Automating Trading Strategies in MQL5 (Part 42): Session-Based Opening Range Breakout (ORB) System

Introduction

In our previous article (Part 41), we developed a Candle Range Theory (CRT) trading system incorporating Accumulation, Manipulation, and Distribution (AMD) phases in MetaQuotes Language 5 (MQL5) that identified accumulation ranges on a specified timeframe, detected breaches with manipulation depth filtering, and confirmed reversals through bar closures for entry trades in the distribution phase. In Part 42, we develop a fully customizable Session-Based Opening Range Breakout (ORB) system.

This system allows us to define the start time and duration of any session in minutes. It automatically captures the true high and low during that period on a chosen timeframe. It detects breakouts with optional multi-bar close confirmation to reduce false signals. The system executes trades only in the breakout direction. Stop-loss and take-profit levels can be dynamic (range-size based) or static. Trailing stops can be used after a profit threshold has been reached. Position limits are enforced per direction. We will cover the following topics:

- Understanding the Opening Range Breakout (ORB) Strategy

- Implementation in MQL5

- Backtesting

- Conclusion

By the end, you’ll have an MQL5 program capable of trading clean opening range breakouts in any market session — London, New York, Asian, or even custom openings — ready for further customization. Let’s dive in!

Understanding the Opening Range Breakout (ORB) Strategy

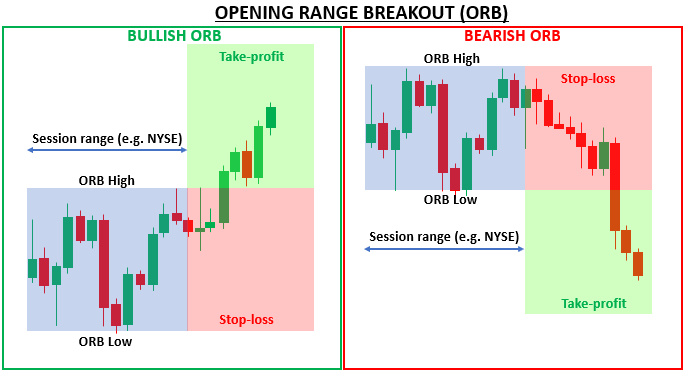

The Opening Range Breakout (ORB) is a classic intraday momentum strategy that capitalizes on the initial directional bias established at the start of a trading session. We define an "opening range" as the high and low formed during the first few minutes (typically 5–60 minutes) after the market opens, then wait for the price to break decisively above the range high (bullish breakout) or below the range low (bearish breakout) and enter in the direction of the break. The premise is simple but powerful: the opening range often represents the battle between buyers and sellers as the market digests overnight news and order flow, and a clean breakout signals that one side has won control, frequently leading to a sustained directional move. The system is generally easy. Have a look below at the different setups we could have.

Our plan is to create a fully session-flexible ORB system that works on any instrument and any trading session (New York, London, Asian, or even custom openings). We will allow users to set the exact start time. For example, 09:30 for the NYSE or 08:00 for London. Users will also be able to define the range duration in minutes. The system will automatically calculate the true high and low on the selected timeframe within that window. If needed, users can enable multiple bar-close confirmations to validate a breakout.

The algorithm will execute only one trade per direction per session. We will offer two types of stop-loss and take-profit calculations: dynamic (based on the range size) and static, with customizable risk-reward ratios. Points-based trailing stops will also be available, activating after a minimum profit threshold is reached. In addition, the tool will provide rich chart visualization. This includes filled range rectangles, vertical markers for session start and end, persistent high/low levels, and entry arrows.

Visualization is equally important in our case, as you might have noticed by now, for clarity. In brief, here is a visual representation of our objectives.

Implementation in MQL5

To create the program in MQL5, open the MetaEditor, go to the Navigator, locate the Experts folder, click on the "New" tab, and follow the prompts to create the file. Once it is made, in the coding environment, we will need to declare some input parameters and global variables that we will use throughout the program.

//+------------------------------------------------------------------+ //| ORB Opening Range Breakout EA.mq5 | //| Copyright 2025, Allan Munene Mutiiria. | //| https://t.me/Forex_Algo_Trader | //+------------------------------------------------------------------+ #property copyright "Copyright 2025, Allan Munene Mutiiria." #property link "https://t.me/Forex_Algo_Trader" #property version "1.00" #include <Trade\Trade.mqh> //+------------------------------------------------------------------+ //| Enums | //+------------------------------------------------------------------+ enum SLTP_Method { // Define SL/TP method enum Dynamic_Method = 0, // Dynamic based on range size Static_Method = 1 // Static based on fixed points }; enum TrailingTypeEnum { // Define trailing type enum Trailing_None = 0, // None Trailing_Points = 1 // By Points }; //+------------------------------------------------------------------+ //| Input Parameters | //+------------------------------------------------------------------+ input ENUM_TIMEFRAMES RangeTF = PERIOD_M5; // Timeframe for Opening Range Calculation input int RangeDurationMinutes = 30; // Duration of Opening Range in Minutes input string SessionStartTime = "09:00"; // Session Start Time (HH:MM) input double TradeVolume = 0.01; // Trade Volume Size input double RR_Ratio = 2.0; // Risk to Reward Ratio input SLTP_Method SLTP_Approach = Dynamic_Method; // SL/TP Calculation Method input int SL_Points = 50; // SL Points (for Static Method) input TrailingTypeEnum TrailingType = Trailing_None; // Trailing Stop Type input double Trailing_Stop_Points = 20.0; // Trailing Stop in Points input double Min_Profit_To_Trail_Points = 30.0; // Min Profit to Start Trailing in Points input int UniqueID = 987654321; // Unique Trade Identifier input int MaxPositionsDir = 1; // Max Positions per Direction input bool UseBreakoutFilter = true; // Use Breakout Confirmation Filter input int ConfirmBars = 1; // Bars to Confirm Breakout on Close (0 to disable)

We begin the implementation by including the trade library with "#include <Trade\Trade.mqh>", which supplies the CTrade class and functions necessary for order execution and position management. We then define two enumerations to organize user options clearly. The "SLTP_Method" enum provides "Dynamic_Method" for stop-loss and take-profit levels based on the actual opening range size and "Static_Method" for fixed points-based calculations. Similarly, the "TrailingTypeEnum" enum offers "Trailing_None" to disable trailing and "Trailing_Points" to enable trailing by a user-defined number of points once a minimum profit threshold is reached.

Next, we declare input parameters that make the program highly configurable directly from the properties window. These include "RangeTF" to select the timeframe used for calculating the opening range high and low, "RangeDurationMinutes" to set how many minutes after session start constitute the opening range, "SessionStartTime" as a string in "HH:MM" format to define when each new session begins (e.g., "09:30" for NYSE open, "08:00" for London, etc.), "TradeVolume" for lot size, and the rest which are self explanatory. We added comments for clarity. This set of inputs ensures the system can be perfectly adapted to any market or session without code changes. The next thing we need is the global variables definition.

//+------------------------------------------------------------------+ //| Global Variables | //+------------------------------------------------------------------+ CTrade obj_Trade; //--- Trade object datetime sessionStart = 0; //--- Session start time datetime rangeEndTime = 0; //--- Range end time double rangeHigh = 0.0; //--- Range high double rangeLow = 0.0; //--- Range low bool rangeDefined = false; //--- Range defined flag bool breakoutHigh = false; //--- Breakout high flag bool breakoutLow = false; //--- Breakout low flag double breakoutPrice = 0.0; //--- Breakout price string highLevelObj = "ORB_HighLevel"; //--- High level object name string lowLevelObj = "ORB_LowLevel"; //--- Low level object name string highTextObj = "ORB_High_Text"; //--- High text object string lowTextObj = "ORB_Low_Text"; //--- Low text object bool tradedLong = false; //--- Traded long flag bool tradedShort = false; //--- Traded short flag datetime lastConfirmTime = 0; //--- Last confirm time

We continue by declaring a set of global variables that maintain the program's state throughout each trading session and ensure proper tracking of the opening range breakout logic. We instantiate "obj_Trade" from the CTrade class to handle all order executions and position modifications. Timing variables include "sessionStart" to record the exact datetime when a new session begins and "rangeEndTime" to mark when the opening range period concludes. We track the opening range boundaries with "rangeHigh" (initialized to 0.0) and "rangeLow", while "rangeDefined" serves as a boolean flag indicating whether the current session's range has been fully established. The rest are straightforward. Once that is done, we need to initialize the system by just setting the magic number.

//+------------------------------------------------------------------+ //| EA Start Function | //+------------------------------------------------------------------+ int OnInit() { obj_Trade.SetExpertMagicNumber(UniqueID); //--- Set magic number return(INIT_SUCCEEDED); //--- Return success }

In the OnInit event handler, which executes automatically when the program is first loaded or attached to a chart, we assign the user-defined "UniqueID" as the magic number to the "obj_Trade" object by calling "obj_Trade.SetExpertMagicNumber(UniqueID)". This ensures that every trade opened by the program carries this unique identifier, allowing precise filtering and management even when multiple programs or manual trades are active on the same account. We conclude by returning INIT_SUCCEEDED, confirming to the platform that initialization completed without issues and the program is ready for operation. We will define some helper functions that we will use for visualization when we have the logic ready, as below.

//+------------------------------------------------------------------+ //| Render Horizontal Level | //+------------------------------------------------------------------+ void RenderLevel(string objName, double levelVal, color levelClr, string levelDesc) { ObjectDelete(ChartID(), objName); //--- Delete object ObjectCreate(ChartID(), objName, OBJ_HLINE, 0, 0, levelVal); //--- Create hline ObjectSetInteger(ChartID(), objName, OBJPROP_COLOR, levelClr); //--- Set color ObjectSetInteger(ChartID(), objName, OBJPROP_STYLE, STYLE_DOT); //--- Set style ObjectSetString(ChartID(), objName, OBJPROP_TOOLTIP, levelDesc); //--- Set tooltip ChartRedraw(ChartID()); //--- Redraw chart } //+------------------------------------------------------------------+ //| Render Vertical Line | //+------------------------------------------------------------------+ void RenderVLine(string objName, datetime timeVal, color lineClr, string desc) { ObjectDelete(ChartID(), objName); //--- Delete object ObjectCreate(ChartID(), objName, OBJ_VLINE, 0, timeVal, 0); //--- Create vline ObjectSetInteger(ChartID(), objName, OBJPROP_COLOR, lineClr); //--- Set color ObjectSetInteger(ChartID(), objName, OBJPROP_STYLE, STYLE_DOT); //--- Set style ObjectSetInteger(ChartID(), objName, OBJPROP_WIDTH, 1); //--- Set width ObjectSetInteger(ChartID(), objName, OBJPROP_BACK, true); //--- Set back ObjectSetInteger(ChartID(), objName, OBJPROP_RAY, true); //--- Set ray ObjectSetInteger(ChartID(), objName, OBJPROP_HIDDEN, true); //--- Set hidden ObjectSetString(ChartID(), objName, OBJPROP_TOOLTIP, desc); //--- Set tooltip ChartRedraw(ChartID()); //--- Redraw chart } //+------------------------------------------------------------------+ //| Render Text Label | //+------------------------------------------------------------------+ void RenderText(string objName, datetime timeVal, double priceVal, string textStr, color textClr, int anchorVal) { ObjectDelete(ChartID(), objName); //--- Delete object ObjectCreate(ChartID(), objName, OBJ_TEXT, 0, timeVal, priceVal); //--- Create text ObjectSetString(ChartID(), objName, OBJPROP_TEXT, textStr); //--- Set text ObjectSetInteger(ChartID(), objName, OBJPROP_COLOR, textClr); //--- Set color ObjectSetInteger(ChartID(), objName, OBJPROP_ANCHOR, anchorVal); //--- Set anchor ObjectSetInteger(ChartID(), objName, OBJPROP_FONTSIZE, 10); //--- Set fontsize ChartRedraw(ChartID()); //--- Redraw chart } //+------------------------------------------------------------------+ //| Draw Entry Arrow | //+------------------------------------------------------------------+ void DrawEntryArrow(datetime timeVal, double priceVal, bool isBuy) { string markerName = "EntryMarker_" + IntegerToString(timeVal); //--- Marker name ObjectCreate(ChartID(), markerName, OBJ_ARROW, 0, timeVal, priceVal); //--- Create arrow int arrowCode = isBuy ? 233 : 234; //--- Arrow code color arrowClr = isBuy ? clrBlue : clrRed; //--- Arrow color int anchor = isBuy ? ANCHOR_BOTTOM : ANCHOR_TOP; //--- Anchor ObjectSetInteger(ChartID(), markerName, OBJPROP_ARROWCODE, arrowCode); //--- Set code ObjectSetInteger(ChartID(), markerName, OBJPROP_COLOR, arrowClr); //--- Set color ObjectSetInteger(ChartID(), markerName, OBJPROP_ANCHOR, anchor); //--- Set anchor ChartRedraw(ChartID()); //--- Redraw chart } //+------------------------------------------------------------------+ //| Count Active Positions by Type | //+------------------------------------------------------------------+ int ActivePositions(ENUM_POSITION_TYPE posType) { int total = 0; //--- Init total for (int pos = PositionsTotal() - 1; pos >= 0; pos--) { //--- Iterate positions if (PositionGetSymbol(pos) == _Symbol && PositionGetInteger(POSITION_MAGIC) == UniqueID && PositionGetInteger(POSITION_TYPE) == posType) { //--- Check position total++; //--- Increment total } } return total; //--- Return total }

Here, we create several helper functions to handle chart visualization and position management, ensuring the opening range and trade signals are clearly displayed while maintaining clean code organization. The "RenderLevel" function draws or updates persistent horizontal lines for the range high and low. It deletes any existing object with the given name, creates a new OBJ_HLINE at the specified price level, sets its color (green for high, red for low), applies a dotted style, adds a descriptive tooltip, and redraws the chart for immediate visibility.

Similarly, the "RenderVLine" function places vertical lines to mark session start and range end times. It removes prior instances, creates an OBJ_VLINE at the given datetime, configures it with blue color, dotted style, width 1, background placement, rightward ray extension, hidden from object list, a tooltip showing the exact time, and triggers a chart redraw using the ChartRedraw function. The "RenderText" function adds customizable text labels, such as start/end times or "ORB High"/"ORB Low" annotations. It clears existing text objects, creates an OBJ_TEXT at the specified time and price coordinates, sets the text content, and other properties.

For trade entries, we implement "DrawEntryArrow," which places a visual marker directly on the chart at the moment of execution. It generates a unique name using the current time, creates an OBJ_ARROW, selects Wingdings symbol 233 (up arrow) for buys or 234 (down arrow) for sells, applies blue for long or red for short, anchors it correctly at the bottom or top, and redraws the chart. For the arrow codes, MQL5 has dedicated fonts as below, and you can switch to whichever you like.

Finally, we define the "ActivePositions" function to safely count how many open positions exist for a specific type (buy or sell) that belong to this program. It loops backward through all positions, checks for a matching symbol, magic number via "UniqueID", and position type using POSITION_TYPE_BUY or "POSITION_TYPE_SELL", then returns the accurate count. With these, we can now begin the strategy implementation by first defining the ranges daily.

//+------------------------------------------------------------------+ //| Tick Processing Function | //+------------------------------------------------------------------+ void OnTick() { datetime currentTime = TimeCurrent(); //--- Get current time MqlDateTime timeStruct; //--- Time structure TimeToStruct(currentTime, timeStruct); //--- Convert to struct // Determine if a new session has started string currentTimeStr = StringFormat("%02d:%02d", timeStruct.hour, timeStruct.min); //--- Format time string if (currentTimeStr == SessionStartTime && sessionStart != currentTime - (timeStruct.hour * 3600 + timeStruct.min * 60 + timeStruct.sec)) { //--- Check new session sessionStart = currentTime - timeStruct.sec; //--- Align to minute start rangeEndTime = sessionStart + RangeDurationMinutes * 60; //--- Calc end time rangeHigh = 0.0; //--- Reset high rangeLow = DBL_MAX; //--- Reset low rangeDefined = false; //--- Reset defined breakoutHigh = false; //--- Reset high breakout breakoutLow = false; //--- Reset low breakout tradedLong = false; //--- Reset long traded tradedShort = false; //--- Reset short traded lastConfirmTime = 0; //--- Reset confirm time // Clean previous visuals for current levels ObjectDelete(ChartID(), highLevelObj); //--- Delete high level ObjectDelete(ChartID(), lowLevelObj); //--- Delete low level ObjectDelete(ChartID(), highTextObj); //--- Delete high text ObjectDelete(ChartID(), lowTextObj); //--- Delete low text } if (sessionStart == 0) return; //--- Return if no session double currBid = SymbolInfoDouble(_Symbol, SYMBOL_BID); //--- Get bid double currAsk = SymbolInfoDouble(_Symbol, SYMBOL_ASK); //--- Get ask // Define the opening range if (currentTime < rangeEndTime) { //--- Check within range rangeHigh = MathMax(rangeHigh, iHigh(_Symbol, RangeTF, 0)); //--- Update high rangeLow = MathMin(rangeLow, iLow(_Symbol, RangeTF, 0)); //--- Update low } else if (!rangeDefined) { //--- Check not defined rangeDefined = true; //--- Set defined // Draw the opening range rectangle string rectObj = "ORB_Rectangle_" + IntegerToString(sessionStart); //--- Rect name ObjectCreate(ChartID(), rectObj, OBJ_RECTANGLE, 0, sessionStart, rangeHigh, rangeEndTime, rangeLow); //--- Create rect ObjectSetInteger(ChartID(), rectObj, OBJPROP_COLOR, clrLightBlue); //--- Set color ObjectSetInteger(ChartID(), rectObj, OBJPROP_FILL, true); //--- Set fill ObjectSetInteger(ChartID(), rectObj, OBJPROP_BACK, true); //--- Set back ObjectSetInteger(ChartID(), rectObj, OBJPROP_STYLE, STYLE_SOLID); //--- Set style ChartRedraw(ChartID()); //--- Redraw chart // Add vertical lines for start and end string startVLineObj = "ORB_StartVLine_" + IntegerToString(sessionStart); //--- Start vline name RenderVLine(startVLineObj, sessionStart, clrBlue, "ORB Start at " + TimeToString(sessionStart, TIME_MINUTES)); //--- Render start vline string endVLineObj = "ORB_EndVLine_" + IntegerToString(sessionStart); //--- End vline name RenderVLine(endVLineObj, rangeEndTime, clrBlue, "ORB End at " + TimeToString(rangeEndTime, TIME_MINUTES)); //--- Render end vline // Add time text labels for start and end double textOffset = (rangeHigh - rangeLow) * 0.05; //--- Calc offset string startTimeTextObj = "ORB_StartTime_Text_" + IntegerToString(sessionStart); //--- Start text name RenderText(startTimeTextObj, sessionStart, rangeLow - textOffset, TimeToString(sessionStart, TIME_MINUTES), clrBlue, ANCHOR_UPPER); //--- Render start text string endTimeTextObj = "ORB_EndTime_Text_" + IntegerToString(sessionStart); //--- End text name RenderText(endTimeTextObj, rangeEndTime, rangeLow - textOffset, TimeToString(rangeEndTime, TIME_MINUTES), clrBlue, ANCHOR_UPPER); //--- Render end text // Render high and low levels RenderLevel(highLevelObj, rangeHigh, clrGreen, "ORB High"); //--- Render high level RenderLevel(lowLevelObj, rangeLow, clrRed, "ORB Low"); //--- Render low level // Add text labels RenderText(highTextObj, rangeEndTime, rangeHigh, "ORB High", clrGreen, ANCHOR_RIGHT_LOWER); //--- Render high text RenderText(lowTextObj, rangeEndTime, rangeLow, "ORB Low", clrRed, ANCHOR_RIGHT_UPPER); //--- Render low text } }

In the OnTick event handler, we begin by capturing the server's current time with TimeCurrent into "currentTime", converting it to an MqlDateTime structure via TimeToStruct to access individual components like hour and minute. We then format the current time as a "HH:MM" string using StringFormat and store it in "currentTimeStr". This is how the structure looks.

struct MqlDateTime { int year; // Year int mon; // Month int day; // Day int hour; // Hour int min; // Minutes int sec; // Seconds int day_of_week; // Day of week (0-Sunday, 1-Monday, ... ,6-Saturday) int day_of_year; // Day number of the year (January 1st is assigned the number value of zero) };

Segregating into a structure helps us get the specific components with ease. To detect the exact start of a new trading session, we compare this string to the user-defined "SessionStartTime". The additional condition ensures we trigger only once per day by checking that "sessionStart" does not already match the current day aligned to that minute (subtracting seconds to normalize). When a new session begins, we align "sessionStart" precisely to the start of that minute by subtracting remaining seconds, calculate "rangeEndTime" by adding "RangeDurationMinutes" × 60 seconds, reset "rangeHigh" to 0.0 and "rangeLow" to the maximum double value for proper initial updates, clear all flags ("rangeDefined", "breakoutHigh", "breakoutLow", "tradedLong", "tradedShort", "lastConfirmTime"), and delete the persistent high/low level and text objects from the previous session to prepare a clean slate. If no active session has been detected yet ("sessionStart" == 0), we simply return to avoid unnecessary processing. Otherwise, we retrieve the current bid and ask prices using the SymbolInfoDouble function.

During the opening range formation period (while "currentTime" < "rangeEndTime"), we continuously update the range boundaries by setting "rangeHigh" to the maximum of its current value or the latest bar's high on "RangeTF" at shift 0 via "iHigh", and "rangeLow" to the minimum of its current value or the latest bar's low via the iLow function. Once the range period ends and the range hasn't been finalized yet ("!rangeDefined"), we set "rangeDefined" to true and proceed to visualize the completed opening range.

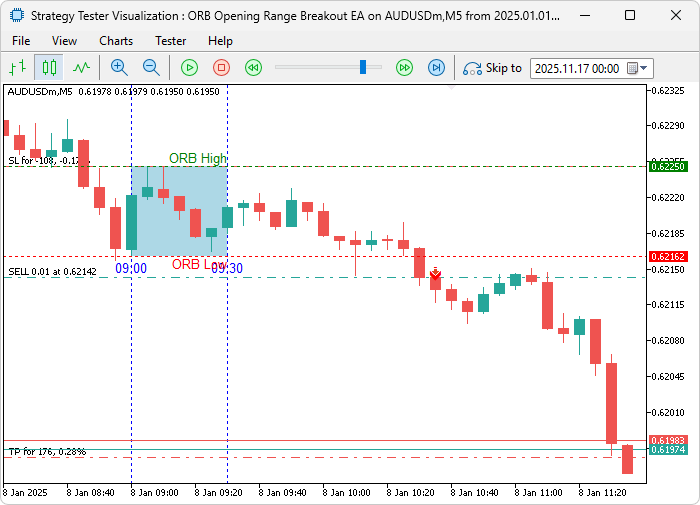

We draw a filled light-blue rectangle spanning from "sessionStart" at "rangeHigh" to "rangeEndTime" at "rangeLow" using a unique name based on the session timestamp, with solid style and background placement. Vertical blue dotted lines are added at both start and end times via "RenderVLine" with descriptive tooltips. Time labels are placed just below the range using "RenderText" with a small offset calculated as 5% of the range size, anchored upward in blue. Finally, we render the persistent horizontal levels with "RenderLevel" (green for high, red for low) and their corresponding text labels anchored at the right side of the range end time, ensuring we always see the exact breakout levels even hours or days later. Upon compilation, we get the following outcome.

With the ranges established, we just need to track them and their breakouts, and once we break from either range, we determine the direction and thus the type of breakout setup and open trades. Easy peasy. Here is the logic we use to achieve that.

if (!rangeDefined) return; //--- Return if not defined // Detect breakout bool justBreached = false; //--- Init just breached if (currAsk > rangeHigh && !breakoutHigh) { //--- Check high breakout breakoutHigh = true; //--- Set high breakout justBreached = true; //--- Set just breached breakoutPrice = currAsk; //--- Set breakout price } else if (currBid < rangeLow && !breakoutLow) { //--- Check low breakout breakoutLow = true; //--- Set low breakout justBreached = true; //--- Set just breached breakoutPrice = currBid; //--- Set breakout price } if ((breakoutHigh || breakoutLow) && !(tradedLong || tradedShort)) { //--- Check breakout and not traded // Confirm breakout with bar closures if enabled bool confirmed = false; //--- Init confirmed if (ConfirmBars == 0) { //--- Check no confirm confirmed = true; //--- Set confirmed } else { //--- Else datetime currConfirmTime = iTime(_Symbol, RangeTF, 0); //--- Get confirm time if (currConfirmTime != lastConfirmTime) { //--- Check new confirm lastConfirmTime = currConfirmTime; //--- Update last confirm int confirmCount = 0; //--- Init count for (int i = 1; i <= ConfirmBars; i++) { //--- Iterate bars double closePrice = iClose(_Symbol, RangeTF, i); //--- Get close if (breakoutHigh && closePrice > rangeHigh) confirmCount++; //--- Check high if (breakoutLow && closePrice < rangeLow) confirmCount++; //--- Check low } if (confirmCount >= ConfirmBars) confirmed = true; //--- Set confirmed } } if (confirmed && UseBreakoutFilter) { //--- Check confirmed and filter // Additional filter logic if needed, but for now assume confirmed } if (confirmed) { //--- Check confirmed double sl = 0.0, tp = 0.0; //--- Init SL TP if (breakoutHigh && ActivePositions(POSITION_TYPE_BUY) < MaxPositionsDir && !tradedLong) { //--- Check long entry if (SLTP_Approach == Dynamic_Method) { //--- Check dynamic double rangeSize = rangeHigh - rangeLow; //--- Calc range size sl = NormalizeDouble(rangeLow, _Digits); //--- Set SL tp = NormalizeDouble(currAsk + rangeSize * RR_Ratio, _Digits); //--- Set TP } else { //--- Static sl = NormalizeDouble(currAsk - SL_Points * _Point, _Digits); //--- Set SL tp = NormalizeDouble(currAsk + (SL_Points * _Point) * RR_Ratio, _Digits); //--- Set TP } if (obj_Trade.Buy(TradeVolume, _Symbol, currAsk, sl, tp, "ORB Long Breakout")) { //--- Open buy if (obj_Trade.ResultRetcode() == TRADE_RETCODE_DONE) { //--- Check success Print("Long Breakout: Entry at ", DoubleToString(currAsk, _Digits), " SL at ", DoubleToString(sl, _Digits), " TP at ", DoubleToString(tp, _Digits)); //--- Log entry DrawEntryArrow(currentTime, currBid, true); //--- Draw arrow tradedLong = true; //--- Set long traded } } } else if (breakoutLow && ActivePositions(POSITION_TYPE_SELL) < MaxPositionsDir && !tradedShort) { //--- Check short entry if (SLTP_Approach == Dynamic_Method) { //--- Check dynamic double rangeSize = rangeHigh - rangeLow; //--- Calc range size sl = NormalizeDouble(rangeHigh, _Digits); //--- Set SL tp = NormalizeDouble(currBid - rangeSize * RR_Ratio, _Digits); //--- Set TP } else { //--- Static sl = NormalizeDouble(currBid + SL_Points * _Point, _Digits); //--- Set SL tp = NormalizeDouble(currBid - (SL_Points * _Point) * RR_Ratio, _Digits); //--- Set TP } if (obj_Trade.Sell(TradeVolume, _Symbol, currBid, sl, tp, "ORB Short Breakout")) { //--- Open sell if (obj_Trade.ResultRetcode() == TRADE_RETCODE_DONE) { //--- Check success Print("Short Breakout: Entry at ", DoubleToString(currBid, _Digits), " SL at ", DoubleToString(sl, _Digits), " TP at ", DoubleToString(tp, _Digits)); //--- Log entry DrawEntryArrow(currentTime, currAsk, false); //--- Draw arrow tradedShort = true; //--- Set short traded } } } } }

Once the opening range is fully defined, we immediately return if "rangeDefined" is still false, ensuring no breakout logic runs prematurely. We then monitor for a breakout: if the current ask price exceeds "rangeHigh" and "breakoutHigh" is not yet set, we mark a bullish breakout by setting "breakoutHigh" to true, record the exact breakout price in "breakoutPrice", and note that a fresh breach has occurred. We do the same thing for low breakout. When at least one breakout direction is active and neither a long nor short trade has been taken in this session ("!tradedLong && !tradedShort"), we proceed to the confirmation stage. If "ConfirmBars" is zero, the breakout is considered instantly confirmed. Otherwise, on each new bar of the range timeframe (detected by comparing iTime at shift 0 with "lastConfirmTime"), we count how many of the previous "ConfirmBars" bars closed decisively outside the range — above "rangeHigh" for bullish or below "rangeLow" for bearish. Only when the required number of confirming closes is reached do we set "confirmed" to true.

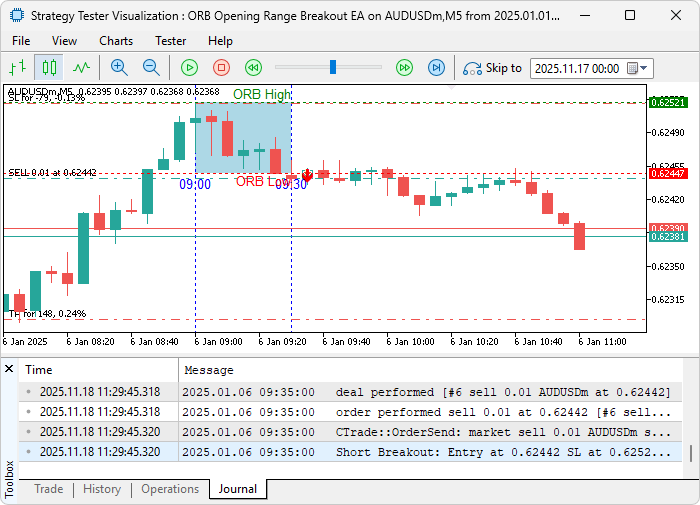

We respect the "UseBreakoutFilter" input (though currently it simply passes the confirmation forward — room for future enhancements if you want to add more filters). Once confirmed, we calculate stop-loss and take-profit levels according to the chosen method. For a bullish breakout, if buy positions are below "MaxPositionsDir" and no long has been traded yet, we use dynamic mode to place stop-loss exactly at the range low (normalized) and take-profit at current ask plus the full range size multiplied by "RR_Ratio". In static mode, we place a stop-loss at a fixed "SL_Points" below the ask and take-profit the same distance times ratio above. We then execute the buy order via "obj_Trade.Buy", and on success (TRADE_RETCODE_DONE), log the entry details to the Experts tab, draw a blue upward arrow at the entry using "DrawEntryArrow", and set "tradedLong" to true to lock out further longs this session. The bearish side mirrors this exactly. Upon compilation, we get the following outcome.

From the image, we can see that we open trades once we have a breakout. We now just need to manage the open positions by applying a trailing stop once the market moves in our favour, if we want to.

//+------------------------------------------------------------------+ //| Apply Points Trailing Stop | //+------------------------------------------------------------------+ void ApplyPointsTrailing() { double point = _Point; //--- Get point for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate positions if (PositionGetTicket(i) > 0) { //--- Check ticket if (PositionGetString(POSITION_SYMBOL) == _Symbol && PositionGetInteger(POSITION_MAGIC) == UniqueID) { //--- Check symbol magic double sl = PositionGetDouble(POSITION_SL); //--- Get SL double tp = PositionGetDouble(POSITION_TP); //--- Get TP double openPrice = PositionGetDouble(POSITION_PRICE_OPEN); //--- Get open ulong ticket = PositionGetInteger(POSITION_TICKET); //--- Get ticket if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY) { //--- Check buy double newSL = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_BID) - Trailing_Stop_Points * point, _Digits); //--- Calc new SL if (newSL > sl && SymbolInfoDouble(_Symbol, SYMBOL_BID) - openPrice > Min_Profit_To_Trail_Points * point) { //--- Check conditions obj_Trade.PositionModify(ticket, newSL, tp); //--- Modify position } } else if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL) { //--- Check sell double newSL = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_ASK) + Trailing_Stop_Points * point, _Digits); //--- Calc new SL if (newSL < sl && openPrice - SymbolInfoDouble(_Symbol, SYMBOL_ASK) > Min_Profit_To_Trail_Points * point) { //--- Check conditions obj_Trade.PositionModify(ticket, newSL, tp); //--- Modify position } } } } } } //--- Call the function per tick in the "OnTick" event handler if (TrailingType == Trailing_Points && PositionsTotal() > 0) { //--- Check trailing ApplyPointsTrailing(); //--- Apply trailing }

Here, we implement the "ApplyPointsTrailing" function to dynamically trail the stop-loss when "Trailing_Points" mode is selected, protecting profits as the market moves in our favor. The function begins by storing the symbol's point value in "point" using _Point. It then iterates backward through all open positions to safely handle any modifications without index conflicts. For each valid ticket, we verify that the position belongs to the current symbol and carries our "UniqueID" magic number. We retrieve the current stop-loss, take-profit, open price, and ticket number.

For buy positions, we calculate a potential new stop-loss by subtracting "Trailing_Stop_Points" × point from the current bid (normalized to the symbol's digits). We only apply the modification if this new level is higher than the existing stop-loss (tightening it) and the unrealized profit exceeds "Min_Profit_To_Trail_Points" × point, ensuring we only trail after a meaningful buffer. The position is updated via "obj_Trade.PositionModify" while preserving the original take-profit. The logic for sell positions mirrors this exactly. Finally, at the end of OnTick, we check if trailing is enabled ("TrailingType == Trailing_Points") and there are open positions. If so, we immediately invoke "ApplyPointsTrailing" on every tick, providing real-time profit protection without delay. Finally, we need to delete our visualization objects when we remove the program from the chart.

//+------------------------------------------------------------------+ //| EA Stop Function | //+------------------------------------------------------------------+ void OnDeinit(const int code) { ObjectDelete(ChartID(), highLevelObj); //--- Delete high level ObjectDelete(ChartID(), lowLevelObj); //--- Delete low level ObjectDelete(ChartID(), highTextObj); //--- Delete high text ObjectDelete(ChartID(), lowTextObj); //--- Delete low text // Clean dynamic objects ObjectsDeleteAll(ChartID(), "ORB_Rectangle_", OBJ_RECTANGLE); //--- Delete rectangles ObjectsDeleteAll(ChartID(), "ORB_StartVLine_", OBJ_VLINE); //--- Delete start vlines ObjectsDeleteAll(ChartID(), "ORB_EndVLine_", OBJ_VLINE); //--- Delete end vlines ObjectsDeleteAll(ChartID(), "ORB_StartTime_Text_", OBJ_TEXT); //--- Delete start texts ObjectsDeleteAll(ChartID(), "ORB_EndTime_Text_", OBJ_TEXT); //--- Delete end texts ObjectsDeleteAll(ChartID(), "EntryMarker_", OBJ_ARROW); //--- Delete entry markers }

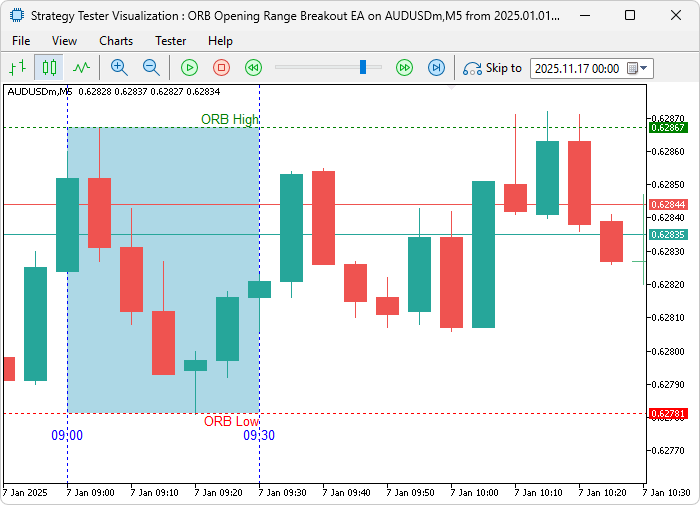

In the OnDeinit function, which runs when the program is removed from the chart or the terminal shuts down, we first delete the four persistent objects by name: the high and low horizontal levels via "highLevelObj" and "lowLevelObj", and their text labels with "highTextObj" and "lowTextObj". We then use ObjectsDeleteAll to remove every dynamically created object from the current session and all previous ones. This complete cleanup prevents object accumulation across multiple sessions or chart reloads. Upon compilation, we get the following outcome when the trailing stop is enabled.

From the visualization, we can see that we define the ranges, open positions, and manage them by applying trailing stops when needed, hence achieving our objectives. The thing that remains is backtesting the program, and that is handled in the next section.

Backtesting

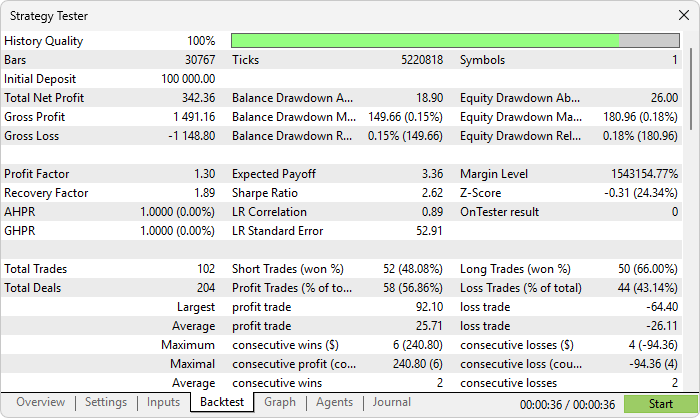

After thorough backtesting, we have the following results.

Backtest graph:

Backtest report:

Conclusion

In conclusion, we’ve developed a session-based Opening Range Breakout (ORB) system in MQL5 that allows custom session start times and opening range durations in minutes, automatically determines the true high and low on a selected timeframe, detects breakouts with optional multi-bar close confirmation, and executes trades only in the breakout direction.

Disclaimer: This article is for educational purposes only. Trading carries significant financial risks, and market volatility may result in losses. Thorough backtesting and careful risk management are crucial before deploying this program in live markets.

With this session-based Opening Range Breakout strategy, you’re equipped to trade intraday breakout setups in any chosen market session, ready for further optimization in your trading journey. Happy trading!

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

From Basic to Intermediate: Struct (I)

From Basic to Intermediate: Struct (I)

MetaTrader 5 Machine Learning Blueprint (Part 6): Engineering a Production-Grade Caching System

MetaTrader 5 Machine Learning Blueprint (Part 6): Engineering a Production-Grade Caching System

The MQL5 Standard Library Explorer (Part 4): Custom Signal Library

The MQL5 Standard Library Explorer (Part 4): Custom Signal Library

Market Positioning Codex for VGT with Kendall's Tau and Distance Correlation

Market Positioning Codex for VGT with Kendall's Tau and Distance Correlation

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi Allan and thanks for your continuing contributions , nicely put together than you , I was wondering if you have any solutions for automating the opening time ? generally I use broker time change but it is not always accurate for me as I am in NZ my broker is in AU there are factors like austalias offset and times when there is a tokyo offset and a new york offset . I have had trouble getting this to work , any suggestions appreciated . chat gpt gives me me a scipt that checks each coutnries daylight saving dates, was wondering if there was a more eloquent solution

Hello. Thanks for the kind feedback. You can define the time in your code by using the local time instead of the broker's time or you can define yours. See example.

Local time:

TimeLocal()You can also use direct time as per your computer's settings using the trade server:

TimeTradeServer()GMT Time:

TimeGMT()You could also define your dedicated date and time as below:

It is all upon you to choose the best approach. Thanks.

Hi Allan and thanks for your continuing contributions , nicely put together than you , I was wondering if you have any solutions for automating the opening time ? generally I use broker time change but it is not always accurate for me as I am in NZ my broker is in AU there are factors like austalias offset and times when there is a tokyo offset and a new york offset . I have had trouble getting this to work , any suggestions appreciated . chat gpt gives me me a scipt that checks each coutnries daylight saving dates, was wondering if there was a more eloquent solution

Your problem is not clear enough. But you can try the extensive Local Timezones and Local Session Hours library or more simple TimeServerDaylightSavings. Without time adjustments you can't reliably test your strategy on a history which usually affected by DST and timezone switches. Or probably you want Determine Broker's Daylight (DST) schedule to detect timezone changes online.

Unfortunately, built-in MQL5 API does not provide a ready-made and more eloquent solution.