Stochastic Divergence Indicator for MT5

- Indicators

- Eda Kaya

- Version: 3.1

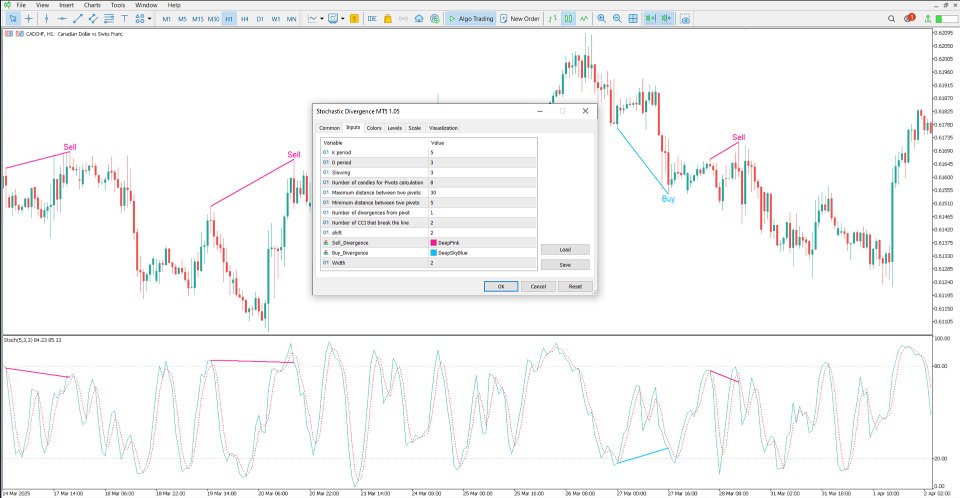

Stochastic Divergence Indicator MetaTrader 5

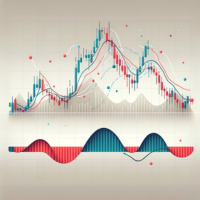

The Stochastic Divergence Indicator is designed to detect trend divergences between price action and the Stochastic Oscillator. This MetaTrader 5 tool automatically highlights divergence zones using blue and pink lines. It also displays “Buy” and “Sell” signals directly on these lines, indicating potential entry and exit points.

«Indicator Installation & User Guide»

MT5 Indicator Installation | Stochastic Divergence Indicator for MT4 | ALL Products By TradingFinderLab | Best MT5 Indicator: Refined Order Block Indicator for MT5 | Best MT5 Utility: Trade Assistant Expert TF MT5 | TP & SL Tool: Risk Reward Ratio Calculator RRR MT5 | Prop Firm Protector: Trade Assist Prop Firm Plus TF Expert MT5 | Money Management + DrawDown Protector: Trade Panel Prop Firm Drawdawn Limiter Pro MT5

Stochastic Divergence Specifications Table

The table below shows the specifications of the Stochastic Divergence Indicator:

| Category | Oscillator – Trading Tool – Price Action |

| Platform | MetaTrader 5 |

| Skill Level | Intermediate |

| Indicator Type | Reversal – Overbought and Oversold |

| Timeframe | Multi Timeframe |

| Trading Style | Intraday Trading |

| Trading Market | All Markets |

Stochastic Divergence Indicator Overview

Stochastic Divergence signals potential trend reversals when there is a mismatch between the price direction and the Stochastic Oscillator. This MetaTrader 5 oscillator analyzes the momentum and strength of price movements, identifying overbought and oversold zones, and forecasting possible trend changes.

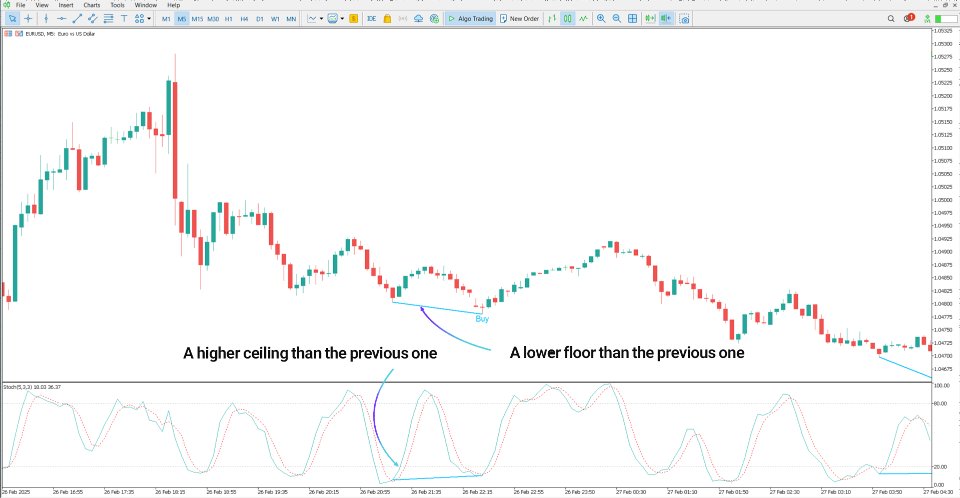

Uptrend Conditions

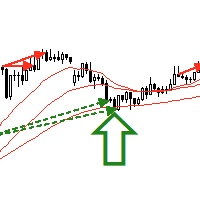

The chart below illustrates the EUR/USD pair on a 5-minute timeframe. A bullish divergence occurs when the price records a new lower low, while the Stochastic Oscillator forms a higher low. This suggests declining selling pressure and the possibility of an upward trend reversal, prompting a Buy signal to appear on the chart.

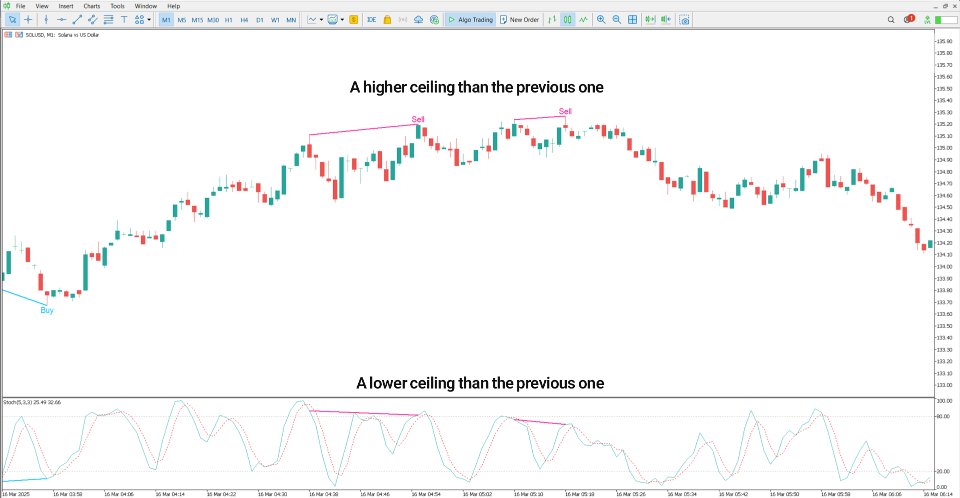

Downtrend Conditions

On the 1-minute chart of Solana (SOL/USD), a bearish divergence is observed when the price hits a new higher high, but the oscillator registers a lower high. This discrepancy indicates fading buying strength and the potential for a downward trend shift, signaling Sell opportunities.

Indicator Settings

The image below displays the customizable settings available in the Stochastic Divergence Indicator:

- K Period: K Length

- D Period: D Length

- Slowing: Deceleration

- Number of Candles for Pivots Calculation: Candle Count for Pivots

- Maximum Distance Between Two Pivots: Max Pivot Distance

- Minimum Distance Between Two Pivots: Min Pivot Distance

- Number of Divergences from Pivot: Divergence Count

- Number of Main Stochastic Breaks: Main Stochastic Breaks Count

- Shift: Displacement or Offset

- Sell Divergence: Color for Sell signals

- Buy Divergence: Color for Buy signals

- Width: Line thickness

Conclusion

The Stochastic Divergence Indicator for MetaTrader 5 automatically detects and marks divergences between price movements and the Stochastic Oscillator. It serves as a reliable price action tool by providing real-time Buy and Sell signals via colored lines on the chart.