Automating Trading Strategies in MQL5 (Part 26): Building a Pin Bar Averaging System for Multi-Position Trading

Introduction

In our previous article (Part 25), we developed a trendline trading system in MetaQuotes Language 5 (MQL5) that used least squares fit to detect support and resistance trendlines, generating automated trades based on price touches with visual feedback. In Part 26, we create a Pin Bar Averaging program that identifies pin bar candlestick patterns to initiate trades and manages multiple positions through an averaging strategy, incorporating trailing stops, breakeven adjustments, and a dashboard for real-time monitoring. We will cover the following topics:

By the end, you’ll have a powerful MQL5 strategy for pin bar-based trading, ready for customization—let’s get started!

Understanding the Pin Bar Averaging Framework

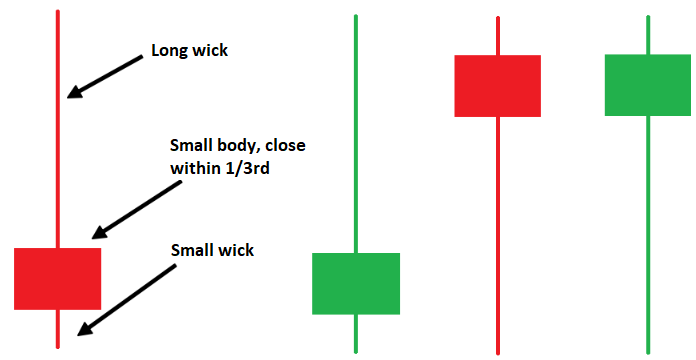

We’re building an automated trading system that capitalizes on pin bar candlestick patterns, which are single-candle formations characterized by a long wick and a small body, often signaling strong price reversals at key market levels. Pin bar strategies are popular in trading because they identify moments where price rejection occurs, offering high-probability entry points for trades, especially when combined with support and resistance levels. Here is a visualization of some common formations.

Our approach will focus on detecting these pin bars within the current timeframe and utilizing an averaging strategy to open additional positions if the market moves against the initial trade. This aims to improve the overall trade outcome while managing risk through the use of trailing stops and breakeven adjustments. To achieve this, we first will identify pin bars relative to a support or resistance level derived from the previous H4 candle’s close, ensuring trades align with significant market zones.

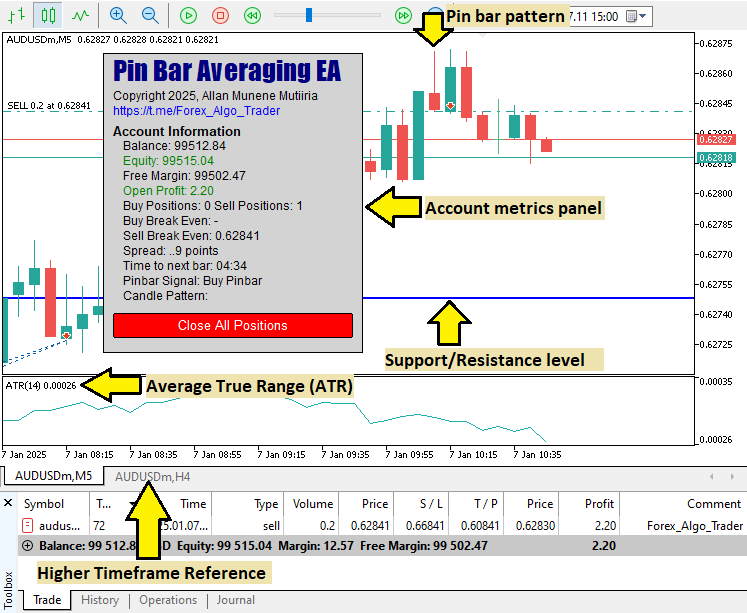

Then, we will implement an averaging mechanism to add positions at predefined price intervals, enhancing flexibility in volatile conditions. Finally, we will incorporate a dashboard to display real-time trade metrics and use visual indicators like lines to mark key levels, ensuring we can monitor and adjust our strategy effectively. Have a look at what we will be aiming to achieve, and then we can proceed to the implementation.

Implementation in MQL5

To create the program in MQL5, open the MetaEditor, go to the Navigator, locate the Indicators folder, click on the "New" tab, and follow the prompts to create the file. Once it is made, in the coding environment, we will start by declaring some inputs and global variables that will make the program more dynamic.

//+------------------------------------------------------------------+ //| a. Pin Bar Averaging EA.mq5 | //| Copyright 2025, Allan Munene Mutiiria. | //| https://t.me/Forex_Algo_Trader | //+------------------------------------------------------------------+ #property copyright "Copyright 2025, Allan Munene Mutiiria." #property link "https://t.me/Forex_Algo_Trader" #property version "1.00" #property strict #include <Trade\Trade.mqh> //--- Include Trade library for trading operations CTrade obj_Trade; //--- Instantiate trade object //+------------------------------------------------------------------+ //| Trading signal enumeration | //+------------------------------------------------------------------+ enum EnableTradingBySignal { //--- Define trading signal enum ENABLED = 1, // Enable trading signals DISABLED = 0 // Disable trading signals }; //+------------------------------------------------------------------+ //| Input parameters | //+------------------------------------------------------------------+ input bool useSignalMode = DISABLED; // Set signal mode (ENABLED/DISABLED) input int orderDistancePips = 50; // Set order distance (pips) input double lotMultiplier = 1; // Set lot size multiplier input bool useRSIFilter = false; // Enable RSI filter input int magicNumber = 123456789; // Set magic number input double initialLotSize = 0.01; // Set initial lot size input int compoundPercent = 2; // Set compounding percent (0 for fixed lots) input int maxOrders = 5; // Set maximum orders input double stopLossPips = 400; // Set stop loss (pips) input double takeProfitPips = 200; // Set take profit (pips) input bool useAutoTakeProfit = true; // Enable auto take profit input bool useTrailingStop = true; // Enable trailing stop input double trailingStartPips = 15; // Set trailing start (pips) input double breakevenPips = 10; // Set breakeven (pips) input string orderComment = "Forex_Algo_Trader"; // Set order comment input color lineColor = clrBlue; // Set line color input int lineWidth = 2; // Set line width //+------------------------------------------------------------------+ //| Global variables | //+------------------------------------------------------------------+ bool isTradingAllowed(); //--- Declare trading allowed check double slBreakevenMinus = 0; //--- Initialize breakeven minus double normalizedPoint; //--- Declare normalized point ulong currentTicket = 0; //--- Initialize current ticket double buyCount, currentBuyLot, totalBuyLots; //--- Declare buy metrics double sellCount, currentSellLot, totalSellLots; //--- Declare sell metrics double totalSum, totalSwap; //--- Declare total sum and swap double buyProfit, sellProfit, totalOperations; //--- Declare profit and operations double buyWeightedSum, sellWeightedSum; //--- Declare weighted sums double buyBreakEvenPrice, sellBreakEvenPrice; //--- Declare breakeven prices double minBuyLot, minSellLot; //--- Declare minimum lot sizes double maxSellPrice, minBuyPrice; //--- Declare price extremes

To lay the foundation for the Pin Bar Averaging system in MQL5 to automate trading based on pin bar patterns with a robust position management system, we first include the "<Trade\Trade.mqh>" library and instantiate "obj_Trade" as a CTrade object to handle trade operations like opening and closing positions. Then, we proceed to define the "EnableTradingBySignal" enumeration with "ENABLED" (1) and "DISABLED" (0) to control whether trading signals are used for position management. Next, we set up input parameters to customize the EA: a boolean to toggle signal mode, order distance in pips, lot size multiplier, RSI filter toggle, magic number for trade identification, initial lot size, compounding percentage (0 for fixed lots), maximum orders, stop loss and take profit in pips, toggles for auto take profit and trailing stop, trailing start and breakeven in pips, order comment, and line color and width for visual indicators.

Last, we declare global variables: a function "isTradingAllowed" to check trading conditions, "slBreakevenMinus" initialized to 0 for stop loss adjustments, "normalizedPoint" for price scaling, "currentTicket" for tracking trades, counters and sums like "buyCount", "currentBuyLot", "totalBuyLots", "sellCount", "currentSellLot", "totalSellLots", "totalSum", "totalSwap", "buyProfit", "sellProfit", "totalOperations", "buyWeightedSum", "sellWeightedSum", "buyBreakEvenPrice", "sellBreakEvenPrice", "minBuyLot", "minSellLot", "maxSellPrice", and "minBuyPrice" for position metrics, establishing the EA’s core framework for pin bar detection and averaging. We can now go on to initializing the program since most of the heavy lifting will be done on tick-based production.

//+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { normalizedPoint = _Point; //--- Initialize point value if (_Digits == 5 || _Digits == 3) { //--- Check for 5 or 3 digit symbols normalizedPoint *= 10; //--- Adjust point value } ChartSetInteger(0, CHART_SHOW_GRID, false); //--- Disable chart grid obj_Trade.SetExpertMagicNumber(magicNumber); //--- Set magic number for trade object obj_Trade.SetTypeFilling(ORDER_FILLING_IOC); //--- Set order filling type return(INIT_SUCCEEDED); //--- Return success } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { ObjectsDeleteAll(0); //--- Delete all chart objects ChartRedraw(0); //--- Redraw chart }

First, in the OnInit event handler, we initialize "normalizedPoint" to _Point and adjust it by multiplying by 10 for 5 or 3-digit symbols using _Digits to ensure accurate price calculations, disable the chart grid with ChartSetInteger setting CHART_SHOW_GRID to false for a cleaner display, configure "obj_Trade" with "SetExpertMagicNumber" using "magicNumber" for trade identification, set the order filling type to "ORDER_FILLING_IOC" with "SetTypeFilling", and return "INIT_SUCCEEDED" to confirm successful setup. Then, we proceed to the OnDeinit event handler, where we remove all chart objects with ObjectsDeleteAll to clear visual elements like the dashboard and lines that we will define later, we only did this so we can be sure to clean the chart already, and call ChartRedraw to refresh the chart, ensuring a clean exit. Before we go deep into the complex trading logic, let us define some helper functions that we will need to make the program dynamic and easy to maintain.

//+------------------------------------------------------------------+ //| Count total trades | //+------------------------------------------------------------------+ int CountTrades() { int positionCount = 0; //--- Initialize position count for (int trade = PositionsTotal() - 1; trade >= 0; trade--) { //--- Iterate through positions ulong ticket = PositionGetTicket(trade); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetString(POSITION_SYMBOL) != Symbol() || PositionGetInteger(POSITION_MAGIC) != magicNumber) continue; //--- Skip non-matching positions if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL || PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY) { //--- Check trade type positionCount++; //--- Increment position count } } return(positionCount); //--- Return total count } //+------------------------------------------------------------------+ //| Count buy trades | //+------------------------------------------------------------------+ int CountTradesBuy() { int buyPositionCount = 0; //--- Initialize buy position count for (int trade = PositionsTotal() - 1; trade >= 0; trade--) { //--- Iterate through positions ulong ticket = PositionGetTicket(trade); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetString(POSITION_SYMBOL) != Symbol() || PositionGetInteger(POSITION_MAGIC) != magicNumber) continue; //--- Skip non-matching positions if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY) { //--- Check buy position buyPositionCount++; //--- Increment buy count } } return(buyPositionCount); //--- Return buy count } //+------------------------------------------------------------------+ //| Count sell trades | //+------------------------------------------------------------------+ int CountTradesSell() { int sellPositionCount = 0; //--- Initialize sell position count for (int trade = PositionsTotal() - 1; trade >= 0; trade--) { //--- Iterate through positions ulong ticket = PositionGetTicket(trade); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetString(POSITION_SYMBOL) != Symbol() || PositionGetInteger(POSITION_MAGIC) != magicNumber) continue; //--- Skip non-matching positions if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL) { //--- Check sell position sellPositionCount++; //--- Increment sell count } } return(sellPositionCount); //--- Return sell count } //+------------------------------------------------------------------+ //| Normalize price | //+------------------------------------------------------------------+ double NormalizePrice(double price) { return(NormalizeDouble(price, _Digits)); //--- Normalize price to symbol digits } //+------------------------------------------------------------------+ //| Get lot digit for normalization | //+------------------------------------------------------------------+ int fnGetLotDigit() { double lotStepValue = SymbolInfoDouble(Symbol(), SYMBOL_VOLUME_STEP); //--- Get lot step value if (lotStepValue == 1) return(0); //--- Return 0 for step 1 if (lotStepValue == 0.1) return(1); //--- Return 1 for step 0.1 if (lotStepValue == 0.01) return(2); //--- Return 2 for step 0.01 if (lotStepValue == 0.001) return(3); //--- Return 3 for step 0.001 if (lotStepValue == 0.0001) return(4); //--- Return 4 for step 0.0001 return(1); //--- Default to 1 } //+------------------------------------------------------------------+ //| Check buy orders for specific magic number | //+------------------------------------------------------------------+ int CheckBuyOrders(int magic) { int buyOrderCount = 0; //--- Initialize buy order count for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions ulong ticket = PositionGetTicket(i); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetInteger(POSITION_MAGIC) != magic) continue; //--- Skip non-matching magic if (PositionGetString(POSITION_SYMBOL) == Symbol()) { //--- Check symbol if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY) { //--- Check buy position buyOrderCount++; //--- Increment buy count break; //--- Exit loop } } } return(buyOrderCount); //--- Return buy order count } //+------------------------------------------------------------------+ //| Check sell orders for specific magic number | //+------------------------------------------------------------------+ int CheckSellOrders(int magic) { int sellOrderCount = 0; //--- Initialize sell order count for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions ulong ticket = PositionGetTicket(i); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetInteger(POSITION_MAGIC) != magic) continue; //--- Skip non-matching magic if (PositionGetString(POSITION_SYMBOL) == Symbol()) { //--- Check symbol if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL) { //--- Check sell position sellOrderCount++; //--- Increment sell count break; //--- Exit loop } } } return(sellOrderCount); //--- Return sell order count } //+------------------------------------------------------------------+ //| Check total buy orders | //+------------------------------------------------------------------+ int CheckTotalBuyOrders(int magic) { int totalBuyOrderCount = 0; //--- Initialize total buy order count for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions ulong ticket = PositionGetTicket(i); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetInteger(POSITION_MAGIC) != magic) continue; //--- Skip non-matching magic if (PositionGetString(POSITION_SYMBOL) == Symbol()) { //--- Check symbol if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY) { //--- Check buy position totalBuyOrderCount++; //--- Increment buy count } } } return(totalBuyOrderCount); //--- Return total buy count } //+------------------------------------------------------------------+ //| Check total sell orders | //+------------------------------------------------------------------+ int CheckTotalSellOrders(int magic) { int totalSellOrderCount = 0; //--- Initialize total sell order count for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions ulong ticket = PositionGetTicket(i); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetInteger(POSITION_MAGIC) != magic) continue; //--- Skip non-matching magic if (PositionGetString(POSITION_SYMBOL) == Symbol()) { //--- Check symbol if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL) { //--- Check sell position totalSellOrderCount++; //--- Increment sell count } } } return(totalSellOrderCount); //--- Return total sell count } //+------------------------------------------------------------------+ //| Check market buy orders | //+------------------------------------------------------------------+ int CheckMarketBuyOrders() { int marketBuyCount = 0; //--- Initialize market buy count for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions ulong ticket = PositionGetTicket(i); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetInteger(POSITION_MAGIC) != magicNumber) continue; //--- Skip non-matching magic if (PositionGetString(POSITION_SYMBOL) == Symbol()) { //--- Check symbol if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY) { //--- Check buy position marketBuyCount++; //--- Increment buy count } } } return(marketBuyCount); //--- Return market buy count } //+------------------------------------------------------------------+ //| Check market sell orders | //+------------------------------------------------------------------+ int CheckMarketSellOrders() { int marketSellCount = 0; //--- Initialize market sell count for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions ulong ticket = PositionGetTicket(i); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetInteger(POSITION_MAGIC) != magicNumber) continue; //--- Skip non-matching magic if (PositionGetString(POSITION_SYMBOL) == Symbol()) { //--- Check symbol if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL) { //--- Check sell position marketSellCount++; //--- Increment sell count } } } return(marketSellCount); //--- Return market sell count } //+------------------------------------------------------------------+ //| Close all buy positions | //+------------------------------------------------------------------+ void CloseBuy() { while (CheckMarketBuyOrders() > 0) { //--- Check buy orders exist for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions ulong ticket = PositionGetTicket(i); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetString(POSITION_SYMBOL) == Symbol() && PositionGetInteger(POSITION_MAGIC) == magicNumber) { //--- Check symbol and magic if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY) { //--- Check buy position obj_Trade.PositionClose(ticket); //--- Close position } } } } } //+------------------------------------------------------------------+ //| Close all sell positions | //+------------------------------------------------------------------+ void CloseSell() { while (CheckMarketSellOrders() > 0) { //--- Check sell orders exist for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions ulong ticket = PositionGetTicket(i); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetString(POSITION_SYMBOL) == Symbol() && PositionGetInteger(POSITION_MAGIC) == magicNumber) { //--- Check symbol and magic if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL) { //--- Check sell position obj_Trade.PositionClose(ticket); //--- Close position } } } } } //+------------------------------------------------------------------+ //| Calculate lot size | //+------------------------------------------------------------------+ double GetLots() { double calculatedLot; //--- Initialize calculated lot double minLot = SymbolInfoDouble(Symbol(), SYMBOL_VOLUME_MIN); //--- Get minimum lot double maxLot = SymbolInfoDouble(Symbol(), SYMBOL_VOLUME_MAX); //--- Get maximum lot if (compoundPercent != 0) { //--- Check compounding calculatedLot = NormalizeDouble(AccountInfoDouble(ACCOUNT_BALANCE) * compoundPercent / 100 / 10000, fnGetLotDigit()); //--- Calculate compounded lot if (calculatedLot < minLot) calculatedLot = minLot; //--- Enforce minimum lot if (calculatedLot > maxLot) calculatedLot = maxLot; //--- Enforce maximum lot } else { calculatedLot = initialLotSize; //--- Use fixed lot size } return(calculatedLot); //--- Return calculated lot } //+------------------------------------------------------------------+ //| Check account free margin | //+------------------------------------------------------------------+ double AccountFreeMarginCheck(string symbol, int orderType, double volume) { double marginRequired = 0.0; //--- Initialize margin required double price = orderType == ORDER_TYPE_BUY ? SymbolInfoDouble(symbol, SYMBOL_ASK) : SymbolInfoDouble(symbol, SYMBOL_BID); //--- Get price double calculatedMargin; //--- Declare calculated margin bool success = OrderCalcMargin(orderType == ORDER_TYPE_BUY ? ORDER_TYPE_BUY : ORDER_TYPE_SELL, symbol, volume, price, calculatedMargin); //--- Calculate margin if (success) marginRequired = calculatedMargin; //--- Set margin if successful return AccountInfoDouble(ACCOUNT_MARGIN_FREE) - marginRequired; //--- Return free margin } //+------------------------------------------------------------------+ //| Check if trading is allowed | //+------------------------------------------------------------------+ bool isTradingAllowed() { bool isAllowed = false; //--- Initialize allowed flag return(true); //--- Return true }

Here, we implement utility functions for the program to manage trade counting, position closing, lot size calculation, margin checking, and trading permissions, ensuring robust trade handling. First, we create functions to count trades: "CountTrades" tallies total positions by iterating through PositionsTotal, checking for valid tickets with PositionGetTicket, matching "Symbol" and "magicNumber", and incrementing "positionCount" for buy or sell positions; "CountTradesBuy" and "CountTradesSell" count buy and sell positions respectively, filtering by POSITION_TYPE_BUY or "POSITION_TYPE_SELL"; "CheckBuyOrders" and "CheckSellOrders" detect at least one buy or sell position with a specific magic number, breaking after the first match; "CheckTotalBuyOrders" and "CheckTotalSellOrders" count all buy or sell positions with a magic number; and "CheckMarketBuyOrders" and "CheckMarketSellOrders" count buy or sell positions with the magic number.

Then, we proceed to implement "NormalizePrice" to normalize prices to _Digits using NormalizeDouble, and "fnGetLotDigit" to return the appropriate decimal precision for lot sizes based on SYMBOL_VOLUME_STEP (e.g., 0 for 1, 1 for 0.1). Next, we develop "CloseBuy" and "CloseSell" to close all buy or sell positions by looping through positions, checking "Symbol" and "magicNumber", and using "obj_Trade.PositionClose" until "CheckMarketBuyOrders" or "CheckMarketSellOrders" returns 0. Last, we implement "GetLots" to calculate lot size based on "compoundPercent" (normalizing "AccountInfoDouble (ACCOUNT_BALANCE) * compoundPercent / 100 / 10000" with "fnGetLotDigit", constrained by SYMBOL_VOLUME_MIN and "SYMBOL_VOLUME_MAX") or "initialLotSize", and "AccountFreeMarginCheck" to compute available margin by calculating required margin with OrderCalcMargin for the given order type and volume, and "isTradingAllowed" as a placeholder returning true. For visualization, we will need functions to draw lines and labels on the chart.

//+------------------------------------------------------------------+ //| Draw support/resistance line | //+------------------------------------------------------------------+ void MakeLine(double price) { string name = "level"; //--- Set line name if (ObjectFind(0, name) != -1) { //--- Check if line exists ObjectMove(0, name, 0, iTime(Symbol(), PERIOD_CURRENT, 0), price); //--- Move line return; //--- Exit function } ObjectCreate(0, name, OBJ_HLINE, 0, 0, price); //--- Create horizontal line ObjectSetInteger(0, name, OBJPROP_COLOR, lineColor); //--- Set color ObjectSetInteger(0, name, OBJPROP_STYLE, STYLE_SOLID); //--- Set style ObjectSetInteger(0, name, OBJPROP_WIDTH, lineWidth); //--- Set width ObjectSetInteger(0, name, OBJPROP_BACK, true); //--- Set to background } //+------------------------------------------------------------------+ //| Create dashboard label | //+------------------------------------------------------------------+ void LABEL(string labelName, string fontName, int fontSize, int xPosition, int yPosition, color textColor, int corner, string labelText) { if (ObjectFind(0, labelName) < 0) { //--- Check if label exists ObjectCreate(0, labelName, OBJ_LABEL, 0, 0, 0); //--- Create label } ObjectSetString(0, labelName, OBJPROP_TEXT, labelText); //--- Set label text ObjectSetString(0, labelName, OBJPROP_FONT, fontName); //--- Set font ObjectSetInteger(0, labelName, OBJPROP_FONTSIZE, fontSize); //--- Set font size ObjectSetInteger(0, labelName, OBJPROP_COLOR, textColor); //--- Set text color ObjectSetInteger(0, labelName, OBJPROP_CORNER, corner); //--- Set corner ObjectSetInteger(0, labelName, OBJPROP_XDISTANCE, xPosition); //--- Set x position ObjectSetInteger(0, labelName, OBJPROP_YDISTANCE, yPosition); //--- Set y position }

To create visual elements for the program, we develop the "MakeLine" function, which will draw a horizontal line at a specified "price" to mark a support or resistance level, setting its name to "level", checking if it exists with ObjectFind, moving it with ObjectMove to the current bar time from iTime if found, or creating it with ObjectCreate as OBJ_HLINE, and setting "OBJPROP_COLOR" to "lineColor", OBJPROP_STYLE to "STYLE_SOLID", "OBJPROP_WIDTH" to "lineWidth", and "OBJPROP_BACK" to true using ObjectSetInteger for background placement.

Then, we proceed to implement the "LABEL" function, which will create or update dashboard labels by checking if "labelName" exists, creating an OBJ_LABEL with "ObjectCreate" if not, and setting properties with "ObjectSetString" for "OBJPROP_TEXT" to "labelText" and "OBJPROP_FONT" to "fontName", and "ObjectSetInteger" for "OBJPROP_FONTSIZE" to "fontSize", "OBJPROP_COLOR" to "textColor", OBJPROP_CORNER to "corner", "OBJPROP_XDISTANCE" to "xPosition", and "OBJPROP_YDISTANCE" to the y-position. We can then define indicator utility functions that we will use.

//+------------------------------------------------------------------+ //| Calculate ATR indicator | //+------------------------------------------------------------------+ double MyiATR(string symbol, ENUM_TIMEFRAMES timeframe, int period, int shift) { int handle = iATR(symbol, timeframe, period); //--- Create ATR handle if (handle == INVALID_HANDLE) return 0; //--- Check invalid handle double buffer[1]; //--- Declare buffer if (CopyBuffer(handle, 0, shift, 1, buffer) != 1) buffer[0] = 0; //--- Copy ATR value IndicatorRelease(handle); //--- Release handle return buffer[0]; //--- Return ATR value } //+------------------------------------------------------------------+ //| Check bullish engulfing pattern | //+------------------------------------------------------------------+ bool BullishEngulfingExists() { if (iOpen(Symbol(), PERIOD_CURRENT, 1) <= iClose(Symbol(), PERIOD_CURRENT, 2) && iClose(Symbol(), PERIOD_CURRENT, 1) >= iOpen(Symbol(), PERIOD_CURRENT, 2) && iOpen(Symbol(), PERIOD_CURRENT, 2) - iClose(Symbol(), PERIOD_CURRENT, 2) >= 10 * _Point && iClose(Symbol(), PERIOD_CURRENT, 1) - iOpen(Symbol(), PERIOD_CURRENT, 1) >= 10 * _Point) { //--- Check bullish engulfing conditions return(true); //--- Return true } return(false); //--- Return false } //+------------------------------------------------------------------+ //| Check bullish harami pattern | //+------------------------------------------------------------------+ bool BullishHaramiExists() { if (iClose(Symbol(), PERIOD_CURRENT, 2) < iOpen(Symbol(), PERIOD_CURRENT, 2) && iOpen(Symbol(), PERIOD_CURRENT, 1) < iClose(Symbol(), PERIOD_CURRENT, 1) && iOpen(Symbol(), PERIOD_CURRENT, 2) - iClose(Symbol(), PERIOD_CURRENT, 2) > MyiATR(Symbol(), PERIOD_CURRENT, 14, 2) && iOpen(Symbol(), PERIOD_CURRENT, 2) - iClose(Symbol(), PERIOD_CURRENT, 2) > 4 * (iClose(Symbol(), PERIOD_CURRENT, 1) - iOpen(Symbol(), PERIOD_CURRENT, 1))) { //--- Check bullish harami conditions return(true); //--- Return true } return(false); //--- Return false } //+------------------------------------------------------------------+ //| Check doji at bottom pattern | //+------------------------------------------------------------------+ bool DojiAtBottomExists() { if (iOpen(Symbol(), PERIOD_CURRENT, 3) - iClose(Symbol(), PERIOD_CURRENT, 3) >= 8 * _Point && MathAbs(iClose(Symbol(), PERIOD_CURRENT, 2) - iOpen(Symbol(), PERIOD_CURRENT, 2)) <= 1 * _Point && iClose(Symbol(), PERIOD_CURRENT, 1) - iOpen(Symbol(), PERIOD_CURRENT, 1) >= 8 * _Point) { //--- Check doji at bottom conditions return(true); //--- Return true } return(false); //--- Return false } //+------------------------------------------------------------------+ //| Check doji at top pattern | //+------------------------------------------------------------------+ bool DojiAtTopExists() { if (iClose(Symbol(), PERIOD_CURRENT, 3) - iOpen(Symbol(), PERIOD_CURRENT, 3) >= 8 * _Point && MathAbs(iClose(Symbol(), PERIOD_CURRENT, 2) - iOpen(Symbol(), PERIOD_CURRENT, 2)) <= 1 * _Point && iOpen(Symbol(), PERIOD_CURRENT, 1) - iClose(Symbol(), PERIOD_CURRENT, 1) >= 8 * _Point) { //--- Check doji at top conditions return(true); //--- Return true } return(false); //--- Return false } //+------------------------------------------------------------------+ //| Check bearish harami pattern | //+------------------------------------------------------------------+ bool BearishHaramiExists() { if (iClose(Symbol(), PERIOD_CURRENT, 2) > iClose(Symbol(), PERIOD_CURRENT, 1) && iOpen(Symbol(), PERIOD_CURRENT, 2) < iOpen(Symbol(), PERIOD_CURRENT, 1) && iClose(Symbol(), PERIOD_CURRENT, 2) > iOpen(Symbol(), PERIOD_CURRENT, 2) && iOpen(Symbol(), PERIOD_CURRENT, 1) > iClose(Symbol(), PERIOD_CURRENT, 1) && iClose(Symbol(), PERIOD_CURRENT, 2) - iOpen(Symbol(), PERIOD_CURRENT, 2) > MyiATR(Symbol(), PERIOD_CURRENT, 14, 2) && iClose(Symbol(), PERIOD_CURRENT, 2) - iOpen(Symbol(), PERIOD_CURRENT, 2) > 4 * (iOpen(Symbol(), PERIOD_CURRENT, 1) - iClose(Symbol(), PERIOD_CURRENT, 1))) { //--- Check bearish harami conditions return(true); //--- Return true } return(false); //--- Return false } //+------------------------------------------------------------------+ //| Check long up candle pattern | //+------------------------------------------------------------------+ bool LongUpCandleExists() { if (iOpen(Symbol(), PERIOD_CURRENT, 2) < iClose(Symbol(), PERIOD_CURRENT, 2) && iHigh(Symbol(), PERIOD_CURRENT, 2) - iLow(Symbol(), PERIOD_CURRENT, 2) >= 40 * _Point && iHigh(Symbol(), PERIOD_CURRENT, 2) - iLow(Symbol(), PERIOD_CURRENT, 2) > 2.5 * MyiATR(Symbol(), PERIOD_CURRENT, 14, 2) && iClose(Symbol(), PERIOD_CURRENT, 1) < iOpen(Symbol(), PERIOD_CURRENT, 1) && iOpen(Symbol(), PERIOD_CURRENT, 1) - iClose(Symbol(), PERIOD_CURRENT, 1) > 10 * _Point) { //--- Check long up candle conditions return(true); //--- Return true } return(false); //--- Return false } //+------------------------------------------------------------------+ //| Check long down candle pattern | //+------------------------------------------------------------------+ bool LongDownCandleExists() { if (iOpen(Symbol(), PERIOD_CURRENT, 1) > iClose(Symbol(), PERIOD_CURRENT, 1) && iHigh(Symbol(), PERIOD_CURRENT, 1) - iLow(Symbol(), PERIOD_CURRENT, 1) >= 40 * _Point && iHigh(Symbol(), PERIOD_CURRENT, 1) - iLow(Symbol(), PERIOD_CURRENT, 1) > 2.5 * MyiATR(Symbol(), PERIOD_CURRENT, 14, 1)) { //--- Check long down candle conditions return(true); //--- Return true } return(false); //--- Return false } //+------------------------------------------------------------------+ //| Check bearish engulfing pattern | //+------------------------------------------------------------------+ bool BearishEngulfingExists() { if (iOpen(Symbol(), PERIOD_CURRENT, 1) >= iClose(Symbol(), PERIOD_CURRENT, 2) && iClose(Symbol(), PERIOD_CURRENT, 1) <= iOpen(Symbol(), PERIOD_CURRENT, 2) && iOpen(Symbol(), PERIOD_CURRENT, 2) - iClose(Symbol(), PERIOD_CURRENT, 2) >= 10 * _Point && iClose(Symbol(), PERIOD_CURRENT, 1) - iOpen(Symbol(), PERIOD_CURRENT, 1) >= 10 * _Point) { //--- Check bearish engulfing conditions return(true); //--- Return true } return(false); //--- Return false } //+------------------------------------------------------------------+ //| Calculate average range over 4 days | //+------------------------------------------------------------------+ double AveRange4() { double rangeSum = 0; //--- Initialize range sum int count = 0; //--- Initialize count int index = 1; //--- Initialize index while (count < 4) { //--- Loop until 4 days MqlDateTime dateTime; //--- Declare datetime structure TimeToStruct(iTime(Symbol(), PERIOD_CURRENT, index), dateTime); //--- Convert time if (dateTime.day_of_week != 0) { //--- Check non-Sunday rangeSum += iHigh(Symbol(), PERIOD_CURRENT, index) - iLow(Symbol(), PERIOD_CURRENT, index); //--- Add range count++; //--- Increment count } index++; //--- Increment index } return(rangeSum / 4.0); //--- Return average range } //+------------------------------------------------------------------+ //| Check buy pinbar | //+------------------------------------------------------------------+ bool IsBuyPinbar() { double currentOpen, currentClose, currentHigh, currentLow; //--- Declare current candle variables double previousHigh, previousLow, previousClose, previousOpen; //--- Declare previous candle variables double currentRange, previousRange, currentHigherPart, currentHigherPart1; //--- Declare range variables currentOpen = iOpen(Symbol(), PERIOD_CURRENT, 1); //--- Get current open currentClose = iClose(Symbol(), PERIOD_CURRENT, 1); //--- Get current close currentHigh = iHigh(Symbol(), PERIOD_CURRENT, 0); //--- Get current high currentLow = iLow(Symbol(), PERIOD_CURRENT, 1); //--- Get current low previousOpen = iOpen(Symbol(), PERIOD_CURRENT, 2); //--- Get previous open previousClose = iClose(Symbol(), PERIOD_CURRENT, 2); //--- Get previous close previousHigh = iHigh(Symbol(), PERIOD_CURRENT, 2); //--- Get previous high previousLow = iLow(Symbol(), PERIOD_CURRENT, 2); //--- Get previous low currentRange = currentHigh - currentLow; //--- Calculate current range previousRange = previousHigh - previousLow; //--- Calculate previous range currentHigherPart = currentHigh - currentRange * 0.4; //--- Calculate higher part currentHigherPart1 = currentHigh - currentRange * 0.4; //--- Calculate higher part double averageDailyRange = AveRange4(); //--- Get average daily range if ((currentClose > currentHigherPart1 && currentOpen > currentHigherPart) && //--- Check close/open in higher third (currentRange > averageDailyRange * 0.5) && //--- Check pinbar size (currentLow + currentRange * 0.25 < previousLow)) { //--- Check nose length double lowArray[3]; //--- Declare low array CopyLow(Symbol(), PERIOD_CURRENT, 3, 3, lowArray); //--- Copy low prices int minIndex = ArrayMinimum(lowArray); //--- Find minimum low index if (lowArray[minIndex] > currentLow) return(true); //--- Confirm buy pinbar } return(false); //--- Return false } //+------------------------------------------------------------------+ //| Check sell pinbar | //+------------------------------------------------------------------+ bool IsSellPinbar() { double currentOpen, currentClose, currentHigh, currentLow; //--- Declare current candle variables double previousHigh, previousLow, previousClose, previousOpen; //--- Declare previous candle variables double currentRange, previousRange, currentLowerPart, currentLowerPart1; //--- Declare range variables currentOpen = iOpen(Symbol(), PERIOD_CURRENT, 1); //--- Get current open currentClose = iClose(Symbol(), PERIOD_CURRENT, 1); //--- Get current close currentHigh = iHigh(Symbol(), PERIOD_CURRENT, 1); //--- Get current high currentLow = iLow(Symbol(), PERIOD_CURRENT, 1); //--- Get current low previousOpen = iOpen(Symbol(), PERIOD_CURRENT, 2); //--- Get previous open previousClose = iClose(Symbol(), PERIOD_CURRENT, 2); //--- Get previous close previousHigh = iHigh(Symbol(), PERIOD_CURRENT, 2); //--- Get previous high previousLow = iLow(Symbol(), PERIOD_CURRENT, 2); //--- Get previous low currentRange = currentHigh - currentLow; //--- Calculate current range previousRange = previousHigh - previousLow; //--- Calculate previous range currentLowerPart = currentLow + currentRange * 0.4; //--- Calculate lower part currentLowerPart1 = currentLow + currentRange * 0.4; //--- Calculate lower part double averageDailyRange = AveRange4(); //--- Get average daily range if ((currentClose < currentLowerPart1 && currentOpen < currentLowerPart) && //--- Check close/open in lower third (currentRange > averageDailyRange * 0.5) && //--- Check pinbar size (currentHigh - currentRange * 0.25 > previousHigh)) { //--- Check nose length double highArray[3]; //--- Declare high array CopyHigh(Symbol(), PERIOD_CURRENT, 3, 3, highArray); //--- Copy high prices int maxIndex = ArrayMaximum(highArray); //--- Find maximum high index if (highArray[maxIndex] < currentHigh) return(true); //--- Confirm sell pinbar } return(false); //--- Return false }

Here, we implement functions to detect candlestick patterns and calculate the Average True Range (ATR) for our system. First, we create the "MyiATR" function, which computes the ATR by creating a handle with the iATR function for the given symbol, timeframe, and period, returning 0 if the handle is invalid, copying the ATR value into a buffer with CopyBuffer, releasing the handle with IndicatorRelease, and returning the ATR value.

Then, we proceed to implement candlestick pattern detection functions: "BullishEngulfingExists" checks if the current candle engulfs the previous bearish candle with significant body sizes; "BullishHaramiExists" identifies a small bullish candle within a larger bearish candle using "MyiATR" for size comparison; "DojiAtBottomExists" detects a doji between a bearish and bullish candle for a morning star pattern; "DojiAtTopExists" identifies a doji between a bullish and bearish candle for an evening star pattern; "BearishHaramiExists" checks for a small bearish candle within a larger bullish candle; "LongUpCandleExists" confirms a strong bullish candle followed by a bearish one using ATR; "LongDownCandleExists" detects a strong bearish candle; and "BearishEngulfingExists" verifies a bearish candle engulfing a bullish one.

Last, we implement "IsBuyPinbar" and "IsSellPinbar", which identify pin bars by checking if the current candle’s close and open are in the upper or lower third of its range, the range exceeds half the average daily range from "AveRange4" (which averages the high-low range over four non-Sunday days), and the pin bar’s nose extends beyond the previous candle’s low or high, confirmed by comparing recent lows or highs with CopyLow or CopyHigh and "ArrayMinimum" or ArrayMaximum functions. Then, we can define some functions to get the signal type for display purposes and the weighted price for position management.

//+------------------------------------------------------------------+ //| Analyze candlestick patterns | //+------------------------------------------------------------------+ string CandleStick_Analyzer() { string candlePattern, comment1 = "", comment2 = "", comment3 = ""; //--- Initialize pattern strings string comment4 = "", comment5 = "", comment6 = "", comment7 = ""; //--- Initialize pattern strings string comment8 = "", comment9 = ""; //--- Initialize pattern strings if (BullishEngulfingExists()) comment1 = " Bullish Engulfing "; //--- Check bullish engulfing if (BullishHaramiExists()) comment2 = " Bullish Harami "; //--- Check bullish harami if (LongUpCandleExists()) comment3 = " Bullish LongUp "; //--- Check long up candle if (DojiAtBottomExists()) comment4 = " MorningStar Doji "; //--- Check morning star doji if (DojiAtTopExists()) comment5 = " EveningStar Doji "; //--- Check evening star doji if (BearishHaramiExists()) comment6 = " Bearish Harami "; //--- Check bearish harami if (BearishEngulfingExists()) comment7 = " Bearish Engulfing "; //--- Check bearish engulfing if (LongDownCandleExists()) comment8 = " Bearish LongDown "; //--- Check long down candle candlePattern = comment1 + comment2 + comment3 + comment4 + comment5 + comment6 + comment7 + comment8 + comment9; //--- Combine patterns return(candlePattern); //--- Return combined pattern } //+------------------------------------------------------------------+ //| Calculate average price for order type | //+------------------------------------------------------------------+ double rata_price(int orderType) { double totalVolume = 0; //--- Initialize total volume double weightedOpenSum = 0; //--- Initialize weighted open sum double averagePrice = 0; //--- Initialize average price for (int positionIndex = 0; positionIndex < PositionsTotal(); positionIndex++) { //--- Iterate through positions ulong ticket = PositionGetTicket(positionIndex); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetString(POSITION_SYMBOL) == Symbol() && PositionGetInteger(POSITION_MAGIC) == magicNumber && (PositionGetInteger(POSITION_TYPE) == orderType)) { //--- Check position match totalVolume += PositionGetDouble(POSITION_VOLUME); //--- Add volume weightedOpenSum += (PositionGetDouble(POSITION_VOLUME) * PositionGetDouble(POSITION_PRICE_OPEN)); //--- Add weighted open } } if (totalVolume != 0) { //--- Check non-zero volume averagePrice = weightedOpenSum / totalVolume; //--- Calculate average price } return(averagePrice); //--- Return average price }

For enhanced position management, we create the "CandleStick_Analyzer" function, which initializes string variables like "comment1" to "comment9" as empty, checks for candlestick patterns using functions like "BullishEngulfingExists" that we did alreday define, assigns descriptive strings (e.g., " Bullish Engulfing ") to corresponding variables if patterns are detected, and concatenates them into "candlePattern" to return a combined string of detected patterns for dashboard display.

Then, we proceed to implement the "rata_price" function, which calculates the weighted average price for a specified "orderType" (buy or sell) by initializing "totalVolume" and "weightedOpenSum" to 0, iterating through "PositionsTotal" to sum POSITION_VOLUME and the product of "POSITION_VOLUME" and POSITION_PRICE_OPEN for positions matching "Symbol", "magicNumber", and "orderType" using "PositionGetTicket", PositionGetString, and "PositionGetInteger", and computing "averagePrice" as "weightedOpenSum / totalVolume" if "totalVolume" is non-zero, returning the result, providing critical pattern analysis for trade signals and accurate average price calculations for averaging and take-profit adjustments. For positions, we will need to get their metrics first. Let us define a logic for that.

//+------------------------------------------------------------------+ //| Calculate position metrics | //+------------------------------------------------------------------+ void calculatePositionMetrics() { buyCount = 0; //--- Reset buy count currentBuyLot = 0; //--- Reset current buy lot totalBuyLots = 0; //--- Reset total buy lots sellCount = 0; //--- Reset sell count currentSellLot = 0; //--- Reset current sell lot totalSellLots = 0; //--- Reset total sell lots totalSum = 0; //--- Reset total sum totalSwap = 0; //--- Reset total swap buyProfit = 0; //--- Reset buy profit sellProfit = 0; //--- Reset sell profit buyWeightedSum = 0; //--- Reset buy weighted sum sellWeightedSum = 0; //--- Reset sell weighted sum buyBreakEvenPrice = 0; //--- Reset buy breakeven price sellBreakEvenPrice = 0; //--- Reset sell breakeven price minBuyLot = 9999; //--- Initialize min buy lot minSellLot = 9999; //--- Initialize min sell lot maxSellPrice = 0; //--- Initialize max sell price minBuyPrice = 999999999; //--- Initialize min buy price for (int i = 0; i < PositionsTotal(); i++) { //--- Iterate through positions ulong ticket = PositionGetTicket(i); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetString(POSITION_SYMBOL) != Symbol()) continue; //--- Skip non-matching symbols if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY) { //--- Check buy position buyCount++; //--- Increment buy count totalOperations++; //--- Increment total operations currentBuyLot = PositionGetDouble(POSITION_VOLUME); //--- Set current buy lot buyProfit += PositionGetDouble(POSITION_PROFIT); //--- Add buy profit totalBuyLots += PositionGetDouble(POSITION_VOLUME); //--- Add to total buy lots minBuyLot = MathMin(minBuyLot, PositionGetDouble(POSITION_VOLUME)); //--- Update min buy lot buyWeightedSum += PositionGetDouble(POSITION_VOLUME) * PositionGetDouble(POSITION_PRICE_OPEN); //--- Add weighted open price minBuyPrice = MathMin(minBuyPrice, PositionGetDouble(POSITION_PRICE_OPEN)); //--- Update min buy price } if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL) { //--- Check sell position sellCount++; //--- Increment sell count totalOperations++; //--- Increment total operations currentSellLot = PositionGetDouble(POSITION_VOLUME); //--- Set current sell lot sellProfit += PositionGetDouble(POSITION_PROFIT); //--- Add sell profit totalSellLots += PositionGetDouble(POSITION_VOLUME); //--- Add to total sell lots minSellLot = MathMin(minSellLot, PositionGetDouble(POSITION_VOLUME)); //--- Update min sell lot sellWeightedSum += PositionGetDouble(POSITION_VOLUME) * PositionGetDouble(POSITION_PRICE_OPEN); //--- Add weighted open price maxSellPrice = MathMax(maxSellPrice, PositionGetDouble(POSITION_PRICE_OPEN)); //--- Update max sell price } } if (totalBuyLots > 0) { //--- Check buy lots buyBreakEvenPrice = buyWeightedSum / totalBuyLots; //--- Calculate buy breakeven } if (totalSellLots > 0) { //--- Check sell lots sellBreakEvenPrice = sellWeightedSum / totalSellLots; //--- Calculate sell breakeven } }

To compute essential metrics for managing multiple positions effectively, we implement the "calculatePositionMetrics" function. First, we reset key variables to zero or their respective initial value for accurate tracking. Then, we proceed to iterate through all positions using PositionsTotal, retrieving each position’s ticket with PositionGetTicket, skipping invalid tickets or non-matching symbols with PositionGetString, and for buy positions (POSITION_TYPE_BUY), incrementing "buyCount" and "totalOperations", setting "currentBuyLot", adding "POSITION_PROFIT" to "buyProfit" and "POSITION_VOLUME" to "totalBuyLots", updating "minBuyLot" with MathMin, adding weighted open price to "buyWeightedSum", and updating "minBuyPrice"; for sell positions (POSITION_TYPE_SELL), we perform similar updates for sell metrics. Last, we calculate "buyBreakEvenPrice" as "buyWeightedSum / totalBuyLots" if "totalBuyLots" is positive, and "sellBreakEvenPrice" as "sellWeightedSum / totalSellLots" if "totalSellLots" is positive, providing weighted average prices for breakeven management, ensuring precise tracking of position metrics for averaging and risk control. With these functions, we are all set to begin the position opening logic. We will do this in the OnTick event handler.

//+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { static datetime previousBarTime = 0; //--- Store previous bar time if (previousBarTime != iTime(Symbol(), PERIOD_CURRENT, 0)) { //--- Check new bar previousBarTime = iTime(Symbol(), PERIOD_CURRENT, 0); //--- Update previous bar time ChartRedraw(0); //--- Redraw chart } else { return; //--- Exit if not new bar } if (iVolume(Symbol(), PERIOD_H4, 0) > iVolume(Symbol(), PERIOD_H4, 1)) return; //--- Exit if volume increased double supportResistanceLevel = NormalizeDouble(iClose(Symbol(), PERIOD_H4, 1), _Digits); //--- Get support/resistance level ObjectDelete(0, "level"); //--- Delete existing level line MakeLine(supportResistanceLevel); //--- Draw support/resistance line if (SymbolInfoInteger(Symbol(), SYMBOL_SPREAD) > 150) return; //--- Exit if spread too high int totalBuyPositions = 0; //--- Initialize buy positions count int totalSellPositions = 0; //--- Initialize sell positions count for (int i = 0; i < PositionsTotal(); i++) { //--- Iterate through positions ulong ticket = PositionGetTicket(i); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetString(POSITION_SYMBOL) != Symbol() || PositionGetInteger(POSITION_MAGIC) != magicNumber) continue; //--- Skip non-matching positions if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY) { //--- Check buy position totalBuyPositions++; //--- Increment buy count } if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL) { //--- Check sell position totalSellPositions++; //--- Increment sell count } } }

In the OnTick event handler, we implement the initial logic for the pin bar averaging system to manage trading decisions and visual updates on each new bar. First, we check for a new bar by comparing "previousBarTime" (static, initialized to 0) with the current bar time from iTime for the current symbol and period at shift 0, updating "previousBarTime" and calling ChartRedraw if a new bar is detected, or exiting if not.

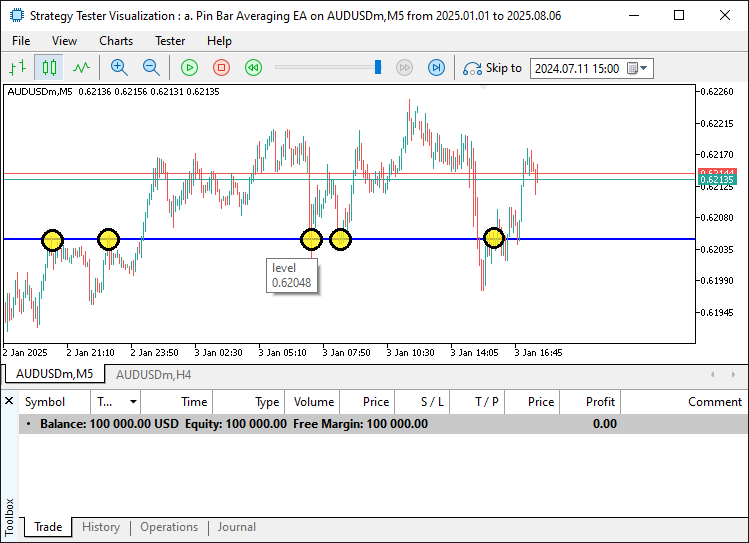

Then, we proceed to exit if the current H4 bar’s volume from iVolume exceeds the previous bar’s, avoiding high-volatility periods. Next, we calculate the support/resistance level as the normalized close price of the previous H4 bar using iClose and NormalizeDouble, delete any existing "level" line with ObjectDelete, and draw a new horizontal line with "MakeLine" at this level. Last, we check if the spread from SymbolInfoInteger exceeds 150 points, exiting if too high, and count open positions by iterating through PositionsTotal, using "PositionGetTicket" to get tickets, skipping invalid or non-matching symbol and "magicNumber" positions, and incrementing "totalBuyPositions" or "totalSellPositions" for buy or sell positions identified with the PositionGetInteger function. This initial setup ensures the EA processes trades only on new bars with favorable conditions and maintains an updated visual reference. Upon compilation, we get the following outcome.

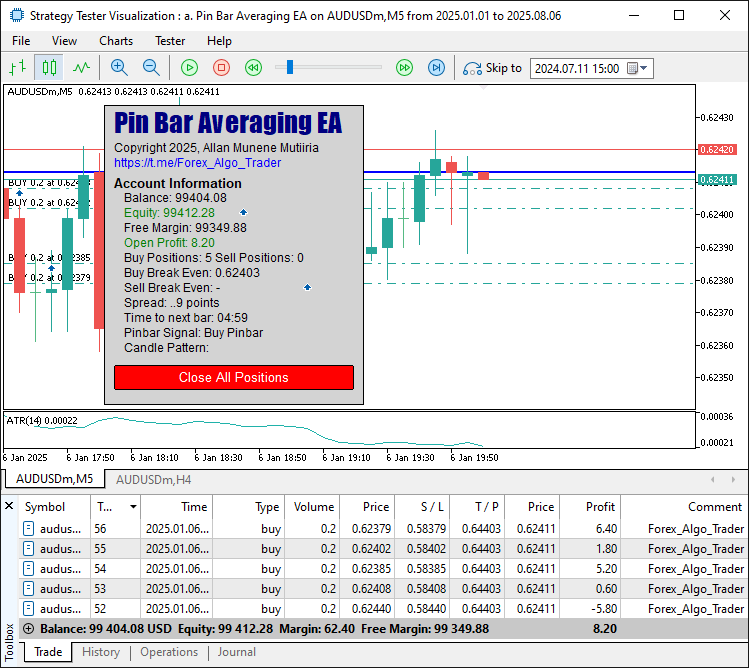

From the image, we can see that we mark the support and resistance levels on the chart dynamically. We now need to move on to adding the positions dynamically.

if (CheckMarketBuyOrders() < 70 && CheckMarketSellOrders() < 70) { //--- Check order limits if (supportResistanceLevel > iOpen(Symbol(), PERIOD_CURRENT, 0) && useSignalMode == DISABLED) { //--- Check buy condition if (IsBuyPinbar() && totalBuyPositions < maxOrders && (isTradingAllowed() || totalBuyPositions > 0)) { //--- Check buy pinbar and limits double buyStopLoss = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_ASK) - stopLossPips * normalizedPoint, _Digits); //--- Calculate buy stop loss double buyTakeProfit = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_ASK) + takeProfitPips * normalizedPoint, _Digits); //--- Calculate buy take profit if (AccountFreeMarginCheck(Symbol(), ORDER_TYPE_BUY, GetLots()) > 0) { //--- Check margin obj_Trade.PositionOpen(Symbol(), ORDER_TYPE_BUY, GetLots(), SymbolInfoDouble(_Symbol, SYMBOL_ASK), buyStopLoss, buyTakeProfit, orderComment); //--- Open buy position if (useAutoTakeProfit) { //--- Check auto take profit ModifyTP(ORDER_TYPE_BUY, rata_price(ORDER_TYPE_BUY) + takeProfitPips * normalizedPoint); //--- Modify take profit } CloseSell(); //--- Close sell positions } } } if (supportResistanceLevel < iOpen(Symbol(), PERIOD_CURRENT, 0) && useSignalMode == DISABLED) { //--- Check sell condition if (IsSellPinbar() && totalSellPositions < maxOrders && (isTradingAllowed() || totalSellPositions > 0)) { //--- Check sell pinbar and limits double sellStopLoss = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_BID) + stopLossPips * normalizedPoint, _Digits); //--- Calculate sell stop loss double sellTakeProfit = NormalizeDouble(SymbolInfoDouble(_Symbol, SYMBOL_BID) - takeProfitPips * normalizedPoint, _Digits); //--- Calculate sell take profit if (AccountFreeMarginCheck(Symbol(), ORDER_TYPE_SELL, GetLots()) > 0) { //--- Check margin obj_Trade.PositionOpen(Symbol(), ORDER_TYPE_SELL, GetLots(), SymbolInfoDouble(_Symbol, SYMBOL_BID), sellStopLoss, sellTakeProfit, orderComment); //--- Open sell position if (useAutoTakeProfit) { //--- Check auto take profit ModifyTP(ORDER_TYPE_SELL, rata_price(ORDER_TYPE_SELL) - takeProfitPips * normalizedPoint); //--- Modify take profit } CloseBuy(); //--- Close buy positions } } } } if (CountTrades() == 0) { //--- Check no trades if (supportResistanceLevel > iOpen(Symbol(), PERIOD_CURRENT, 0) && useSignalMode == ENABLED) { //--- Check buy signal mode if (IsBuyPinbar() && CountTrades() < maxOrders) { //--- Check buy pinbar and limit obj_Trade.PositionOpen(Symbol(), ORDER_TYPE_BUY, GetLots(), SymbolInfoDouble(_Symbol, SYMBOL_ASK), SymbolInfoDouble(_Symbol, SYMBOL_ASK) - stopLossPips * normalizedPoint, SymbolInfoDouble(_Symbol, SYMBOL_ASK) + (takeProfitPips * normalizedPoint), orderComment); //--- Open buy position } } } if (CountTrades() == 0) { //--- Check no trades if (supportResistanceLevel < iOpen(Symbol(), PERIOD_CURRENT, 0) && useSignalMode == ENABLED) { //--- Check sell signal mode if (IsSellPinbar() && CountTrades() < maxOrders) { //--- Check sell pinbar and limit obj_Trade.PositionOpen(Symbol(), ORDER_TYPE_SELL, GetLots(), SymbolInfoDouble(_Symbol, SYMBOL_BID), SymbolInfoDouble(_Symbol, SYMBOL_BID) + stopLossPips * normalizedPoint, SymbolInfoDouble(_Symbol, SYMBOL_BID) - (takeProfitPips * normalizedPoint), orderComment); //--- Open sell position } } }

We continue the tick function implementation, adding logic to open new positions based on pin bar signals and market conditions. First, we check if open buy and sell orders are below 70 using "CheckMarketBuyOrders" and "CheckMarketSellOrders", ensuring the EA doesn’t exceed practical limits. Then, if "useSignalMode" is "DISABLED", we evaluate buy conditions: when "supportResistanceLevel" exceeds the current open price from iOpen, a buy pin bar is detected with "IsBuyPinbar", "totalBuyPositions" is below "maxOrders", and trading is allowed via "isTradingAllowed" or existing buys exist, we calculate "buyStopLoss" and "buyTakeProfit" using SymbolInfoDouble with "stopLossPips" and "takeProfitPips" adjusted by "normalizedPoint", verify margin with "AccountFreeMarginCheck", open a buy position with "obj_Trade.

PositionOpen" using "GetLots", modify take profit with "ModifyTP" if "useAutoTakeProfit" is true, and close sell positions with "CloseSell"; similar logic applies for sell conditions when "supportResistanceLevel" is below the open price, using "IsSellPinbar". Next, if no trades exist ("CountTrades" is 0) and "useSignalMode" is "ENABLED", we open a buy position on a buy pin bar with "IsBuyPinbar" and "CountTrades" below "maxOrders", using "obj_Trade.PositionOpen" with calculated stop loss and take profit, and similarly for sell positions with "IsSellPinbar", ensuring the EA opens positions based on pin bar signals at key levels with proper risk management. Upon compilation, we get the following outcome.

Since we now confirm signals and open positions, we need to manage the signals. What we will do is define some functions for that.

//+------------------------------------------------------------------+ //| Update stop loss and take profit | //+------------------------------------------------------------------+ void updateStopLossTakeProfit() { for (int i = PositionsTotal() - 1; i >= 0; i--) { //--- Iterate through positions ulong ticket = PositionGetTicket(i); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetString(POSITION_SYMBOL) != Symbol()) continue; //--- Skip non-matching symbols if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY) { //--- Check buy position double buyTakeProfitLevel = (buyBreakEvenPrice + takeProfitPips * _Point) * (takeProfitPips > 0); //--- Calculate buy take profit double buyStopLossLevel = PositionGetDouble(POSITION_SL); //--- Get current stop loss if (slBreakevenMinus > 0) { //--- Check breakeven adjustment buyStopLossLevel = (buyBreakEvenPrice - slBreakevenMinus * _Point); //--- Set breakeven stop loss } if (buyCount == 1) { //--- Check single buy position buyTakeProfitLevel = NormalizePrice(PositionGetDouble(POSITION_PRICE_OPEN) + takeProfitPips * _Point) * (takeProfitPips > 0); //--- Set take profit if (laterUseSL > 0) { //--- Check unused stop loss buyStopLossLevel = (PositionGetDouble(POSITION_PRICE_OPEN) - laterUseSL * _Point); //--- Set stop loss } } buyTakeProfitLevel = NormalizePrice(buyTakeProfitLevel); //--- Normalize take profit buyStopLossLevel = NormalizePrice(buyStopLossLevel); //--- Normalize stop loss if (SymbolInfoDouble(_Symbol, SYMBOL_BID) >= buyTakeProfitLevel && buyTakeProfitLevel > 0) { //--- Check take profit hit obj_Trade.PositionClose(ticket); //--- Close position } if (SymbolInfoDouble(_Symbol, SYMBOL_BID) <= buyStopLossLevel) { //--- Check stop loss hit obj_Trade.PositionClose(ticket); //--- Close position } if (NormalizePrice(PositionGetDouble(POSITION_TP)) != buyTakeProfitLevel || NormalizePrice(PositionGetDouble(POSITION_SL)) != buyStopLossLevel) { //--- Check modification needed obj_Trade.PositionModify(ticket, buyStopLossLevel, buyTakeProfitLevel); //--- Modify position } } if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL) { //--- Check sell position double sellTakeProfitLevel = (sellBreakEvenPrice - takeProfitPips * _Point) * (takeProfitPips > 0); //--- Calculate sell take profit double sellStopLossLevel = PositionGetDouble(POSITION_SL); //--- Get current stop loss if (slBreakevenMinus > 0) { //--- Check breakeven adjustment sellStopLossLevel = (sellBreakEvenPrice + slBreakevenMinus * _Point); //--- Set breakeven stop loss } if (sellCount == 1) { //--- Check single sell position sellTakeProfitLevel = (PositionGetDouble(POSITION_PRICE_OPEN) - takeProfitPips * _Point) * (takeProfitPips > 0); //--- Set take profit if (laterUseSL > 0) { //--- Check unused stop loss sellStopLossLevel = (PositionGetDouble(POSITION_PRICE_OPEN) + laterUseSL * _Point); //--- Set stop loss } } sellTakeProfitLevel = NormalizePrice(sellTakeProfitLevel); //--- Normalize take profit sellStopLossLevel = NormalizePrice(sellStopLossLevel); //--- Normalize stop loss if (SymbolInfoDouble(_Symbol, SYMBOL_ASK) <= sellTakeProfitLevel) { //--- Check take profit hit obj_Trade.PositionClose(ticket); //--- Close position } if (SymbolInfoDouble(_Symbol, SYMBOL_ASK) >= sellStopLossLevel && sellStopLossLevel > 0) { //--- Check stop loss hit obj_Trade.PositionClose(ticket); //--- Close position } if (NormalizePrice(PositionGetDouble(POSITION_TP)) != sellTakeProfitLevel || NormalizePrice(PositionGetDouble(POSITION_SL)) != sellStopLossLevel) { //--- Check modification needed obj_Trade.PositionModify(ticket, sellStopLossLevel, sellTakeProfitLevel); //--- Modify position } } } } //+------------------------------------------------------------------+ //| Add averaging order | //+------------------------------------------------------------------+ void addAveragingOrder() { int positionIndex = 0; //--- Initialize position index double lastOpenPrice = 0; //--- Initialize last open price double lastLotSize = 0; //--- Initialize last lot size bool isLastBuy = false; //--- Initialize buy flag int totalBuyPositions = 0; //--- Initialize buy positions count int totalSellPositions = 0; //--- Initialize sell positions count long currentSpread = SymbolInfoInteger(Symbol(), SYMBOL_SPREAD); //--- Get current spread double supportResistanceLevel = iClose(Symbol(), PERIOD_H4, 1); //--- Get support/resistance level for (positionIndex = 0; positionIndex < PositionsTotal(); positionIndex++) { //--- Iterate through positions ulong ticket = PositionGetTicket(positionIndex); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY && PositionGetString(POSITION_SYMBOL) == Symbol() && PositionGetInteger(POSITION_MAGIC) == magicNumber) { //--- Check buy position if (lastOpenPrice == 0) { //--- Check initial price lastOpenPrice = PositionGetDouble(POSITION_PRICE_OPEN); //--- Set initial price } if (lastOpenPrice > PositionGetDouble(POSITION_PRICE_OPEN)) { //--- Check lower price lastOpenPrice = PositionGetDouble(POSITION_PRICE_OPEN); //--- Update last price } if (lastLotSize < PositionGetDouble(POSITION_VOLUME)) { //--- Check larger lot lastLotSize = PositionGetDouble(POSITION_VOLUME); //--- Update lot size } isLastBuy = true; //--- Set buy flag totalBuyPositions++; //--- Increment buy count } if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL && PositionGetString(POSITION_SYMBOL) == Symbol() && PositionGetInteger(POSITION_MAGIC) == magicNumber) { //--- Check sell position if (lastOpenPrice == 0) { //--- Check initial price lastOpenPrice = PositionGetDouble(POSITION_PRICE_OPEN); //--- Set initial price } if (lastOpenPrice < PositionGetDouble(POSITION_PRICE_OPEN)) { //--- Check higher price lastOpenPrice = PositionGetDouble(POSITION_PRICE_OPEN); //--- Update last price } if (lastLotSize < PositionGetDouble(POSITION_VOLUME)) { //--- Check larger lot lastLotSize = PositionGetDouble(POSITION_VOLUME); //--- Update lot size } isLastBuy = false; //--- Clear buy flag totalSellPositions++; //--- Increment sell count } } if (isLastBuy) { //--- Check buy position if (supportResistanceLevel > iOpen(Symbol(), PERIOD_CURRENT, 0)) { //--- Check buy condition if (IsBuyPinbar() && SymbolInfoDouble(_Symbol, SYMBOL_BID) <= lastOpenPrice - (orderDistancePips * _Point)) { //--- Check buy pinbar and distance obj_Trade.PositionOpen(Symbol(), ORDER_TYPE_BUY, NormalizeDouble((lastLotSize * lotMultiplier), fnGetLotDigit()), SymbolInfoDouble(_Symbol, SYMBOL_ASK), SymbolInfoDouble(_Symbol, SYMBOL_ASK) - stopLossPips * normalizedPoint, SymbolInfoDouble(_Symbol, SYMBOL_ASK) + (takeProfitPips * normalizedPoint), orderComment); //--- Open buy position isLastBuy = false; //--- Clear buy flag return; //--- Exit function } } } else if (!isLastBuy) { //--- Check sell position if (supportResistanceLevel < iOpen(Symbol(), PERIOD_CURRENT, 0)) { //--- Check sell condition if (IsSellPinbar() && SymbolInfoDouble(_Symbol, SYMBOL_ASK) >= lastOpenPrice + (orderDistancePips * _Point)) { //--- Check sell pinbar and distance obj_Trade.PositionOpen(Symbol(), ORDER_TYPE_SELL, NormalizeDouble((lastLotSize * lotMultiplier), fnGetLotDigit()), SymbolInfoDouble(_Symbol, SYMBOL_BID), SymbolInfoDouble(_Symbol, SYMBOL_BID) + stopLossPips * normalizedPoint, SymbolInfoDouble(_Symbol, SYMBOL_BID) - (takeProfitPips * normalizedPoint), orderComment); //--- Open sell position return; //--- Exit function } } } } //+------------------------------------------------------------------+ //| Add averaging order with auto take profit | //+------------------------------------------------------------------+ void addAveragingOrderWithAutoTP() { int positionIndex = 0; //--- Initialize position index double lastOpenPrice = 0; //--- Initialize last open price double lastLotSize = 0; //--- Initialize last lot size bool isLastBuy = false; //--- Initialize buy flag int totalBuyPositions = 0; //--- Initialize buy positions count int totalSellPositions = 0; //--- Initialize sell positions count long currentSpread = SymbolInfoInteger(Symbol(), SYMBOL_SPREAD); //--- Get current spread double supportResistanceLevel = iClose(Symbol(), PERIOD_H4, 1); //--- Get support/resistance level for (positionIndex = 0; positionIndex < PositionsTotal(); positionIndex++) { //--- Iterate through positions ulong ticket = PositionGetTicket(positionIndex); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY && PositionGetString(POSITION_SYMBOL) == Symbol() && PositionGetInteger(POSITION_MAGIC) == magicNumber) { //--- Check buy position if (lastOpenPrice == 0) { //--- Check initial price lastOpenPrice = PositionGetDouble(POSITION_PRICE_OPEN); //--- Set initial price } if (lastOpenPrice > PositionGetDouble(POSITION_PRICE_OPEN)) { //--- Check lower price lastOpenPrice = PositionGetDouble(POSITION_PRICE_OPEN); //--- Update last price } if (lastLotSize < PositionGetDouble(POSITION_VOLUME)) { //--- Check larger lot lastLotSize = PositionGetDouble(POSITION_VOLUME); //--- Update lot size } isLastBuy = true; //--- Set buy flag totalBuyPositions++; //--- Increment buy count } if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL && PositionGetString(POSITION_SYMBOL) == Symbol() && PositionGetInteger(POSITION_MAGIC) == magicNumber) { //--- Check sell position if (lastOpenPrice == 0) { //--- Check initial price lastOpenPrice = PositionGetDouble(POSITION_PRICE_OPEN); //--- Set initial price } if (lastOpenPrice < PositionGetDouble(POSITION_PRICE_OPEN)) { //--- Check higher price lastOpenPrice = PositionGetDouble(POSITION_PRICE_OPEN); //--- Update last price } if (lastLotSize < PositionGetDouble(POSITION_VOLUME)) { //--- Check larger lot lastLotSize = PositionGetDouble(POSITION_VOLUME); //--- Update lot size } isLastBuy = false; //--- Clear buy flag totalSellPositions++; //--- Increment sell count } } if (isLastBuy) { //--- Check buy position if (supportResistanceLevel > iOpen(Symbol(), PERIOD_CURRENT, 0)) { //--- Check buy condition if (IsBuyPinbar() && SymbolInfoDouble(_Symbol, SYMBOL_BID) <= lastOpenPrice - (orderDistancePips * _Point)) { //--- Check buy pinbar and distance obj_Trade.PositionOpen(Symbol(), ORDER_TYPE_BUY, NormalizeDouble((lastLotSize * lotMultiplier), fnGetLotDigit()), SymbolInfoDouble(_Symbol, SYMBOL_ASK), 0, 0, orderComment); //--- Open buy position calculatePositionMetrics(); //--- Calculate position metrics updateStopLossTakeProfit(); //--- Update stop loss and take profit isLastBuy = false; //--- Clear buy flag return; //--- Exit function } } } else if (!isLastBuy) { //--- Check sell position if (supportResistanceLevel < iOpen(Symbol(), PERIOD_CURRENT, 0)) { //--- Check sell condition if (IsSellPinbar() && SymbolInfoDouble(_Symbol, SYMBOL_ASK) >= lastOpenPrice + (orderDistancePips * _Point)) { //--- Check sell pinbar and distance obj_Trade.PositionOpen(Symbol(), ORDER_TYPE_SELL, NormalizeDouble((lastLotSize * lotMultiplier), fnGetLotDigit()), SymbolInfoDouble(_Symbol, SYMBOL_BID), 0, 0, orderComment); //--- Open sell position calculatePositionMetrics(); //--- Calculate position metrics updateStopLossTakeProfit(); //--- Update stop loss and take profit return; //--- Exit function } } } }

Here, we implement the "updateStopLossTakeProfit" and "addAveragingOrder" functions, along with "addAveragingOrderWithAutoTP", to manage stop loss, take profit, and averaging trades, ensuring dynamic position adjustments. First, we develop the "updateStopLossTakeProfit" function, which iterates through all positions. For buy positions (POSITION_TYPE_BUY), we calculate "buyTakeProfitLevel" based on "buyBreakEvenPrice" plus "takeProfitPips * _Point" if "takeProfitPips" is positive, get the current stop loss with PositionGetDouble, adjust it to "buyBreakEvenPrice - slBreakevenMinus * _Point" if "slBreakevenMinus" is positive, or for single positions ("buyCount == 1"), set take profit and stop loss based on POSITION_PRICE_OPEN adjusted by take profit and stop loss, normalize both levels with "NormalizePrice", close positions with "obj_Trade.PositionClose" if the bid price hits take profit or stop loss, and modify positions with "obj_Trade.PositionModify" if levels differ; similar logic applies for sell positions using "sellBreakEvenPrice" and ask price.

Then, we proceed to implement the "addAveragingOrder" function, which tracks the latest position by iterating through PositionsTotal, updating "lastOpenPrice" to the lowest buy or highest sell price and "lastLotSize" to the largest volume, setting "isLastBuy" accordingly. For buys, if "supportResistanceLevel" exceeds the current open price and a buy pin bar is detected with "IsBuyPinbar" and the bid price is below "lastOpenPrice" by "orderDistancePips * _Point", we open a buy position with "obj_Trade.PositionOpen" using a lot size of "lastLotSize * lotMultiplier" normalized by "fnGetLotDigit", with calculated stop loss and take profit, and clear "isLastBuy"; for sells, we check if the ask price is above "lastOpenPrice" by "orderDistancePips * _Point" and open a sell position similarly.

Last, we implement "addAveragingOrderWithAutoTP", which follows the same logic as "addAveragingOrder" but opens positions without initial stop loss or take profit (set to 0), calls "calculatePositionMetrics" to update metrics like "buyBreakEvenPrice", and invokes "updateStopLossTakeProfit" to set breakeven-based levels, ensuring dynamic adjustments for averaging trades. We can now call these functions in the tick logic for the logic to take effect.

if (useSignalMode == ENABLED && CountTradesBuy() >= 1 && CountTradesBuy() < maxOrders && useAutoTakeProfit == false) { //--- Check buy averaging addAveragingOrder(); //--- Add buy averaging order } if (useSignalMode == ENABLED && CountTradesSell() >= 1 && CountTradesSell() < maxOrders && useAutoTakeProfit == false) { //--- Check sell averaging addAveragingOrder(); //--- Add sell averaging order } if (useSignalMode == ENABLED && CountTradesBuy() >= 1 && CountTradesBuy() < maxOrders && useAutoTakeProfit == true) { //--- Check buy averaging with auto TP addAveragingOrderWithAutoTP(); //--- Add buy averaging order with auto TP } if (useSignalMode == ENABLED && CountTradesSell() >= 1 && CountTradesSell() < maxOrders && useAutoTakeProfit == true) { //--- Check sell averaging with auto TP addAveragingOrderWithAutoTP(); //--- Add sell averaging order with auto TP }

We complete the tick logic implementation by adding logic to handle averaging trades under specific conditions, enhancing the EA’s ability to scale into positions dynamically. First, when "useSignalMode" is "ENABLED", we check if there is at least one buy position with "CountTradesBuy" and the number of buy positions is below "maxOrders"; if "useAutoTakeProfit" is false, we call "addAveragingOrder" to open an additional buy position based on pin bar detection and price distance criteria, using a multiplied lot size.

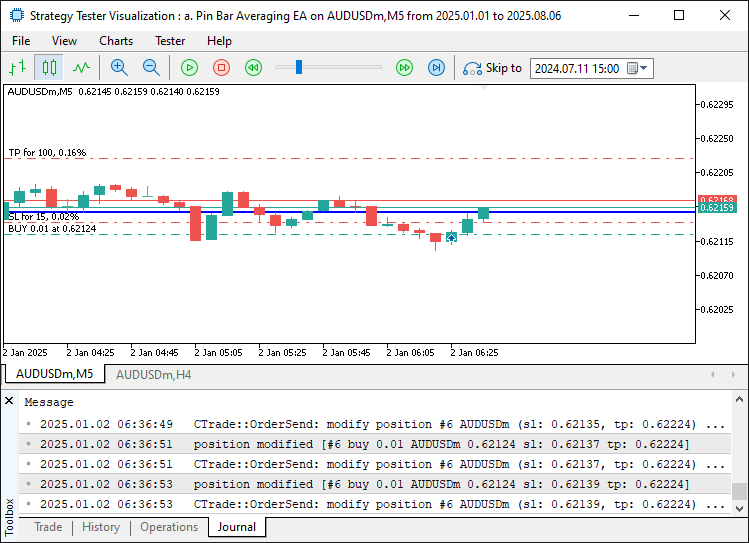

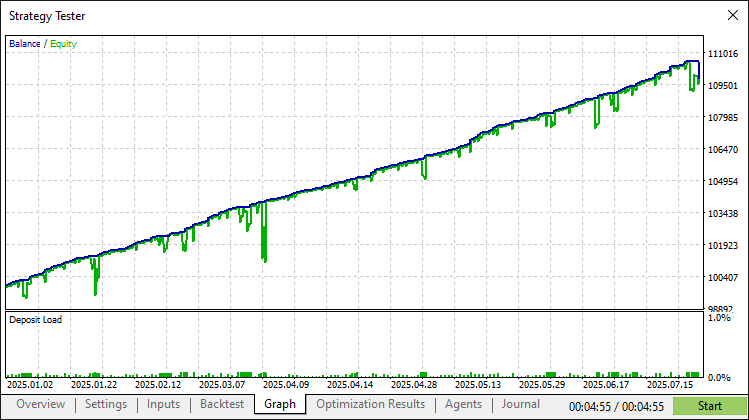

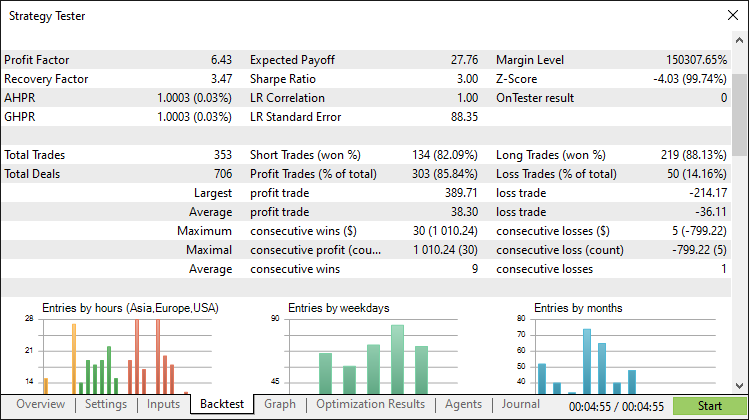

Then, we proceed to apply the same logic for sell positions, checking "CountTradesSell" and calling "addAveragingOrder" if "useAutoTakeProfit" is false to add a sell position under similar conditions. Next, for buy positions when "useAutoTakeProfit" is true, we call "addAveragingOrderWithAutoTP" to open a buy position without an initial stop loss or take profit, followed by updating metrics and adjusting breakeven-based levels. Last, we repeat this for sell positions when "useAutoTakeProfit" is true, invoking "addAveragingOrderWithAutoTP" to add a sell position with dynamic stop loss and take profit adjustments. This logic will ensure the EA effectively manages averaging trades in signal mode, adapting to market movements. Upon compilation, we have the following outcome.

Now that we have added the averaging option, what remains is adding a trailing stop logic for risk management. The logic will need to be done on every tick for precise risk control, so we will add the logic outside the bar restriction logic.

double setPointValue = normalizedPoint; //--- Set point value for calculations if (useTrailingStop && trailingStartPips > 0 && breakevenPips < trailingStartPips) { //--- Check trailing stop conditions double averageBuyPrice = rata_price(ORDER_TYPE_BUY); //--- Calculate average buy price double trailingReference = 0; //--- Initialize trailing reference for (int iTrade = 0; iTrade < PositionsTotal(); iTrade++) { //--- Iterate through positions ulong ticket = PositionGetTicket(iTrade); //--- Get position ticket if (ticket == 0) continue; //--- Skip invalid tickets if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_BUY && PositionGetString(POSITION_SYMBOL) == Symbol() && PositionGetInteger(POSITION_MAGIC) == magicNumber) { //--- Check buy position if (useAutoTakeProfit) { //--- Check auto take profit trailingReference = averageBuyPrice; //--- Use average buy price } else { //--- Use open price trailingReference = PositionGetDouble(POSITION_PRICE_OPEN); //--- Set open price } if (SymbolInfoDouble(_Symbol, SYMBOL_BID) - trailingReference > trailingStartPips * setPointValue) { //--- Check trailing condition if (SymbolInfoDouble(_Symbol, SYMBOL_BID) - ((trailingStartPips - breakevenPips) * setPointValue) > PositionGetDouble(POSITION_SL)) { //--- Check stop loss adjustment obj_Trade.PositionModify(ticket, SymbolInfoDouble(_Symbol, SYMBOL_BID) - ((trailingStartPips - breakevenPips) * setPointValue), PositionGetDouble(POSITION_TP)); //--- Modify position } } } } double averageSellPrice = rata_price(ORDER_TYPE_SELL); //--- Calculate average sell price for (int iTrade2 = 0; iTrade2 < PositionsTotal(); iTrade2++) { //--- Iterate through positions ulong ticket2 = PositionGetTicket(iTrade2); //--- Get position ticket if (ticket2 == 0) continue; //--- Skip invalid tickets if (PositionGetInteger(POSITION_TYPE) == POSITION_TYPE_SELL && PositionGetString(POSITION_SYMBOL) == Symbol() && PositionGetInteger(POSITION_MAGIC) == magicNumber) { //--- Check sell position if (useAutoTakeProfit) { //--- Check auto take profit trailingReference = averageSellPrice; //--- Use average sell price } else { //--- Use open price trailingReference = PositionGetDouble(POSITION_PRICE_OPEN); //--- Set open price } if (trailingReference - SymbolInfoDouble(_Symbol, SYMBOL_ASK) > trailingStartPips * setPointValue) { //--- Check trailing condition if (SymbolInfoDouble(_Symbol, SYMBOL_ASK) + ((trailingStartPips - breakevenPips) * setPointValue) < PositionGetDouble(POSITION_SL) || PositionGetDouble(POSITION_SL) == 0) { //--- Check stop loss adjustment obj_Trade.PositionModify(ticket2, SymbolInfoDouble(_Symbol, SYMBOL_ASK) + ((trailingStartPips - breakevenPips) * setPointValue), PositionGetDouble(POSITION_TP)); //--- Modify position } } } } }

We implement the trailing stop logic by first setting "setPointValue" to "normalizedPoint" for consistent price calculations and checking if "useTrailingStop" is true, "trailingStartPips" is positive, and "breakevenPips" is less than "trailingStartPips" to ensure valid trailing conditions. Then, we proceed to handle buy positions by calculating "averageBuyPrice" using "rata_price" for ORDER_TYPE_BUY, iterating through all positions to get valid buy position tickets that match "Symbol" and "magicNumber", setting "trailingReference" to "averageBuyPrice" if "useAutoTakeProfit" is true or to "POSITION_PRICE_OPEN" otherwise, and modifying the stop loss with "obj_Trade.PositionModify" to SYMBOL_BID - (trailingStartPips - breakevenPips) * setPointValue" if the bid price exceeds "trailingReference" by "trailingStartPips * setPointValue" and the new stop loss is higher than the current one.

Next, we apply similar logic for sell positions, calculating "averageSellPrice" with "rata_price" for "ORDER_TYPE_SELL", iterating through positions, setting "trailingReference" to "averageSellPrice" or POSITION_PRICE_OPEN, and modifying the stop loss to "SYMBOL_ASK + (trailingStartPips - breakevenPips) * setPointValue" if the ask price is below "trailingReference" by "trailingStartPips * setPointValue" and the new stop loss is lower or unset. Last, we ensure modifications maintain the existing take profit via "PositionGetDouble(POSITION_TP)" and call ChartRedraw in the parent function to update the chart. Upon compilation, we get the following outcome.

Before trailing stop:

After trailing stop:

Now that we have completed the position management logic, we can create a dashboard to visualize the account metrics. We use a function for that as well for easier management.