Tips for Purchasing a Product on the Market. Step-By-Step Guide

Introduction

It's no secret that MetaTrader Market offers a wide choice of all sorts of products: from Expert Advisors and indicators to panels and utilities for convenient trading. When entering such kind of a shop a purchaser often encounters the problem of choice and needs to be able to search for products by various parameters such as price, functionality, user-friendliness, efficiency, mode of application. This article makes an attempt to puzzle out different methods of searching for an appropriate product, sorting out unwanted products, determining product efficiency and essentiality for you.

Types of Shoppers

Such notions as "cold" and "hot" shoppers can be widely met in the sales technology.

A "cold" shopper is a person who came to the store but is hardly interested in products. Probably simple curiosity has been leading this person. Such shoppers are on a fence about what they want to purchase and if they really want to purchase anything at all. But they have some still not framed demand for a product. Otherwise they would not come to this particular store. The store's and the seller's task is to help such shopper to decide upon what he or she would like to purchase, figure out the shopper's requirements and select a product which will be the best for the shopper.

A "hot" shopper is a person who also came to the store, but as distinct from the first type a hot shopper is acutely aware what product he or she wants to find, for instance, a trend indicator. In this case the store's and the seller's task is to furnish a required type of a product and help to make a final decision upon purchasing.

"Cold" shoppers which should be "warmed up" are of more frequent occurrence.

Note! Under no circumstances you shall force up a shopper to buy a product or kid a shopper into purchasing something he or she does not need. It is to be understood that selling an unwanted product to one customer, you will lose not just this customer (when he or she sees such dishonesty) but all those to whom this deceived customer will tell about your ways of selling. Similarly if a shopper gets a wish, his or her friends will definitely know about this, and the store will probably have new customers.

MetaTrader Market. Tools for Searching for Required Product

MetaTrader Market is a unique store of applications, books and magazines for traders. Let's study out tools we have for searching for required product.

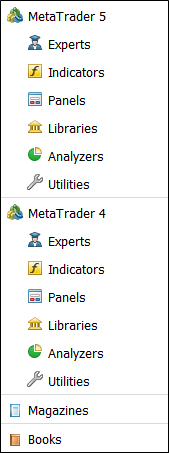

These are sections (Fig.1) by categories of products, or virtual segments, which help to select a type of digital product being of interest, as well as a trading platform we are selecting a product for. Products are divided into 4 large categories:

This step is simple: decide if we want to purchase professional literature in digitized form or select a trading terminal you want to buy a digital product for. You can select a category, for instance MetaTrader 5, and get acquainted with products from all subsections, or select a category subsection.

Fig.1. Sections and Types of Digital Products

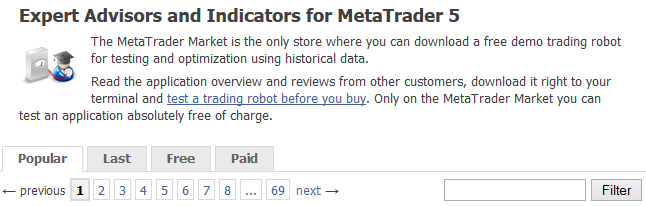

If you enter one of categories, you will see new additional search tools (Fig.2):

- section/category;

- useful links aiding to use the Market;

- tabs with products of the given category (popular, last, free, paid);

- navigation through pages in the selected category;

- product filter in the selected tab.

These are the main tools to choose a required product. Using them we can narrow search on the initial step. For instance Fig.2 displays that we are in the section Expert Advisors and Indicators for MetaTrader 5. Just below we can see helpful information for this exact section represented as tips and the link to the guidance on testing trading robots. The Popular tab contains products which are much sought after by users.

The Last tab enlights latest offers, both paid and free of charge. The last two tabs represent popular free and paid products. Navigation enables you to switch to following Market pages. The Filter field will help you to select products by keywords of particular characteristics, for example "trend indicator", or a calculation method: CCI, MACD, Triple Screen Strategy, Bill Williams.

Fig.2. Search tools in the category section

Four Steps Towards Purchasing an Indicator

Step No.1. Choose Product Category

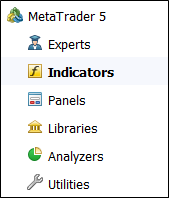

At the first step of selecting an indicator you need to know what trading terminal you use to avoid purchasing a trading indicator for a wrong platform. We selected the Indicators subsection for MetaTrader 5 (Fig.3). The heading of the selected section, namely Technical Indicators for MetaTrader 5, additionally confirms our choice.

Fig.3. Selecting the Indicators subsection in the MetaTrader 5 category

Step No.2. Selecting Keywords and a Targeted Tab

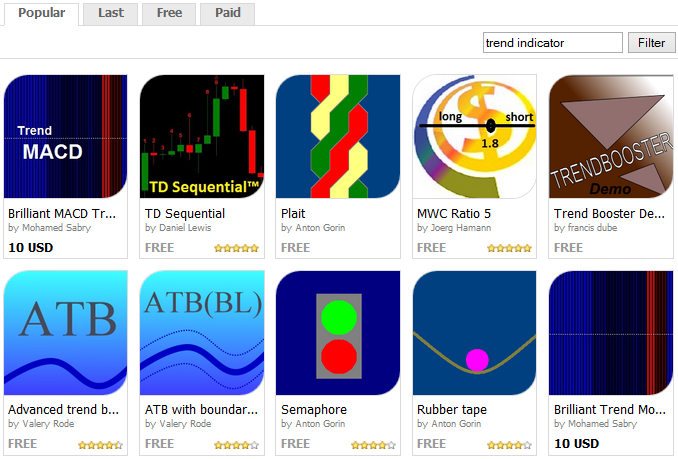

At the second step you need to decide upon right keywords, for example Trend indicator, and select the Popular tab. It is important to realize that if you select a tab and search through this tab using keywords, you will obtain results for this tab only. Fig.4 depicts results of search by keywords "trend indicator" among popular products for MetaTrader 5.

Thus we have a preliminary list of products which correspond to our request criteria. Here we can see additional parameters for further selection: price, rating, brief description (you can see them if you hover a cursor over a product). An author can also be a request criterion, as you may know him or her due to previously made products or certain reputation.

Fig.4. Keyword search results in the Popular tab

Step No.3. Stage of Selection

At this stage you should scrutinize each indicator and pay attention to following characteristics and features:

- Detailed and clear product description. You must be fully aware of operational principles of the product you are going to purchase.

- Parameters and tools of the selected indicator. They must be clearly explained, and among other things their influence on the indicator's operation must be described.

- Trading suggestions. It must be understood that a signal is only a part of the story. The signal can not always indicate opening a buy or a sell order. That is why pieces of advice from the product's author are dramatic benefits. If the author does not recommend anything, you can always get things straight in the Comments tab.

- The product operation should be demonstrated on screenshots or video. Information on how and in what instances the author uses the product provides a glimpse of the product's correspondence to its description.

- Feedbacks and comments are indirect characteristics of the product. Questions to the developer and the developer's answers. Here you can learn more useful information or details of product operation.

- And the last method to examine the product is to download its demo version (which is an important advantage of MetaTrader Market, as you can test the product without purchasing it), and test its operation on history and currency pair as well as its features in the terminal's tester!

Step No.4. Product Price and Premier Choice

After you have examined and determined final nominees for purchasing, you have one criterion left, that is the price. Here it is strongly not recommended to rely upon a hackneyed option: "buy the cheapest one".

Note! Cast off illusions that you can find a "cheap and perfect" product. Even high quality, perfect operation algorithm and practical functions are found seldom or never. It is to be understood and accepted that really high-quality product, which you have chosen and tested as a demo version and which is good for you, is good value for money. Products, which do not come up to their prices, must be eliminated at previous steps.

You should understand that there might be more complicated products having more settings, easier to use, but at the same time more expensive than other indicators which you have chosen. That is why at the last step the challenge for you is to find a balance of products' prices and their functional capabilities. In other words you have to find your personal value-for-money ratio. The last but not the least factor is how often you are going to use the product for trading, if it is going to be an essential component of your trading system or just a tool for occasional use.

When you pass four simple steps you will make no doubt that you:

- have chosen a section proper for your trading terminal;

- narrowed search for products by keywords and tabs;

- examined products and paid attention to essential and necessary details;

- decided to buy a proper product which will be helpful to the greatest possible extent.

Four Steps Towards Purchasing an Expert Advisor

Step No.1. Choose Product Category

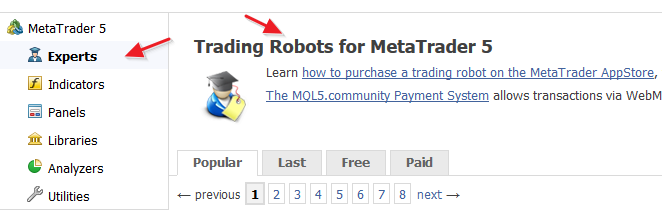

This step coincides with the first step of choosing an indicator. So we decide for which trading terminal we are going to choose an expert. In our situation we select the Experts subsection (Fig.5). Our choice is confirmed by the heading Trading Robots for MetaTrader 5.

Fig.5. Selection the Trading Robots subsection

Step No.2. Select Required Tab and Enter Keywords in the Filter Field

At this stage your search will be similar to the abovementioned one. The difference is that when you perform a keyword search, you should know the type of an EA you are looking for and which EA will be good for you. Let's review some of them.

- Trend Expert Advisors.

These are EAs trading systems of which include algorithms of searching for a trend and applying this trend for trading. Their operation principles mostly lie in entering during the trend, increasing a position and gradual partial closing at signs of the trend end. Advantage of such systems consists in significant profitability during long-term trends, but disadvantage is complexity of work if signals are absent (flat).

- Scalpers.

These EAs usually apply intraday trading on lower time frames making a large number of deals with minimum profit targets. They efficiently work on tranquil markets. There is even such type of EAs as "night scalpers". Risk will be increased if you use these EAs on active and dynamic markets with frequent requotes. It is strongly not recommended to use such systems during news time.

- Expert Advisors based on Martingale. Averaging Expert Advisors.

Martingale principle is generally based on increasing a lot in case of loss until an opened position closes with profit which covers all losses caused by previous trades. This strategy is pretty risky but all the same it may produce tidy income if positions are closed with profit. Such trading system explicitly requires sufficiently large deposit to sustain long lot increasing in case of loss.

- Multi-currency Expert Advisors.

These are systems algorithms of which include tracking and trading several currency pairs simultaneously. Such EAs have one important advantage — risk diversification. What does it mean? When you trade one symbol, profit and losses are extended only to this symbol. And a system, which uses several symbols, can cover drawdown/loss of one symbol by profit of another and even achieve positive results. That is why applying multi-currency EAs, you reduce your risks.

- Combined Expert Advisors.

These are EAs which use several trading strategies. Risks, profitability and unprofitability of such systems mostly depend on chosen strategies

So, decide what system we are looking for and select nominees for further examination.

Step No.3. Analysis, Testing and Subsequent Selection

At this step you should decide upon criteria and basis of comparison to analyze and compare Expert Advisors. For this end, formulate your distinct requirements on following:

- Risks you can afford when trading with an automated system. They are often defined by allowed drawdown of the deposit.

- Trading instruments, session, time, time frame you are going to use an EA on. Not every system can suit all criteria.

- Expected profit. Bear in mind that the more you expect, the more considerable losses - both psychological and financial - you may sustain.

- Deposit you are going to use in trading.

- Broker and types of trading accounts.

Example.

- Risk: 2% of the deposit per trade. Maximum allowed drawdown: 20% of the deposit.

- Currency pair: EURUSD, European session, time frame - H1.

- Approximate profit: 10-15% per month.

- Deposit: 300 USD.

- Standard dollar account. 5 digits. Floating spread is from 0.3. Maximum leverage is 1:500.

Keep eyes open when you familiarize with description, trading conditions, requirements to initial or recommended deposit and conditions for trading accounts to avoid purchasing a trading system which will not suit you.

Examine description and characteristics of selected EAs for meeting above-mentioned requirements. Attached video or screenshots of the product will furnish additional information. It is quite useful to have a look at backtesting results and check these results in your strategy tester using a trial version of an offered product. More details can be found in the article How to Test a Trading Robot Before Buying.

Trading Signals service is increasingly frequently used for demonstrating operation on real accounts in the function of monitoring. Comparison of operation on history and on a real account is especially valuable. It allows to make a judgment on the system's behavior and stability under ever-changing conditions. Substantial part of unsuitable products are filtered out after you have determined criteria and examined testing results of the system operation and monitoring.

Step No.4. Select a Product with the Best Price

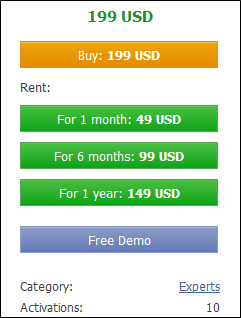

MetaTrader Market offers a very flexible approach to purchasing. Let's have a look at its advantages. Fig.6 gives an example of methods and options of purchasing an Expert Advisor. The Buy button allows to purchase 10 timeless activations of the product. You can also rent the product: you can purchase a time limited fully-featured copy of the EA. Rent is a good way of testing an interesting product during a month or purchasing EAs with medium-term trading systems for six or twelve months.

Fig.6. Options of Purchasing Expert Advisors

When you have decided upon the last criterion, namely the price and quality criterion, select a desired product. The article MQL5.community Payment System will help you to top up your account. System approach to selection an Expert Advisor has many advantages which allow you to make a choice not by colorful pictures, attractive names or following your emotions. Such approach helps you to make more deliberate, intelligent, logical and reasonable choice:

- You will select a correct type of EA.

- You will determine criteria and factors of your required product.

- You will perform an intelligent analysis of all nominees.

- You will select a convenient way of purchasing.

- You will be sure that you have selected a product which you really need.

Conclusion

This article has covered the main principles to consider when searching, examining and evaluating products. We offered methods of making more intelligent and reasonable decision when purchasing digital goods. As every reliable and successful on-line store, such MetaTrader Market as, is interested in providing its customers an opportunity to find something they need and be pleased with their digital purchase.

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/1776

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

MQL5 Cookbook: Implementing an Associative Array or a Dictionary for Quick Data Access

MQL5 Cookbook: Implementing an Associative Array or a Dictionary for Quick Data Access

Plotting trend lines based on fractals using MQL4 and MQL5

Plotting trend lines based on fractals using MQL4 and MQL5

Tips for Selecting a Trading Signal to Subscribe. Step-By-Step Guide

Tips for Selecting a Trading Signal to Subscribe. Step-By-Step Guide

Trading Ideas Based on Prices Direction and Movement Speed

Trading Ideas Based on Prices Direction and Movement Speed

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Example.

Such articles are categorically harmful. Because they throw into the masses the illusion that a profitable Expert Advisor can be so easy to come to the Market and buy.

When such articles are written, the author thinks for a moment that the buyer puts this Expert Advisor with his own money (often the last one), with his family's money (in the hope of repaying a non-repayable loan), and then drains everything. And it is guaranteed.

Let's take the above example:

-- $300 deposit

-- 10-15% profit per month

Guaranteed 100% of buyers make this table:

-- i.e., 300% per year.

And then the first-time buyer raises the starting balance:

And it all ends up in loans and borrowing from friends/acquaintances.

And as a result -- draining and bad loans.

p.s."We are responsible for those we have tamed" (A. Saint-Exupery "The Little Prince").

Вот такие статьи категорически вредны. Т.к. они вбрасывают в массы иллюзий, что прибыльный советник можно так запросто прийти в Маркет и купить.

When such articles are written, the author thinks for a moment that the buyer puts this advisor with his own money (often his last), his family's money (in the hope of repaying a bad loan) and then drains everything. And it is guaranteed.

The author thinks about it. And now let everyone who goes to the market think about these theses:

All this is far from a mystery, but that's the way man is built, that sometimes refuses to see the obvious.

I can not find where in the article it says - "take a more expensive. where more profit shows. without looking" ? Everywhere I call for careful scrutiny.