Neural Networks Made Easy (Part 93): Adaptive Forecasting in Frequency and Time Domains (Final Part)

In this article, we continue the implementation of the approaches of the ATFNet model, which adaptively combines the results of 2 blocks (frequency and time) within time series forecasting.

MQL5 Trading Tools (Part 7): Informational Dashboard for Multi-Symbol Position and Account Monitoring

In this article, we develop an informational dashboard in MQL5 for monitoring multi-symbol positions and account metrics like balance, equity, and free margin. We implement a sortable grid with real-time updates, CSV export, and a glowing header effect to enhance usability and visual appeal.

Neural Networks in Trading: Transformer with Relative Encoding

Self-supervised learning can be an effective way to analyze large amounts of unlabeled data. The efficiency is provided by the adaptation of models to the specific features of financial markets, which helps improve the effectiveness of traditional methods. This article introduces an alternative attention mechanism that takes into account the relative dependencies and relationships between inputs.

Risk Management (Part 2): Implementing Lot Calculation in a Graphical Interface

In this article, we will look at how to improve and more effectively apply the concepts presented in the previous article using the powerful MQL5 graphical control libraries. We'll go step by step through the process of creating a fully functional GUI. I'll be explaining the ideas behind it, as well as the purpose and operation of each method used. Additionally, at the end of the article, we will test the panel we created to ensure it functions correctly and meets its stated goals.

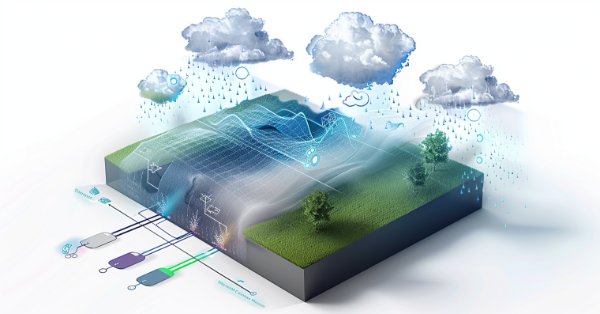

Developing a multi-currency Expert Advisor (Part 5): Variable position sizes

In the previous parts, the Expert Advisor (EA) under development was able to use only a fixed position size for trading. This is acceptable for testing, but is not advisable when trading on a real account. Let's make it possible to trade using variable position sizes.

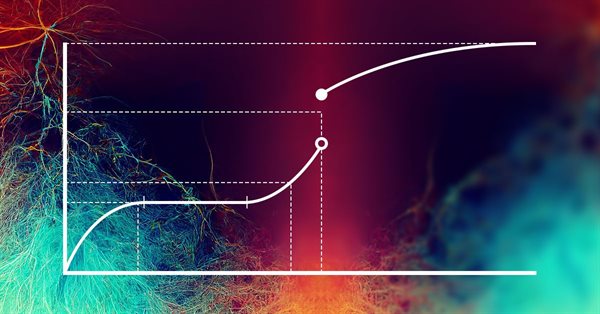

Developing a multi-currency Expert Advisor (Part 14): Adaptive volume change in risk manager

The previously developed risk manager contained only basic functionality. Let's try to consider possible ways of its development, allowing us to improve trading results without interfering with the logic of trading strategies.

Pure implementation of RSA encryption in MQL5

MQL5 lacks built-in asymmetric cryptography, making secure data exchange over insecure channels like HTTP difficult. This article presents a pure MQL5 implementation of RSA using PKCS#1 v1.5 padding, enabling safe transmission of AES session keys and small data blocks without external libraries. This approach provides HTTPS-like security over standard HTTP and even more, it fills an important gap in secure communication for MQL5 applications.

Neural Networks Made Easy (Part 92): Adaptive Forecasting in Frequency and Time Domains

The authors of the FreDF method experimentally confirmed the advantage of combined forecasting in the frequency and time domains. However, the use of the weight hyperparameter is not optimal for non-stationary time series. In this article, we will get acquainted with the method of adaptive combination of forecasts in frequency and time domains.

MQL5 Wizard Techniques you should know (Part 46): Ichimoku

The Ichimuko Kinko Hyo is a renown Japanese indicator that serves as a trend identification system. We examine this, on a pattern by pattern basis, as has been the case in previous similar articles, and also assess its strategies & test reports with the help of the MQL5 wizard library classes and assembly.

Neural networks made easy (Part 80): Graph Transformer Generative Adversarial Model (GTGAN)

In this article, I will get acquainted with the GTGAN algorithm, which was introduced in January 2024 to solve complex problems of generation architectural layouts with graph constraints.

Neural networks made easy (Part 34): Fully Parameterized Quantile Function

We continue studying distributed Q-learning algorithms. In previous articles, we have considered distributed and quantile Q-learning algorithms. In the first algorithm, we trained the probabilities of given ranges of values. In the second algorithm, we trained ranges with a given probability. In both of them, we used a priori knowledge of one distribution and trained another one. In this article, we will consider an algorithm which allows the model to train for both distributions.

Data Science and ML (Part 27): Convolutional Neural Networks (CNNs) in MetaTrader 5 Trading Bots — Are They Worth It?

Convolutional Neural Networks (CNNs) are renowned for their prowess in detecting patterns in images and videos, with applications spanning diverse fields. In this article, we explore the potential of CNNs to identify valuable patterns in financial markets and generate effective trading signals for MetaTrader 5 trading bots. Let us discover how this deep machine learning technique can be leveraged for smarter trading decisions.

Utilizing CatBoost Machine Learning model as a Filter for Trend-Following Strategies

CatBoost is a powerful tree-based machine learning model that specializes in decision-making based on stationary features. Other tree-based models like XGBoost and Random Forest share similar traits in terms of their robustness, ability to handle complex patterns, and interpretability. These models have a wide range of uses, from feature analysis to risk management. In this article, we're going to walk through the procedure of utilizing a trained CatBoost model as a filter for a classic moving average cross trend-following strategy.

Developing a multi-currency Expert Advisor (Part 21): Preparing for an important experiment and optimizing the code

For further progress it would be good to see if we can improve the results by periodically re-running the automatic optimization and generating a new EA. The stumbling block in many debates about the use of parameter optimization is the question of how long the obtained parameters can be used for trading in the future period while maintaining the profitability and drawdown at the specified levels. And is it even possible to do this?

Integrate Your Own LLM into EA (Part 4): Training Your Own LLM with GPU

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Mastering Kagi Charts in MQL5 (Part I): Creating the Indicator

Learn how to build a complete Kagi Chart engine in MQL5—constructing price reversals, generating dynamic line segments, and updating Kagi structures in real time. This first part teaches you how to render Kagi charts directly on MetaTrader 5, giving traders a clear view of trend shifts and market strength while preparing for automated Kagi-based trading logic in Part 2.

From Novice to Expert: Parameter Control Utility

Imagine transforming the traditional EA or indicator input properties into a real-time, on-chart control interface. This discussion builds upon our foundational work in the Market Periods Synchronizer indicator, marking a significant evolution in how we visualize and manage higher-timeframe (HTF) market structures. Here, we turn that concept into a fully interactive utility—a dashboard that brings dynamic control and enhanced multi-period price action visualization directly onto the chart. Join us as we explore how this innovation reshapes the way traders interact with their tools.

Chaos theory in trading (Part 1): Introduction, application in financial markets and Lyapunov exponent

Can chaos theory be applied to financial markets? In this article, we will consider how conventional Chaos theory and chaotic systems are different from the concept proposed by Bill Williams.

Neural Networks in Trading: Practical Results of the TEMPO Method

We continue our acquaintance with the TEMPO method. In this article we will evaluate the actual effectiveness of the proposed approaches on real historical data.

Neural networks made easy (Part 68): Offline Preference-guided Policy Optimization

Since the first articles devoted to reinforcement learning, we have in one way or another touched upon 2 problems: exploring the environment and determining the reward function. Recent articles have been devoted to the problem of exploration in offline learning. In this article, I would like to introduce you to an algorithm whose authors completely eliminated the reward function.

Neural networks made easy (Part 60): Online Decision Transformer (ODT)

The last two articles were devoted to the Decision Transformer method, which models action sequences in the context of an autoregressive model of desired rewards. In this article, we will look at another optimization algorithm for this method.

Neural Networks in Trading: State Space Models

A large number of the models we have reviewed so far are based on the Transformer architecture. However, they may be inefficient when dealing with long sequences. And in this article, we will get acquainted with an alternative direction of time series forecasting based on state space models.

Neural Networks Made Easy (Part 84): Reversible Normalization (RevIN)

We already know that pre-processing of the input data plays a major role in the stability of model training. To process "raw" input data online, we often use a batch normalization layer. But sometimes we need a reverse procedure. In this article, we discuss one of the possible approaches to solving this problem.

MQL5 Wizard Techniques you should know (Part 75): Using Awesome Oscillator and the Envelopes

The Awesome Oscillator by Bill Williams and the Envelopes Channel are a pairing that could be used complimentarily within an MQL5 Expert Advisor. We use the Awesome Oscillator for its ability to spot trends, while the envelopes channel is incorporated to define our support/resistance levels. In exploring this indicator pairing, we use the MQL5 wizard to build and test any potential these two may possess.

MQL5 Wizard Techniques you should know (Part 64): Using Patterns of DeMarker and Envelope Channels with the White-Noise Kernel

The DeMarker Oscillator and the Envelopes' indicator are momentum and support/ resistance tools that can be paired when developing an Expert Advisor. We continue from our last article that introduced these pair of indicators by adding machine learning to the mix. We are using a recurrent neural network that uses the white-noise kernel to process vectorized signals from these two indicators. This is done in a custom signal class file that works with the MQL5 wizard to assemble an Expert Advisor.

Creating a Trading Administrator Panel in MQL5 (Part V): Two-Factor Authentication (2FA)

Today, we will discuss enhancing security for the Trading Administrator Panel currently under development. We will explore how to implement MQL5 in a new security strategy, integrating the Telegram API for two-factor authentication (2FA). This discussion will provide valuable insights into the application of MQL5 in reinforcing security measures. Additionally, we will examine the MathRand function, focusing on its functionality and how it can be effectively utilized within our security framework. Continue reading to discover more!

Neural networks made easy (Part 39): Go-Explore, a different approach to exploration

We continue studying the environment in reinforcement learning models. And in this article we will look at another algorithm – Go-Explore, which allows you to effectively explore the environment at the model training stage.

Neural Networks in Trading: Multi-Task Learning Based on the ResNeXt Model

A multi-task learning framework based on ResNeXt optimizes the analysis of financial data, taking into account its high dimensionality, nonlinearity, and time dependencies. The use of group convolution and specialized heads allows the model to effectively extract key features from the input data.

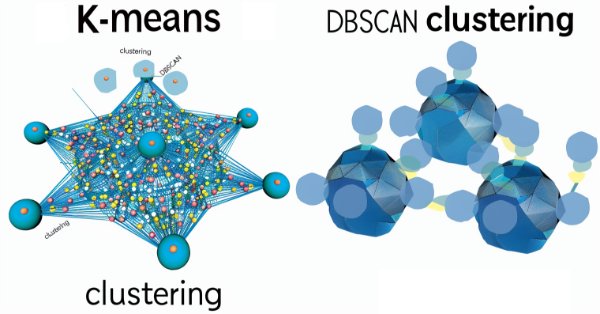

MQL5 Wizard Techniques you should know (Part 13): DBSCAN for Expert Signal Class

Density Based Spatial Clustering for Applications with Noise is an unsupervised form of grouping data that hardly requires any input parameters, save for just 2, which when compared to other approaches like k-means, is a boon. We delve into how this could be constructive for testing and eventually trading with Wizard assembled Expert Advisers

Reimagining Classic Strategies (Part VI): Multiple Time-Frame Analysis

In this series of articles, we revisit classic strategies to see if we can improve them using AI. In today's article, we will examine the popular strategy of multiple time-frame analysis to judge if the strategy would be enhanced with AI.

Developing a multi-currency Expert Advisor (Part 3): Architecture revision

We have already made some progress in developing a multi-currency EA with several strategies working in parallel. Considering the accumulated experience, let's review the architecture of our solution and try to improve it before we go too far ahead.

Neural Networks in Trading: Dual-Attention-Based Trend Prediction Model

We continue the discussion about the use of piecewise linear representation of time series, which was started in the previous article. Today we will see how to combine this method with other approaches to time series analysis to improve the price trend prediction quality.

Neural Networks in Trading: Unified Trajectory Generation Model (UniTraj)

Understanding agent behavior is important in many different areas, but most methods focus on just one of the tasks (understanding, noise removal, or prediction), which reduces their effectiveness in real-world scenarios. In this article, we will get acquainted with a model that can adapt to solving various problems.

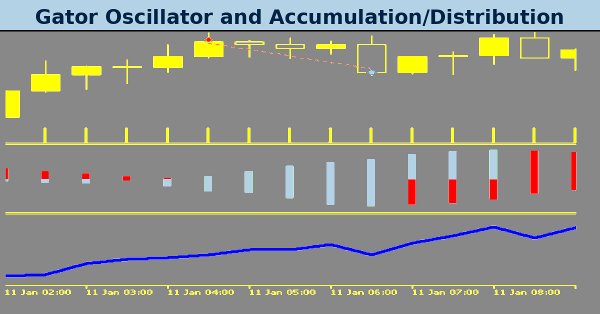

MQL5 Wizard Techniques you should know (Part 77): Using Gator Oscillator and the Accumulation/Distribution Oscillator

The Gator Oscillator by Bill Williams and the Accumulation/Distribution Oscillator are another indicator pairing that could be used harmoniously within an MQL5 Expert Advisor. We use the Gator Oscillator for its ability to affirm trends, while the A/D is used to provide confirmation of the trends via checks on volume. In exploring this indicator pairing, as always, we use the MQL5 wizard to build and test out their potential.

Trading with the MQL5 Economic Calendar (Part 5): Enhancing the Dashboard with Responsive Controls and Filter Buttons

In this article, we create buttons for currency pair filters, importance levels, time filters, and a cancel option to improve dashboard control. These buttons are programmed to respond dynamically to user actions, allowing seamless interaction. We also automate their behavior to reflect real-time changes on the dashboard. This enhances the overall functionality, mobility, and responsiveness of the panel.

Trading with the MQL5 Economic Calendar (Part 4): Implementing Real-Time News Updates in the Dashboard

This article enhances our Economic Calendar dashboard by implementing real-time news updates to keep market information current and actionable. We integrate live data fetching techniques in MQL5 to update events on the dashboard continuously, improving the responsiveness of the interface. This update ensures that we can access the latest economic news directly from the dashboard, optimizing trading decisions based on the freshest data.

MQL5 Wizard Techniques you should know (Part 56): Bill Williams Fractals

The Fractals by Bill Williams is a potent indicator that is easy to overlook when one initially spots it on a price chart. It appears too busy and probably not incisive enough. We aim to draw away this curtain on this indicator by examining what its various patterns could accomplish when examined with forward walk tests on all, with wizard assembled Expert Advisor.

MQL5 Wizard Techniques you should know (Part 37): Gaussian Process Regression with Linear and Matérn Kernels

Linear Kernels are the simplest matrix of its kind used in machine learning for linear regression and support vector machines. The Matérn kernel on the other hand is a more versatile version of the Radial Basis Function we looked at in an earlier article, and it is adept at mapping functions that are not as smooth as the RBF would assume. We build a custom signal class that utilizes both kernels in forecasting long and short conditions.

Neural networks made easy (Part 46): Goal-conditioned reinforcement learning (GCRL)

In this article, we will have a look at yet another reinforcement learning approach. It is called goal-conditioned reinforcement learning (GCRL). In this approach, an agent is trained to achieve different goals in specific scenarios.

Integrate Your Own LLM into EA (Part 3): Training Your Own LLM with CPU

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.