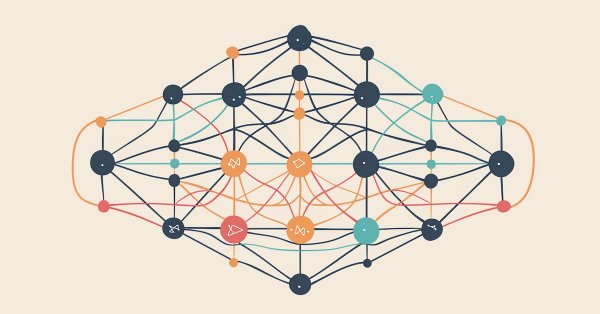

Neural Networks in Trading: An Ensemble of Agents with Attention Mechanisms (Final Part)

In the previous article, we introduced the multi-agent adaptive framework MASAAT, which uses an ensemble of agents to perform cross-analysis of multimodal time series at different data scales. Today we will continue implementing the approaches of this framework in MQL5 and bring this work to a logical conclusion.

Population optimization algorithms: Artificial Bee Colony (ABC)

In this article, we will study the algorithm of an artificial bee colony and supplement our knowledge with new principles of studying functional spaces. In this article, I will showcase my interpretation of the classic version of the algorithm.

MQL5 Wizard Techniques you should know (Part 44): Average True Range (ATR) technical indicator

The ATR oscillator is a very popular indicator for acting as a volatility proxy, especially in the forex markets where volume data is scarce. We examine this, on a pattern basis as we have with prior indicators, and share strategies & test reports thanks to the MQL5 wizard library classes and assembly.

Hidden Markov Models for Trend-Following Volatility Prediction

Hidden Markov Models (HMMs) are powerful statistical tools that identify underlying market states by analyzing observable price movements. In trading, HMMs enhance volatility prediction and inform trend-following strategies by modeling and anticipating shifts in market regimes. In this article, we will present the complete procedure for developing a trend-following strategy that utilizes HMMs to predict volatility as a filter.

Price Action Analysis Toolkit Development Part (4): Analytics Forecaster EA

We are moving beyond simply viewing analyzed metrics on charts to a broader perspective that includes Telegram integration. This enhancement allows important results to be delivered directly to your mobile device via the Telegram app. Join us as we explore this journey together in this article.

Data Science and Machine Learning(Part 14): Finding Your Way in the Markets with Kohonen Maps

Are you looking for a cutting-edge approach to trading that can help you navigate complex and ever-changing markets? Look no further than Kohonen maps, an innovative form of artificial neural networks that can help you uncover hidden patterns and trends in market data. In this article, we'll explore how Kohonen maps work, and how they can be used to develop smarter, more effective trading strategies. Whether you're a seasoned trader or just starting out, you won't want to miss this exciting new approach to trading.

Data Science and ML(Part 30): The Power Couple for Predicting the Stock Market, Convolutional Neural Networks(CNNs) and Recurrent Neural Networks(RNNs)

In this article, We explore the dynamic integration of Convolutional Neural Networks (CNNs) and Recurrent Neural Networks (RNNs) in stock market prediction. By leveraging CNNs' ability to extract patterns and RNNs' proficiency in handling sequential data. Let us see how this powerful combination can enhance the accuracy and efficiency of trading algorithms.

Price Action Analysis Toolkit Development (Part 20): External Flow (IV) — Correlation Pathfinder

Correlation Pathfinder offers a fresh approach to understanding currency pair dynamics as part of the Price Action Analysis Toolkit Development Series. This tool automates data collection and analysis, providing insight into how pairs like EUR/USD and GBP/USD interact. Enhance your trading strategy with practical, real-time information that helps you manage risk and spot opportunities more effectively.

Build Self Optimizing Expert Advisors With MQL5 And Python (Part II): Tuning Deep Neural Networks

Machine learning models come with various adjustable parameters. In this series of articles, we will explore how to customize your AI models to fit your specific market using the SciPy library.

Population optimization algorithms: Stochastic Diffusion Search (SDS)

The article discusses Stochastic Diffusion Search (SDS), which is a very powerful and efficient optimization algorithm based on the principles of random walk. The algorithm allows finding optimal solutions in complex multidimensional spaces, while featuring a high speed of convergence and the ability to avoid local extrema.

Data Science and ML (Part 41): Forex and Stock Markets Pattern Detection using YOLOv8

Detecting patterns in financial markets is challenging because it involves seeing what's on the chart, something that's difficult to undertake in MQL5 due to image limitations. In this article, we are going to discuss a decent model made in Python that helps us detect patterns present on the chart with minimal effort.

Integrating MQL5 with data processing packages (Part 5): Adaptive Learning and Flexibility

This part focuses on building a flexible, adaptive trading model trained on historical XAUUSD data, preparing it for ONNX export and potential integration into live trading systems.

Quantitative analysis in MQL5: Implementing a promising algorithm

We will analyze the question of what quantitative analysis is and how it is used by major players. We will create one of the quantitative analysis algorithms in the MQL5 language.

Timeseries in DoEasy library (part 50): Multi-period multi-symbol standard indicators with a shift

In the article, let’s improve library methods for correct display of multi-symbol multi-period standard indicators, which lines are displayed on the current symbol chart with a shift set in the settings. As well, let’s put things in order in methods of work with standard indicators and remove the redundant code to the library area in the final indicator program.

Price Action Analysis Toolkit Development (Part 30): Commodity Channel Index (CCI), Zero Line EA

Automating price action analysis is the way forward. In this article, we utilize the Dual CCI indicator, the Zero Line Crossover strategy, EMA, and price action to develop a tool that generates trade signals and sets stop-loss (SL) and take-profit (TP) levels using ATR. Please read this article to learn how we approach the development of the CCI Zero Line EA.

Price Action Analysis Toolkit Development (Part 23): Currency Strength Meter

Do you know what really drives a currency pair’s direction? It’s the strength of each individual currency. In this article, we’ll measure a currency’s strength by looping through every pair it appears in. That insight lets us predict how those pairs may move based on their relative strengths. Read on to learn more.

Category Theory in MQL5 (Part 3)

Category Theory is a diverse and expanding branch of Mathematics which as of yet is relatively uncovered in the MQL5 community. These series of articles look to introduce and examine some of its concepts with the overall goal of establishing an open library that provides insight while hopefully furthering the use of this remarkable field in Traders' strategy development.

Data Science and ML (Part 26): The Ultimate Battle in Time Series Forecasting — LSTM vs GRU Neural Networks

In the previous article, we discussed a simple RNN which despite its inability to understand long-term dependencies in the data, was able to make a profitable strategy. In this article, we are discussing both the Long-Short Term Memory(LSTM) and the Gated Recurrent Unit(GRU). These two were introduced to overcome the shortcomings of a simple RNN and to outsmart it.

Brute force approach to patterns search (Part V): Fresh angle

In this article, I will show a completely different approach to algorithmic trading I ended up with after quite a long time. Of course, all this has to do with my brute force program, which has undergone a number of changes that allow it to solve several problems simultaneously. Nevertheless, the article has turned out to be more general and as simple as possible, which is why it is also suitable for those who know nothing about brute force.

Currency pair strength indicator in pure MQL5

We are going to develop a professional indicator for currency strength analysis in MQL5. This step-by-step guide will show you how to develop a powerful trading tool with a visual dashboard for MetaTrader 5. You will learn how to calculate the strength of currency pairs across multiple timeframes (H1, H4, D1), implement dynamic data updates, and create a user-friendly interface.

Price Action Analysis Toolkit Development (Part 2): Analytical Comment Script

Aligned with our vision of simplifying price action, we are pleased to introduce another tool that can significantly enhance your market analysis and help you make well-informed decisions. This tool displays key technical indicators such as previous day's prices, significant support and resistance levels, and trading volume, while automatically generating visual cues on the chart.

Matrix Utils, Extending the Matrices and Vector Standard Library Functionality

Matrix serves as the foundation of machine learning algorithms and computers in general because of their ability to effectively handle large mathematical operations, The Standard library has everything one needs but let's see how we can extend it by introducing several functions in the utils file, that are not yet available in the library

Benefiting from Forex market seasonality

We are all familiar with the concept of seasonality, for example, we are all accustomed to rising prices for fresh vegetables in winter or rising fuel prices during severe frosts, but few people know that similar patterns exist in the Forex market.

Price Action Analysis Toolkit Development (Part 5): Volatility Navigator EA

Determining market direction can be straightforward, but knowing when to enter can be challenging. As part of the series titled "Price Action Analysis Toolkit Development", I am excited to introduce another tool that provides entry points, take profit levels, and stop loss placements. To achieve this, we have utilized the MQL5 programming language. Let’s delve into each step in this article.

Population optimization algorithms: Firefly Algorithm (FA)

In this article, I will consider the Firefly Algorithm (FA) optimization method. Thanks to the modification, the algorithm has turned from an outsider into a real rating table leader.

Data Science and Machine Learning (Part 19): Supercharge Your AI models with AdaBoost

AdaBoost, a powerful boosting algorithm designed to elevate the performance of your AI models. AdaBoost, short for Adaptive Boosting, is a sophisticated ensemble learning technique that seamlessly integrates weak learners, enhancing their collective predictive strength.

MQL5 Trading Tools (Part 10): Building a Strategy Tracker System with Visual Levels and Success Metrics

In this article, we develop an MQL5 strategy tracker system that detects moving average crossover signals filtered by a long-term MA, simulates or executes trades with configurable TP levels and SL in points, and monitors outcomes like TP/SL hits for performance analysis.

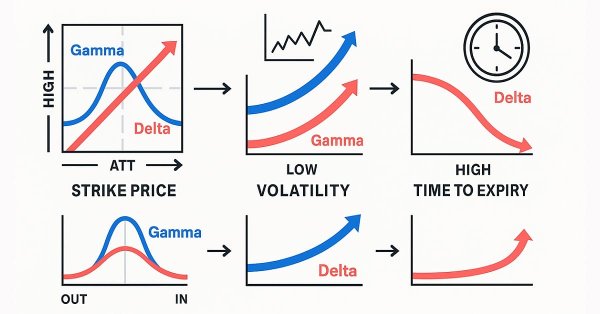

Black-Scholes Greeks: Gamma and Delta

Gamma and Delta measure how an option’s value reacts to changes in the underlying asset’s price. Delta represents the rate of change of the option’s price relative to the underlying, while Gamma measures how Delta itself changes as price moves. Together, they describe an option’s directional sensitivity and convexity—critical for dynamic hedging and volatility-based trading strategies.

Non-linear regression models on the stock exchange

Non-linear regression models on the stock exchange: Is it possible to predict financial markets? Let's consider creating a model for forecasting prices for EURUSD, and make two robots based on it - in Python and MQL5.

Data Science and Machine Learning (Part 25): Forex Timeseries Forecasting Using a Recurrent Neural Network (RNN)

Recurrent neural networks (RNNs) excel at leveraging past information to predict future events. Their remarkable predictive capabilities have been applied across various domains with great success. In this article, we will deploy RNN models to predict trends in the forex market, demonstrating their potential to enhance forecasting accuracy in forex trading.

MQL5 Trading Tools (Part 8): Enhanced Informational Dashboard with Draggable and Minimizable Features

In this article, we develop an enhanced informational dashboard that upgrades the previous part by adding draggable and minimizable features for improved user interaction, while maintaining real-time monitoring of multi-symbol positions and account metrics.

Population optimization algorithms: Cuckoo Optimization Algorithm (COA)

The next algorithm I will consider is cuckoo search optimization using Levy flights. This is one of the latest optimization algorithms and a new leader in the leaderboard.

Neural networks made easy (Part 38): Self-Supervised Exploration via Disagreement

One of the key problems within reinforcement learning is environmental exploration. Previously, we have already seen the research method based on Intrinsic Curiosity. Today I propose to look at another algorithm: Exploration via Disagreement.

Neuro-symbolic systems in algorithmic trading: Combining symbolic rules and neural networks

The article describes the experience of developing a hybrid trading system that combines classical technical analysis with neural networks. The author provides a detailed analysis of the system architecture from basic pattern analysis and neural network structure to the mechanisms behind trading decisions, and shares real code and practical observations.

News Trading Made Easy (Part 3): Performing Trades

In this article, our news trading expert will begin opening trades based on the economic calendar stored in our database. In addition, we will improve the expert's graphics to display more relevant information about upcoming economic calendar events.

MQL5 Trading Tools (Part 6): Dynamic Holographic Dashboard with Pulse Animations and Controls

In this article, we create a dynamic holographic dashboard in MQL5 for monitoring symbols and timeframes with RSI, volatility alerts, and sorting options. We add pulse animations, interactive buttons, and holographic effects to make the tool visually engaging and responsive.

Developing a Replay System (Part 78): New Chart Trade (V)

In this article, we will look at how to implement part of the receiver code. Here we will implement an Expert Advisor to test and learn how the protocol interaction works. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Pipelines in MQL5

In this piece, we look at a key data preparation step for machine learning that is gaining rapid significance. Data Preprocessing Pipelines. These in essence are a streamlined sequence of data transformation steps that prepare raw data before it is fed to a model. As uninteresting as this may initially seem to the uninducted, this ‘data standardization’ not only saves on training time and execution costs, but it goes a long way in ensuring better generalization. In this article we are focusing on some SCIKIT-LEARN preprocessing functions, and while we are not exploiting the MQL5 Wizard, we will return to it in coming articles.

MetaTrader Meets Google Sheets with Pythonanywhere: A Guide to Secure Data Flow

This article demonstrates a secure way to export MetaTrader data to Google Sheets. Google Sheet is the most valuable solution as it is cloud based and the data saved in there can be accessed anytime and from anywhere. So traders can access trading and related data exported to google sheet and do further analysis for future trading anytime and wherever they are at the moment.

Data Science and ML (Part 33): Pandas Dataframe in MQL5, Data Collection for ML Usage made easier

When working with machine learning models, it’s essential to ensure consistency in the data used for training, validation, and testing. In this article, we will create our own version of the Pandas library in MQL5 to ensure a unified approach for handling machine learning data, for ensuring the same data is applied inside and outside MQL5, where most of the training occurs.