Creating Active Control Panels in MQL5 for Trading

The article covers the problem of development of active control panels in MQL5. Interface elements are managed by the event handling mechanism. Besides, the option of a flexible setup of control elements properties is available. The active control panel allows working with positions, as well setting, modifying and deleting market and pending orders.

Learn how to design different Moving Average systems

There are many strategies that can be used to filter generated signals based on any strategy, even by using the moving average itself which is the subject of this article. So, the objective of this article is to share with you some of Moving Average Strategies and how to design an algorithmic trading system.

Creating Neural Network EAs Using MQL5 Wizard and Hlaiman EA Generator

The article describes a method of automated creation of neural network EAs using MQL5 Wizard and Hlaiman EA Generator. It shows you how you can easily start working with neural networks, without having to learn the entire body of theoretical information and writing your own code.

Forecasting Time Series (Part 1): Empirical Mode Decomposition (EMD) Method

This article deals with the theory and practical use of the algorithm for forecasting time series, based on the empirical decomposition mode. It proposes the MQL implementation of this method and presents test indicators and Expert Advisors.

Learn how to design a trading system by Fibonacci

In this article, we will continue our series of creating a trading system based on the most popular technical indicator. Here is a new technical tool which is the Fibonacci and we will learn how to design a trading system based on this technical indicator.

Auto detection of extreme points based on a specified price variation

Automation of trading strategies involving graphical patterns requires the ability to search for extreme points on the charts for further processing and interpretation. Existing tools do not always provide such an ability. The algorithms described in the article allow finding all extreme points on charts. The tools discussed here are equally efficient both during trends and flat movements. The obtained results are not strongly affected by a selected timeframe and are only defined by a specified scale.

Developing a self-adapting algorithm (Part II): Improving efficiency

In this article, I will continue the development of the topic by improving the flexibility of the previously created algorithm. The algorithm became more stable with an increase in the number of candles in the analysis window or with an increase in the threshold percentage of the overweight of falling or growing candles. I had to make a compromise and set a larger sample size for analysis or a larger percentage of the prevailing candle excess.

Machine Learning: How Support Vector Machines can be used in Trading

Support Vector Machines have long been used in fields such as bioinformatics and applied mathematics to assess complex data sets and extract useful patterns that can be used to classify data. This article looks at what a support vector machine is, how they work and why they can be so useful in extracting complex patterns. We then investigate how they can be applied to the market and potentially used to advise on trades. Using the Support Vector Machine Learning Tool, the article provides worked examples that allow readers to experiment with their own trading.

MQL for "Dummies": How to Design and Construct Object Classes

By creating a sample program of visual design, we demonstrate how to design and construct classes in MQL5. The article is written for beginner programmers, who are working on MT5 applications. We propose a simple and easy grasping technology for creating classes, without the need to deeply immerse into the theory of object-oriented programming.

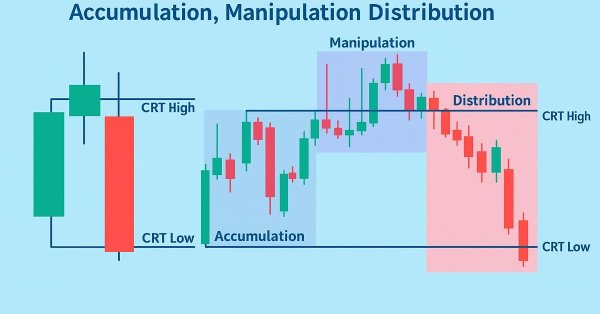

Automating Trading Strategies in MQL5 (Part 41): Candle Range Theory (CRT) – Accumulation, Manipulation, Distribution (AMD)

In this article, we develop a Candle Range Theory (CRT) trading system in MQL5 that identifies accumulation ranges on a specified timeframe, detects breaches with manipulation depth filtering, and confirms reversals for entry trades in the distribution phase. The system supports dynamic or static stop-loss and take-profit calculations based on risk-reward ratios, optional trailing stops, and limits on positions per direction for controlled risk management.

Evaluation and selection of variables for machine learning models

This article focuses on specifics of choice, preconditioning and evaluation of the input variables (predictors) for use in machine learning models. New approaches and opportunities of deep predictor analysis and their influence on possible overfitting of models will be considered. The overall result of using models largely depends on the result of this stage. We will analyze two packages offering new and original approaches to the selection of predictors.

Expert Advisor featuring GUI: Adding functionality (part II)

This is the second part of the article showing the development of a multi-symbol signal Expert Advisor for manual trading. We have already created the graphical interface. It is now time to connect it with the program's functionality.

How to use MQL5 to detect candlesticks patterns

A new article to learn how to detect candlesticks patterns on prices automatically by MQL5.

MQL5 Wizard: New Version

The article contains descriptions of the new features available in the updated MQL5 Wizard. The modified architecture of signals allow creating trading robots based on the combination of various market patterns. The example contained in the article explains the procedure of interactive creation of an Expert Advisor.

Automating Trading Strategies in MQL5 (Part 42): Session-Based Opening Range Breakout (ORB) System

In this article, we create a fully customizable session-based Opening Range Breakout (ORB) system in MQL5 that lets us set any desired session start time and range duration, automatically calculates the high and low of that opening period, and trades only confirmed breakouts in the direction of the move.

Developing a cross-platform grid EA: testing a multi-currency EA

Markets dropped down by more that 30% within one month. It seems to be the best time for testing grid- and martingale-based Expert Advisors. This article is an unplanned continuation of the series "Creating a Cross-Platform Grid EA". The current market provides an opportunity to arrange a stress rest for the grid EA. So, let's use this opportunity and test our Expert Advisor.

Exploring Trading Strategy Classes of the Standard Library - Customizing Strategies

In this article we are going to show how to explore the Standard Library of Trading Strategy Classes and how to add Custom Strategies and Filters/Signals using the Patterns-and-Models logic of the MQL5 Wizard. In the end you will be able easily add your own strategies using MetaTrader 5 standard indicators, and MQL5 Wizard will create a clean and powerful code and fully functional Expert Advisor.

Simple Trading Systems Using Semaphore Indicators

If we thoroughly examine any complex trading system, we will see that it is based on a set of simple trading signals. Therefore, there is no need for novice developers to start writing complex algorithms immediately. This article provides an example of a trading system that uses semaphore indicators to perform deals.

Mechanical Trading System "Chuvashov's Triangle"

Let me offer you an overview and the program code of the mechanical trading system based on ideas of Stanislav Chuvashov. Triangle's construction is based on the intersection of two trend lines built by the upper and lower fractals.

Martingale as the basis for a long-term trading strategy

In this article we will consider in detail the martingale system. We will review whether this system can be applied in trading and how to use it in order to minimize risks. The main disadvantage of this simple system is the probability of losing the entire deposit. This fact must be taken into account, if you decide to trade using the martingale technique.

Change Expert Advisor Parameters From the User Panel "On the Fly"

This article provides a small example demonstrating the implementation of an Expert Advisor whose parameters can be controlled from the user panel. When changing the parameters "on the fly", the Expert Advisor writes the values obtained from the info panel to a file to further read them from the file and display accordingly on the panel. This article may be relevant to those who trade manually or in semi-automatic mode.

Creating MQL5 Expert Advisors in minutes using EA Tree: Part One

EA Tree is the first drag and drop MetaTrader MQL5 Expert Advisor builder. You can create complex MQL5 using a very easy to use graphical user interface. In EA Tree, Expert Advisors are created by connecting boxes together. Boxes may contain MQL5 functions, technical indicators, custom indicators, or values. Using the "tree of boxes", EA Tree generates the MQL5 code of the Expert Advisor.

Deep Neural Networks (Part I). Preparing Data

This series of articles continues exploring deep neural networks (DNN), which are used in many application areas including trading. Here new dimensions of this theme will be explored along with testing of new methods and ideas using practical experiments. The first article of the series is dedicated to preparing data for DNN.

Deep Neural Networks (Part VIII). Increasing the classification quality of bagging ensembles

The article considers three methods which can be used to increase the classification quality of bagging ensembles, and their efficiency is estimated. The effects of optimization of the ELM neural network hyperparameters and postprocessing parameters are evaluated.

Better Programmer (Part 07): Notes on becoming a successful freelance developer

Do you wish to become a successful Freelance developer on MQL5? If the answer is yes, this article is right for you.

Building an Automatic News Trader

This is the continuation of Another MQL5 OOP class article which showed you how to build a simple OO EA from scratch and gave you some tips on object-oriented programming. Today I am showing you the technical basics needed to develop an EA able to trade the news. My goal is to keep on giving you ideas about OOP and also cover a new topic in this series of articles, working with the file system.

My First "Grail"

Examined are the most frequent mistakes that lead the first-time programmers to creation of a "super-moneymaking" (when tested) trading systems. Exemplary experts that show fantastic results in tester, but result in losses during real trading are presented.

MetaTrader 4 Expert Advisor exchanges information with the outside world

A simple, universal and reliable solution of information exchange between МetaТrader 4 Expert Advisor and the outside world. Suppliers and consumers of the information can be located on different computers, the connection is performed through the global IP addresses.

Applying OLAP in trading (part 4): Quantitative and visual analysis of tester reports

The article offers basic tools for the OLAP analysis of tester reports relating to single passes and optimization results. The tool can work with standard format files (tst and opt), and it also provides a graphical interface. MQL source codes are attached below.

Deep Neural Networks (Part IV). Creating, training and testing a model of neural network

This article considers new capabilities of the darch package (v.0.12.0). It contains a description of training of a deep neural networks with different data types, different structure and training sequence. Training results are included.

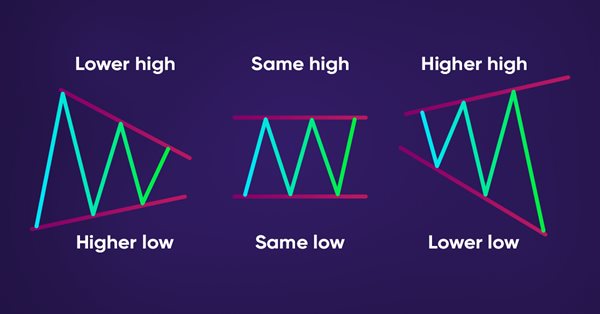

How to detect trends and chart patterns using MQL5

In this article, we will provide a method to detect price actions patterns automatically by MQL5, like trends (Uptrend, Downtrend, Sideways), Chart patterns (Double Tops, Double Bottoms).

MQL5 Cookbook - Pivot trading signals

The article describes the development and implementation of a class for sending signals based on pivots — reversal levels. This class is used to form a strategy applying the Standard Library. Improving the pivot strategy by adding filters is considered.

Developing a trading Expert Advisor from scratch

In this article, we will discuss how to develop a trading robot with minimum programming. Of course, MetaTrader 5 provides a high level of control over trading positions. However, using only the manual ability to place orders can be quite difficult and risky for less experienced users.

Deep Neural Networks (Part VII). Ensemble of neural networks: stacking

We continue to build ensembles. This time, the bagging ensemble created earlier will be supplemented with a trainable combiner — a deep neural network. One neural network combines the 7 best ensemble outputs after pruning. The second one takes all 500 outputs of the ensemble as input, prunes and combines them. The neural networks will be built using the keras/TensorFlow package for Python. The features of the package will be briefly considered. Testing will be performed and the classification quality of bagging and stacking ensembles will be compared.

MQL5 Cookbook - Trading signals of moving channels

The article describes the process of developing and implementing a class for sending signals based on the moving channels. Each of the signal version is followed by a trading strategy with testing results. Classes of the Standard Library are used for creating derived classes.

Cross-Platform Expert Advisor: Money Management

This article discusses the implementation of money management method for a cross-platform expert advisor. The money management classes are responsible for the calculation of the lot size to be used for the next trade to be entered by the expert advisor.

Order Strategies. Multi-Purpose Expert Advisor

This article centers around strategies that actively use pending orders, a metalanguage that can be created to formally describe such strategies and the use of a multi-purpose Expert Advisor whose operation is based on those descriptions

Developing a self-adapting algorithm (Part I): Finding a basic pattern

In the upcoming series of articles, I will demonstrate the development of self-adapting algorithms considering most market factors, as well as show how to systematize these situations, describe them in logic and take them into account in your trading activity. I will start with a very simple algorithm that will gradually acquire theory and evolve into a very complex project.

Using text files for storing input parameters of Expert Advisors, indicators and scripts

The article describes the application of text files for storing dynamic objects, arrays and other variables used as properties of Expert Advisors, indicators and scripts. The files serve as a convenient addition to the functionality of standard tools offered by MQL languages.

Developing a cross-platform grider EA

In this article, we will learn how to create Expert Advisors (EAs) working both in MetaTrader 4 and MetaTrader 5. To do this, we are going to develop an EA constructing order grids. Griders are EAs that place several limit orders above the current price and the same number of limit orders below it simultaneously.