Introduction to MQL5 (Part 5): A Beginner's Guide to Array Functions in MQL5

Explore the world of MQL5 arrays in Part 5, designed for absolute beginners. Simplifying complex coding concepts, this article focuses on clarity and inclusivity. Join our community of learners, where questions are embraced, and knowledge is shared!

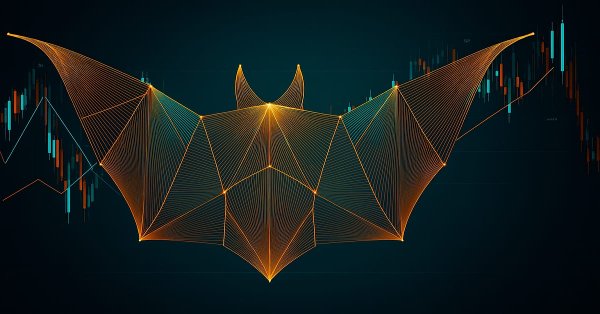

Automating Trading Strategies in MQL5 (Part 28): Creating a Price Action Bat Harmonic Pattern with Visual Feedback

In this article, we develop a Bat Pattern system in MQL5 that identifies bullish and bearish Bat harmonic patterns using pivot points and Fibonacci ratios, triggering trades with precise entry, stop loss, and take-profit levels, enhanced with visual feedback through chart objects

Neural Networks in Trading: A Multimodal, Tool-Augmented Agent for Financial Markets (FinAgent)

We invite you to explore FinAgent, a multimodal financial trading agent framework designed to analyze various types of data reflecting market dynamics and historical trading patterns.

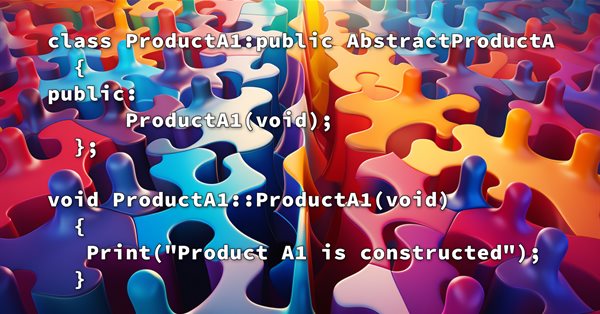

Design Patterns in software development and MQL5 (Part I): Creational Patterns

There are methods that can be used to solve many problems that can be repeated. Once understand how to use these methods it can be very helpful to create your software effectively and apply the concept of DRY ((Do not Repeat Yourself). In this context, the topic of Design Patterns will serve very well because they are patterns that provide solutions to well-described and repeated problems.

Creating an EA that works automatically (Part 07): Account types (II)

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode. The trader should always be aware of what the automatic EA is doing, so that if it "goes off the rails", the trader could remove it from the chart as soon as possible and take control of the situation.

Trading with the MQL5 Economic Calendar (Part 9): Elevating News Interaction with a Dynamic Scrollbar and Polished Display

In this article, we enhance the MQL5 Economic Calendar with a dynamic scrollbar for intuitive news navigation. We ensure seamless event display and efficient updates. We validate the responsive scrollbar and polished dashboard through testing.

MQL5 Wizard Techniques you should know (Part 44): Average True Range (ATR) technical indicator

The ATR oscillator is a very popular indicator for acting as a volatility proxy, especially in the forex markets where volume data is scarce. We examine this, on a pattern basis as we have with prior indicators, and share strategies & test reports thanks to the MQL5 wizard library classes and assembly.

Creating an Interactive Graphical User Interface in MQL5 (Part 2): Adding Controls and Responsiveness

Enhancing the MQL5 GUI panel with dynamic features can significantly improve the trading experience for users. By incorporating interactive elements, hover effects, and real-time data updates, the panel becomes a powerful tool for modern traders.

MQL5 Wizard Techniques you should know (Part 83): Using Patterns of Stochastic Oscillator and the FrAMA — Behavioral Archetypes

The Stochastic Oscillator and the Fractal Adaptive Moving Average are another indicator pairing that could be used for their ability to compliment each other within an MQL5 Expert Advisor. We look at the Stochastic for its ability to pinpoint momentum shifts, while the FrAMA is used to provide confirmation of the prevailing trends. In exploring this indicator pairing, as always, we use the MQL5 wizard to build and test out their potential.

Category Theory in MQL5 (Part 8): Monoids

This article continues the series on category theory implementation in MQL5. Here we introduce monoids as domain (set) that sets category theory apart from other data classification methods by including rules and an identity element.

MQL5 Trading Tools (Part 1): Building an Interactive Visual Pending Orders Trade Assistant Tool

In this article, we introduce the development of an interactive Trade Assistant Tool in MQL5, designed to simplify placing pending orders in Forex trading. We outline the conceptual design, focusing on a user-friendly GUI for setting entry, stop-loss, and take-profit levels visually on the chart. Additionally, we detail the MQL5 implementation and backtesting process to ensure the tool’s reliability, setting the stage for advanced features in the preceding parts.

Modified Grid-Hedge EA in MQL5 (Part III): Optimizing Simple Hedge Strategy (I)

In this third part, we revisit the Simple Hedge and Simple Grid Expert Advisors (EAs) developed earlier. Our focus shifts to refining the Simple Hedge EA through mathematical analysis and a brute force approach, aiming for optimal strategy usage. This article delves deep into the mathematical optimization of the strategy, setting the stage for future exploration of coding-based optimization in later installments.

Larry Williams Market Secrets (Part 5): Automating the Volatility Breakout Strategy in MQL5

This article demonstrates how to automate Larry Williams’ volatility breakout strategy in MQL5 using a practical, step-by-step approach. You will learn how to calculate daily range expansions, derive buy and sell levels, manage risk with range-based stops and reward-based targets, and structure a professional Expert Advisor for MetaTrader 5. Designed for traders and developers looking to transform Larry Williams’ market concepts into a fully testable and deployable automated trading system.

Data Science and ML (Part 41): Forex and Stock Markets Pattern Detection using YOLOv8

Detecting patterns in financial markets is challenging because it involves seeing what's on the chart, something that's difficult to undertake in MQL5 due to image limitations. In this article, we are going to discuss a decent model made in Python that helps us detect patterns present on the chart with minimal effort.

Outline of MetaTrader Market (Infographics)

A few weeks ago we published the infographic on Freelance service. We also promised to reveal some statistics of the MetaTrader Market. Now, we invite you to examine the data we have gathered.

Building A Candlestick Trend Constraint Model(Part 3): Detecting changes in trends while using this system

This article explores how economic news releases, investor behavior, and various factors can influence market trend reversals. It includes a video explanation and proceeds by incorporating MQL5 code into our program to detect trend reversals, alert us, and take appropriate actions based on market conditions. This builds upon previous articles in the series.

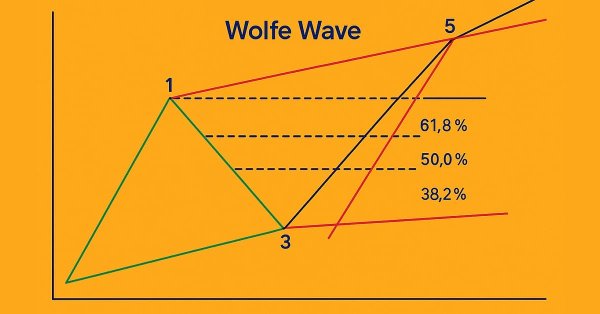

Introduction to MQL5 (Part 18): Introduction to Wolfe Wave Pattern

This article explains the Wolfe Wave pattern in detail, covering both the bearish and bullish variations. It also breaks down the step-by-step logic used to identify valid buy and sell setups based on this advanced chart pattern.

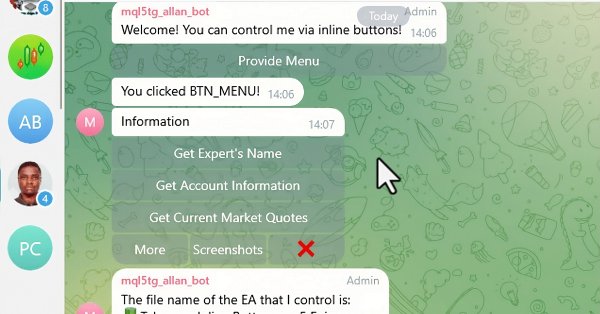

Creating an MQL5-Telegram Integrated Expert Advisor (Part 6): Adding Responsive Inline Buttons

In this article, we integrate interactive inline buttons into an MQL5 Expert Advisor, allowing real-time control via Telegram. Each button press triggers specific actions and sends responses back to the user. We also modularize functions for handling Telegram messages and callback queries efficiently.

Developing a Calendar-Based News Event Breakout Expert Advisor in MQL5

Volatility tends to peak around high-impact news events, creating significant breakout opportunities. In this article, we will outline the implementation process of a calendar-based breakout strategy. We'll cover everything from creating a class to interpret and store calendar data, developing realistic backtests using this data, and finally, implementing execution code for live trading.

Neural networks made easy (Part 58): Decision Transformer (DT)

We continue to explore reinforcement learning methods. In this article, I will focus on a slightly different algorithm that considers the Agent’s policy in the paradigm of constructing a sequence of actions.

Neural networks made easy (Part 23): Building a tool for Transfer Learning

In this series of articles, we have already mentioned Transfer Learning more than once. However, this was only mentioning. in this article, I suggest filling this gap and taking a closer look at Transfer Learning.

Dynamic Swing Architecture: Market Structure Recognition from Swings to Automated Execution

This article introduces a fully automated MQL5 system designed to identify and trade market swings with precision. Unlike traditional fixed-bar swing indicators, this system adapts dynamically to evolving price structure—detecting swing highs and swing lows in real time to capture directional opportunities as they form.

Integrate Your Own LLM into EA (Part 5): Develop and Test Trading Strategy with LLMs (III) – Adapter-Tuning

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Neural networks made easy (Part 73): AutoBots for predicting price movements

We continue to discuss algorithms for training trajectory prediction models. In this article, we will get acquainted with a method called "AutoBots".

Data label for timeseries mining (Part 2):Make datasets with trend markers using Python

This series of articles introduces several time series labeling methods, which can create data that meets most artificial intelligence models, and targeted data labeling according to needs can make the trained artificial intelligence model more in line with the expected design, improve the accuracy of our model, and even help the model make a qualitative leap!

MQL5 Wizard Techniques you should know (Part 42): ADX Oscillator

The ADX is another relatively popular technical indicator used by some traders to gauge the strength of a prevalent trend. Acting as a combination of two other indicators, it presents as an oscillator whose patterns we explore in this article with the help of MQL5 wizard assembly and its support classes.

Building A Candlestick Trend Constraint Model (Part 1): For EAs And Technical Indicators

This article is aimed at beginners and pro-MQL5 developers. It provides a piece of code to define and constrain signal-generating indicators to trends in higher timeframes. In this way, traders can enhance their strategies by incorporating a broader market perspective, leading to potentially more robust and reliable trading signals.

Developing a trading Expert Advisor from scratch (Part 27): Towards the future (II)

Let's move on to a more complete order system directly on the chart. In this article, I will show a way to fix the order system, or rather, to make it more intuitive.

Introduction to MQL5 (Part 13): A Beginner's Guide to Building Custom Indicators (II)

This article guides you through building a custom Heikin Ashi indicator from scratch and demonstrates how to integrate custom indicators into an EA. It covers indicator calculations, trade execution logic, and risk management techniques to enhance automated trading strategies.

Integrate Your Own LLM into EA (Part 2): Example of Environment Deployment

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

MQL5 Trading Toolkit (Part 3): Developing a Pending Orders Management EX5 Library

Learn how to develop and implement a comprehensive pending orders EX5 library in your MQL5 code or projects. This article will show you how to create an extensive pending orders management EX5 library and guide you through importing and implementing it by building a trading panel or graphical user interface (GUI). The expert advisor orders panel will allow users to open, monitor, and delete pending orders associated with a specified magic number directly from the graphical interface on the chart window.

Adaptive Smart Money Architecture (ASMA): Merging SMC Logic With Market Sentiment for Dynamic Strategy Switching

This topic explores how to build an Adaptive Smart Money Architecture (ASMA)—an intelligent Expert Advisor that merges Smart Money Concepts (Order Blocks, Break of Structure, Fair Value Gaps) with real-time market sentiment to automatically choose the best trading strategy depending on current market conditions.

Developing an MQTT client for MetaTrader 5: a TDD approach

This article reports the first attempts in the development of a native MQTT client for MQL5. MQTT is a Client Server publish/subscribe messaging transport protocol. It is lightweight, open, simple, and designed to be easy to implement. These characteristics make it ideal for use in many situations.

Developing a multi-currency Expert Advisor (Part 17): Further preparation for real trading

Currently, our EA uses the database to obtain initialization strings for single instances of trading strategies. However, the database is quite large and contains a lot of information that is not needed for the actual EA operation. Let's try to ensure the EA's functionality without a mandatory connection to the database.

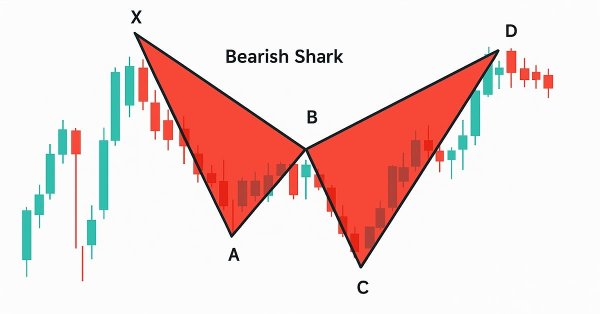

Automating Trading Strategies in MQL5 (Part 33): Creating a Price Action Shark Harmonic Pattern System

In this article, we develop a Shark pattern system in MQL5 that identifies bullish and bearish Shark harmonic patterns using pivot points and Fibonacci ratios, executing trades with customizable entry, stop-loss, and take-profit levels based on user-selected options. We enhance trader insight with visual feedback through chart objects like triangles, trendlines, and labels to clearly display the X-A-B-C-D pattern structure

From Novice to Expert: Predictive Price Pathways

Fibonacci levels provide a practical framework that markets often respect, highlighting price zones where reactions are more likely. In this article, we build an expert advisor that applies Fibonacci retracement logic to anticipate likely future moves and trade retracements with pending orders. Explore the full workflow—from swing detection to level plotting, risk controls, and execution.

Trend criteria in trading

Trends are an important part of many trading strategies. In this article, we will look at some of the tools used to identify trends and their characteristics. Understanding and correctly interpreting trends can significantly improve trading efficiency and minimize risks.

Data Science and ML (Part 26): The Ultimate Battle in Time Series Forecasting — LSTM vs GRU Neural Networks

In the previous article, we discussed a simple RNN which despite its inability to understand long-term dependencies in the data, was able to make a profitable strategy. In this article, we are discussing both the Long-Short Term Memory(LSTM) and the Gated Recurrent Unit(GRU). These two were introduced to overcome the shortcomings of a simple RNN and to outsmart it.

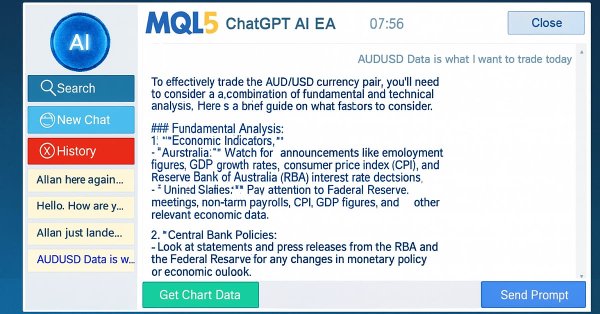

Building AI-Powered Trading Systems in MQL5 (Part 6): Introducing Chat Deletion and Search Functionality

In Part 6 of our MQL5 AI trading system series, we advance the ChatGPT-integrated Expert Advisor by introducing chat deletion functionality through interactive delete buttons in the sidebar, small/large history popups, and a new search popup, allowing traders to manage and organize persistent conversations efficiently while maintaining encrypted storage and AI-driven signals from chart data.

MQL5 Trading Tools (Part 10): Building a Strategy Tracker System with Visual Levels and Success Metrics

In this article, we develop an MQL5 strategy tracker system that detects moving average crossover signals filtered by a long-term MA, simulates or executes trades with configurable TP levels and SL in points, and monitors outcomes like TP/SL hits for performance analysis.