks in the financial markets.

Econometric Approach to Analysis of Charts

This article describes the econometric methods of analysis, the autocorrelation analysis and the analysis of conditional variance in particular. What is the benefit of the approach described here? Use of the non-linear GARCH models allows representing the analyzed series formally from the mathematical point of view and creating a forecast for a specified number of steps.

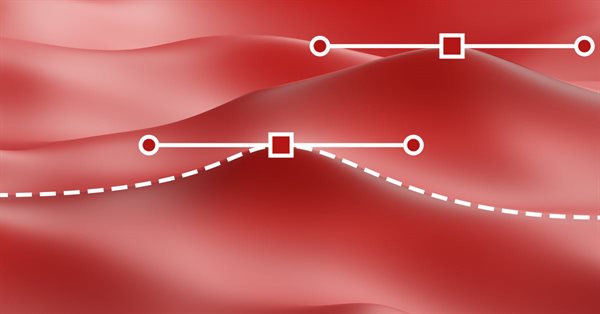

Automating Trading Strategies in MQL5 (Part 43): Adaptive Linear Regression Channel Strategy

In this article, we implement an adaptive Linear Regression Channel system in MQL5 that automatically calculates the regression line and standard deviation channel over a user-defined period, only activates when the slope exceeds a minimum threshold to confirm a clear trend, and dynamically recreates or extends the channel when the price breaks out by a configurable percentage of channel width.

Combinatorics and probability for trading (Part IV): Bernoulli Logic

In this article, I decided to highlight the well-known Bernoulli scheme and to show how it can be used to describe trading-related data arrays. All this will then be used to create a self-adapting trading system. We will also look for a more generic algorithm, a special case of which is the Bernoulli formula, and will find an application for it.

Price Action Analysis Toolkit Development (Part 53): Pattern Density Heatmap for Support and Resistance Zone Discovery

This article introduces the Pattern Density Heatmap, a price‑action mapping tool that transforms repeated candlestick pattern detections into statistically significant support and resistance zones. Rather than treating each signal in isolation, the EA aggregates detections into fixed price bins, scores their density with optional recency weighting, and confirms levels against higher‑timeframe data. The resulting heatmap reveals where the market has historically reacted—levels that can be used proactively for trade timing, risk management, and strategy confidence across any trading style.

Trader-friendly stop loss and take profit

Stop loss and take profit can have a significant impact on trading results. In this article, we will look at several ways to find optimal stop order values.

Price Action Analysis Toolkit Development (Part 44): Building a VWMA Crossover Signal EA in MQL5

This article introduces a VWMA crossover signal tool for MetaTrader 5, designed to help traders identify potential bullish and bearish reversals by combining price action with trading volume. The EA generates clear buy and sell signals directly on the chart, features an informative panel, and allows for full user customization, making it a practical addition to your trading strategy.

Combinatorics and probability theory for trading (Part II): Universal fractal

In this article, we will continue to study fractals and will pay special attention to summarizing all the material. To do this, I will try to bring all earlier developments into a compact form which would be convenient and understandable for practical application in trading.

Brute force approach to pattern search

In this article, we will search for market patterns, create Expert Advisors based on the identified patterns, and check how long these patterns remain valid, if they ever retain their validity.

Other classes in DoEasy library (Part 66): MQL5.com Signals collection class

In this article, I will create the signal collection class of the MQL5.com Signals service with the functions for managing signals. Besides, I will improve the Depth of Market snapshot object class for displaying the total DOM buy and sell volumes.

Library for easy and quick development of MetaTrader programs (part XI). Compatibility with MQL4 - Position closure events

We continue the development of a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. In the tenth part, we resumed our work on the library compatibility with MQL4 and defined the events of opening positions and activating pending orders. In this article, we will define the events of closing positions and get rid of the unused order properties.

Research of Statistical Recurrences of Candle Directions

Is it possible to predict the behavior of the market for a short upcoming interval of time, based on the recurring tendencies of candle directions, at specific times throughout the day? That is, If such an occurrence is found in the first place. This question has probably arisen in the mind of every trader. The purpose of this article is to attempt to predict the behavior of the market, based on the statistical recurrences of candle directions during specific intervals of time.

Self-organizing feature maps (Kohonen maps) - revisiting the subject

This article describes techniques of operating with Kohonen maps. The subject will be of interest to both market researchers with basic level of programing in MQL4 and MQL5 and experienced programmers that face difficulties with connecting Kohonen maps to their projects.

Controlling the Slope of Balance Curve During Work of an Expert Advisor

Finding rules for a trade system and programming them in an Expert Advisor is a half of the job. Somehow, you need to correct the operation of the Expert Advisor as it accumulates the results of trading. This article describes one of approaches, which allows improving performance of an Expert Advisor through creation of a feedback that measures slope of the balance curve.

Library for easy and quick development of MetaTrader programs (part III). Collection of market orders and positions, search and sorting

In the first part, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. Further on, we implemented the collection of history orders and deals. Our next step is creating a class for a convenient selection and sorting of orders, deals and positions in collection lists. We are going to implement the base library object called Engine and add collection of market orders and positions to the library.

How to visualize multicurrency trading history based on HTML and CSV reports

Since its introduction, MetaTrader 5 provides multicurrency testing options. This possibility is often used by traders. However the function is not universal. The article presents several programs for drawing graphical objects on charts based on HTML and CSV trading history reports. Multicurrency trading can be analyzed in parallel, in several sub-windows, as well as in one window using the dynamic switching command.

Neural networks made easy (Part 9): Documenting the work

We have already passed a long way and the code in our library is becoming bigger and bigger. This makes it difficult to keep track of all connections and dependencies. Therefore, I suggest creating documentation for the earlier created code and to keep it updating with each new step. Properly prepared documentation will help us see the integrity of our work.

Practical Use of Kohonen Neural Networks in Algorithmic Trading. Part II. Optimizing and forecasting

Based on universal tools designed for working with Kohonen networks, we construct the system of analyzing and selecting the optimal EA parameters and consider forecasting time series. In Part I, we corrected and improved the publicly available neural network classes, having added necessary algorithms. Now, it is time to apply them to practice.

Timeseries in DoEasy library (part 36): Object of timeseries for all used symbol periods

In this article, we will consider combining the lists of bar objects for each used symbol period into a single symbol timeseries object. Thus, each symbol will have an object storing the lists of all used symbol timeseries periods.

Implementing an ARIMA training algorithm in MQL5

In this article we will implement an algorithm that applies the Box and Jenkins Autoregressive Integrated Moving Average model by using Powells method of function minimization. Box and Jenkins stated that most time series could be modeled by one or both of two frameworks.

A scientific approach to the development of trading algorithms

The article considers the methodology for developing trading algorithms, in which a consistent scientific approach is used to analyze possible price patterns and to build trading algorithms based on these patterns. Development ideals are demonstrated using examples.

Movement continuation model - searching on the chart and execution statistics

This article provides programmatic definition of one of the movement continuation models. The main idea is defining two waves — the main and the correction one. For extreme points, I apply fractals as well as "potential" fractals - extreme points that have not yet formed as fractals.

Prices in DoEasy library (Part 64): Depth of Market, classes of DOM snapshot and snapshot series objects

In this article, I will create two classes (the class of DOM snapshot object and the class of DOM snapshot series object) and test creation of the DOM data series.

Neural networks made easy (Part 26): Reinforcement Learning

We continue to study machine learning methods. With this article, we begin another big topic, Reinforcement Learning. This approach allows the models to set up certain strategies for solving the problems. We can expect that this property of reinforcement learning will open up new horizons for building trading strategies.

Combinatorics and probability for trading (Part V): Curve analysis

In this article, I decided to conduct a study related to the possibility of reducing multiple states to double-state systems. The main purpose of the article is to analyze and to come to useful conclusions that may help in the further development of scalable trading algorithms based on the probability theory. Of course, this topic involves mathematics. However, given the experience of previous articles, I see that generalized information is more useful than details.