Price Action Analysis Toolkit Development (Part 17): TrendLoom EA Tool

As a price action observer and trader, I've noticed that when a trend is confirmed by multiple timeframes, it usually continues in that direction. What may vary is how long the trend lasts, and this depends on the type of trader you are, whether you hold positions for the long term or engage in scalping. The timeframes you choose for confirmation play a crucial role. Check out this article for a quick, automated system that helps you analyze the overall trend across different timeframes with just a button click or regular updates.

Population optimization algorithms: Grey Wolf Optimizer (GWO)

Let's consider one of the newest modern optimization algorithms - Grey Wolf Optimization. The original behavior on test functions makes this algorithm one of the most interesting among the ones considered earlier. This is one of the top algorithms for use in training neural networks, smooth functions with many variables.

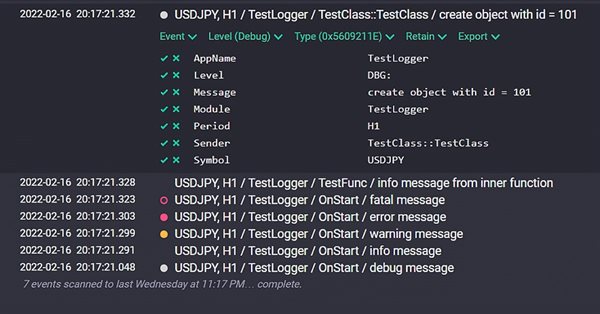

Tips from a professional programmer (Part III): Logging. Connecting to the Seq log collection and analysis system

Implementation of the Logger class for unifying and structuring messages which are printed to the Experts log. Connection to the Seq log collection and analysis system. Monitoring log messages online.

Timeseries in DoEasy library (part 54): Descendant classes of abstract base indicator

The article considers creation of classes of descendant objects of base abstract indicator. Such objects will provide access to features of creating indicator EAs, collecting and getting data value statistics of various indicators and prices. Also, create indicator object collection from which getting access to properties and data of each indicator created in the program will be possible.

MetaTrader 5 Machine Learning Blueprint (Part 1): Data Leakage and Timestamp Fixes

Before we can even begin to make use of ML in our trading on MetaTrader 5, it’s crucial to address one of the most overlooked pitfalls—data leakage. This article unpacks how data leakage, particularly the MetaTrader 5 timestamp trap, can distort our model's performance and lead to unreliable trading signals. By diving into the mechanics of this issue and presenting strategies to prevent it, we pave the way for building robust machine learning models that deliver trustworthy predictions in live trading environments.

Data Science and Machine Learning (Part 24): Forex Time series Forecasting Using Regular AI Models

In the forex markets It is very challenging to predict the future trend without having an idea of the past. Very few machine learning models are capable of making the future predictions by considering past values. In this article, we are going to discuss how we can use classical(Non-time series) Artificial Intelligence models to beat the market

Population optimization algorithms: Harmony Search (HS)

In the current article, I will study and test the most powerful optimization algorithm - harmonic search (HS) inspired by the process of finding the perfect sound harmony. So what algorithm is now the leader in our rating?

Neural networks made easy (Part 25): Practicing Transfer Learning

In the last two articles, we developed a tool for creating and editing neural network models. Now it is time to evaluate the potential use of Transfer Learning technology using practical examples.

Day Trading Larry Connors RSI2 Mean-Reversion Strategies

Larry Connors is a renowned trader and author, best known for his work in quantitative trading and strategies like the 2-period RSI (RSI2), which helps identify short-term overbought and oversold market conditions. In this article, we’ll first explain the motivation behind our research, then recreate three of Connors’ most famous strategies in MQL5 and apply them to intraday trading of the S&P 500 index CFD.

Forex arbitrage trading: A simple synthetic market maker bot to get started

Today we will take a look at my first arbitrage robot — a liquidity provider (if you can call it that) for synthetic assets. Currently, this bot is successfully operating as a module in a large machine learning system, but I pulled up an old Forex arbitrage robot from the cloud, so let's take a look at it and think about what we can do with it today.

MQL4 as a Trader's Tool, or The Advanced Technical Analysis

Trading is, first of all, a calculus of probabilities. The proverb about idleness being an engine for progress reveals us the reason why all those indicators and trading systems have been developed. It comes that the major of newcomers in trading study "ready-made" trading theories. But, as luck would have it, there are some more undiscovered market secrets, and tools used in analyzing of price movements exist, basically, as those unrealized technical indicators or math and stat packages. Thanks awfully to Bill Williams for his contribution to the market movements theory. Though, perhaps, it's too early to rest on oars.

Price Action Analysis Toolkit Development (Part 39): Automating BOS and ChoCH Detection in MQL5

This article presents Fractal Reaction System, a compact MQL5 system that converts fractal pivots into actionable market-structure signals. Using closed-bar logic to avoid repainting, the EA detects Change-of-Character (ChoCH) warnings and confirms Breaks-of-Structure (BOS), draws persistent chart objects, and logs/alerts every confirmed event (desktop, mobile and sound). Read on for the algorithm design, implementation notes, testing results and the full EA code so you can compile, test and deploy the detector yourself.

Forex arbitrage trading: A simple synthetic market maker bot to get started

Today we will take a look at my first arbitrage robot — a liquidity provider (if you can call it that) for synthetic assets. Currently, this bot is successfully operating as a module in a large machine learning system, but I pulled up an old Forex arbitrage robot from the cloud, so let's take a look at it and think about what we can do with it today.

News Trading Made Easy (Part 1): Creating a Database

News trading can be complicated and overwhelming, in this article we will go through steps to obtain news data. Additionally we will learn about the MQL5 Economic Calendar and what it has to offer.

Timeseries in DoEasy library (part 48): Multi-period multi-symbol indicators on one buffer in a subwindow

The article considers an example of creating multi-symbol multi-period standard indicators using a single indicator buffer for construction and working in the indicator subwindow. I am going to prepare the library classes for working with standard indicators working in the program main window and having more than one buffer for displaying their data.

Econometric tools for forecasting volatility: GARCH model

The article describes the properties of the non-linear model of conditional heteroscedasticity (GARCH). The iGARCH indicator has been built on its basis for predicting volatility one step ahead. The ALGLIB numerical analysis library is used to estimate the model parameters.

Population optimization algorithms

This is an introductory article on optimization algorithm (OA) classification. The article attempts to create a test stand (a set of functions), which is to be used for comparing OAs and, perhaps, identifying the most universal algorithm out of all widely known ones.

Category Theory (Part 9): Monoid-Actions

This article continues the series on category theory implementation in MQL5. Here we continue monoid-actions as a means of transforming monoids, covered in the previous article, leading to increased applications.

Price Action Analysis Toolkit Development (Part 46): Designing an Interactive Fibonacci Retracement EA with Smart Visualization in MQL5

Fibonacci tools are among the most popular instruments used by technical analysts. In this article, we’ll build an Interactive Fibonacci EA that draws retracement and extension levels that react dynamically to price movement, delivering real‑time alerts, stylish lines, and a scrolling news‑style headline. Another key advantage of this EA is flexibility; you can manually type the high (A) and low (B) swing values directly on the chart, giving you exact control over the market range you want to analyze.

Cycles and Forex

Cycles are of great importance in our lives. Day and night, seasons, days of the week and many other cycles of different nature are present in the life of any person. In this article, we will consider cycles in financial markets.

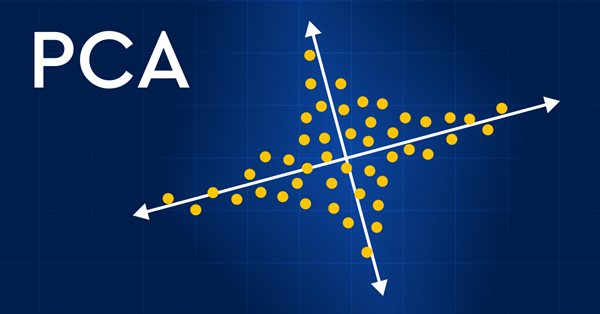

Data Science and Machine Learning (Part 13): Improve your financial market analysis with Principal Component Analysis (PCA)

Revolutionize your financial market analysis with Principal Component Analysis (PCA)! Discover how this powerful technique can unlock hidden patterns in your data, uncover latent market trends, and optimize your investment strategies. In this article, we explore how PCA can provide a new lens for analyzing complex financial data, revealing insights that would be missed by traditional approaches. Find out how applying PCA to financial market data can give you a competitive edge and help you stay ahead of the curve

High frequency arbitrage trading system in Python using MetaTrader 5

In this article, we will create an arbitration system that remains legal in the eyes of brokers, creates thousands of synthetic prices on the Forex market, analyzes them, and successfully trades for profit.

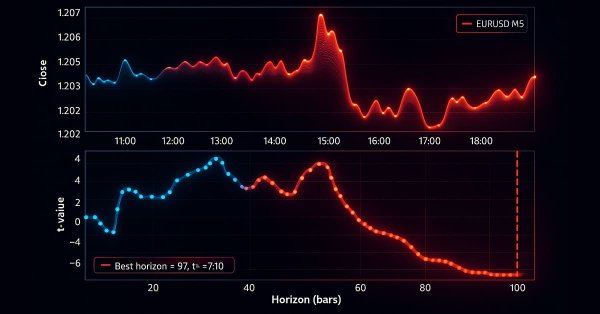

MetaTrader 5 Machine Learning Blueprint (Part 3): Trend-Scanning Labeling Method

We have built a robust feature engineering pipeline using proper tick-based bars to eliminate data leakage and solved the critical problem of labeling with meta-labeled triple-barrier signals. This installment covers the advanced labeling technique, trend-scanning, for adaptive horizons. After covering the theory, an example shows how trend-scanning labels can be used with meta-labeling to improve on the classic moving average crossover strategy.

Implementing the Generalized Hurst Exponent and the Variance Ratio test in MQL5

In this article, we investigate how the Generalized Hurst Exponent and the Variance Ratio test can be utilized to analyze the behaviour of price series in MQL5.

Timeseries in DoEasy library (part 47): Multi-period multi-symbol standard indicators

In this article, I will start developing the methods of working with standard indicators, which will ultimately allow creating multi-symbol multi-period standard indicators based on library classes. Besides, I will add the "Skipped bars" event to the timeseries classes and eliminate excessive load from the main program code by moving the library preparation functions to CEngine class.

Modified Grid-Hedge EA in MQL5 (Part IV): Optimizing Simple Grid Strategy (I)

In this fourth part, we revisit the Simple Hedge and Simple Grid Expert Advisors (EAs) developed earlier. Our focus shifts to refining the Simple Grid EA through mathematical analysis and a brute force approach, aiming for optimal strategy usage. This article delves deep into the mathematical optimization of the strategy, setting the stage for future exploration of coding-based optimization in later installments.

Data Science and Machine Learning (Part 21): Unlocking Neural Networks, Optimization algorithms demystified

Dive into the heart of neural networks as we demystify the optimization algorithms used inside the neural network. In this article, discover the key techniques that unlock the full potential of neural networks, propelling your models to new heights of accuracy and efficiency.

Population optimization algorithms: Gravitational Search Algorithm (GSA)

GSA is a population optimization algorithm inspired by inanimate nature. Thanks to Newton's law of gravity implemented in the algorithm, the high reliability of modeling the interaction of physical bodies allows us to observe the enchanting dance of planetary systems and galactic clusters. In this article, I will consider one of the most interesting and original optimization algorithms. The simulator of the space objects movement is provided as well.

MQL5 Wizard Techniques you should know (Part 09): Pairing K-Means Clustering with Fractal Waves

K-Means clustering takes the approach to grouping data points as a process that’s initially focused on the macro view of a data set that uses random generated cluster centroids before zooming in and adjusting these centroids to accurately represent the data set. We will look at this and exploit a few of its use cases.

MQL5 Market Results for Q2 2013

Successfully operating for 1.5 years, MQL5 Market has become the largest traders' store of trading strategies and technical indicators. It offers around 800 trading applications provided by 350 developers from around the world. Over 100.000 trading programs have already been purchased and downloaded by traders to their MetaTrader 5 terminals.

Price Action Analysis Toolkit Development (Part 41): Building a Statistical Price-Level EA in MQL5

Statistics has always been at the heart of financial analysis. By definition, statistics is the discipline that collects, analyzes, interprets, and presents data in meaningful ways. Now imagine applying that same framework to candlesticks—compressing raw price action into measurable insights. How helpful would it be to know, for a specific period of time, the central tendency, spread, and distribution of market behavior? In this article, we introduce exactly that approach, showing how statistical methods can transform candlestick data into clear, actionable signals.

Developing a Replay System — Market simulation (Part 21): FOREX (II)

We will continue to build a system for working in the FOREX market. In order to solve this problem, we must first declare the loading of ticks before loading the previous bars. This solves the problem, but at the same time forces the user to follow some structure in the configuration file, which, personally, does not make much sense to me. The reason is that by designing a program that is responsible for analyzing and executing what is in the configuration file, we can allow the user to declare the elements he needs in any order.

Population optimization algorithms: Fish School Search (FSS)

Fish School Search (FSS) is a new optimization algorithm inspired by the behavior of fish in a school, most of which (up to 80%) swim in an organized community of relatives. It has been proven that fish aggregations play an important role in the efficiency of foraging and protection from predators.

Trader's Statistical Cookbook: Hypotheses

This article considers hypothesis - one of the basic ideas of mathematical statistics. Various hypotheses are examined and verified through examples using methods of mathematical statistics. The actual data is generalized using nonparametric methods. The Statistica package and the ported ALGLIB MQL5 numerical analysis library are used for processing data.

Implementing the Janus factor in MQL5

Gary Anderson developed a method of market analysis based on a theory he dubbed the Janus Factor. The theory describes a set of indicators that can be used to reveal trends and assess market risk. In this article we will implement these tools in mql5.

Data Science and Machine Learning (Part 23): Why LightGBM and XGBoost outperform a lot of AI models?

These advanced gradient-boosted decision tree techniques offer superior performance and flexibility, making them ideal for financial modeling and algorithmic trading. Learn how to leverage these tools to optimize your trading strategies, improve predictive accuracy, and gain a competitive edge in the financial markets.

Python, ONNX and MetaTrader 5: Creating a RandomForest model with RobustScaler and PolynomialFeatures data preprocessing

In this article, we will create a random forest model in Python, train the model, and save it as an ONNX pipeline with data preprocessing. After that we will use the model in the MetaTrader 5 terminal.

Developing a Replay System — Market simulation (Part 06): First improvements (I)

In this article, we will begin to stabilize the entire system, without which we might not be able to proceed to the next steps.

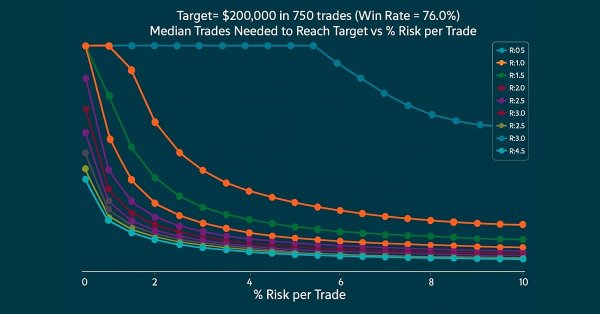

Building a Trading System (Part 3): Determining Minimum Risk Levels for Realistic Profit Targets

Every trader's ultimate goal is profitability, which is why many set specific profit targets to achieve within a defined trading period. In this article, we will use Monte Carlo simulations to determine the optimal risk percentage per trade needed to meet trading objectives. The results will help traders assess whether their profit targets are realistic or overly ambitious. Finally, we will discuss which parameters can be adjusted to establish a practical risk percentage per trade that aligns with trading goals.

MQL5 Market Results for Q1 2013

Since its founding, the store of trading robots and technical indicators MQL5 Market has already attracted more than 250 developers who have published 580 products. The first quarter of 2013 has turned out to be quite successful for some MQL5 Market sellers who have managed to make handsome profit by selling their products.