Building a Social Technology Startup, Part I: Tweet Your MetaTrader 5 Signals

Today we will learn how to link an MetaTrader 5 terminal with Twitter so that you can tweet your EAs' trading signals. We are developing a Social Decision Support System in PHP based on a RESTful web service. This idea comes from a particular conception of automatic trading called computer-assisted trading. We want the cognitive abilities of human traders to filter those trading signals which otherwise would be automatically placed on the market by the Expert Advisors.

How to integrate Smart Money Concepts (OB) coupled with Fibonacci indicator for Optimal Trade Entry

The SMC (Order Block) are key areas where institutional traders initiate significant buying or selling. After a significant price move, fibonacci helps to identify potential retracement from a recent swing high to a swing low to identify optimal trade entry.

Creating Graphical Panels Became Easy in MQL5

In this article, we will provide a simple and easy guide to anyone who needs to create one of the most valuable and helpful tools in trading which is the graphical panel to simplify and ease doing tasks around trading which helps to save time and focus more on your trading process itself without any distractions.

Trailing stop in trading

In this article, we will look at the use of a trailing stop in trading. We will assess how useful and effective it is, and how it can be used. The efficiency of a trailing stop largely depends on price volatility and the selection of the stop loss level. A variety of approaches can be used to set a stop loss.

How to Quickly Create an Expert Advisor for Automated Trading Championship 2010

In order to develop an expert to participate in Automated Trading Championship 2010, let's use a template of ready expert advisor. Even novice MQL5 programmer will be capable of this task, because for your strategies the basic classes, functions, templates are already developed. It's enough to write a minimal amount of code to implement your trading idea.

Practical Use of Kohonen Neural Networks in Algorithmic Trading. Part I. Tools

The present article develops the idea of using Kohonen Maps in MetaTrader 5, covered in some previous publications. The improved and enhanced classes provide tools to solve application tasks.

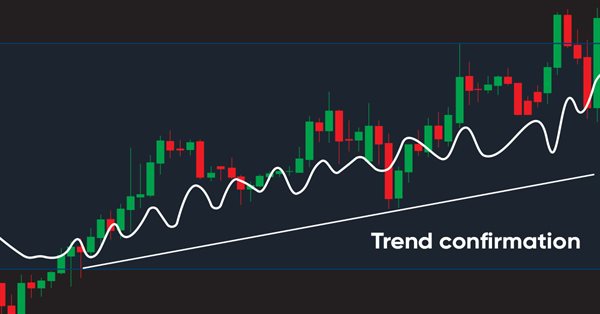

Testing different Moving Average types to see how insightful they are

We all know the importance of the Moving Average indicator for a lot of traders. There are other Moving average types that can be useful in trading, we will identify these types in this article and make a simple comparison between each one of them and the most popular simple Moving average type to see which one can show the best results.

How to Create an Interactive MQL5 Dashboard/Panel Using the Controls Class (Part 1): Setting Up the Panel

In this article, we create an interactive trading dashboard using the Controls class in MQL5, designed to streamline trading operations. The panel features a title, navigation buttons for Trade, Close, and Information, and specialized action buttons for executing trades and managing positions. By the end of the article, you will have a foundational panel ready for further enhancements in future installments.

Automating Trading Strategies in MQL5 (Part 14): Trade Layering Strategy with MACD-RSI Statistical Methods

In this article, we introduce a trade layering strategy that combines MACD and RSI indicators with statistical methods to automate dynamic trading in MQL5. We explore the architecture of this cascading approach, detail its implementation through key code segments, and guide readers on backtesting to optimize performance. Finally, we conclude by highlighting the strategy’s potential and setting the stage for further enhancements in automated trading.

Automating Trading Strategies in MQL5 (Part 17): Mastering the Grid-Mart Scalping Strategy with a Dynamic Dashboard

In this article, we explore the Grid-Mart Scalping Strategy, automating it in MQL5 with a dynamic dashboard for real-time trading insights. We detail its grid-based Martingale logic and risk management features. We also guide backtesting and deployment for robust performance.

Creating an EA that works automatically (Part 11): Automation (III)

An automated system will not be successful without proper security. However, security will not be ensured without a good understanding of certain things. In this article, we will explore why achieving maximum security in automated systems is such a challenge.

Multiple indicators on one chart (Part 06): Turning MetaTrader 5 into a RAD system (II)

In my previous article, I showed you how to create a Chart Trade using MetaTrader 5 objects and thus to turn the platform into a RAD system. The system works very well, and for sure many of the readers might have thought about creating a library, which would allow having extended functionality in the proposed system. Based on this, it would be possible to develop a more intuitive Expert Advisor with a nicer and easier to use interface.

Developing a trading Expert Advisor from scratch (Part 18): New order system (I)

This is the first part of the new order system. Since we started documenting this EA in our articles, it has undergone various changes and improvements while maintaining the same on-chart order system model.

Revisiting an Old Trend Trading Strategy: Two Stochastic oscillators, a MA and Fibonacci

Old trading strategies. This article presents one of the strategies used to follow the trend in a purely technical way. The strategy is purely technical and uses a few technical indicators and tools to deliver signals and targets. The components of the strategy are as follows: A 14-period stochastic oscillator. A 5-period stochastic oscillator. A 200-period moving average. A Fibonacci projection tool (for target setting).

Other classes in DoEasy library (Part 72): Tracking and recording chart object parameters in the collection

In this article, I will complete working with chart object classes and their collection. I will also implement auto tracking of changes in chart properties and their windows, as well as saving new parameters to the object properties. Such a revision allows the future implementation of an event functionality for the entire chart collection.

Learn how to design a trading system by Bill Williams' MFI

This is a new article in the series in which we learn how to design a trading system based on popular technical indicators. This time we will cover Bill Williams' Market Facilitation Index (BW MFI).

Building and testing Aroon Trading Systems

In this article, we will learn how we can build an Aroon trading system after learning the basics of the indicators and the needed steps to build a trading system based on the Aroon indicator. After building this trading system, we will test it to see if it can be profitable or needs more optimization.

Learn how to design a trading system by Gator Oscillator

A new article in our series about learning how to design a trading system based on popular technical indicators will be about the Gator Oscillator technical indicator and how to create a trading system through simple strategies.

Creating an EA that works automatically (Part 12): Automation (IV)

If you think automated systems are simple, then you probably don't fully understand what it takes to create them. In this article, we will talk about the problem that kills a lot of Expert Advisors. The indiscriminate triggering of orders is a possible solution to this problem.

How to create a custom Donchian Channel indicator using MQL5

There are many technical tools that can be used to visualize a channel surrounding prices, One of these tools is the Donchian Channel indicator. In this article, we will learn how to create the Donchian Channel indicator and how we can trade it as a custom indicator using EA.

How to create a trading journal with MetaTrader and Google Sheets

Create a trading journal using MetaTrader and Google Sheets! You will learn how to sync your trading data via HTTP POST and retrieve it using HTTP requests. In the end, You have a trading journal that will help you keep track of your trades effectively and efficiently.

Creating an EA that works automatically (Part 06): Account types (I)

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode. Our EA in its current state can work in any situation but it is not yet ready for automation. We still have to work on a few points.

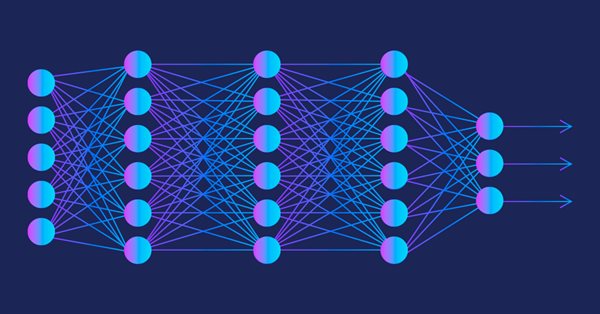

Neural networks made easy (Part 13): Batch Normalization

In the previous article, we started considering methods aimed at improving neural network training quality. In this article, we will continue this topic and will consider another approach — batch data normalization.

Data Science and Machine Learning (Part 04): Predicting Current Stock Market Crash

In this article I am going to attempt to use our logistic model to predict the stock market crash based upon the fundamentals of the US economy, the NETFLIX and APPLE are the stocks we are going to focus on, Using the previous market crashes of 2019 and 2020 let's see how our model will perform in the current dooms and glooms.

Learn how to design a trading system by Force Index

Welcome to a new article in our series about how to design a trading system by the most popular technical indicators. In this article, we will learn about a new technical indicator and how to create a trading system using the Force Index indicator.

Neural networks made easy (Part 30): Genetic algorithms

Today I want to introduce you to a slightly different learning method. We can say that it is borrowed from Darwin's theory of evolution. It is probably less controllable than the previously discussed methods but it allows training non-differentiable models.

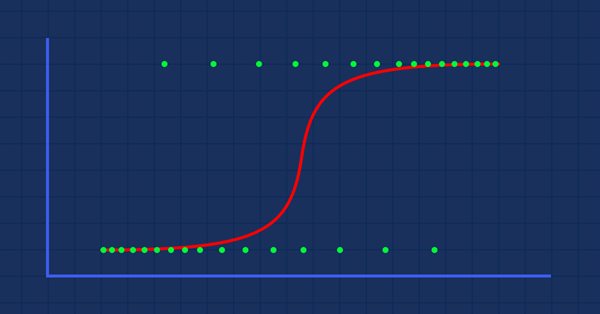

Data Science and Machine Learning (Part 02): Logistic Regression

Data Classification is a crucial thing for an algo trader and a programmer. In this article, we are going to focus on one of classification logistic algorithms that can probability help us identify the Yes's or No's, the Ups and Downs, Buys and Sells.

Brute force approach to pattern search (Part II): Immersion

In this article we will continue discussing the brute force approach. I will try to provide a better explanation of the pattern using the new improved version of my application. I will also try to find the difference in stability using different time intervals and timeframes.

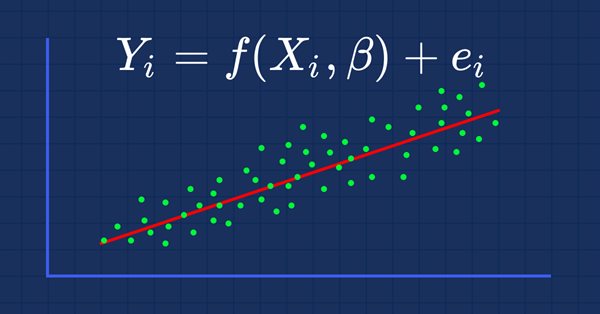

MQL5 Wizard techniques you should know (Part 01): Regression Analysis

Todays trader is a philomath who is almost always (either consciously or not...) looking up new ideas, trying them out, choosing to modify them or discard them; an exploratory process that should cost a fair amount of diligence. This clearly places a premium on the trader's time and the need to avoid mistakes. These series of articles will proposition that the MQL5 wizard should be a mainstay for traders. Why? Because not only does the trader save time by assembling his new ideas with the MQL5 wizard, and greatly reduce mistakes from duplicate coding; he is ultimately set-up to channel his energy on the few critical areas of his trading philosophy.

Implementing a Rapid-Fire Trading Strategy Algorithm with Parabolic SAR and Simple Moving Average (SMA) in MQL5

In this article, we develop a Rapid-Fire Trading Expert Advisor in MQL5, leveraging the Parabolic SAR and Simple Moving Average (SMA) indicators to create a responsive trading strategy. We detail the strategy’s implementation, including indicator usage, signal generation, and the testing and optimization process.

Price Action Analysis Toolkit Development (Part 6): Mean Reversion Signal Reaper

While some concepts may seem straightforward at first glance, bringing them to life in practice can be quite challenging. In the article below, we'll take you on a journey through our innovative approach to automating an Expert Advisor (EA) that skillfully analyzes the market using a mean reversion strategy. Join us as we unravel the intricacies of this exciting automation process.

Learn how to design a trading system by DeMarker

Here is a new article in our series about how to design a trading system by the most popular technical indicators. In this article, we will present how to create a trading system by the DeMarker indicator.

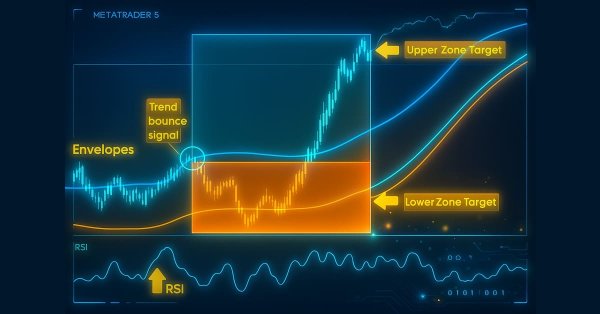

Automating Trading Strategies in MQL5 (Part 22): Creating a Zone Recovery System for Envelopes Trend Trading

In this article, we develop a Zone Recovery System integrated with an Envelopes trend-trading strategy in MQL5. We outline the architecture for using RSI and Envelopes indicators to trigger trades and manage recovery zones to mitigate losses. Through implementation and backtesting, we show how to build an effective automated trading system for dynamic markets

Building A Candlestick Trend Constraint Model(Part 2): Merging Native Indicators

This article focuses on taking advantage of in-built meta trader 5 indicators to screen out off-trend signals. Advancing from the previous article we will explore how to do it using MQL5 code to communicate our idea to the final program.

Experiments with neural networks (Part 6): Perceptron as a self-sufficient tool for price forecast

The article provides an example of using a perceptron as a self-sufficient price prediction tool by showcasing general concepts and the simplest ready-made Expert Advisor followed by the results of its optimization.

Learn how to design a trading system by Accumulation/Distribution (AD)

Welcome to the new article from our series about learning how to design trading systems based on the most popular technical indicators. In this article, we will learn about a new technical indicator called Accumulation/Distribution indicator and find out how to design an MQL5 trading system based on simple AD trading strategies.

Automating Trading Strategies in MQL5 (Part 19): Envelopes Trend Bounce Scalping — Trade Execution and Risk Management (Part II)

In this article, we implement trade execution and risk management for the Envelopes Trend Bounce Scalping Strategy in MQL5. We implement order placement and risk controls like stop-loss and position sizing. We conclude with backtesting and optimization, building on Part 18’s foundation.

Larry Williams Market Secrets (Part 4): Automating Short-Term Swing Highs and Lows in MQL5

Master the automation of Larry Williams’ short-term swing patterns using MQL5. In this guide, we develop a fully configurable Expert Advisor (EA) that leverages non-random market structures. We’ll cover how to integrate robust risk management and flexible exit logic, providing a solid foundation for systematic strategy development and backtesting.

Introduction to Connexus (Part 1): How to Use the WebRequest Function?

This article is the beginning of a series of developments for a library called “Connexus” to facilitate HTTP requests with MQL5. The goal of this project is to provide the end user with this opportunity and show how to use this helper library. I intended to make it as simple as possible to facilitate study and to provide the possibility for future developments.

MQL5 Wizard techniques you should know (Part 05): Markov Chains

Markov chains are a powerful mathematical tool that can be used to model and forecast time series data in various fields, including finance. In financial time series modelling and forecasting, Markov chains are often used to model the evolution of financial assets over time, such as stock prices or exchange rates. One of the main advantages of Markov chain models is their simplicity and ease of use.