Automating Trading Strategies in MQL5 (Part 11): Developing a Multi-Level Grid Trading System

In this article, we develop a multi-level grid trading system EA using MQL5, focusing on the architecture and algorithm design behind grid trading strategies. We explore the implementation of multi-layered grid logic and risk management techniques to handle varying market conditions. Finally, we provide detailed explanations and practical tips to guide you through building, testing, and refining the automated trading system.

The Optimal Method for Calculation of Total Position Volume by Specified Magic Number

The problem of calculation of the total position volume of the specified symbol and magic number is considered in this article. The proposed method requests only the minimum necessary part of the history of deals, finds the closest time when the total position was equal to zero, and performs the calculations with the recent deals. Working with global variables of the client terminal is also considered.

Introduction to MQL5 (Part 7): Beginner's Guide to Building Expert Advisors and Utilizing AI-Generated Code in MQL5

Discover the ultimate beginner's guide to building Expert Advisors (EAs) with MQL5 in our comprehensive article. Learn step-by-step how to construct EAs using pseudocode and harness the power of AI-generated code. Whether you're new to algorithmic trading or seeking to enhance your skills, this guide provides a clear path to creating effective EAs.

Reversing: Formalizing the entry point and developing a manual trading algorithm

This is the last article within the series devoted to the Reversing trading strategy. Here we will try to solve the problem, which caused the testing results instability in previous articles. We will also develop and test our own algorithm for manual trading in any market using the reversing strategy.

Resolving entries into indicators

Different situations happen in trader’s life. Often, the history of successful trades allows us to restore a strategy, while looking at a loss history we try to develop and improve it. In both cases, we compare trades with known indicators. This article suggests methods of batch comparison of trades with a number of indicators.

Neural networks made easy (Part 7): Adaptive optimization methods

In previous articles, we used stochastic gradient descent to train a neural network using the same learning rate for all neurons within the network. In this article, I propose to look towards adaptive learning methods which enable changing of the learning rate for each neuron. We will also consider the pros and cons of this approach.

Creating a trading robot for Moscow Exchange. Where to start?

Many traders on Moscow Exchange would like to automate their trading algorithms, but they do not know where to start. The MQL5 language offers a huge range of trading functions, and it additionally provides ready classes that help users to make their first steps in algo trading.

MQL5 Cookbook - Programming moving channels

This article presents a method of programming the equidistant channel system. Certain details of building such channels are being considered here. Channel typification is provided, and a universal type of moving channels' method is suggested. Object-oriented programming (OOP) is used for code implementation.

Cross-Platform Expert Advisor: Custom Stops, Breakeven and Trailing

This article discusses how custom stop levels can be set up in a cross-platform expert advisor. It also discusses a closely-related method by which the evolution of a stop level over time can be defined.

Ready-made Expert Advisors from the MQL5 Wizard work in MetaTrader 4

The article offers a simple emulator of the MetaTrader 5 trading environment for MetaTrader 4. The emulator implements migration and adjustment of trade classes of the Standard Library. As a result, Expert Advisors generated in the MetaTrader 5 Wizard can be compiled and executed in MetaTrader 4 without changes.

Mastering Market Dynamics: Creating a Support and Resistance Strategy Expert Advisor (EA)

A comprehensive guide to developing an automated trading algorithm based on the Support and Resistance strategy. Detailed information on all aspects of creating an expert advisor in MQL5 and testing it in MetaTrader 5 – from analyzing price range behaviors to risk management.

MQL5 Cookbook: Saving Optimization Results of an Expert Advisor Based on Specified Criteria

We continue the series of articles on MQL5 programming. This time we will see how to get results of each optimization pass right during the Expert Advisor parameter optimization. The implementation will be done so as to ensure that if the conditions specified in the external parameters are met, the corresponding pass values will be written to a file. In addition to test values, we will also save the parameters that brought about such results.

Neural networks made easy (Part 4): Recurrent networks

We continue studying the world of neural networks. In this article, we will consider another type of neural networks, recurrent networks. This type is proposed for use with time series, which are represented in the MetaTrader 5 trading platform by price charts.

Automating Trading Strategies in MQL5 (Part 45): Inverse Fair Value Gap (IFVG)

In this article, we create an Inverse Fair Value Gap (IFVG) detection system in MQL5 that identifies bullish/bearish FVGs on recent bars with minimum gap size filtering, tracks their states as normal/mitigated/inverted based on price interactions (mitigation on far-side breaks, retracement on re-entry, inversion on close beyond far side from inside), and ignores overlaps while limiting tracked FVGs.

Multibot in MetaTrader: Launching multiple robots from a single chart

In this article, I will consider a simple template for creating a universal MetaTrader robot that can be used on multiple charts while being attached to only one chart, without the need to configure each instance of the robot on each individual chart.

Larry Williams Market Secrets (Part 2): Automating a Market Structure Trading System

Learn how to automate Larry Williams market structure concepts in MQL5 by building a complete Expert Advisor that reads swing points, generates trade signals, manages risk, and applies a dynamic trailing stop strategy.

Building interactive semi-automatic drag-and-drop Expert Advisor based on predefined risk and R/R ratio

Some traders execute all their trades automatically, and some mix automatic and manual trades based on the output of several indicators. Being a member of the latter group I needed an interactive tool to asses dynamically risk and reward price levels directly from the chart. This article will present a way to implement an interactive semi-automatic Expert Advisor with predefined equity risk and R/R ratio. The Expert Advisor risk, R/R and lot size parameters can be changed during runtime on the EA panel.

Bi-Directional Trading and Hedging of Positions in MetaTrader 5 Using the HedgeTerminal API, Part 2

This article describes a new approach to hedging of positions and draws the line in the debates between users of MetaTrader 4 and MetaTrader 5 about this matter. It is a continuation of the first part: "Bi-Directional Trading and Hedging of Positions in MetaTrader 5 Using the HedgeTerminal Panel, Part 1". In the second part, we discuss integration of custom Expert Advisors with HedgeTerminalAPI, which is a special visualization library designed for bi-directional trading in a comfortable software environment providing tools for convenient position management.

Practical application of neural networks in trading (Part 2). Computer vision

The use of computer vision allows training neural networks on the visual representation of the price chart and indicators. This method enables wider operations with the whole complex of technical indicators, since there is no need to feed them digitally into the neural network.

Deep Learning Forecast and ordering with Python and MetaTrader5 python package and ONNX model file

The project involves using Python for deep learning-based forecasting in financial markets. We will explore the intricacies of testing the model's performance using key metrics such as Mean Absolute Error (MAE), Mean Squared Error (MSE), and R-squared (R2) and we will learn how to wrap everything into an executable. We will also make a ONNX model file with its EA.

Modeling time series using custom symbols according to specified distribution laws

The article provides an overview of the terminal's capabilities for creating and working with custom symbols, offers options for simulating a trading history using custom symbols, trend and various chart patterns.

Learn how to deal with date and time in MQL5

A new article about a new important topic which is dealing with date and time. As traders or programmers of trading tools, it is very crucial to understand how to deal with these two aspects date and time very well and effectively. So, I will share some important information about how we can deal with date and time to create effective trading tools smoothly and simply without any complicity as much as I can.

Learn how to design a trading system by Alligator

In this article, we'll complete our series about how to design a trading system based on the most popular technical indicator. We'll learn how to create a trading system based on the Alligator indicator.

Developing a cross-platform grider EA (part II): Range-based grid in trend direction

In this article, we will develop a grider EA for trading in a trend direction within a range. Thus, the EA is to be suited mostly for Forex and commodity markets. According to the tests, our grider showed profit since 2018. Unfortunately, this is not true for the period of 2014-2018.

A Few Tips for First-Time Customers

A proverbial wisdom often attributed to various famous people says: "He who makes no mistakes never makes anything." Unless you consider idleness itself a mistake, this statement is hard to argue with. But you can always analyze the past mistakes (your own and of others) to minimize the number of your future mistakes. We are going to attempt to review possible situations arising when executing jobs in the same-name service.

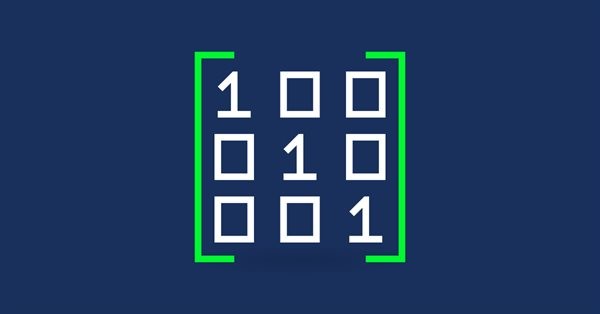

Matrices and vectors in MQL5

By using special data types 'matrix' and 'vector', it is possible to create code which is very close to mathematical notation. With these methods, you can avoid the need to create nested loops or to mind correct indexing of arrays in calculations. Therefore, the use of matrix and vector methods increases the reliability and speed in developing complex programs.

The RSI Deep Three Move Trading Technique

Presenting the RSI Deep Three Move Trading Technique in MetaTrader 5. This article is based on a new series of studies that showcase a few trading techniques based on the RSI, a technical analysis indicator used to measure the strength and momentum of a security, such as a stock, currency, or commodity.

Self-adapting algorithm (Part IV): Additional functionality and tests

I continue filling the algorithm with the minimum necessary functionality and testing the results. The profitability is quite low but the articles demonstrate the model of the fully automated profitable trading on completely different instruments traded on fundamentally different markets.

Learn how to design a trading system by Bear's Power

Welcome to a new article in our series about learning how to design a trading system by the most popular technical indicator here is a new article about learning how to design a trading system by Bear's Power technical indicator.

Modified Grid-Hedge EA in MQL5 (Part I): Making a Simple Hedge EA

We will be creating a simple hedge EA as a base for our more advanced Grid-Hedge EA, which will be a mixture of classic grid and classic hedge strategies. By the end of this article, you will know how to create a simple hedge strategy, and you will also get to know what people say about whether this strategy is truly 100% profitable.

Design Patterns in software development and MQL5 (Part 4): Behavioral Patterns 2

In this article, we will complete our series about the Design Patterns topic, we mentioned that there are three types of design patterns creational, structural, and behavioral. We will complete the remaining patterns of the behavioral type which can help set the method of interaction between objects in a way that makes our code clean.

MQL5 Integration: Python

Python is a well-known and popular programming language with many features, especially in the fields of finance, data science, Artificial Intelligence, and Machine Learning. Python is a powerful tool that can be useful in trading as well. MQL5 allows us to use this powerful language as an integration to get our objectives done effectively. In this article, we will share how we can use Python as an integration in MQL5 after learning some basic information about Python.

Cross-Platform Expert Advisor: The CExpertAdvisor and CExpertAdvisors Classes

This article deals primarily with the classes CExpertAdvisor and CExpertAdvisors, which serve as the container for all the other components described in this article-series regarding cross-platform expert advisors.

Neural Networks Cheap and Cheerful - Link NeuroPro with MetaTrader 5

If specific neural network programs for trading seem expensive and complex or, on the contrary, too simple, try NeuroPro. It is free and contains the optimal set of functionalities for amateurs. This article will tell you how to use it in conjunction with MetaTrader 5.

Another MQL5 OOP Class

This article shows you how to build an Object-Oriented Expert Advisor from scratch, from conceiving a theoretical trading idea to programming a MQL5 EA that makes that idea real in the empirical world. Learning by doing is IMHO a solid approach to succeed, so I am showing a practical example in order for you to see how you can order your ideas to finally code your Forex robots. My goal is also to invite you to adhere the OO principles.

Graphics in DoEasy library (Part 74): Basic graphical element powered by the CCanvas class

In this article, I will rework the concept of building graphical objects from the previous article and prepare the base class of all graphical objects of the library powered by the Standard Library CCanvas class.

Cross-Platform Expert Advisor: Introduction

This article details a method by which cross-platform expert advisors can be developed faster and easier. The proposed method consolidates the features shared by both versions into a single class, and splits the implementation on derived classes for incompatible features.

Can Heiken-Ashi Combined With Moving Averages Provide Good Signals Together?

Combinations of strategies may offer better opportunities. We can combine indicators or patterns together, or even better, indicators with patterns, so that we get an extra confirmation factor. Moving averages help us confirm and ride the trend. They are the most known technical indicators and this is because of their simplicity and their proven track record of adding value to analyses.

Applying OLAP in trading (part 3): Analyzing quotes for the development of trading strategies

In this article we will continue dealing with the OLAP technology applied to trading. We will expand the functionality presented in the first two articles. This time we will consider the operational analysis of quotes. We will put forward and test the hypotheses on trading strategies based on aggregated historical data. The article presents Expert Advisors for studying bar patterns and adaptive trading.

Automating Trading Strategies in MQL5 (Part 9): Building an Expert Advisor for the Asian Breakout Strategy

In this article, we build an Expert Advisor in MQL5 for the Asian Breakout Strategy by calculating the session's high and low and applying trend filtering with a moving average. We implement dynamic object styling, user-defined time inputs, and robust risk management. Finally, we demonstrate backtesting and optimization techniques to refine the program.