Video: How to setup MetaTrader 5 and MQL5 for simple automated trading

In this little video course you will learn how to download, install and setup MetaTrader 5 for Automated Trading. You will also learn how to adjust the chart settings and the options for automated trading. You will do your first backtest and by the end of this course you will know how to import an Expert Advisor that can automatically trade 24/7 while you don't have to sit in front of your screen.

Quick Manual Trading Toolkit: Basic Functionality

Today, many traders switch to automated trading systems which can require additional setup or can be fully automated and ready to use. However, there is a considerable part of traders who prefer trading manually, in the old fashioned way. In this article, we will create toolkit for quick manual trading, using hotkeys, and for performing typical trading actions in one click.

Enhancing the StrategyTester to Optimize Indicators Solely on the Example of Flat and Trend Markets

It is essential to detect whether a market is flat or not for many strategies. Using the well known ADX we demonstrate how we can use the Strategy Tester not only to optimize this indicator for our specific purpose, but as well we can decide whether this indicator will meet our needs and get to know the average range of the flat and trend markets which might be quite important to determine stops and targets of the markets.

TradeObjects: Automation of trading based on MetaTrader graphical objects

The article deals with a simple approach to creating an automated trading system based on the chart linear markup and offers a ready-made Expert Advisor using the standard properties of the MetaTrader 4 and 5 objects and supporting the main trading operations.

Library for easy and quick development of MetaTrader programs (part XVIII): Interactivity of account and any other library objects

The article arranges the work of an account object on a new base object of all library objects, improves the CBaseObj base object and tests setting tracked parameters, as well as receiving events for any library objects.

MQL5 Wizard: How to Create a Risk and Money Management Module

The generator of trading strategies of the MQL5 Wizard greatly simplifies testing of trading ideas. The article describes how to develop a custom risk and money management module and enable it in the MQL5 Wizard. As an example we've considered a money management algorithm, in which the size of the trade volume is determined by the results of the previous deal. The structure and format of description of the created class for the MQL5 Wizard are also discussed in the article.

Creating Expert Advisors Using Expert Advisor Visual Wizard

Expert Advisor Visual Wizard for MetaTrader 5 provides a highly intuitive graphical environment with a comprehensive set of predefined trading blocks that let you design Expert Advisors in minutes. The click, drag and drop approach of Expert Advisor Visual Wizard allows you to create visual representations of forex trading strategies and signals as you would with pencil and paper. These trading diagrams are analyzed automatically by Molanis’ MQL5 code generator that transforms them into ready to use Expert Advisors. The interactive graphical environment simplifies the design process and eliminates the need to write MQL5 code.

Useful and exotic techniques for automated trading

In this article I will demonstrate some very interesting and useful techniques for automated trading. Some of them may be familiar to you. I will try to cover the most interesting methods and will explain why they are worth using. Furthermore, I will show what these techniques are apt to in practice. We will create Expert Advisors and test all the described techniques using historic quotes.

Genetic Algorithms vs. Simple Search in the MetaTrader 4 Optimizer

The article compares the time and results of Expert Advisors' optimization using genetic algorithms and those obtained by simple search.

Extracting structured data from HTML pages using CSS selectors

The article provides a description of a universal method for analyzing and converting data from HTML documents based on CSS selectors. Trading reports, tester reports, your favorite economic calendars, public signals, account monitoring and additional online quote sources will become available straight from MQL.

Learn how to design a trading system by CCI

In this new article from our series for learning how to design trading systems, I will present the Commodities Channel Index (CCI), explain its specifics, and share with you how to create a trading system based on this indicator.

How to Write a Good Description for a Market Product

MQL5 Market has many products for sale but some of their descriptions leave much to be desired. Many texts are obviously in need of improvement, as common traders are not able to comprehend them. This article will help you to put your product in a favorable light. Use our recommendations to write an eye-catching description that will easily show your customers what exactly you are selling.

Using OpenCL to test candlestick patterns

The article describes the algorithm for implementing the OpenCL candlestick patterns tester in the "1 minute OHLC" mode. We will also compare its speed with the built-in strategy tester launched in the fast and slow optimization modes.

Deep Neural Networks (Part VI). Ensemble of neural network classifiers: bagging

The article discusses the methods for building and training ensembles of neural networks with bagging structure. It also determines the peculiarities of hyperparameter optimization for individual neural network classifiers that make up the ensemble. The quality of the optimized neural network obtained in the previous article of the series is compared with the quality of the created ensemble of neural networks. Possibilities of further improving the quality of the ensemble's classification are considered.

OpenAI's ChatGPT features within the framework of MQL4 and MQL5 development

In this article, we will fiddle around ChatGPT from OpenAI in order to understand its capabilities in terms of reducing the time and labor intensity of developing Expert Advisors, indicators and scripts. I will quickly navigate you through this technology and try to show you how to use it correctly for programming in MQL4 and MQL5.

Practical evaluation of the adaptive market following method

The main difference of the trading system proposed in the article is the use of mathematical tools for analyzing stock quotes. The system applies digital filtering and spectral estimation of discrete time series. The theoretical aspects of the strategy are described and a test Expert Advisor is created.

Quick Manual Trading Toolkit: Working with open positions and pending orders

In this article, we will expand the capabilities of the toolkit: we will add the ability to close trade positions upon specific conditions and will create tables for controlling market and pending orders, with the ability to edit these orders.

Learn how to design a trading system by Stochastic

In this article, we continue our learning series — this time we will learn how to design a trading system using one of the most popular and useful indicators, which is the Stochastic Oscillator indicator, to build a new block in our knowledge of basics.

Cross-Platform Expert Advisor: Order Manager

This article discusses the creation of an order manager for a cross-platform expert advisor. The order manager is responsible for the entry and exit of orders or positions entered by the expert, as well as for keeping an independent record of such trades that is usable for both versions.

An Example of a Trading Strategy Based on Timezone Differences on Different Continents

Surfing the Internet, it is easy to find many strategies, which will give you a number of various recommendations. Let’s take an insider’s approach and look into the process of strategy creation, based on the differences in timezones on different continents.

Cross-Platform Expert Advisor: Orders

MetaTrader 4 and MetaTrader 5 uses different conventions in processing trade requests. This article discusses the possibility of using a class object that can be used to represent the trades processed by the server, in order for a cross-platform expert advisor to further work on them, regardless of the version of the trading platform and mode being used.

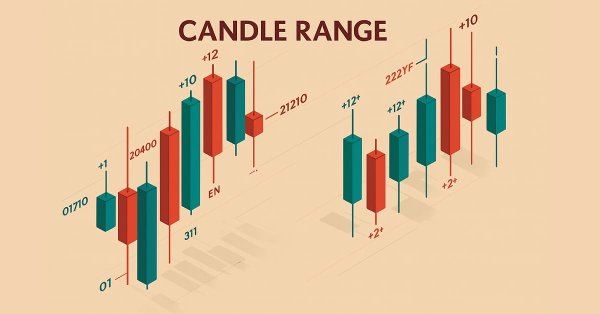

Price Action Analysis Toolkit Development (Part 33): Candle Range Theory Tool

Upgrade your market reading with the Candle-Range Theory suite for MetaTrader 5, a fully MQL5-native solution that converts raw price bars into real-time volatility intelligence. The lightweight CRangePattern library benchmarks each candle’s true range against an adaptive ATR and classifies it the instant it closes; the CRT Indicator then projects those classifications on your chart as crisp, color-coded rectangles and arrows that reveal tightening consolidations, explosive breakouts, and full-range engulfment the moment they occur.

Genetic Algorithms: Mathematics

Genetic (evolutionary) algorithms are used for optimization purposes. An example of such purpose can be neuronet learning, i.e., selection of such weight values that allow reaching the minimum error. At this, the genetic algorithm is based on the random search method.

Applying OLAP in trading (part 1): Online analysis of multidimensional data

The article describes how to create a framework for the online analysis of multidimensional data (OLAP), as well as how to implement this in MQL and to apply such analysis in the MetaTrader environment using the example of trading account history processing.

Creating a new trading strategy using a technology of resolving entries into indicators

The article suggests a technology helping everyone to create custom trading strategies by assembling an individual indicator set, as well as to develop custom market entry signals.

Library for easy and quick development of MetaTrader programs (part XIX): Class of library messages

In this article, we will consider the class of displaying text messages. Currently, we have a sufficient number of different text messages. It is time to re-arrange the methods of their storage, display and translation of Russian or English messages to other languages. Besides, it would be good to introduce convenient ways of adding new languages to the library and quickly switching between them.

Reversing: Reducing maximum drawdown and testing other markets

In this article, we continue to dwell on reversing techniques. We will try to reduce the maximum balance drawdown till an acceptable level for the instruments considered earlier. We will see if the measures will reduce the profit. We will also check how the reversing method performs on other markets, including stock, commodity, index, ETF and agricultural markets. Attention, the article contains a lot of images!

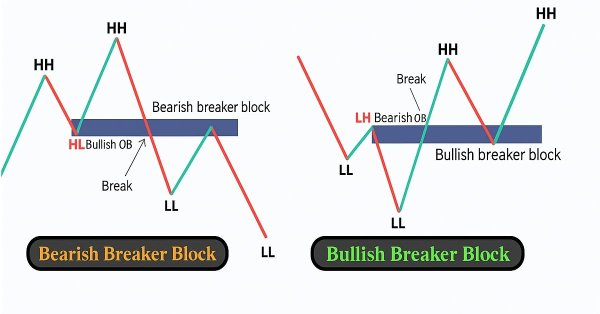

Automating Trading Strategies in MQL5 (Part 35): Creating a Breaker Block Trading System

In this article, we create a Breaker Block Trading System in MQL5 that identifies consolidation ranges, detects breakouts, and validates breaker blocks with swing points to trade retests with defined risk parameters. The system visualizes order and breaker blocks with dynamic labels and arrows, supporting automated trading and trailing stops.

Error 146 ("Trade context busy") and How to Deal with It

The article deals with conflict-free trading of several experts on one МТ 4 Client Terminal. It will be useful for those who have basic command of working with the terminal and programming in MQL 4.

Processing optimization results using the graphical interface

This is a continuation of the idea of processing and analysis of optimization results. This time, our purpose is to select the 100 best optimization results and display them in a GUI table. The user will be able to select a row in the optimization results table and receive a multi-symbol balance and drawdown graph on separate charts.

Self-adapting algorithm (Part III): Abandoning optimization

It is impossible to get a truly stable algorithm if we use optimization based on historical data to select parameters. A stable algorithm should be aware of what parameters are needed when working on any trading instrument at any time. It should not forecast or guess, it should know for sure.

Graphics in DoEasy library (Part 75): Methods of handling primitives and text in the basic graphical element

In this article, I will continue the development of the basic graphical element class of all library graphical objects powered by the CCanvas Standard Library class. I will create the methods for drawing graphical primitives and for displaying a text on a graphical element object.

Learn how to design a trading system by Fractals

This article is a new one from our series about how to design a trading system based on the most popular technical indicators. We will learn a new indicator which Fractals indicator and we will learn how to design a trading system based on it to be executed in the MetaTrader 5 terminal.

DIY multi-threaded asynchronous MQL5 WebRequest

The article describes the library allowing you to increase the efficiency of working with HTTP requests in MQL5. Execution of WebRequest in non-blocking mode is implemented in additional threads that use auxiliary charts and Expert Advisors, exchanging custom events and reading shared resources. The source codes are applied as well.

Learn how to design a trading system by Volumes

Here is a new article from our series about learning how to design a trading system based on the most popular technical indicators. The current article will be devoted to the Volumes indicator. Volume as a concept is one of the very important factors in financial markets trading and we have to pay attention to it. Through this article, we will learn how to design a simple trading system by Volumes indicator.

Automating Trading Strategies in MQL5 (Part 46): Liquidity Sweep on Break of Structure (BoS)

In this article, we build a Liquidity Sweep on Break of Structure (BoS) system in MQL5 that detects swing highs/lows over a user-defined length, labels them as HH/HL/LH/LL to identify BOS (HH in uptrend or LL in downtrend), and spots liquidity sweeps when price wicks beyond the swing but closes back inside on a bullish/bearish candle.

Automating Trading Strategies in MQL5 (Part 12): Implementing the Mitigation Order Blocks (MOB) Strategy

In this article, we build an MQL5 trading system that automates order block detection for Smart Money trading. We outline the strategy’s rules, implement the logic in MQL5, and integrate risk management for effective trade execution. Finally, we backtest the system to assess its performance and refine it for optimal results.

Automating Trading Strategies in MQL5 (Part 40): Fibonacci Retracement Trading with Custom Levels

In this article, we build an MQL5 Expert Advisor for Fibonacci retracement trading, using either daily candle ranges or lookback arrays to calculate custom levels like 50% and 61.8% for entries, determining bullish or bearish setups based on close vs. open. The system triggers buys or sells on price crossings of levels with max trades per level, optional closure on new Fib calcs, points-based trailing stops after a min profit threshold, and SL/TP buffers as percentages of the range.

Learn how to design a trading system by Momentum

In my previous article, I mentioned the importance of identifying the trend which is the direction of prices. In this article I will share one of the most important concepts and indicators which is the Momentum indicator. I will share how to design a trading system based on this Momentum indicator.

The Optimal Method for Calculation of Total Position Volume by Specified Magic Number

The problem of calculation of the total position volume of the specified symbol and magic number is considered in this article. The proposed method requests only the minimum necessary part of the history of deals, finds the closest time when the total position was equal to zero, and performs the calculations with the recent deals. Working with global variables of the client terminal is also considered.