Risk Management (Part 2): Implementing Lot Calculation in a Graphical Interface

In this article, we will look at how to improve and more effectively apply the concepts presented in the previous article using the powerful MQL5 graphical control libraries. We'll go step by step through the process of creating a fully functional GUI. I'll be explaining the ideas behind it, as well as the purpose and operation of each method used. Additionally, at the end of the article, we will test the panel we created to ensure it functions correctly and meets its stated goals.

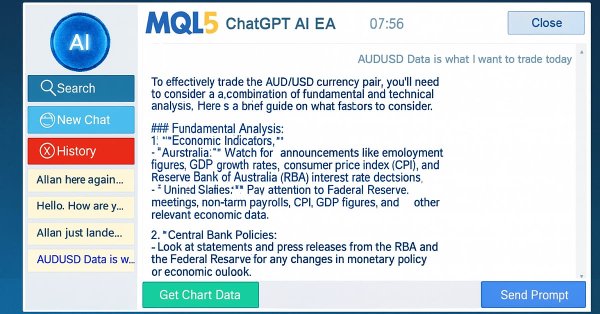

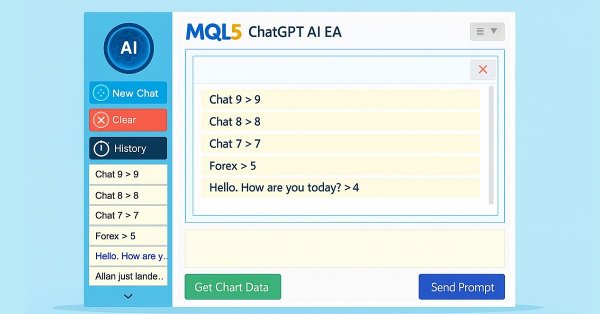

Building AI-Powered Trading Systems in MQL5 (Part 6): Introducing Chat Deletion and Search Functionality

In Part 6 of our MQL5 AI trading system series, we advance the ChatGPT-integrated Expert Advisor by introducing chat deletion functionality through interactive delete buttons in the sidebar, small/large history popups, and a new search popup, allowing traders to manage and organize persistent conversations efficiently while maintaining encrypted storage and AI-driven signals from chart data.

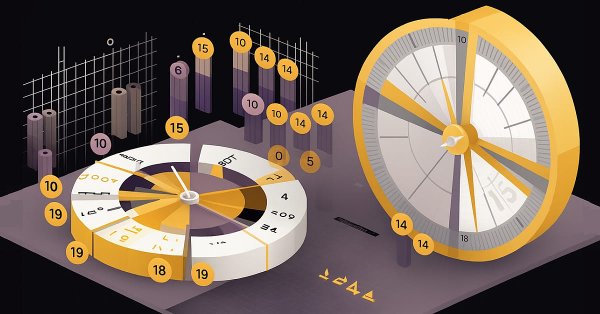

Markets Positioning Codex in MQL5 (Part 2): Bitwise Learning, with Multi-Patterns for Nvidia

We continue our new series on Market-Positioning, where we study particular assets, with specific trade directions over manageable test windows. We started this by considering Nvidia Corp stock in the last article, where we covered 5 signal patterns from the complimentary pairing of the RSI and DeMarker oscillators. For this article, we cover the remaining 5 patterns and also delve into multi-pattern options that not only feature untethered combinations of all ten, but also specialized combinations of just a pair.

Developing Trading Strategy: Pseudo Pearson Correlation Approach

Generating new indicators from existing ones offers a powerful way to enhance trading analysis. By defining a mathematical function that integrates the outputs of existing indicators, traders can create hybrid indicators that consolidate multiple signals into a single, efficient tool. This article introduces a new indicator built from three oscillators using a modified version of the Pearson correlation function, which we call the Pseudo Pearson Correlation (PPC). The PPC indicator aims to quantify the dynamic relationship between oscillators and apply it within a practical trading strategy.

From Novice to Expert: Predictive Price Pathways

Fibonacci levels provide a practical framework that markets often respect, highlighting price zones where reactions are more likely. In this article, we build an expert advisor that applies Fibonacci retracement logic to anticipate likely future moves and trade retracements with pending orders. Explore the full workflow—from swing detection to level plotting, risk controls, and execution.

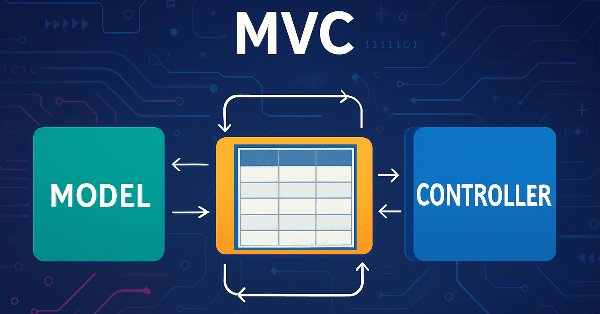

Implementation of a table model in MQL5: Applying the MVC concept

In this article, we look at the process of developing a table model in MQL5 using the MVC (Model-View-Controller) architectural pattern to separate data logic, presentation, and control, enabling structured, flexible, and scalable code. We consider implementation of classes for building a table model, including the use of linked lists for storing data.

Neural Networks in Trading: Hierarchical Dual-Tower Transformer (Hidformer)

We invite you to get acquainted with the Hierarchical Double-Tower Transformer (Hidformer) framework, which was developed for time series forecasting and data analysis. The framework authors proposed several improvements to the Transformer architecture, which resulted in increased forecast accuracy and reduced computational resource consumption.

Price Action Analysis Toolkit Development (Part 50): Developing the RVGI, CCI and SMA Confluence Engine in MQL5

Many traders struggle to identify genuine reversals. This article presents an EA that combines RVGI, CCI (±100), and an SMA trend filter to produce a single clear reversal signal. The EA includes an on-chart panel, configurable alerts, and the full source file for immediate download and testing.

Market Simulation (Part 06): Transferring Information from MetaTrader 5 to Excel

Many people, especially non=programmers, find it very difficult to transfer information between MetaTrader 5 and other programs. One such program is Excel. Many use Excel as a way to manage and maintain their risk control. It is an excellent program and easy to learn, even for those who are not VBA programmers. Here we will look at how to establish a connection between MetaTrader 5 and Excel (a very simple method).

Automating Trading Strategies in MQL5 (Part 40): Fibonacci Retracement Trading with Custom Levels

In this article, we build an MQL5 Expert Advisor for Fibonacci retracement trading, using either daily candle ranges or lookback arrays to calculate custom levels like 50% and 61.8% for entries, determining bullish or bearish setups based on close vs. open. The system triggers buys or sells on price crossings of levels with max trades per level, optional closure on new Fib calcs, points-based trailing stops after a min profit threshold, and SL/TP buffers as percentages of the range.

Self Optimizing Expert Advisors in MQL5 (Part 17): Ensemble Intelligence

All algorithmic trading strategies are difficult to set up and maintain, regardless of complexity—a challenge shared by beginners and experts alike. This article introduces an ensemble framework where supervised models and human intuition work together to overcome their shared limitations. By aligning a moving average channel strategy with a Ridge Regression model on the same indicators, we achieve centralized control, faster self-correction, and profitability from otherwise unprofitable systems.

Markets Positioning Codex in MQL5 (Part 1): Bitwise Learning for Nvidia

We commence a new article series that builds upon our earlier efforts laid out in the MQL5 Wizard series, by taking them further as we step up our approach to systematic trading and strategy testing. Within these new series, we’ll concentrate our focus on Expert Advisors that are coded to hold only a single type of position - primarily longs. Focusing on just one market trend can simplify analysis, lessen strategy complexity and expose some key insights, especially when dealing in assets beyond forex. Our series, therefore, will investigate if this is effective in equities and other non-forex assets, where long only systems usually correlate well with smart money or institution strategies.

Integrating MQL5 with Data Processing Packages (Part 6): Merging Market Feedback with Model Adaptation

In this part, we focus on how to merge real-time market feedback—such as live trade outcomes, volatility changes, and liquidity shifts—with adaptive model learning to maintain a responsive and self-improving trading system.

Blood inheritance optimization (BIO)

I present to you my new population optimization algorithm - Blood Inheritance Optimization (BIO), inspired by the human blood group inheritance system. In this algorithm, each solution has its own "blood type" that determines the way it evolves. Just as in nature where a child's blood type is inherited according to specific rules, in BIO new solutions acquire their characteristics through a system of inheritance and mutations.

From Novice to Expert: Time Filtered Trading

Just because ticks are constantly flowing in doesn’t mean every moment is an opportunity to trade. Today, we take an in-depth study into the art of timing—focusing on developing a time isolation algorithm to help traders identify and trade within their most favorable market windows. Cultivating this discipline allows retail traders to synchronize more closely with institutional timing, where precision and patience often define success. Join this discussion as we explore the science of timing and selective trading through the analytical capabilities of MQL5.

Building AI-Powered Trading Systems in MQL5 (Part 5): Adding a Collapsible Sidebar with Chat Popups

In Part 5 of our MQL5 AI trading system series, we enhance the ChatGPT-integrated Expert Advisor by introducing a collapsible sidebar, improving navigation with small and large history popups for seamless chat selection, while maintaining multiline input handling, persistent encrypted chat storage, and AI-driven trade signal generation from chart data.

Neural Networks in Trading: Memory Augmented Context-Aware Learning for Cryptocurrency Markets (Final Part)

The MacroHFT framework for high-frequency cryptocurrency trading uses context-aware reinforcement learning and memory to adapt to dynamic market conditions. At the end of this article, we will test the implemented approaches on real historical data to assess their effectiveness.

Analyzing all price movement options on the IBM quantum computer

We will use a quantum computer from IBM to discover all price movement options. Sounds like science fiction? Welcome to the world of quantum computing for trading!

MQL5 Trading Tools (Part 10): Building a Strategy Tracker System with Visual Levels and Success Metrics

In this article, we develop an MQL5 strategy tracker system that detects moving average crossover signals filtered by a long-term MA, simulates or executes trades with configurable TP levels and SL in points, and monitors outcomes like TP/SL hits for performance analysis.

Risk-Based Trade Placement EA with On-Chart UI (Part 2): Adding Interactivity and Logic

Learn how to build an interactive MQL5 Expert Advisor with an on-chart control panel. Know how to compute risk-based lot sizes and place trades directly from the chart.

Developing a Trading Strategy: The Triple Sine Mean Reversion Method

This article introduces the Triple Sine Mean Reversion Method, a trading strategy built upon a new mathematical indicator — the Triple Sine Oscillator (TSO). The TSO is derived from the sine cube function, which oscillates between –1 and +1, making it suitable for identifying overbought and oversold market conditions. Overall, the study demonstrates how mathematical functions can be transformed into practical trading tools.

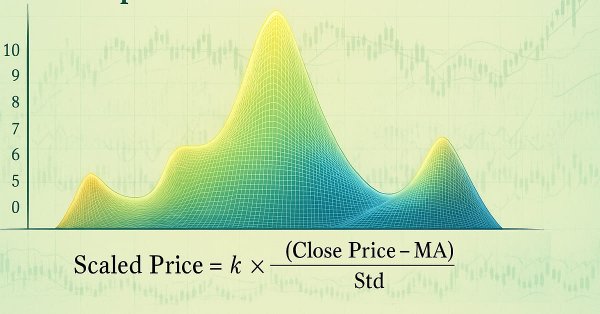

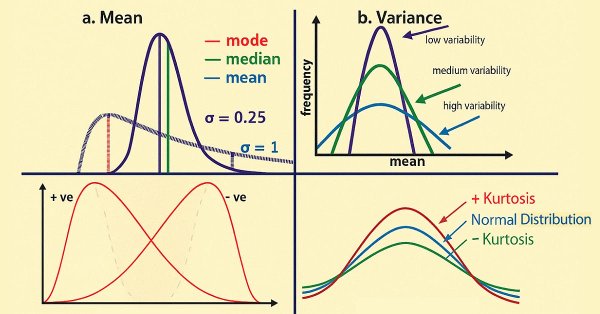

Automating Trading Strategies in MQL5 (Part 39): Statistical Mean Reversion with Confidence Intervals and Dashboard

In this article, we develop an MQL5 Expert Advisor for statistical mean reversion trading, calculating moments like mean, variance, skewness, kurtosis, and Jarque-Bera statistics over a specified period to identify non-normal distributions and generate buy/sell signals based on confidence intervals with adaptive thresholds

How can century-old functions update your trading strategies?

This article considers the Rademacher and Walsh functions. We will explore ways to apply these functions to financial time series analysis and also consider various applications for them in trading.

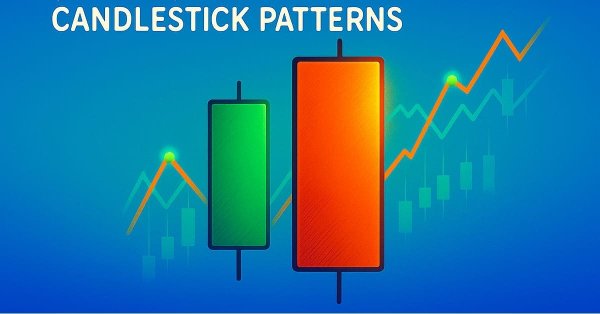

Reimagining Classic Strategies (Part 18): Searching For Candlestick Patterns

This article helps new community members search for and discover their own candlestick patterns. Describing these patterns can be daunting, as it requires manually searching and creatively identifying improvements. Here, we introduce the engulfing candlestick pattern and show how it can be enhanced for more profitable trading applications.

Formulating Dynamic Multi-Pair EA (Part 5): Scalping vs Swing Trading Approaches

This part explores how to design a Dynamic Multi-Pair Expert Advisor capable of adapting between Scalping and Swing Trading modes. It covers the structural and algorithmic differences in signal generation, trade execution, and risk management, allowing the EA to intelligently switch strategies based on market behavior and user input.

From Novice to Expert: Forex Market Periods

Every market period has a beginning and an end, each closing with a price that defines its sentiment—much like any candlestick session. Understanding these reference points allows us to gauge the prevailing market mood, revealing whether bullish or bearish forces are in control. In this discussion, we take an important step forward by developing a new feature within the Market Periods Synchronizer—one that visualizes Forex market sessions to support more informed trading decisions. This tool can be especially powerful for identifying, in real time, which side—bulls or bears—dominates the session. Let’s explore this concept and uncover the insights it offers.

Bivariate Copulae in MQL5 (Part 2): Implementing Archimedean copulae in MQL5

In the second installment of the series, we discuss the properties of bivariate Archimedean copulae and their implementation in MQL5. We also explore applying copulae to the development of a simple pairs trading strategy.

Risk-Based Trade Placement EA with On-Chart UI (Part 1): Designing the User Interface

Learn how to build a clean and professional on-chart control panel in MQL5 for a Risk-Based Trade Placement Expert Advisor. This step-by-step guide explains how to design a functional GUI that allows traders to input trade parameters, calculate lot size, and prepare for automated order placement.

Developing a multi-currency Expert Advisor (Part 22): Starting the transition to hot swapping of settings

If we are going to automate periodic optimization, we need to think about auto updates of the settings of the EAs already running on the trading account. This should also allow us to run the EA in the strategy tester and change its settings within a single run.

Neural Networks in Trading: Memory Augmented Context-Aware Learning (MacroHFT) for Cryptocurrency Markets

I invite you to explore the MacroHFT framework, which applies context-aware reinforcement learning and memory to improve high-frequency cryptocurrency trading decisions using macroeconomic data and adaptive agents.

Price Action Analysis Toolkit Development (Part 49): Integrating Trend, Momentum, and Volatility Indicators into One MQL5 System

Simplify your MetaTrader 5 charts with the Multi Indicator Handler EA. This interactive dashboard merges trend, momentum, and volatility indicators into one real‑time panel. Switch instantly between profiles to focus on the analysis you need most. Declutter with one‑click Hide/Show controls and stay focused on price action. Read on to learn step‑by‑step how to build and customize it yourself in MQL5.

Developing a Trading Strategy: The Butterfly Oscillator Method

In this article, we demonstrated how the fascinating mathematical concept of the Butterfly Curve can be transformed into a practical trading tool. We constructed the Butterfly Oscillator and built a foundational trading strategy around it. The strategy effectively combines the oscillator's unique cyclical signals with traditional trend confirmation from moving averages, creating a systematic approach for identifying potential market entries.

Statistical Arbitrage Through Cointegrated Stocks (Part 7): Scoring System 2

This article describes two additional scoring criteria used for selection of baskets of stocks to be traded in mean-reversion strategies, more specifically, in cointegration based statistical arbitrage. It complements a previous article where liquidity and strength of the cointegration vectors were presented, along with the strategic criteria of timeframe and lookback period, by including the stability of the cointegration vectors and the time to mean reversion (half-time). The article includes the commented results of a backtest with the new filters applied and the files required for its reproduction are also provided.

Optimizing Long-Term Trades: Engulfing Candles and Liquidity Strategies

This is a high-timeframe-based EA that makes long-term analyses, trading decisions, and executions based on higher-timeframe analyses of W1, D1, and MN. This article will explore in detail an EA that is specifically designed for long-term traders who are patient enough to withstand and hold their positions during tumultuous lower time frame price action without changing their bias frequently until take-profit targets are hit.

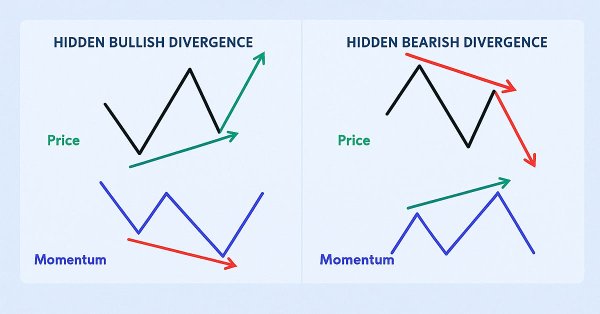

Automating Trading Strategies in MQL5 (Part 38): Hidden RSI Divergence Trading with Slope Angle Filters

In this article, we build an MQL5 EA that detects hidden RSI divergences via swing points with strength, bar ranges, tolerance, and slope angle filters for price and RSI lines. It executes buy/sell trades on validated signals with fixed lots, SL/TP in pips, and optional trailing stops for risk control.

Circle Search Algorithm (CSA)

The article presents a new metaheuristic optimization Circle Search Algorithm (CSA) based on the geometric properties of a circle. The algorithm uses the principle of moving points along tangents to find the optimal solution, combining the phases of global exploration and local exploitation.

MetaTrader 5 Machine Learning Blueprint (Part 5): Sequential Bootstrapping—Debiasing Labels, Improving Returns

Sequential bootstrapping reshapes bootstrap sampling for financial machine learning by actively avoiding temporally overlapping labels, producing more independent training samples, sharper uncertainty estimates, and more robust trading models. This practical guide explains the intuition, shows the algorithm step‑by‑step, provides optimized code patterns for large datasets, and demonstrates measurable performance gains through simulations and real backtests.

Reimagining Classic Strategies (Part 17): Modelling Technical Indicators

In this discussion, we focus on how we can break the glass ceiling imposed by classical machine learning techniques in finance. It appears that the greatest limitation to the value we can extract from statistical models does not lie in the models themselves — neither in the data nor in the complexity of the algorithms — but rather in the methodology we use to apply them. In other words, the true bottleneck may be how we employ the model, not the model’s intrinsic capability.

Market Simulation (Part 05): Creating the C_Orders Class (II)

In this article, I will explain how Chart Trade, together with the Expert Advisor, will process a request to close all of the users' open positions. This may sound simple, but there are a few complications that you need to know how to manage.

The MQL5 Standard Library Explorer (Part 3): Expert Standard Deviation Channel

In this discussion, we will develop an Expert Advisor using the CTrade and CStdDevChannel classes, while applying several filters to enhance profitability. This stage puts our previous discussion into practical application. Additionally, I’ll introduce another simple approach to help you better understand the MQL5 Standard Library and its underlying codebase. Join the discussion to explore these concepts in action.