How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 2): Indicator Signals: Multi Timeframe Parabolic SAR Indicator

The Multi-Currency Expert Advisor in this article is Expert Advisor or trading robot that can trade (open orders, close orders and manage orders for example: Trailing Stop Loss and Trailing Profit) for more than 1 symbol pair only from one symbol chart. This time we will use only 1 indicator, namely Parabolic SAR or iSAR in multi-timeframes starting from PERIOD_M15 to PERIOD_D1.

Learn how to design a trading system by Accelerator Oscillator

A new article from our series about how to create simple trading systems by the most popular technical indicators. We will learn about a new one which is the Accelerator Oscillator indicator and we will learn how to design a trading system using it.

Swaps (Part I): Locking and Synthetic Positions

In this article I will try to expand the classic concept of swap trading methods. I will explain why I have come to the conclusion that this concept deserves special attention and is absolutely recommended for study.

Graphics in DoEasy library (Part 73): Form object of a graphical element

The article opens up a new large section of the library for working with graphics. In the current article, I will create the mouse status object, the base object of all graphical elements and the class of the form object of the library graphical elements.

Practical Use of Kohonen Neural Networks in Algorithmic Trading. Part II. Optimizing and forecasting

Based on universal tools designed for working with Kohonen networks, we construct the system of analyzing and selecting the optimal EA parameters and consider forecasting time series. In Part I, we corrected and improved the publicly available neural network classes, having added necessary algorithms. Now, it is time to apply them to practice.

Developing an Expert Advisor (EA) based on the Consolidation Range Breakout strategy in MQL5

This article outlines the steps to create an Expert Advisor (EA) that capitalizes on price breakouts after consolidation periods. By identifying consolidation ranges and setting breakout levels, traders can automate their trading decisions based on this strategy. The Expert Advisor aims to provide clear entry and exit points while avoiding false breakouts

Automating Trading Strategies in MQL5 (Part 10): Developing the Trend Flat Momentum Strategy

In this article, we develop an Expert Advisor in MQL5 for the Trend Flat Momentum Strategy. We combine a two moving averages crossover with RSI and CCI momentum filters to generate trade signals. We also cover backtesting and potential enhancements for real-world performance.

Contest of Expert Advisors inside an Expert Advisor

Using virtual trading, you can create an adaptive Expert Advisor, which will turn on and off trades at the real market. Combine several strategies in a single Expert Advisor! Your multisystem Expert Advisor will automatically choose a trade strategy, which is the best to trade with at the real market, on the basis of profitability of virtual trades. This kind of approach allows decreasing drawdown and increasing profitability of your work at the market. Experiment and share your results with others! I think many people will be interested to know about your portfolio of strategies.

Build Self Optimizing Expert Advisors in MQL5 (Part 4): Dynamic Position Sizing

Successfully employing algorithmic trading requires continuous, interdisciplinary learning. However, the infinite range of possibilities can consume years of effort without yielding tangible results. To address this, we propose a framework that gradually introduces complexity, allowing traders to refine their strategies iteratively rather than committing indefinite time to uncertain outcomes.

Automating Trading Strategies in MQL5 (Part 1): The Profitunity System (Trading Chaos by Bill Williams)

In this article, we examine the Profitunity System by Bill Williams, breaking down its core components and unique approach to trading within market chaos. We guide readers through implementing the system in MQL5, focusing on automating key indicators and entry/exit signals. Finally, we test and optimize the strategy, providing insights into its performance across various market scenarios.

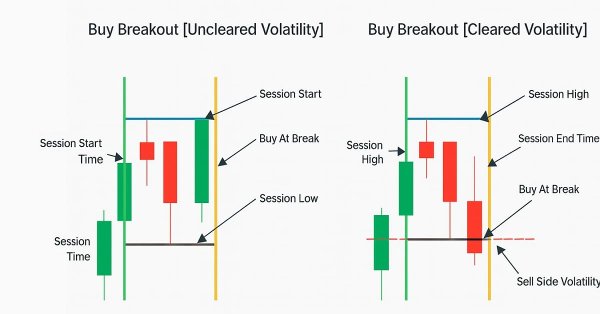

Automating Trading Strategies in MQL5 (Part 16): Midnight Range Breakout with Break of Structure (BoS) Price Action

In this article, we automate the Midnight Range Breakout with Break of Structure strategy in MQL5, detailing code for breakout detection and trade execution. We define precise risk parameters for entries, stops, and profits. Backtesting and optimization are included for practical trading.

A scientific approach to the development of trading algorithms

The article considers the methodology for developing trading algorithms, in which a consistent scientific approach is used to analyze possible price patterns and to build trading algorithms based on these patterns. Development ideals are demonstrated using examples.

Automating Trading Strategies in MQL5 (Part 44): Change of Character (CHoCH) Detection with Swing High/Low Breaks

In this article, we develop a Change of Character (CHoCH) detection system in MQL5 that identifies swing highs and lows over a user-defined bar length, labels them as HH/LH for highs or LL/HL for lows to determine trend direction, and triggers trades on breaks of these swing points, indicating a potential reversal, and trades the breaks when the structure changes.

Movement continuation model - searching on the chart and execution statistics

This article provides programmatic definition of one of the movement continuation models. The main idea is defining two waves — the main and the correction one. For extreme points, I apply fractals as well as "potential" fractals - extreme points that have not yet formed as fractals.

Prices in DoEasy library (Part 64): Depth of Market, classes of DOM snapshot and snapshot series objects

In this article, I will create two classes (the class of DOM snapshot object and the class of DOM snapshot series object) and test creation of the DOM data series.

The Liquidity Grab Trading Strategy

The liquidity grab trading strategy is a key component of Smart Money Concepts (SMC), which seeks to identify and exploit the actions of institutional players in the market. It involves targeting areas of high liquidity, such as support or resistance zones, where large orders can trigger price movements before the market resumes its trend. This article explains the concept of liquidity grab in detail and outlines the development process of the liquidity grab trading strategy Expert Advisor in MQL5.

Deep Neural Networks (Part III). Sample selection and dimensionality reduction

This article is a continuation of the series of articles about deep neural networks. Here we will consider selecting samples (removing noise), reducing the dimensionality of input data and dividing the data set into the train/val/test sets during data preparation for training the neural network.

Neural networks made easy (Part 29): Advantage Actor-Critic algorithm

In the previous articles of this series, we have seen two reinforced learning algorithms. Each of them has its own advantages and disadvantages. As often happens in such cases, next comes the idea to combine both methods into an algorithm, using the best of the two. This would compensate for the shortcomings of each of them. One of such methods will be discussed in this article.

Automating Trading Strategies in MQL5 (Part 3): The Zone Recovery RSI System for Dynamic Trade Management

In this article, we create a Zone Recovery RSI EA System in MQL5, using RSI signals to trigger trades and a recovery strategy to manage losses. We implement a "ZoneRecovery" class to automate trade entries, recovery logic, and position management. The article concludes with backtesting insights to optimize performance and enhance the EA’s effectiveness.

Automating Trading Strategies in MQL5 (Part 13): Building a Head and Shoulders Trading Algorithm

In this article, we automate the Head and Shoulders pattern in MQL5. We analyze its architecture, implement an EA to detect and trade it, and backtest the results. The process reveals a practical trading algorithm with room for refinement.

Brute force approach to pattern search (Part III): New horizons

This article provides a continuation to the brute force topic, and it introduces new opportunities for market analysis into the program algorithm, thereby accelerating the speed of analysis and improving the quality of results. New additions enable the highest-quality view of global patterns within this approach.

Everything you need to learn about the MQL5 program structure

Any Program in any programming language has a specific structure. In this article, you will learn essential parts of the MQL5 program structure by understanding the programming basics of every part of the MQL5 program structure that can be very helpful when creating our MQL5 trading system or trading tool that can be executable in the MetaTrader 5.

Neural networks made easy (Part 5): Multithreaded calculations in OpenCL

We have earlier discussed some types of neural network implementations. In the considered networks, the same operations are repeated for each neuron. A logical further step is to utilize multithreaded computing capabilities provided by modern technology in an effort to speed up the neural network learning process. One of the possible implementations is described in this article.

Using Layouts and Containers for GUI Controls: The CGrid Class

This article presents an alternative method of GUI creation based on layouts and containers, using one layout manager — the CGrid class. The CGrid class is an auxiliary control that acts as a container for other containers and controls using a grid layout.

Neural Networks Made Easy (Part 96): Multi-Scale Feature Extraction (MSFformer)

Efficient extraction and integration of long-term dependencies and short-term features remain an important task in time series analysis. Their proper understanding and integration are necessary to create accurate and reliable predictive models.

Multiple indicators on one chart (Part 04): Advancing to an Expert Advisor

In my previous articles, I have explained how to create an indicator with multiple subwindows, which becomes interesting when using custom indicators. This time we will see how to add multiple windows to an Expert Advisor.

Raise Your Linear Trading Systems to the Power

Today's article shows intermediate MQL5 programmers how they can get more profit from their linear trading systems (Fixed Lot) by easily implementing the so-called technique of exponentiation. This is because the resulting equity curve growth is then geometric, or exponential, taking the form of a parabola. Specifically, we will implement a practical MQL5 variant of the Fixed Fractional position sizing developed by Ralph Vince.

Developing a trading Expert Advisor from scratch (Part 21): New order system (IV)

Finally, the visual system will start working, although it will not yet be completed. Here we will finish making the main changes. There will be quite a few of them, but they are all necessary. Well, the whole work will be quite interesting.

Optimization. A Few Simple Ideas

The optimization process can require significant resources of your computer or even of the MQL5 Cloud Network test agents. This article comprises some simple ideas that I use for work facilitation and improvement of the MetaTrader 5 Strategy Tester. I got these ideas from the documentation, forum and articles.

Building and testing Keltner Channel trading systems

In this article, we will try to provide trading systems using a very important concept in the financial market which is volatility. We will provide a trading system based on the Keltner Channel indicator after understanding it and how we can code it and how we can create a trading system based on a simple trading strategy and then test it on different assets.

Social Trading with the MetaTrader 4 and MetaTrader 5 Trading Platforms

What is social trading? It is a mutually beneficial cooperation of traders and investors whereby successful traders allow monitoring of their trading and potential investors take the opportunity to monitor their performance and copy trades of those who look more promising.

Learn how to design a trading system by Bull's Power

Welcome to a new article in our series about learning how to design a trading system by the most popular technical indicator as we will learn in this article about a new technical indicator and how we can design a trading system by it and this indicator is the Bull's Power indicator.

Neural networks made easy (Part 27): Deep Q-Learning (DQN)

We continue to study reinforcement learning. In this article, we will get acquainted with the Deep Q-Learning method. The use of this method has enabled the DeepMind team to create a model that can outperform a human when playing Atari computer games. I think it will be useful to evaluate the possibilities of the technology for solving trading problems.

Developing a Volatility Based Breakout System

Volatility based breakout system identifies market ranges, then trades when price breaks above or below those levels, filtered by volatility measures such as ATR. This approach helps capture strong directional moves.

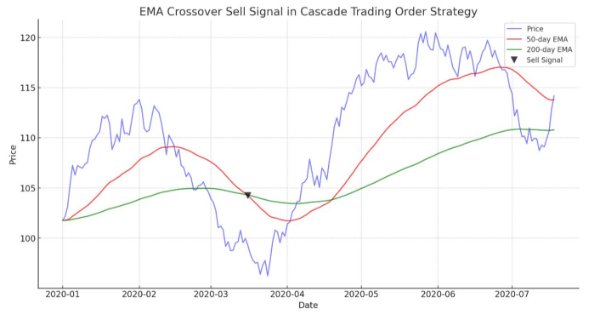

Cascade Order Trading Strategy Based on EMA Crossovers for MetaTrader 5

The article guides in demonstrating an automated algorithm based on EMA Crossovers for MetaTrader 5. Detailed information on all aspects of demonstrating an Expert Advisor in MQL5 and testing it in MetaTrader 5 - from analyzing price range behaviors to risk management.

MQL5 Cookbook - Multi-Currency Expert Advisor and Working with Pending Orders in MQL5

This time we are going to create a multi-currency Expert Advisor with a trading algorithm based on work with the pending orders Buy Stop and Sell Stop. This article considers the following matters: trading in a specified time range, placing/modifying/deleting pending orders, checking if the last position was closed at Take Profit or Stop Loss and control of the deals history for each symbol.

Neural networks made easy (Part 6): Experimenting with the neural network learning rate

We have previously considered various types of neural networks along with their implementations. In all cases, the neural networks were trained using the gradient decent method, for which we need to choose a learning rate. In this article, I want to show the importance of a correctly selected rate and its impact on the neural network training, using examples.

Automating Trading Strategies in MQL5 (Part 4): Building a Multi-Level Zone Recovery System

In this article, we develop a Multi-Level Zone Recovery System in MQL5 that utilizes RSI to generate trading signals. Each signal instance is dynamically added to an array structure, allowing the system to manage multiple signals simultaneously within the Zone Recovery logic. Through this approach, we demonstrate how to handle complex trade management scenarios effectively while maintaining a scalable and robust code design.

Building a Professional Trading System with Heikin Ashi (Part 2): Developing an EA

This article explains how to develop a professional Heikin Ashi-based Expert Advisor (EA) in MQL5. You will learn how to set up input parameters, enumerations, indicators, global variables, and implement the core trading logic. You will also be able to run a backtest on gold to validate your work.

Building a Social Technology Startup, Part I: Tweet Your MetaTrader 5 Signals

Today we will learn how to link an MetaTrader 5 terminal with Twitter so that you can tweet your EAs' trading signals. We are developing a Social Decision Support System in PHP based on a RESTful web service. This idea comes from a particular conception of automatic trading called computer-assisted trading. We want the cognitive abilities of human traders to filter those trading signals which otherwise would be automatically placed on the market by the Expert Advisors.