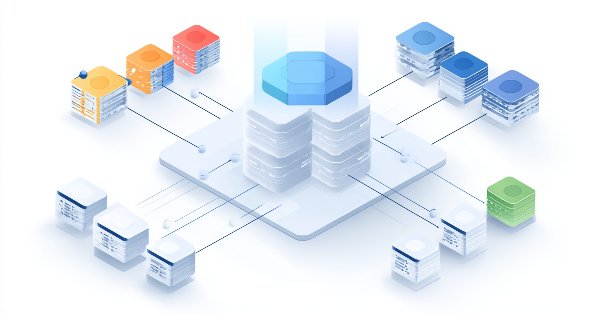

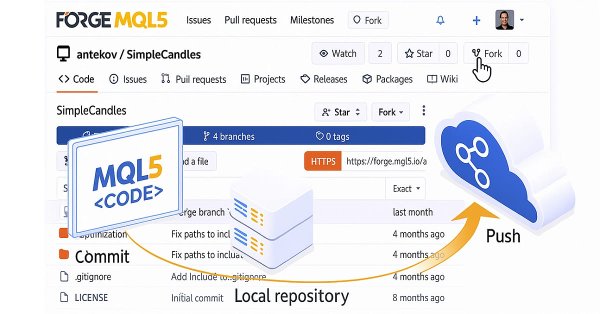

Moving to MQL5 Algo Forge (Part 3): Using External Repositories in Your Own Projects

Let's explore how you can start integrating external code from any repository in the MQL5 Algo Forge storage into your own project. In this article, we finally turn to this promising, yet more complex, task: how to practically connect and use libraries from third-party repositories within MQL5 Algo Forge.

Overcoming The Limitation of Machine Learning (Part 4): Overcoming Irreducible Error Using Multiple Forecast Horizons

Machine learning is often viewed through statistical or linear algebraic lenses, but this article emphasizes a geometric perspective of model predictions. It demonstrates that models do not truly approximate the target but rather map it onto a new coordinate system, creating an inherent misalignment that results in irreducible error. The article proposes that multi-step predictions, comparing the model’s forecasts across different horizons, offer a more effective approach than direct comparisons with the target. By applying this method to a trading model, the article demonstrates significant improvements in profitability and accuracy without changing the underlying model.

Automating The Market Sentiment Indicator

In this article, we automate a custom market sentiment indicator that classifies market conditions into bullish, bearish, risk-on, risk-off, and neutral. The Expert Advisor delivers real-time insights into prevailing sentiment while streamlining the analysis process for current market trends or direction.

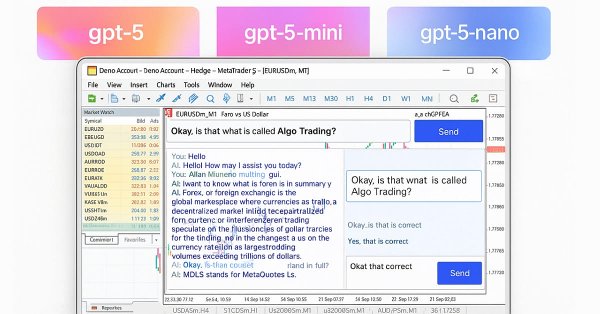

Building AI-Powered Trading Systems in MQL5 (Part 2): Developing a ChatGPT-Integrated Program with User Interface

In this article, we develop a ChatGPT-integrated program in MQL5 with a user interface, leveraging the JSON parsing framework from Part 1 to send prompts to OpenAI’s API and display responses on a MetaTrader 5 chart. We implement a dashboard with an input field, submit button, and response display, handling API communication and text wrapping for user interaction.

Developing Trading Strategies with the Parafrac and Parafrac V2 Oscillators: Single Entry Performance Insights

This article introduces the ParaFrac Oscillator and its V2 model as trading tools. It outlines three trading strategies developed using these indicators. Each strategy was tested and optimized to identify their strengths and weaknesses. Comparative analysis highlighted the performance differences between the original and V2 models.

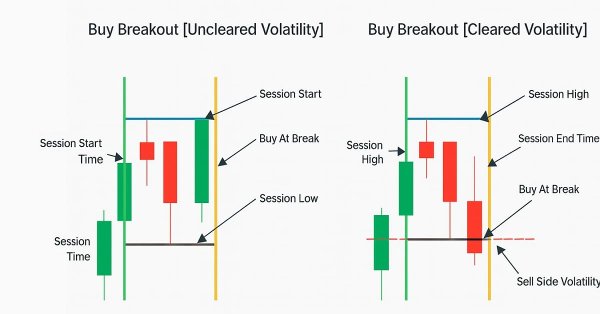

Developing a Volatility Based Breakout System

Volatility based breakout system identifies market ranges, then trades when price breaks above or below those levels, filtered by volatility measures such as ATR. This approach helps capture strong directional moves.

Simplifying Databases in MQL5 (Part 2): Using metaprogramming to create entities

We explored the advanced use of #define for metaprogramming in MQL5, creating entities that represent tables and column metadata (type, primary key, auto-increment, nullability, etc.). We centralized these definitions in TickORM.mqh, automating the generation of metadata classes and paving the way for efficient data manipulation by the ORM, without having to write SQL manually.

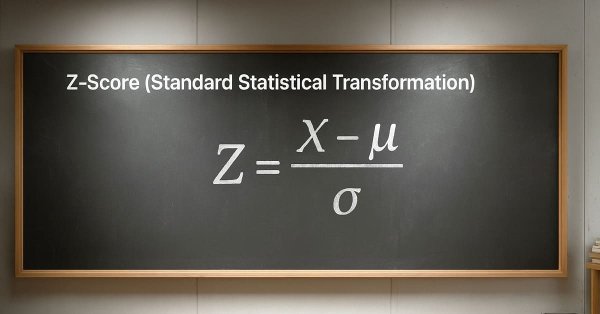

Price Action Analysis Toolkit Development (Part 41): Building a Statistical Price-Level EA in MQL5

Statistics has always been at the heart of financial analysis. By definition, statistics is the discipline that collects, analyzes, interprets, and presents data in meaningful ways. Now imagine applying that same framework to candlesticks—compressing raw price action into measurable insights. How helpful would it be to know, for a specific period of time, the central tendency, spread, and distribution of market behavior? In this article, we introduce exactly that approach, showing how statistical methods can transform candlestick data into clear, actionable signals.

Neuro-symbolic systems in algorithmic trading: Combining symbolic rules and neural networks

The article describes the experience of developing a hybrid trading system that combines classical technical analysis with neural networks. The author provides a detailed analysis of the system architecture from basic pattern analysis and neural network structure to the mechanisms behind trading decisions, and shares real code and practical observations.

Functions for activating neurons during training: The key to fast convergence?

This article presents a study of the interaction of different activation functions with optimization algorithms in the context of neural network training. Particular attention is paid to the comparison of the classical ADAM and its population version when working with a wide range of activation functions, including the oscillating ACON and Snake functions. Using a minimalistic MLP (1-1-1) architecture and a single training example, the influence of activation functions on the optimization is isolated from other factors. The article proposes an approach to manage network weights through the boundaries of activation functions and a weight reflection mechanism, which allows avoiding problems with saturation and stagnation in training.

From Novice to Expert: Animated News Headline Using MQL5 (XI)—Correlation in News Trading

In this discussion, we will explore how the concept of Financial Correlation can be applied to improve decision-making efficiency when trading multiple symbols during major economic events announcement. The focus is on addressing the challenge of heightened risk exposure caused by increased volatility during news releases.

Building AI-Powered Trading Systems in MQL5 (Part 1): Implementing JSON Handling for AI APIs

In this article, we develop a JSON parsing framework in MQL5 to handle data exchange for AI API integration, focusing on a JSON class for processing JSON structures. We implement methods to serialize and deserialize JSON data, supporting various data types like strings, numbers, and objects, essential for communicating with AI services like ChatGPT, enabling future AI-driven trading systems by ensuring accurate data handling and manipulation.

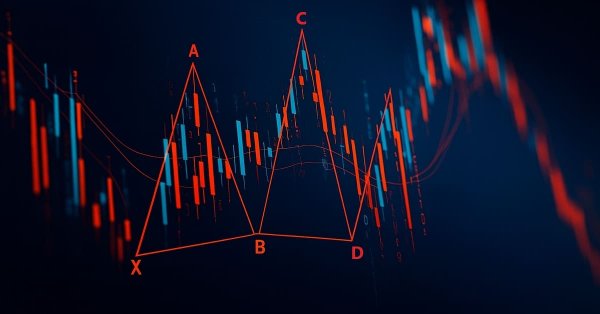

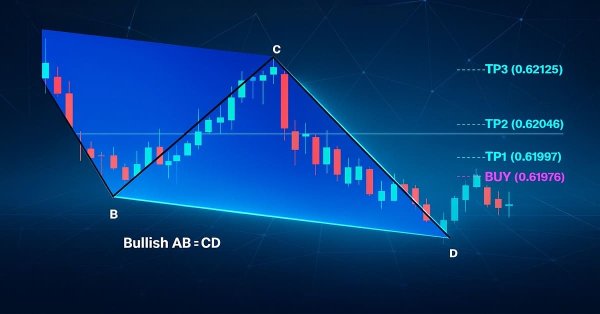

Introduction to MQL5 (Part 21): Automating Harmonic Pattern Detection

Learn how to detect and display the Gartley harmonic pattern in MetaTrader 5 using MQL5. This article explains each step of the process, from identifying swing points to applying Fibonacci ratios and plotting the full pattern on the chart for clear visual confirmation.

Pipelines in MQL5

In this piece, we look at a key data preparation step for machine learning that is gaining rapid significance. Data Preprocessing Pipelines. These in essence are a streamlined sequence of data transformation steps that prepare raw data before it is fed to a model. As uninteresting as this may initially seem to the uninducted, this ‘data standardization’ not only saves on training time and execution costs, but it goes a long way in ensuring better generalization. In this article we are focusing on some SCIKIT-LEARN preprocessing functions, and while we are not exploiting the MQL5 Wizard, we will return to it in coming articles.

Developing A Custom Account Performace Matrix Indicator

This indicator acts as a discipline enforcer by tracking account equity, profit/loss, and drawdown in real-time while displaying a performance dashboard. It can help traders stay consistent, avoid overtrading, and comply with prop-firm challenge rules.

The Parafrac V2 Oscillator: Integrating Parabolic SAR with Average True Range

The Parafrac V2 Oscillator is an advanced technical analysis tool that integrates the Parabolic SAR with the Average True Range (ATR) to overcome limitations of its predecessor, which relied on fractals and was prone to signal spikes overshadowing previous and current signals. By leveraging ATR’s volatility measure, the version 2 offers a smoother, more reliable method for detecting trends, reversals, and divergences, helping traders reduce chart congestion and analysis paralysis.

From Novice to Expert: Implementation of Fibonacci Strategies in Post-NFP Market Trading

In financial markets, the laws of retracement remain among the most undeniable forces. It is a rule of thumb that price will always retrace—whether in large moves or even within the smallest tick patterns, which often appear as a zigzag. However, the retracement pattern itself is never fixed; it remains uncertain and subject to anticipation. This uncertainty explains why traders rely on multiple Fibonacci levels, each carrying a certain probability of influence. In this discussion, we introduce a refined strategy that applies Fibonacci techniques to address the challenges of trading shortly after major economic event announcements. By combining retracement principles with event-driven market behavior, we aim to uncover more reliable entry and exit opportunities. Join to explore the full discussion and see how Fibonacci can be adapted to post-event trading.

Price Action Analysis Toolkit Development (Part 40): Market DNA Passport

This article explores the unique identity of each currency pair through the lens of its historical price action. Inspired by the concept of genetic DNA, which encodes the distinct blueprint of every living being, we apply a similar framework to the markets, treating price action as the “DNA” of each pair. By breaking down structural behaviors such as volatility, swings, retracements, spikes, and session characteristics, the tool reveals the underlying profile that distinguishes one pair from another. This approach provides more profound insight into market behavior and equips traders with a structured way to align strategies with the natural tendencies of each instrument.

Quantum computing and trading: A fresh approach to price forecasts

The article describes an innovative approach to forecasting price movements in financial markets using quantum computing. The main focus is on the application of the Quantum Phase Estimation (QPE) algorithm to find prototypes of price patterns allowing traders to significantly speed up the market data analysis.

Neural Networks in Trading: A Hybrid Trading Framework with Predictive Coding (StockFormer)

In this article, we will discuss the hybrid trading system StockFormer, which combines predictive coding and reinforcement learning (RL) algorithms. The framework uses 3 Transformer branches with an integrated Diversified Multi-Head Attention (DMH-Attn) mechanism that improves on the vanilla attention module with a multi-headed Feed-Forward block, allowing it to capture diverse time series patterns across different subspaces.

Automating Trading Strategies in MQL5 (Part 32): Creating a Price Action 5 Drives Harmonic Pattern System

In this article, we develop a 5 Drives pattern system in MQL5 that identifies bullish and bearish 5 Drives harmonic patterns using pivot points and Fibonacci ratios, executing trades with customizable entry, stop loss, and take-profit levels based on user-selected options. We enhance trader insight with visual feedback through chart objects like triangles, trendlines, and labels to clearly display the A-B-C-D-E-F pattern structure.

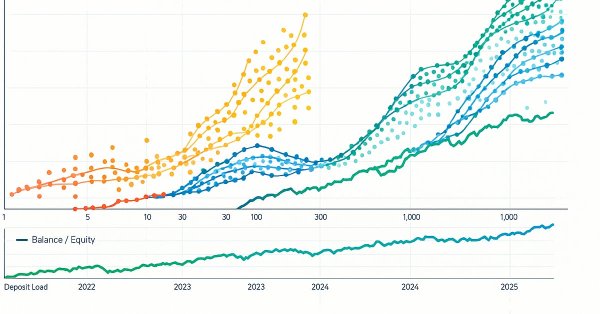

Developing a multi-currency Expert Advisor (Part 21): Preparing for an important experiment and optimizing the code

For further progress it would be good to see if we can improve the results by periodically re-running the automatic optimization and generating a new EA. The stumbling block in many debates about the use of parameter optimization is the question of how long the obtained parameters can be used for trading in the future period while maintaining the profitability and drawdown at the specified levels. And is it even possible to do this?

Neural Networks in Trading: An Ensemble of Agents with Attention Mechanisms (Final Part)

In the previous article, we introduced the multi-agent adaptive framework MASAAT, which uses an ensemble of agents to perform cross-analysis of multimodal time series at different data scales. Today we will continue implementing the approaches of this framework in MQL5 and bring this work to a logical conclusion.

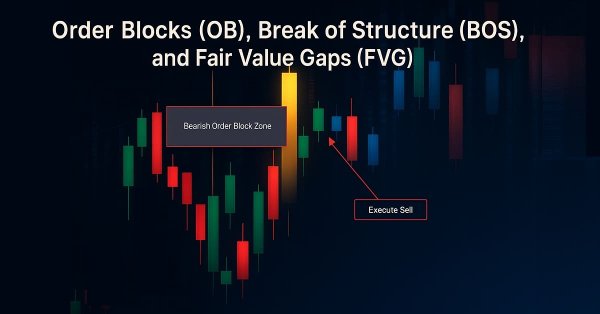

Mastering Fair Value Gaps: Formation, Logic, and Automated Trading with Breakers and Market Structure Shifts

This is an article that I have written aimed to expound and explain Fair Value Gaps, their formation logic for occurring, and automated trading with breakers and market structure shifts.

Dynamic mode decomposition applied to univariate time series in MQL5

Dynamic mode decomposition (DMD) is a technique usually applied to high-dimensional datasets. In this article, we demonstrate the application of DMD on univariate time series, showing its ability to characterize a series as well as make forecasts. In doing so, we will investigate MQL5's built-in implementation of dynamic mode decomposition, paying particular attention to the new matrix method, DynamicModeDecomposition().

Automating Trading Strategies in MQL5 (Part 31): Creating a Price Action 3 Drives Harmonic Pattern System

In this article, we develop a 3 Drives Pattern system in MQL5 that identifies bullish and bearish 3 Drives harmonic patterns using pivot points and Fibonacci ratios, executing trades with customizable entry, stop loss, and take-profit levels based on user-selected options. We enhance trader insight with visual feedback through chart objects.

Moving to MQL5 Algo Forge (Part 2): Working with Multiple Repositories

In this article, we are considering one of the possible approaches to organizing the storage of the project's source code in a public repository. We will distribute the code across different branches to establish clear and convenient rules for the project development.

Self Optimizing Expert Advisors in MQL5 (Part 14): Viewing Data Transformations as Tuning Parameters of Our Feedback Controller

Preprocessing is a powerful yet quickly overlooked tuning parameter. It lives in the shadows of its bigger brothers: optimizers and shiny model architectures. Small percentage improvements here can have disproportionately large, compounding effects on profitability and risk. Too often, this largely unexplored science is boiled down to a simple routine, seen only as a means to an end, when in reality it is where signal can be directly amplified, or just as easily destroyed.

Developing a Custom Market Sentiment Indicator

In this article we are developing a custom market sentiment indicator to classify conditions into bullish, bearish, risk-on, risk-off, or neutral. Using multi-timeframe, the indicator can provide traders with a clearer perspective of overall market bias and short-term confirmations.

Statistical Arbitrage Through Cointegrated Stocks (Part 4): Real-time Model Updating

This article describes a simple but comprehensive statistical arbitrage pipeline for trading a basket of cointegrated stocks. It includes a fully functional Python script for data download and storage; correlation, cointegration, and stationarity tests, along with a sample Metatrader 5 Service implementation for database updating, and the respective Expert Advisor. Some design choices are documented here for reference and for helping in the experiment replication.

Elevate Your Trading With Smart Money Concepts (SMC): OB, BOS, and FVG

Elevate your trading with Smart Money Concepts (SMC) by combining Order Blocks (OB), Break of Structure (BOS), and Fair Value Gaps (FVG) into one powerful EA. Choose automatic strategy execution or focus on any individual SMC concept for flexible and precise trading.

Moving to MQL5 Algo Forge (Part 1): Creating the Main Repository

When working on projects in MetaEditor, developers often face the need to manage code versions. MetaQuotes recently announced migration to GIT and the launch of MQL5 Algo Forge with code versioning and collaboration capabilities. In this article, we will discuss how to use the new and previously existing tools more efficiently.

Automating Trading Strategies in MQL5 (Part 30): Creating a Price Action AB-CD Harmonic Pattern with Visual Feedback

In this article, we develop an AB=CD Pattern EA in MQL5 that identifies bullish and bearish AB=CD harmonic patterns using pivot points and Fibonacci ratios, executing trades with precise entry, stop loss, and take-profit levels. We enhance trader insight with visual feedback through chart objects.

From Novice to Expert: Animated News Headline Using MQL5 (X)—Multiple Symbol Chart View for News Trading

Today we will develop a multi-chart view system using chart objects. The goal is to enhance news trading by applying MQL5 algorithms that help reduce trader reaction time during periods of high volatility, such as major news releases. In this case, we provide traders with an integrated way to monitor multiple major symbols within a single all-in-one news trading tool. Our work is continuously advancing with the News Headline EA, which now features a growing set of functions that add real value both for traders using fully automated systems and for those who prefer manual trading assisted by algorithms. Explore more knowledge, insights, and practical ideas by clicking through and joining this discussion.

Price Action Analysis Toolkit Development (Part 39): Automating BOS and ChoCH Detection in MQL5

This article presents Fractal Reaction System, a compact MQL5 system that converts fractal pivots into actionable market-structure signals. Using closed-bar logic to avoid repainting, the EA detects Change-of-Character (ChoCH) warnings and confirms Breaks-of-Structure (BOS), draws persistent chart objects, and logs/alerts every confirmed event (desktop, mobile and sound). Read on for the algorithm design, implementation notes, testing results and the full EA code so you can compile, test and deploy the detector yourself.

Polynomial models in trading

This article is about orthogonal polynomials. Their use can become the basis for a more accurate and effective analysis of market information allowing traders to make more informed decisions.

Market Simulation (Part 01): Cross Orders (I)

Today we will begin the second stage, where we will look at the market replay/simulation system. First, we will show a possible solution for cross orders. I will show you the solution, but it is not final yet. It will be a possible solution to a problem that we will need to solve in the near future.

Big Bang - Big Crunch (BBBC) algorithm

The article presents the Big Bang - Big Crunch method, which has two key phases: cyclic generation of random points and their compression to the optimal solution. This approach combines exploration and refinement, allowing us to gradually find better solutions and open up new optimization opportunities.

Neural Networks in Trading: An Ensemble of Agents with Attention Mechanisms (MASAAT)

We introduce the Multi-Agent Self-Adaptive Portfolio Optimization Framework (MASAAT), which combines attention mechanisms and time series analysis. MASAAT generates a set of agents that analyze price series and directional changes, enabling the identification of significant fluctuations in asset prices at different levels of detail.

Overcoming The Limitation of Machine Learning (Part 3): A Fresh Perspective on Irreducible Error

This article takes a fresh perspective on a hidden, geometric source of error that quietly shapes every prediction your models make. By rethinking how we measure and apply machine learning forecasts in trading, we reveal how this overlooked perspective can unlock sharper decisions, stronger returns, and a more intelligent way to work with models we thought we already understood.