Risk Evaluation in the Sequence of Deals with One Asset. Continued

The article develops the ideas proposed in the previous part and considers them further. It describes the problems of yield distributions, plotting and studying statistical regularities.

Continuous Walk-Forward Optimization (Part 2): Mechanism for creating an optimization report for any robot

The first article within the Walk-Through Optimization series described the creation of a DLL to be used in our auto optimizer. This continuation is entirely devoted to the MQL5 language.

Controlled optimization: Simulated annealing

The Strategy Tester in the MetaTrader 5 trading platform provides only two optimization options: complete search of parameters and genetic algorithm. This article proposes a new method for optimizing trading strategies — Simulated annealing. The method's algorithm, its implementation and integration into any Expert Advisor are considered. The developed algorithm is tested on the Moving Average EA.

Library for easy and quick development of MetaTrader programs (part XIV): Symbol object

In this article, we will create the class of a symbol object that is to be the basic object for creating the symbol collection. The class will allow us to obtain data on the necessary symbols for their further analysis and comparison.

SQL and MQL5: Working with SQLite Database

This article is intended for developers who would be interested in using SQL in their projects. It explains the functionality and advantages of SQLite. The article does not require special knowledge of SQLite functions, yet minimum understanding of SQL would be beneficial.

Bi-Directional Trading and Hedging of Positions in MetaTrader 5 Using the HedgeTerminal Panel, Part 1

This article describes a new approach to hedging of positions and draws the line in the debates between users of MetaTrader 4 and MetaTrader 5 about this matter. The algorithms making such hedging reliable are described in layman's terms and illustrated with simple charts and diagrams. This article is dedicated to the new panel HedgeTerminal, which is essentially a fully featured trading terminal within MetaTrader 5. Using HedgeTerminal and the virtualization of the trade it offers, positions can be managed in the way similar to MetaTrader 4.

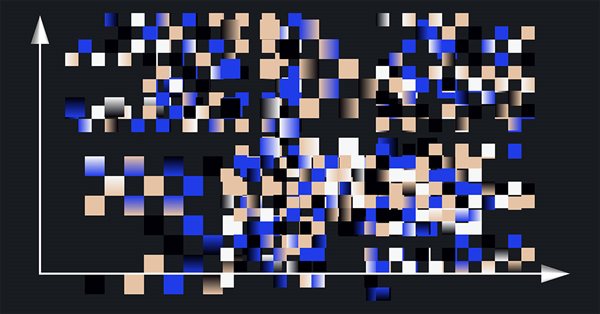

Color optimization of trading strategies

In this article we will perform an experiment: we will color optimization results. The color is determined by three parameters: the levels of red, green and blue (RGB). There are other color coding methods, which also use three parameters. Thus, three testing parameters can be converted to one color, which visually represents the values. Read this article to find out if such a representation can be useful.

Machine learning in Grid and Martingale trading systems. Would you bet on it?

This article describes the machine learning technique applied to grid and martingale trading. Surprisingly, this approach has little to no coverage in the global network. After reading the article, you will be able to create your own trading bots.

Mini Market Emulator or Manual Strategy Tester

Mini Market Emulator is an indicator designed for partial emulation of work in the terminal. Presumably, it can be used to test "manual" strategies of market analysis and trading.

Custom Walk Forward optimization in MetaTrader 5

The article deals with the approaches enabling accurate simulation of walk forward optimization using the built-in tester and auxiliary libraries implemented in MQL.

Multiple Regression Analysis. Strategy Generator and Tester in One

The article gives a description of ways of use of the multiple regression analysis for development of trading systems. It demonstrates the use of the regression analysis for strategy search automation. A regression equation generated and integrated in an EA without requiring high proficiency in programming is given as an example.

Timeseries in DoEasy library (part 38): Timeseries collection - real-time updates and accessing data from the program

The article considers real-time update of timeseries data and sending messages about the "New bar" event to the control program chart from all timeseries of all symbols for the ability to handle these events in custom programs. The "New tick" class is used to determine the need to update timeseries for the non-current chart symbol and periods.

The power of ZigZag (part I). Developing the base class of the indicator

Many researchers do not pay enough attention to determining the price behavior. At the same time, complex methods are used, which very often are simply “black boxes”, such as machine learning or neural networks. The most important question arising in that case is what data to submit for training a particular model.

Selection and navigation utility in MQL5 and MQL4: Adding data to charts

In this article, we will continue expanding the functionality of the utility. This time, we will add the ability to display data that simplifies our trading. In particular, we are going to add High and Low prices of the previous day, round levels, High and Low prices of the year, session start time, etc.

How to analyze the trades of the Signal selected in the chart

The trade Signals service develops in leaps and bounds. Trusting our funds to a signal provider, we would like to minimize the risk of losing our deposit. So how to puzzle out in this forest of trade signals? How to find the one that would produce profits? This paper proposes to create a tool for visually analyzing the history of trades on trade signals in a symbol chart.

Continuous Walk-Forward Optimization (Part 3): Adapting a Robot to Auto Optimizer

The third part serves as a bridge between the previous two parts: it describes the mechanism of interaction with the DLL considered in the first article and the objects for report downloading, which were described in the second article. We will analyze the process of wrapper creation for a class which is imported from DLL and which forms an XML file with the trading history. We will also consider a method for interacting with this wrapper.

PairPlot graph based on CGraphic for analyzing correlations between data arrays (time series)

Comparing several time series during a technical analysis is a quite common task that requires appropriate tools. In this article, I suggest developing a tool for graphical analysis and detecting correlations between two or more time series.

Optimization management (Part I): Creating a GUI

This article describes the process of creating an extension for the MetaTrader terminal. The solution discussed helps to automate the optimization process by running optimizations in other terminals. A few more articles will be written concerning this topic. The extension has been developed using the C# language and design patterns, which additionally demonstrates the ability to expand the terminal capabilities by developing custom modules, as well as the ability to create custom graphical user interfaces using the functionality of a preferred programming language.

Better Programmer (Part 02): Stop doing these 5 things to become a successful MQL5 programmer

This is the must read article for anyone wanting to improve their programming career. This article series is aimed at making you the best programmer you can possibly be, no matter how experienced you are. The discussed ideas work for MQL5 programming newbies as well as professionals.

Random Walk and the Trend Indicator

Random Walk looks very similar to the real market data, but it has some significant features. In this article we will consider the properties of Random Walk, simulated using the coin-tossing game. To study the properties of the data, the trendiness indicator is developed.

The power of ZigZag (part II). Examples of receiving, processing and displaying data

In the first part of the article, I have described a modified ZigZag indicator and a class for receiving data of that type of indicators. Here, I will show how to develop indicators based on these tools and write an EA for tests that features making deals according to signals formed by ZigZag indicator. As an addition, the article will introduce a new version of the EasyAndFast library for developing graphical user interfaces.

Library for easy and quick development of MetaTrader programs (part XXV): Handling errors returned by the trade server

After we send a trading order to the server, we need to check the error codes or the absence of errors. In this article, we will consider handling errors returned by the trade server and prepare for creating pending trading requests.

A New Approach to Interpreting Classic and Hidden Divergence. Part II

The article provides a critical examination of regular divergence and efficiency of various indicators. In addition, it contains filtering options for an increased analysis accuracy and features description of non-standard solutions. As a result, we will create a new tool for solving the technical task.

Timeseries in DoEasy library (part 39): Library-based indicators - preparing data and timeseries events

The article deals with applying DoEasy library for creating multi-symbol multi-period indicators. We are going to prepare the library classes to work within indicators and test creating timeseries to be used as data sources in indicators. We will also implement creating and sending timeseries events.

Practical Implementation of Digital Filters in MQL5 for Beginners

The idea of digital signal filtering has been widely discussed on forum topics about building trading systems. And it would be imprudent not to create a standard code of digital filters in MQL5. In this article the author describes the transformation of simple SMA indicator's code from his article "Custom Indicators in MQL5 for Newbies" into code of more complicated and universal digital filter. This article is a logical sequel to the previous article. It also tells how to replace text in code and how to correct programming errors.

Cluster analysis (Part I): Mastering the slope of indicator lines

Cluster analysis is one of the most important elements of artificial intelligence. In this article, I attempt applying the cluster analysis of the indicator slope to get threshold values for determining whether a market is flat or following a trend.

Multicurrency monitoring of trading signals (Part 1): Developing the application structure

In this article, we will discuss the idea of creating a multicurrency monitor of trading signals and will develop a future application structure along with its prototype, as well as create its framework for further operation. The article presents a step-by-step creation of a flexible multicurrency application which will enable the generation of trading signals and which will assist traders in finding the desired signals.

Custom presentation of trading history and creation of report diagrams

The article describes custom methods for assessing the trading history. Two classes have been written for downloading and analyzing history. The first of them collects the trading history and represents it as a summary table. The second one deals with statistics: it calculates a number of variables and builds charts for a more efficient evaluation of trading results.

Random Forests Predict Trends

This article considers using the Rattle package for automatic search of patterns for predicting long and short positions of currency pairs on Forex. This article can be useful both for novice and experienced traders.

Extracting structured data from HTML pages using CSS selectors

The article provides a description of a universal method for analyzing and converting data from HTML documents based on CSS selectors. Trading reports, tester reports, your favorite economic calendars, public signals, account monitoring and additional online quote sources will become available straight from MQL.

Analyzing trading results using HTML reports

The MetaTrader 5 platform features functionality for saving trading reports, as well as Expert Advisor testing and optimization reports. Trading and testing reports can be saved in two formats: XLSX and HTML, while the optimization report can be saved in XML. In this article we consider the HTML testing report, the XML optimization report and the HTML trading history report.

Studying candlestick analysis techniques (part IV): Updates and additions to Pattern Analyzer

The article presents a new version of the Pattern Analyzer application. This version provides bug fixes and new features, as well as the revised user interface. Comments and suggestions from previous article were taken into account when developing the new version. The resulting application is described in this article.

OpenAI's ChatGPT features within the framework of MQL4 and MQL5 development

In this article, we will fiddle around ChatGPT from OpenAI in order to understand its capabilities in terms of reducing the time and labor intensity of developing Expert Advisors, indicators and scripts. I will quickly navigate you through this technology and try to show you how to use it correctly for programming in MQL4 and MQL5.

Practical application of neural networks in trading. It's time to practice

The article provides a description and instructions for the practical use of neural network modules on the Matlab platform. It also covers the main aspects of creation of a trading system using the neural network module. In order to be able to introduce the complex within one article, I had to modify it so as to combine several neural network module functions in one program.

Library for easy and quick development of MetaTrader programs (part XXIII): Base trading class - verification of valid parameters

In the article, we continue the development of the trading class by implementing the control over incorrect trading order parameter values and voicing trading events.

Applying OLAP in trading (part 1): Online analysis of multidimensional data

The article describes how to create a framework for the online analysis of multidimensional data (OLAP), as well as how to implement this in MQL and to apply such analysis in the MetaTrader environment using the example of trading account history processing.

Time Series Forecasting Using Exponential Smoothing (continued)

This article seeks to upgrade the indicator created earlier on and briefly deals with a method for estimating forecast confidence intervals using bootstrapping and quantiles. As a result, we will get the forecast indicator and scripts to be used for estimation of the forecast accuracy.

The Simple Example of Creating an Indicator Using Fuzzy Logic

The article is devoted to the practical application of the fuzzy logic concept for financial markets analysis. We propose the example of the indicator generating signals based on two fuzzy rules based on Envelopes indicator. The developed indicator uses several indicator buffers: 7 buffers for calculations, 5 buffers for the charts display and 2 color buffers.

Visualizing optimization results using a selected criterion

In the article, we continue to develop the MQL application for working with optimization results. This time, we will show how to form the table of the best results after optimizing the parameters by specifying another criterion via the graphical interface.

Library for easy and quick development of MetaTrader programs (part IV): Trading events

In the previous articles, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. We already have collections of historical orders and deals, market orders and positions, as well as the class for convenient selection and sorting of orders. In this part, we will continue the development of the base object and teach the Engine Library to track trading events on the account.