Price Action Gold Trader

- Indicators

- Kristhara Tharaviriyadech

- Version: 1.3

- Updated: 15 December 2025

- Activations: 20

**Price Action Gold Trader** is a sophisticated, non-repainting multi-timeframe Price Action analysis indicator specifically designed for **XAUUSD (Gold)** trading on MetaTrader 4. This professional-grade tool automatically detects Price Action patterns, provides structured entry zones, precise stop-loss levels, dynamic take-profit targets, and comprehensive market state diagnostics.

Built with systematic trading in mind, this indicator transforms complex Price Action analysis into a fully automated, rule-based trading system. It does not repaint, supports multi-timeframe confirmation, and provides real-time alerts across H4 and H1 timeframes.

---

### ✨ **Key Features**

#### **1. Non-Repainting Signals**

- ✅ All signals are confirmed only after bar closure

- ✅ No false signals or signal disappearance

- ✅ Reliable and trustworthy trading signals

#### **2. Multi-Timeframe Analysis**

- **H4 (Primary Timeframe)**: Main analysis and signal generation

- **H1 (Entry Timeframe)**: Precise entry trigger detection

- **D1 (Context Timeframe)**: Higher timeframe market context and bias

#### **3. Automated Pattern Detection**

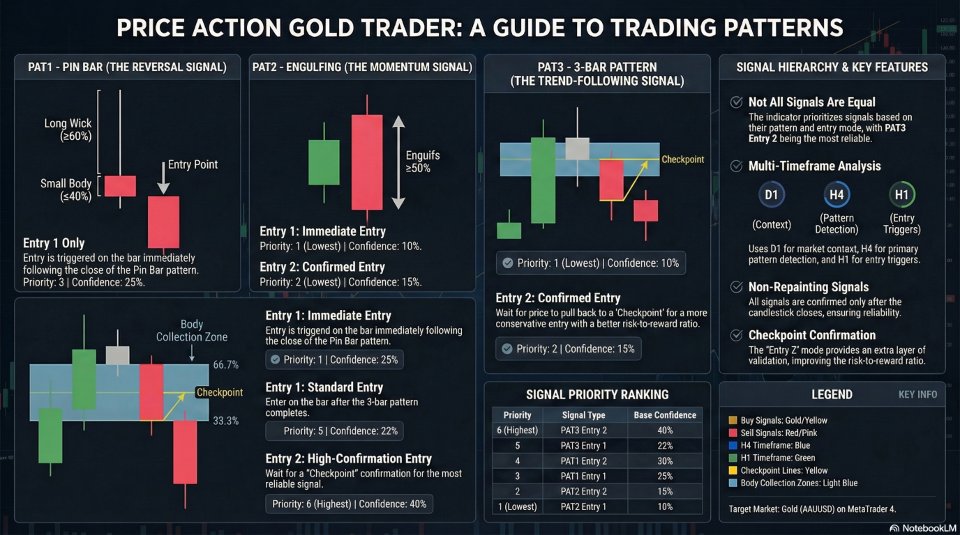

The indicator automatically detects three powerful Price Action patterns:

- **PAT1 (Pin Bar)**: Reversal pattern with customizable body/wick ratios

- **PAT2 (Engulfing)**: Strong reversal pattern with configurable engulf percentage

- **PAT3 (3-Bar Pattern)**: Advanced pattern with body collection zone analysis

#### **4. Dual Entry System**

- **Entry 1**: Faster entry with higher risk/reward ratio

- **Entry 2**: More conservative entry with additional confirmation

- Automatic checkpoint detection for optimal entry timing

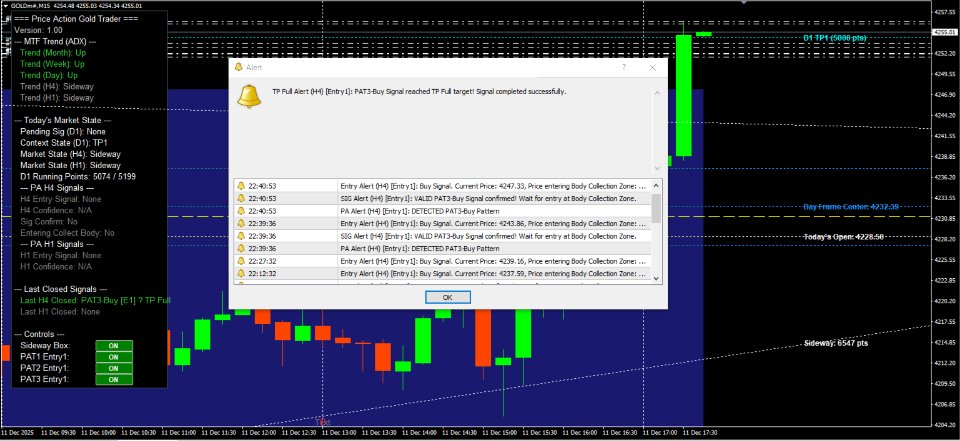

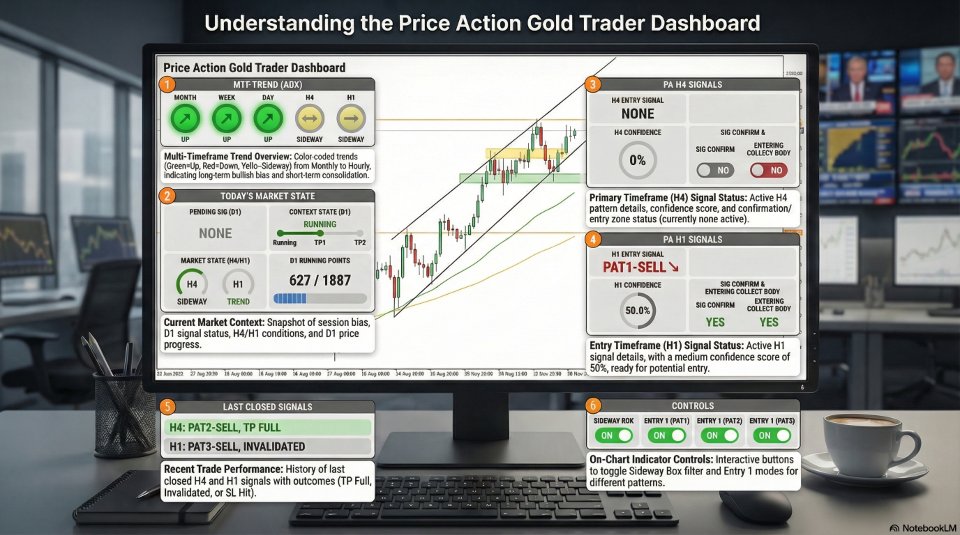

#### **5. Real-Time Dashboard**

Comprehensive on-chart dashboard displaying:

- Multi-timeframe trend analysis (Month, Week, Day, H4, H1) using ADX

- Current market state (Sideway, Up, Down)

- Active and pending signals with confidence levels

- Last closed signals with results (TP Full, Invalidated)

- D1 running points and context state

- Body collection zone status

- Signal confirmation status

#### **6. Advanced Filtering System**

- **PA Filter**: Validates Price Action pattern quality

- **Pending Signal Filter**: Ensures proper signal sequence

- **MTF Override Filter**: Multi-timeframe confirmation

- **Sideway Box Filter**: Identifies and filters sideway market conditions

- **H1 Independent Mode**: Allows H1 signals independent of H4

#### **7. Dynamic Target System**

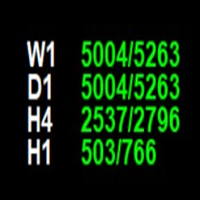

- **H1 Targets**: TP1 (1000 points default)

- **H4 Targets**: TP1 (1500 points) and TP2 (3000 points)

- **D1 Targets**: TP1 (5000 points) and TP2 (10000 points)

- All targets are automatically calculated based on cycle analysis

#### **8. Visual Elements**

- Price Action pattern arrows (Buy/Sell)

- Entry signal markers

- Checkpoint lines for Entry 2

- Body collection zones

- Swing rest / Half rest levels

- Take-profit target lines

- Stop-loss lines

- Day Frame box (customizable time and range)

- Today's open line

- Sideway market box

- PA wick lines (optional)

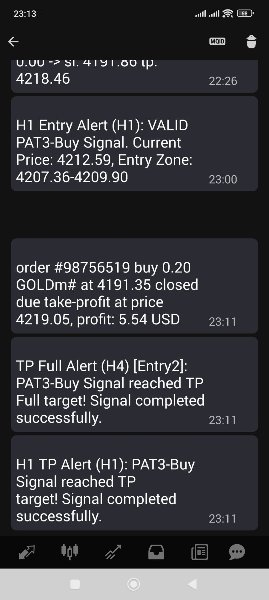

#### **9. Alert & Notification System**

- Real-time alerts for all signal types

- Push notifications (mobile MT4)

- Alerts for:

- New PA pattern detection

- Signal confirmation

- Entry signals (H1)

- TP Full reached

- Signal invalidation

#### **10. Market State Analysis**

- Automatic sideway market detection using ADX

- Day Frame analysis (customizable open time)

- Context state tracking (D1)

- Market bias determination (Buy/Sell/Neutral)

---

User Guide Download Here --> https://drive.google.com/file/d/16Z2ZnAo5jWt90ReGqEoJfWgU_Fw4WmIb/view?usp=sharing

User Guide Download Here --> https://drive.google.com/file/d/16Z2ZnAo5jWt90ReGqEoJfWgU_Fw4WmIb/view?usp=sharing

### 🔧 **How It Works**

#### **Signal Generation Process**

1. **Step 1: Context Check (D1)**

- Analyzes D1 timeframe for market context

- Determines global bias (Buy/Sell/Neutral)

- Identifies pending signals on higher timeframe

2. **Step 2: Structure Position (H4)**

- Checks if price is in high-probability zone

- Validates Day Frame position

- Applies sideway filter if enabled

3. **Step 3: PA Pattern Detection (H4)**

- Scans for PAT1, PAT2, or PAT3 patterns

- Validates pattern quality using filters

- Confirms pattern meets all criteria

4. **Step 4: Signal Confirmation**

- Multi-timeframe confirmation

- Checkpoint detection for Entry 2

- Body collection zone validation

5. **Step 5: Entry Trigger (H1)**

- Monitors H1 timeframe for entry signals

- Provides precise entry points

- Calculates confidence levels

#### **Entry Modes**

- **Entry 1**:

- Faster entry after PA pattern confirmation

- Entry at PA bar + 1 bar (PAT1) or + 2 bars (PAT2/PAT3)

- Higher risk/reward potential

- **Entry 2**:

- More conservative entry with checkpoint confirmation

- Entry at checkpoint bar

- Additional validation for higher probability

---

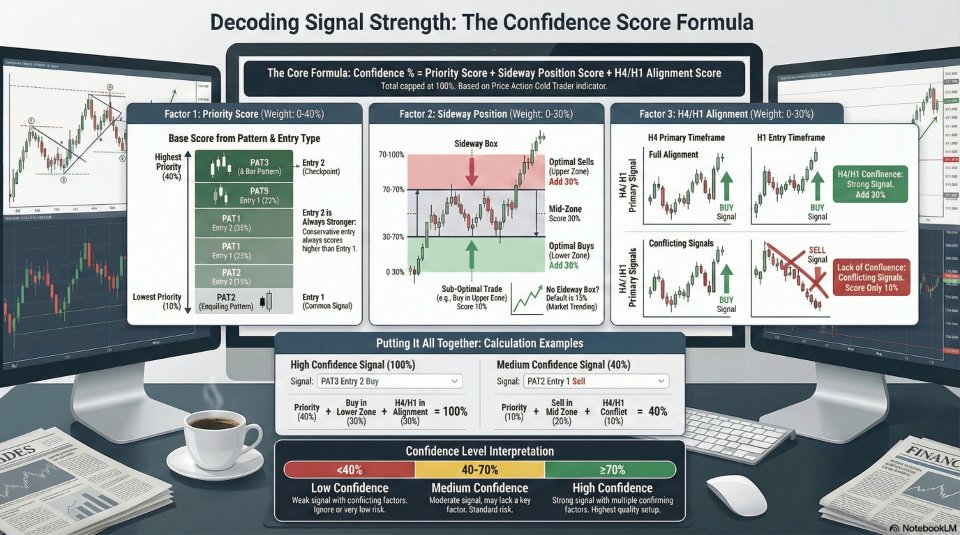

### 📊 **Priority System & Confidence Calculation**

#### **Priority System**

The indicator uses a 6-level priority system (1-6, where 6 = highest) to rank signals based on pattern type and entry mode. When multiple signals are detected, the system automatically selects the one with the highest priority.

**Priority Ranking (Highest to Lowest):**

1. **Priority 6**: PAT3 Entry 2 (Trend Following / Strong Breakout - Entry 2)

- Most reliable trend following signal

- Highest confidence pattern with checkpoint confirmation

2. **Priority 5**: PAT3 Entry 1 (Trend Following / Strong Breakout - Entry 1)

- Trend following but less certain than Entry 2

3. **Priority 4**: PAT1 Entry 2 (Reversal / First Break - Entry 2)

- More reliable reversal signal with checkpoint confirmation

4. **Priority 3**: PAT1 Entry 1 (Reversal / First Break - Entry 1)

- Reversal signal less certain than Entry 2

5. **Priority 2**: PAT2 Entry 2 (Correction / Sideway - Entry 2)

- More reliable correction/sideway signal with checkpoint confirmation

6. **Priority 1**: PAT2 Entry 1 (Correction / Sideway - Entry 1)

- Lowest priority - correction/sideway signal without checkpoint

**Pattern Type Definitions:**

- **PAT3**: Trend Following / Strong Breakout (highest priority pattern type)

- **PAT1**: Reversal / First Break (medium priority pattern type)

- **PAT2**: Correction / Sideway (lowest priority pattern type)

**Entry Mode Impact:**

- Entry 2 (with checkpoint) always has higher priority than Entry 1 (without checkpoint)

- Checkpoint confirmation adds reliability and increases priority level

---

#### **Confidence Percentage Calculation**

The confidence percentage is calculated using a weighted scoring system based on three key factors. The final confidence value is capped at 100%.

**Formula:**

```

Confidence % = Priority Score + Sideway Position Score + Alignment Score

(Maximum: 100%)

```

**Factor 1: Priority Score (0-40%)**

The priority score is determined by the signal's priority level:

| Priority | Pattern Type | Entry Mode | Score |

|----------|--------------|------------|-------|

| 6 | PAT3 | Entry 2 | 40% |

| 4 | PAT1 | Entry 2 | 30% |

| 3 | PAT1 | Entry 1 | 25% |

| 5 | PAT3 | Entry 1 | 22% |

| 2 | PAT2 | Entry 2 | 15% |

| 1 | PAT2 | Entry 1 | 10% |

**Factor 2: Position in Sideway Box (0-30%)**

This factor evaluates the signal's position within the sideway market range. The scoring is dynamic based on signal direction (Buy Low / Sell High principle).

**For BUY Signals:**

- **Lower Zone (0-30%)**: 30% score (Buy Low - discount price)

- **Mid Zone (30-70%)**: 20% score (medium risk)

- **Upper Zone (70-100%)**: 10% score (chasing high - lowest)

**For SELL Signals:**

- **Upper Zone (70-100%)**: 30% score (Sell High - premium price)

- **Mid Zone (30-70%)**: 20% score (medium risk)

- **Lower Zone (0-30%)**: 10% score (selling too cheap - lowest)

**If no sideway box exists or insufficient data**: 15% (default score)

**Factor 3: Alignment H4/H1 (0-30%)**

This factor measures the alignment between H4 and H1 timeframes, providing extra weight for multi-timeframe confluence.

**For H4 Signals:**

- **Same direction as H1 signal**: 30% score (best - strong confluence)

- **Opposite direction to H1 signal**: 10% score (bad - conflicting signals)

- **No H1 signal exists**: 10% score (reduced from 15%)

**For H1 Signals:**

- **Same direction as H4 signal**: 30% score (best - strong confluence)

- **Opposite direction to H4 signal**: 10% score (bad - conflicting signals)

- **No H4 signal exists**: 10% score (reduced from 15%)

**Confidence Level Interpretation:**

The dashboard displays confidence with color coding:

- **Green (≥70%)**: High confidence - Strong signal with multiple confirmations

- **Yellow (40-70%)**: Medium confidence - Moderate signal quality

- **Red (<40%)**: Low confidence - Weak signal or conflicting factors

**Example Calculation:**

A PAT3 Entry 2 Buy signal:

- Priority Score: 40% (PAT3 Entry 2)

- Sideway Position: 30% (Buy signal in lower zone 0-30%)

- Alignment: 30% (H4 and H1 both Buy)

- **Total Confidence: 100%** (capped at maximum)

A PAT2 Entry 1 Sell signal:

- Priority Score: 10% (PAT2 Entry 1)

- Sideway Position: 20% (Sell signal in mid zone)

- Alignment: 10% (No H4 signal or opposite direction)

- **Total Confidence: 40%** (Medium confidence)

---

### ⚙️ **Configuration Settings**

#### **General Settings**

- Calculation candle count (default: 1000)

- Primary timeframe (H4)

- Entry timeframe (H1)

- Context timeframe (D1)

- Day open time (customizable)

- GMT offset settings (Broker and Local)

- Day frame points range

- Price digits configuration

#### **Pattern Detection Settings**

- Enable/disable each pattern type

- PAT1: Body/wick percentage thresholds

- PAT2: Engulf percentage minimum

- PAT3: Body collection zone percentages

#### **Target Settings**

- H1 TP1 and SL offset

- H4 TP1 and TP2

- D1 TP1 and TP2

- All customizable in points

#### **Filter Settings**

- Sideway box enable/disable

- Sideway range minimum points

- Sideway position tolerance

- Sideway filter bars count

#### **Visual Settings**

- Show/hide all visual elements

- Customizable line styles and widths

- Color customization for all elements

- Dashboard display toggle

#### **Alert Settings**

- Enable/disable all alerts

- Push notification toggle

- Individual alert types

---

### 📊 **Dashboard Information**

The real-time dashboard provides:

- **MTF Trend (ADX)**: Trend direction for Month, Week, Day, H4, H1

- **Today's Market State**:

- Pending signals (D1)

- Context state (D1)

- Market state (H4, H1)

- D1 running points

- **PA H4 Signals**:

- Entry signal status

- Confidence level

- Signal confirmation

- Body collection zone status

- **PA H1 Signals**:

- Entry signal status

- Confidence level

- **Last Closed Signals**:

- H4 closed signal with result

- H1 closed signal with result

- **Controls**:

- Sideway box status

- Entry mode toggles (PAT1/PAT2/PAT3 Entry1)

---

### 📱 **Alert Types**

1. **PA Pattern Alert**: When a new Price Action pattern is detected

2. **Signal Confirmation Alert**: When a signal is confirmed

3. **Entry Signal Alert**: When an H1 entry signal appears

4. **TP Full Alert**: When take-profit full is reached

5. **Invalidation Alert**: When a signal is invalidated

All alerts can be sent as:

- On-screen alerts

- Push notifications (mobile MT4)

---

### 🔍 **Technical Specifications**

- **Platform**: MetaTrader 4

- **Symbol**: XAUUSD (Gold)

- **Timeframes**: Optimized for H4, H1, D1

- **Minimum MT4 Build**: 600+

- **Repainting**: No (non-repainting)

- **Calculation Method**: Bar-by-bar analysis

- **Resource Usage**: Optimized for performance

---

### 💡 **Trading Tips**

1. **Best Practices**:

- Always wait for signal confirmation before entering

- Use Entry 2 for more conservative trades

- Monitor the dashboard for market state changes

- Pay attention to D1 context for overall bias

2. **Risk Management**:

- Always use stop-loss levels provided

- Consider partial profit taking at TP1

- Monitor signal invalidation alerts

- Adjust position size based on confidence levels

3. **Timeframe Analysis**:

- H4 provides the main signal direction

- H1 provides precise entry timing

- D1 provides overall market context

- Use all three for best results

---

### 🛠️ **Support & Updates**

- **Version**: 1.00

- **Developer**: WOW.Bearhunter

- **Email**: wowbearhunter@gmail.com

- **Updates**: Regular updates and improvements

- **Support**: Email support available

---

### ⚠️ **Important Notes**

- This indicator is designed specifically for XAUUSD (Gold)

- Signals are non-repainting and confirmed after bar closure

- Past performance does not guarantee future results

- Always use proper risk management

- Test on demo account before live trading

---

### 📈 **What Makes This Indicator Unique**

1. **Specialized for Gold**: Optimized specifically for XAUUSD characteristics

2. **Non-Repainting**: Reliable signals that don't disappear

3. **Multi-Timeframe**: Comprehensive analysis across H4, H1, and D1

4. **Dual Entry System**: Flexibility in entry timing

5. **Advanced Filtering**: Multiple filters ensure high-quality signals

6. **Real-Time Dashboard**: Complete market state at a glance

7. **Automated Analysis**: No manual pattern recognition needed

8. **Professional Grade**: Built for serious traders

---

### 🎯 **Who Should Use This Indicator**

- Gold traders looking for systematic Price Action analysis

- Traders who prefer non-repainting signals

- Multi-timeframe traders

- Traders seeking automated pattern detection

- Professional traders needing comprehensive market analysis

- Traders who want clear entry/exit levels

---

### 📝 **Conclusion**

**Price Action Gold Trader** is a complete, professional-grade Price Action analysis system for Gold trading. With its non-repainting signals, multi-timeframe analysis, advanced filtering, and comprehensive dashboard, it provides everything you need for systematic Gold trading.

Whether you're a beginner looking for clear signals or a professional trader needing advanced analysis tools, this indicator delivers reliable, actionable trading information.

**Start trading Gold with confidence. Get Price Action Gold Trader today!**

---