MetaTrader tick info access from MQL5 services to Python application using sockets

Sometimes everything is not programmable in the MQL5 language. And even if it is possible to convert existing advanced libraries in MQL5, it would be time-consuming. This article tries to show that we can bypass Windows OS dependency by transporting tick information such as bid, ask and time with MetaTrader services to a Python application using sockets.

Category Theory in MQL5 (Part 23): A different look at the Double Exponential Moving Average

In this article we continue with our theme in the last of tackling everyday trading indicators viewed in a ‘new’ light. We are handling horizontal composition of natural transformations for this piece and the best indicator for this, that expands on what we just covered, is the double exponential moving average (DEMA).

Artificial Bee Hive Algorithm (ABHA): Tests and results

In this article, we will continue exploring the Artificial Bee Hive Algorithm (ABHA) by diving into the code and considering the remaining methods. As you might remember, each bee in the model is represented as an individual agent whose behavior depends on internal and external information, as well as motivational state. We will test the algorithm on various functions and summarize the results by presenting them in the rating table.

Data Science and ML (Part 43): Hidden Patterns Detection in Indicators Data Using Latent Gaussian Mixture Models (LGMM)

Have you ever looked at the chart and felt that strange sensation… that there’s a pattern hidden just beneath the surface? A secret code that might reveal where prices are headed if only you could crack it? Meet LGMM, the Market’s Hidden Pattern Detector. A machine learning model that helps identify those hidden patterns in the market.

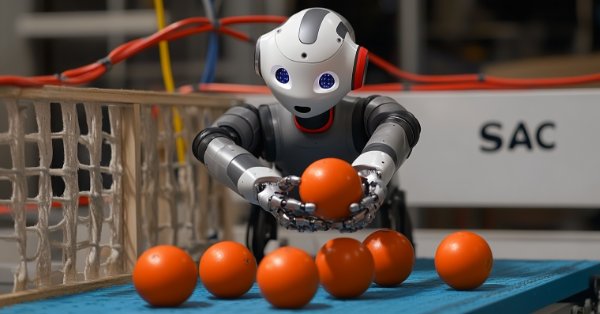

MQL5 Wizard Techniques you should know (Part 51): Reinforcement Learning with SAC

Soft Actor Critic is a Reinforcement Learning algorithm that utilizes 3 neural networks. An actor network and 2 critic networks. These machine learning models are paired in a master slave partnership where the critics are modelled to improve the forecast accuracy of the actor network. While also introducing ONNX in these series, we explore how these ideas could be put to test as a custom signal of a wizard assembled Expert Advisor.

Implementing Practical Modules from Other Languages in MQL5 (Part 03): Schedule Module from Python, the OnTimer Event on Steroids

The schedule module in Python offers a simple way to schedule repeated tasks. While MQL5 lacks a built-in equivalent, in this article we’ll implement a similar library to make it easier to set up timed events in MetaTrader 5.

Developing a Replay System (Part 71): Getting the Time Right (IV)

In this article, we will look at how to implement what was shown in the previous article related to our replay/simulation service. As in many other things in life, problems are bound to arise. And this case was no exception. In this article, we continue to improve things. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Evolutionary trading algorithm with reinforcement learning and extinction of feeble individuals (ETARE)

In this article, I introduce an innovative trading algorithm that combines evolutionary algorithms with deep reinforcement learning for Forex trading. The algorithm uses the mechanism of extinction of inefficient individuals to optimize the trading strategy.

Developing a Replay System — Market simulation (Part 12): Birth of the SIMULATOR (II)

Developing a simulator can be much more interesting than it seems. Today we'll take a few more steps in this direction because things are getting more interesting.

Developing a Replay System (Part 75): New Chart Trade (II)

In this article, we will talk about the C_ChartFloatingRAD class. This is what makes Chart Trade work. However, the explanation does not end there. We will complete it in the next article, as the content of this article is quite extensive and requires deep understanding. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Population optimization algorithms: Simulated Annealing (SA) algorithm. Part I

The Simulated Annealing algorithm is a metaheuristic inspired by the metal annealing process. In the article, we will conduct a thorough analysis of the algorithm and debunk a number of common beliefs and myths surrounding this widely known optimization method. The second part of the article will consider the custom Simulated Isotropic Annealing (SIA) algorithm.

Population optimization algorithms: Changing shape, shifting probability distributions and testing on Smart Cephalopod (SC)

The article examines the impact of changing the shape of probability distributions on the performance of optimization algorithms. We will conduct experiments using the Smart Cephalopod (SC) test algorithm to evaluate the efficiency of various probability distributions in the context of optimization problems.

MQL5 Wizard Techniques you should know (Part 11): Number Walls

Number Walls are a variant of Linear Shift Back Registers that prescreen sequences for predictability by checking for convergence. We look at how these ideas could be of use in MQL5.

Developing a Replay System (Part 61): Playing the service (II)

In this article, we will look at changes that will allow the replay/simulation system to operate more efficiently and securely. I will also not leave without attention those who want to get the most out of using classes. In addition, we will consider a specific problem in MQL5 that reduces code performance when working with classes, and explain how to solve it.

Market Simulation (Part 01): Cross Orders (I)

Today we will begin the second stage, where we will look at the market replay/simulation system. First, we will show a possible solution for cross orders. I will show you the solution, but it is not final yet. It will be a possible solution to a problem that we will need to solve in the near future.

Overcoming The Limitation of Machine Learning (Part 6): Effective Memory Cross Validation

In this discussion, we contrast the classical approach to time series cross-validation with modern alternatives that challenge its core assumptions. We expose key blind spots in the traditional method—especially its failure to account for evolving market conditions. To address these gaps, we introduce Effective Memory Cross-Validation (EMCV), a domain-aware approach that questions the long-held belief that more historical data always improves performance.

Developing a Replay System (Part 28): Expert Advisor project — C_Mouse class (II)

When people started creating the first systems capable of computing, everything required the participation of engineers, who had to know the project very well. We are talking about the dawn of computer technology, a time when there were not even terminals for programming. As it developed and more people got interested in being able to create something, new ideas and ways of programming emerged which replaced the previous-style changing of connector positions. This is when the first terminals appeared.

MQL5 Wizard Techniques you should know (Part 49): Reinforcement Learning with Proximal Policy Optimization

Proximal Policy Optimization is another algorithm in reinforcement learning that updates the policy, often in network form, in very small incremental steps to ensure the model stability. We examine how this could be of use, as we have with previous articles, in a wizard assembled Expert Advisor.

From Novice to Expert: Animated News Headline Using MQL5 (IV) — Locally hosted AI model market insights

In today's discussion, we explore how to self-host open-source AI models and use them to generate market insights. This forms part of our ongoing effort to expand the News Headline EA, introducing an AI Insights Lane that transforms it into a multi-integration assistive tool. The upgraded EA aims to keep traders informed through calendar events, financial breaking news, technical indicators, and now AI-generated market perspectives—offering timely, diverse, and intelligent support to trading decisions. Join the conversation as we explore practical integration strategies and how MQL5 can collaborate with external resources to build a powerful and intelligent trading work terminal.

Developing a Replay System — Market simulation (Part 25): Preparing for the next phase

In this article, we complete the first phase of developing our replay and simulation system. Dear reader, with this achievement I confirm that the system has reached an advanced level, paving the way for the introduction of new functionality. The goal is to enrich the system even further, turning it into a powerful tool for research and development of market analysis.

Price Driven CGI Model: Theoretical Foundation

Let's discuss the data manipulation algorithm, as we dive deeper into conceptualizing the idea of using price data to drive CGI objects. Think about transferring the effects of events, human emotions and actions on financial asset prices to a real-life model. This study delves into leveraging price data to influence the scale of a CGI object, controlling growth and emotions. These visible effects can establish a fresh analytical foundation for traders. Further insights are shared in the article.

Developing a quality factor for Expert Advisors

In this article, we will see how to develop a quality score that your Expert Advisor can display in the strategy tester. We will look at two well-known calculation methods – Van Tharp and Sunny Harris.

Neural networks made easy (Part 41): Hierarchical models

The article describes hierarchical training models that offer an effective approach to solving complex machine learning problems. Hierarchical models consist of several levels, each of which is responsible for different aspects of the task.

Comet Tail Algorithm (CTA)

In this article, we will look at the Comet Tail Optimization Algorithm (CTA), which draws inspiration from unique space objects - comets and their impressive tails that form when approaching the Sun. The algorithm is based on the concept of the motion of comets and their tails, and is designed to find optimal solutions in optimization problems.

Developing A Swing Entries Monitoring (EA)

As the year approaches its end, long-term traders often reflect on market history to analyze its behavior and trends, aiming to project potential future movements. In this article, we will explore the development of a long-term entry monitoring Expert Advisor (EA) using MQL5. The objective is to address the challenge of missed long-term trading opportunities caused by manual trading and the absence of automated monitoring systems. We'll use one of the most prominently traded pairs as an example to strategize and develop our solution effectively.

MQL5 Wizard Techniques you should know (Part 43): Reinforcement Learning with SARSA

SARSA, which is an abbreviation for State-Action-Reward-State-Action is another algorithm that can be used when implementing reinforcement learning. So, as we saw with Q-Learning and DQN, we look into how this could be explored and implemented as an independent model rather than just a training mechanism, in wizard assembled Expert Advisors.

MQL5 Wizard Techniques you should know (Part 31): Selecting the Loss Function

Loss Function is the key metric of machine learning algorithms that provides feedback to the training process by quantifying how well a given set of parameters are performing when compared to their intended target. We explore the various formats of this function in an MQL5 custom wizard class.

Blood inheritance optimization (BIO)

I present to you my new population optimization algorithm - Blood Inheritance Optimization (BIO), inspired by the human blood group inheritance system. In this algorithm, each solution has its own "blood type" that determines the way it evolves. Just as in nature where a child's blood type is inherited according to specific rules, in BIO new solutions acquire their characteristics through a system of inheritance and mutations.

Build a Remote Forex Risk Management System in Python

We are making a remote professional risk manager for Forex in Python, deploying it on the server step by step. In the course of the article, we will understand how to programmatically manage Forex risks, and how not to waste a Forex deposit any more.

Developing a Replay System (Part 77): New Chart Trade (IV)

In this article, we will cover some of the measures and precautions to consider when creating a communication protocol. These are pretty simple and straightforward things, so we won't go into too much detail in this article. But to understand what will happen, you need to understand the content of the article.

Across Neighbourhood Search (ANS)

The article reveals the potential of the ANS algorithm as an important step in the development of flexible and intelligent optimization methods that can take into account the specifics of the problem and the dynamics of the environment in the search space.

Population optimization algorithms: Intelligent Water Drops (IWD) algorithm

The article considers an interesting algorithm derived from inanimate nature - intelligent water drops (IWD) simulating the process of river bed formation. The ideas of this algorithm made it possible to significantly improve the previous leader of the rating - SDS. As usual, the new leader (modified SDSm) can be found in the attachment.

Creating a Trading Administrator Panel in MQL5 (Part IX): Code Organization (II): Modularization

In this discussion, we take a step further in breaking down our MQL5 program into smaller, more manageable modules. These modular components will then be integrated into the main program, enhancing its organization and maintainability. This approach simplifies the structure of our main program and makes the individual components reusable in other Expert Advisors (EAs) and indicator developments. By adopting this modular design, we create a solid foundation for future enhancements, benefiting both our project and the broader developer community.

Dialectic Search (DA)

The article introduces the dialectical algorithm (DA), a new global optimization method inspired by the philosophical concept of dialectics. The algorithm exploits a unique division of the population into speculative and practical thinkers. Testing shows impressive performance of up to 98% on low-dimensional problems and overall efficiency of 57.95%. The article explains these metrics and presents a detailed description of the algorithm and the results of experiments on different types of functions.

Developing a Replay System — Market simulation (Part 18): Ticks and more ticks (II)

Obviously the current metrics are very far from the ideal time for creating a 1-minute bar. That's the first thing we are going to fix. Fixing the synchronization problem is not difficult. This may seem hard, but it's actually quite simple. We did not make the required correction in the previous article since its purpose was to explain how to transfer the tick data that was used to create the 1-minute bars on the chart into the Market Watch window.

Developing a Replay System (Part 36): Making Adjustments (II)

One of the things that can make our lives as programmers difficult is assumptions. In this article, I will show you how dangerous it is to make assumptions: both in MQL5 programming, where you assume that the type will have a certain value, and in MetaTrader 5, where you assume that different servers work the same.

Build a Remote Forex Risk Management System in Python

We are making a remote professional risk manager for Forex in Python, deploying it on the server step by step. In the course of the article, we will understand how to programmatically manage Forex risks, and how not to waste a Forex deposit any more.

MQL5 Wizard Techniques you should know (Part 21): Testing with Economic Calendar Data

Economic Calendar Data is not available for testing with Expert Advisors within Strategy Tester, by default. We look at how Databases could help in providing a work around this limitation. So, for this article we explore how SQLite databases can be used to archive Economic Calendar news such that wizard assembled Expert Advisors can use this to generate trade signals.

Building a Trading System (Part 5): Managing Gains Through Structured Trade Exits

For many traders, it's a familiar pain point: watching a trade come within a whisker of your profit target, only to reverse and hit your stop-loss. Or worse, seeing a trailing stop close you out at breakeven before the market surges toward your original target. This article focuses on using multiple entries at different Reward-to-Risk Ratios to systematically secure gains and reduce overall risk exposure.

Data Science and ML (Part 35): NumPy in MQL5 – The Art of Making Complex Algorithms with Less Code

NumPy library is powering almost all the machine learning algorithms to the core in Python programming language, In this article we are going to implement a similar module which has a collection of all the complex code to aid us in building sophisticated models and algorithms of any kind.