Liquidity Compression MT4

- Indicators

- Vincent Jose Proenca

- Version: 1.0

- Activations: 5

Institutional Liquidity Compression Indicator

This indicator measures real-time liquidity tightening using the normalized width of Bollinger Bands, trading volume, and average spread to identify compression phases preceding price breakouts.

Display:

Professional-style separate window with a histogram showing the “Compression Score” and a threshold line.

Key Features

-

Early Detection: Identifies contraction zones before major price impulses.

-

Multi-Factor Measurement: Combines normalized Bollinger Band width, volume, and average spread.

-

Real-Time Calculation: Updates on every tick for the current bar.

-

Clear Visualization: “Compression” histogram with a dotted “Threshold” line.

-

Compatibility: Fully functional MT4 and MT5 versions.

How to Use

-

Attach the indicator to the target instrument’s chart.

-

Adjust the threshold and weighting parameters according to volatility and trading session.

-

Interpretation: A high score indicates a liquidity compression phase. Monitor price action for a potential breakout.

Parameters

-

BB_Period / BB_Dev: Bollinger Bands width calculation.

-

Norm_Period: Normalization window for recent volatility regime.

-

Vol_Period: Normalization window for tick volume.

-

Spr_Period: Normalization window for average spread (historical spread in MT5, instant proxy in MT4).

-

Weight_Width / Weight_Volume / Weight_Spread: Weights of each factor in the overall score.

-

Smooth_Period: Smoothing period for the final score.

-

Threshold: Reference level (displayed as a dotted line).

Best Practices

-

Adjust periods according to the asset type (FX, indices, crypto).

-

Combine with a directional or contextual filter (market structure, support/resistance levels).

-

Watch for volatility expansion following compression to confirm trade setups.

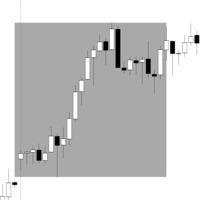

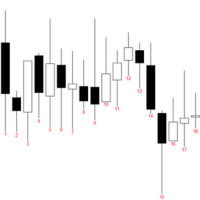

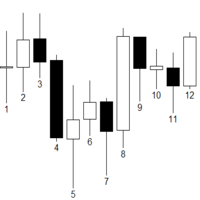

Thank you for a great product. Your efforts and achievements are evident. I'm convinced this is a true indicator of liquidity. What I've noticed: when a new candle opens, liquidity increases, as some traders open and close orders at the opening of a new candle. Look at the stock chart – every day, the last candle before the close. Liquidity increases. This also makes sense: carrying an order over to the next day is dangerous, and many traders close their positions.