Trading signals module using the system by Bill Williams

The article describes the rules of the trading system by Bill Williams, the procedure of application for a developed MQL5 module to search and mark patterns of this system on the chart, automated trading with found patterns, and also presents the results of testing on various trading instruments.

Understanding order placement in MQL5

When creating any trading system, there is a task we need to deal with effectively. This task is order placement or to let the created trading system deal with orders automatically because it is crucial in any trading system. So, you will find in this article most of the topics that you need to understand about this task to create your trading system in terms of order placement effectively.

Learn how to design a trading system by ATR

In this article, we will learn a new technical tool that can be used in trading, as a continuation within the series in which we learn how to design simple trading systems. This time we will work with another popular technical indicator: Average True Range (ATR).

The Implementation of a Multi-currency Mode in MetaTrader 5

For a long time multi-currency analysis and multi-currency trading has been of interest to people. The opportunity to implement a full fledged multi-currency regime became possible only with the public release of MetaTrader 5 and the MQL5 programming language. In this article we propose a way to analyze and process all incoming ticks for several symbols. As an illustration, let's consider a multi-currency RSI indicator of the USDx dollar index.

A Virtual Order Manager to track orders within the position-centric MetaTrader 5 environment

This class library can be added to an MetaTrader 5 Expert Advisor to enable it to be written with an order-centric approach broadly similar to MetaTrader 4, in comparison to the position-based approach of MetaTrader 5. It does this by keeping track of virtual orders at the MetaTrader 5 client terminal, while maintaining a protective broker stop for each position for disaster protection.

Dealing with Time (Part 1): The Basics

Functions and code snippets that simplify and clarify the handling of time, broker offset, and the changes to summer or winter time. Accurate timing may be a crucial element in trading. At the current hour, is the stock exchange in London or New York already open or not yet open, when does the trading time for Forex trading start and end? For a trader who trades manually and live, this is not a big problem.

Processing of trade events in Expert Advisor using the OnTrade() function

MQL5 gave a mass of innovations, including work with events of various types (timer events, trade events, custom events, etc.). Ability to handle events allows you to create completely new type of programs for automatic and semi-automatic trading. In this article we will consider trade events and write some code for the OnTrade() function, that will process the Trade event.

Thomas DeMark's contribution to technical analysis

The article details TD points and TD lines discovered by Thomas DeMark. Their practical implementation is revealed. In addition to that, a process of writing three indicators and two Expert Advisors using the concepts of Thomas DeMark is demonstrated.

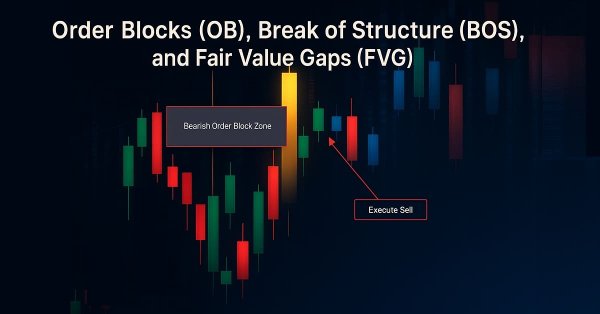

Automating Trading Strategies in MQL5 (Part 6): Mastering Order Block Detection for Smart Money Trading

In this article, we automate order block detection in MQL5 using pure price action analysis. We define order blocks, implement their detection, and integrate automated trade execution. Finally, we backtest the strategy to evaluate its performance.

EA remote control methods

The main advantage of trading robots lies in the ability to work 24 hours a day on a remote VPS server. But sometimes it is necessary to intervene in their work, while there may be no direct access to the server. Is it possible to manage EAs remotely? The article proposes one of the options for controlling EAs via external commands.

Econometric approach to finding market patterns: Autocorrelation, Heat Maps and Scatter Plots

The article presents an extended study of seasonal characteristics: autocorrelation heat maps and scatter plots. The purpose of the article is to show that "market memory" is of seasonal nature, which is expressed through maximized correlation of increments of arbitrary order.

Parallel Calculations in MetaTrader 5

Time has been a great value throughout the history of mankind, and we strive not to waste it unnecessarily. This article will tell you how to accelerate the work of your Expert Advisor if your computer has a multi-core processor. Moreover, the implementation of the proposed method does not require the knowledge of any other languages besides MQL5.

Forecasting Time Series (Part 2): Least-Square Support-Vector Machine (LS-SVM)

This article deals with the theory and practical application of the algorithm for forecasting time series, based on support-vector method. It also proposes its implementation in MQL and provides test indicators and Expert Advisors. This technology has not been implemented in MQL yet. But first, we have to get to know math for it.

Money-Making Algorithms Employing Trailing Stop

This article's objective is to study profitability of algorithms with different entries into trades and exits using trailing stop. Entry types to be used are random entry and reverse entry. Stop orders to be used are trailing stop and trailing take. The article demonstrates money-making algorithms with a profitability of about 30% per annum.

Advanced EA constructor for MetaTrader - botbrains.app

In this article, we demonstrate features of botbrains.app - a no-code platform for trading robots development. To create a trading robot you don't need to write any code - just drag and drop the necessary blocks onto the scheme, set their parameters, and establish connections between them.

Learn how to design a trading system by ADX

In this article, we will continue our series about designing a trading system using the most popular indicators and we will talk about the average directional index (ADX) indicator. We will learn this indicator in detail to understand it well and we will learn how we to use it through a simple strategy. By learning something deeply we can get more insights and we can use it better.

Controlled optimization: Simulated annealing

The Strategy Tester in the MetaTrader 5 trading platform provides only two optimization options: complete search of parameters and genetic algorithm. This article proposes a new method for optimizing trading strategies — Simulated annealing. The method's algorithm, its implementation and integration into any Expert Advisor are considered. The developed algorithm is tested on the Moving Average EA.

Cross-Platform Expert Advisor: Signals

This article discusses the CSignal and CSignals classes which will be used in cross-platform expert advisors. It examines the differences between MQL4 and MQL5 on how particular data needed for evaluation of trade signals are accessed to ensure that the code written will be compatible with both compilers.

Learn how to trade the Fair Value Gap (FVG)/Imbalances step-by-step: A Smart Money concept approach

A step-by-step guide to creating and implementing an automated trading algorithm in MQL5 based on the Fair Value Gap (FVG) trading strategy. A detailed tutorial on creating an expert advisor that can be useful for both beginners and experienced traders.

Cross-Platform Expert Advisor: Time Filters

This article discusses the implementation of various methods of time filtering a cross-platform expert advisor. The time filter classes are responsible for checking whether or not a given time falls under a certain time configuration setting.

Applying Monte Carlo method in reinforcement learning

In the article, we will apply Reinforcement learning to develop self-learning Expert Advisors. In the previous article, we considered the Random Decision Forest algorithm and wrote a simple self-learning EA based on Reinforcement learning. The main advantages of such an approach (trading algorithm development simplicity and high "training" speed) were outlined. Reinforcement learning (RL) is easily incorporated into any trading EA and speeds up its optimization.

Developing a cross-platform grid EA (Last part): Diversification as a way to increase profitability

In previous articles within this series, we tried various methods for creating a more or less profitable grid Expert Advisor. Now we will try to increase the EA profitability through diversification. Our ultimate goal is to reach 100% profit per year with the maximum balance drawdown no more than 20%.

How to copy signals using an EA by your rules?

When you subscribe to signals, such situation may occur: your trade account has a leverage of 1:100, the provider has a leverage of 1:500 and trades using the minimal lot, and your trade balances are virtually equal — but the copy ratio will comprise only 10% to 15%. This article describes how to increase the copy rate in such cases.

Elevate Your Trading With Smart Money Concepts (SMC): OB, BOS, and FVG

Elevate your trading with Smart Money Concepts (SMC) by combining Order Blocks (OB), Break of Structure (BOS), and Fair Value Gaps (FVG) into one powerful EA. Choose automatic strategy execution or focus on any individual SMC concept for flexible and precise trading.

The NRTR indicator and trading modules based on NRTR for the MQL5 Wizard

In this article we are going to analyze the NRTR indicator and create a trading system based on this indicator. We are going to develop a module of trading signals that can be used in creating strategies based on a combination of NRTR with additional trend confirmation indicators.

Using indicators for optimizing Expert Advisors in real time

Efficiency of any trading robot depends on the correct selection of its parameters (optimization). However, parameters that are considered optimal for one time interval may not retain their effectiveness in another period of trading history. Besides, EAs showing profit during tests turn out to be loss-making in real time. The issue of continuous optimization comes to the fore here. When facing plenty of routine work, humans always look for ways to automate it. In this article, I propose a non-standard approach to solving this issue.

Multiple Regression Analysis. Strategy Generator and Tester in One

The article gives a description of ways of use of the multiple regression analysis for development of trading systems. It demonstrates the use of the regression analysis for strategy search automation. A regression equation generated and integrated in an EA without requiring high proficiency in programming is given as an example.

Custom symbols: Practical basics

The article is devoted to the programmatic generation of custom symbols which are used to demonstrate some popular methods for displaying quotes. It describes a suggested variant of minimally invasive adaptation of Expert Advisors for trading a real symbol from a derived custom symbol chart. MQL source codes are attached to this article.

Creating an EA that works automatically (Part 01): Concepts and structures

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode.

Gap - a profitable strategy or 50/50?

The article dwells on gaps — significant differences between a close price of a previous timeframe and an open price of the next one, as well as on forecasting a daily bar direction. Applying the GetOpenFileName function by the system DLL is considered as well.

MQL5 Wizard: Placing Orders, Stop-Losses and Take Profits on Calculated Prices. Standard Library Extension

This article describes the MQL5 Standard Library extension, which allows to create Expert Advisors, place orders, Stop Losses and Take Profits using the MQL5 Wizard by the prices received from included modules. This approach does not apply any additional restrictions on the number of modules and does not cause conflicts in their joint work.

The power of ZigZag (part I). Developing the base class of the indicator

Many researchers do not pay enough attention to determining the price behavior. At the same time, complex methods are used, which very often are simply “black boxes”, such as machine learning or neural networks. The most important question arising in that case is what data to submit for training a particular model.

Limitations and Verifications in Expert Advisors

Is it allowed to trade this symbol on Monday? Is there enough money to open position? How big is the loss if Stop Loss triggers? How to limit the number of pending orders? Was the trade operation executed at the current bar or at the previous one? If a trade robot cannot perform this kind of verifications, then any trade strategy can turn into a losing one. This article shows the examples of verifications that are useful in any Expert Advisor.

Learn how to design a trading system by Ichimoku

Here is a new article in our series about how to design a trading system b the most popular indicators, we will talk about the Ichimoku indicator in detail and how to design a trading system by this indicator.

MQL5.com Freelance: Developers' Source of Income (Infographic)

On the occasion of the MQL5 Freelance Service fourth birthday, we have prepared an info-graphic demonstrating the service results for the entire time of its existence. The figures speak for themselves: more than 10 000 orders worth about $600,000 in total have been executed to date, while 3 000 customers and 300 developers have already used the service.

R-squared as an estimation of quality of the strategy balance curve

This article describes the construction of the custom optimization criterion R-squared. This criterion can be used to estimate the quality of a strategy's balance curve and to select the most smoothly growing and stable strategies. The work discusses the principles of its construction and statistical methods used in estimation of properties and quality of this metric.

Better Programmer (Part 02): Stop doing these 5 things to become a successful MQL5 programmer

This is the must read article for anyone wanting to improve their programming career. This article series is aimed at making you the best programmer you can possibly be, no matter how experienced you are. The discussed ideas work for MQL5 programming newbies as well as professionals.

Learn how to design a trading system by Envelopes

In this article, I will share with you one of the methods of how to trade bands. This time we will consider Envelopes and will see how easy it is to create some strategies based on the Envelopes.

A New Approach to Interpreting Classic and Hidden Divergence. Part II

The article provides a critical examination of regular divergence and efficiency of various indicators. In addition, it contains filtering options for an increased analysis accuracy and features description of non-standard solutions. As a result, we will create a new tool for solving the technical task.

The power of ZigZag (part II). Examples of receiving, processing and displaying data

In the first part of the article, I have described a modified ZigZag indicator and a class for receiving data of that type of indicators. Here, I will show how to develop indicators based on these tools and write an EA for tests that features making deals according to signals formed by ZigZag indicator. As an addition, the article will introduce a new version of the EasyAndFast library for developing graphical user interfaces.