HTF Power of Three ICT MT4

- Indicators

- Antonio Molinaro

- Version: 1.0

- Activations: 5

Overview

The HTF Power of Three indicator is a professional implementation of the Inner Circle Trader's (ICT) Power of Three concept, inspired by Larry Williams. This indicator visualizes higher timeframe (HTF) candle development in real-time on any lower timeframe chart, making it an essential tool for ICT traders who study institutional price movement patterns.

What is Power of Three (PO3)?

Power of Three represents a three-staged Smart Money campaign that occurs in every timeframe:

- ACCUMULATION - Smart money accumulates positions around the opening price

- MANIPULATION - Liquidity is engineered, stops are hunted, and weak hands are shaken out

- DISTRIBUTION - Smart money exits positions, pairing with pending interest

As ICT states: "This is applicable to every time measurement, as long as you have a beginning time, the highest value, the lowest value, and an ending in terms of measuring time."

Key Features

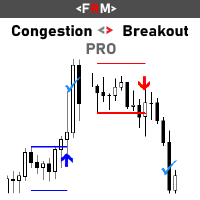

🕯️ Visual HTF Candle Representation

- Displays a single, clean HTF candle on the right side of your chart (multiple instances of the indicator can be used to show 2 or more candle, but the HTF parameter must be different between instances and also the offset from last candle must be changed from the default value).

- Shows real OHLC (Open, High, Low, Close) with proper body and wicks

- Color-coded: Green for bullish candles, Red for bearish candles

- Updates in real-time as the HTF candle develops

📏 Reference Lines System

Three intelligent reference lines connect the HTF candle to your current price action:

- Open Reference Line - Connects from HTF period start to the candle's open

- High Reference Line - Extends from candle high to current time

- Low Reference Line - Extends from candle low to current time

These lines provide clear visual context of the HTF range development.

📊 Advanced Phase Analysis ⭐

This is what sets this version apart from others! The indicator includes intelligent PO3 phase detection displayed in the info panel:

- ACCUMULATION - First third of HTF candle (0-33% completion)

- MANIPULATION - Middle third, especially when price reaches extremes (33-66% completion)

- EXPANSION - Active range development during manipulation phase

- DISTRIBUTION - Final third of HTF candle (66-100% completion)

This automated phase analysis helps you understand WHERE you are in the institutional cycle at any moment.

⏱️ Real-Time Countdown

The indicator shows exactly how many candles remain before the current HTF candle closes, allowing you to:

- Time your entries with precision

- Avoid entering late in the HTF cycle

- Anticipate new HTF candle formation

- Plan exits before distribution completes

📈 Comprehensive Info Panel

Displays all critical information:

- Current HTF timeframe and ratio (e.g., "H4 - Ratio: 1:4")

- Candle type (Bullish/Bearish)

- Range and body size in pips

- Phase analysis (current PO3 stage)

- Progress percentage and candle count

- Countdown (candles remaining)

- All OHLC price levels

Parameters

Higher Time Frame to represent (default: PERIOD_H4)

- Select the Higher Time Frame to monitor

- Available options: M1, M5, M15, M30, H1, H4, D1, W1, MN1

- Must be higher than your current chart timeframe

- The indicator automatically calculates the candle ratio

Examples:

- Chart M5 + HTF H1 = 1:12 (12 M5 candles = 1 H1 candle)

- Chart H1 + HTF H4 = 1:4 (4 H1 candles = 1 H4 candle)

- Chart M15 + HTF D1 = 1:96 (96 M15 candles = 1 D1 candle)

Visual Settings

Offset from last candle (pixels) (default: 20)

- Distance in pixels from the last chart candle to the HTF candle

- Adjust to position the candle where you prefer on the right side

Candle width in pixels (default: 8)

- Width of the HTF candle in pixels

- Increase for better visibility, decrease for a more compact display

Bullish Candle Color (default: Lime)

- Color for bullish HTF candles (Close > Open)

Bearish Candle Color (default: Red)

- Color for bearish HTF candles (Close < Open)

Wick Color (default: Gray)

- Color for candle wicks (upper and lower)

Outline Color (default: Black)

- Color for the candle body outline

Show Candle Outline (default: true)

- Toggle the black outline around the candle body

Reference Lines Settings

Show candle outline (default: true)

- Enable/disable all three reference lines

Connection lines color (default: Red)

- Color for the connection lines

Reference Line Style (default: STYLE_DOT)

- Line style: STYLE_SOLID, STYLE_DASH, STYLE_DOT, STYLE_DASHDOT, STYLE_DASHDOTDOT

Labels & Info Panel

Show OHLC labels (default: true)

- Display OHLC price labels next to the HTF candle

Show info panel (default: true)

- Display the comprehensive information panel

Price label color (default: White)

- Color for all text labels

Price Label Font Size (default: 8)

- Font size for labels and info panel

Label Font (default: "Arial")

- Font type for all text

Info panel corner (default: CORNER_RIGHT_UPPER)

- Position of the info panel on chart

- Options: CORNER_LEFT_UPPER, CORNER_RIGHT_UPPER, CORNER_LEFT_LOWER, CORNER_RIGHT_LOWER

Advanced Features

Show countdown timer in info panel (default: true)

- Display remaining candles until HTF candle closes

- Essential for timing entries and exits

Alert on new HTF candle (default: false)

- Alert notification when a new HTF candle starts

- Useful for multi-timeframe monitoring

Why This Version is Superior

⭐ Intelligent Phase Analysis

Unlike basic HTF candle indicators that only show OHLC levels, this version includes automated PO3 phase detection. You can instantly see whether Smart Money is in:

- Accumulation phase (building positions)

- Manipulation phase (hunting stops, creating liquidity)

- Expansion phase (active trend development)

- Distribution phase (exiting positions)

This analysis is based on time progress through the HTF candle and price position relative to the range, giving you institutional-level insight.

⏱️ Precision Countdown Timer

The real-time countdown shows exactly how many candles remain before the HTF cycle completes. This is crucial because:

- Entering during distribution (late stage) is high risk

- Entering during accumulation (early stage) offers better R:R

- You can anticipate manipulation phases

- You know when to expect new HTF candle formation

📊 Complete Visual Context

The three reference lines system provides unmatched clarity:

- See exactly where the HTF period started

- Understand how far price has travelled

- Identify key institutional levels

- Spot accumulation and distribution zones instantly

🎯 Professional-Grade Implementation

- Clean, non-cluttering single candle display

- Pixel-perfect positioning that doesn't interfere with price action

- Proper error handling (validates HTF > Chart TF)

- Resource-efficient code

- Compatible with all MT5 builds

Use Cases

Scalping & Day Trading

- Use M15 or H1 HTF on M1/M5 charts

- Enter during accumulation, exit before distribution

- Use countdown to time precise entries

Swing Trading

- Use H4 or D1 HTF on H1/H4 charts

- Identify larger institutional cycles

- Avoid late entries by monitoring phase and countdown

Multi-Timeframe Analysis

- Stack multiple instances with different HTF settings

- Monitor H1, H4, and D1 simultaneously on M15 chart

- Align entries with multiple HTF cycles

Backtesting & Study

- Use MT5 Strategy Tester replay mode

- Study historical PO3 patterns

- Understand how institutions moved price

- Perfect for ICT Mentorship students

Tips for Best Results

- Match HTF to your trading style: Scalpers use H1/H4, Swing traders use D1/W1

- Use phase analysis: Only enter during accumulation phase for best R:R

- Watch the countdown: Avoid entries when fewer than 30% of candles remain

- Combine with other ICT concepts: Order blocks, Fair Value Gaps, Liquidity pools

- Study in replay mode: Best way to learn PO3 patterns

Support & Updates

This indicator is designed for serious ICT traders who understand institutional price delivery. The phase analysis and countdown features make it an indispensable tool for timing entries within the Power of Three framework.

Disclaimer: This indicator is for educational purposes. Always practice proper risk management and never risk more than you can afford to lose.