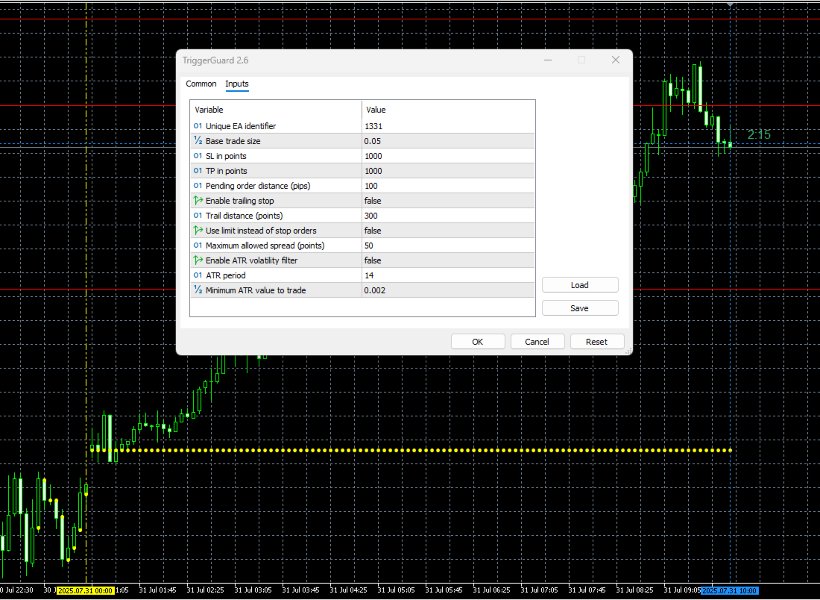

TriggerGuard Pending Order EA

- Experts

- Jason Smith

- Version: 3.11

- Updated: 30 July 2025

- Activations: 5

Introducing TriggerGuard Pending Order EA

This Bot is a state-of-the-art, fully automated Expert Advisor

Utilizing a robust pending order system, TriggerGuard ensures that your trades are placed and executed only when market conditions align with your preset criteria.

A very useful transferable tool for price action strategies, allowing you to effortlessly set traps in the market. It works flawlessly. You can execute the bot during corrections in a descending channel, against impulse waves, or according to your specific strategy. The bot sets traps a certain distance in pips from the price using pending orders, enabling you to target key levels such as support and resistance, Fibonacci retracement levels, or breakouts from consolidation zones. These are just a few examples among many possibilities. It's a great asset to have in your trading toolbox.

Smart Pending Order System – Set strategic traps and capitalize on every market move.

Strategic Pending Orders:

TriggerGuard automates the placement of buy stop and sell stop orders at specified distances from the current market price.

This ensures that your trades only trigger when the market reaches your chosen entry points, avoiding the chaos of market noise and false signals.

Customizable Entry Points:

With TriggerGuard, you define the distance (in pips) at which your pending orders will be placed.

This feature offers total flexibility, allowing you to adapt your strategy to different market conditions, whether you’re looking for short-term or long-term setups.

Risk-Control Mechanisms:

Equipped with Stop Loss and Take Profit settings, TriggerGuard helps protect your capital by automatically managing risk.

The EA ensures that your trades have predefined exit points, protecting you from significant losses while locking in profits.

One Cancels the Other (OCO) Functionality:

TriggerGuard includes an intelligent OCO feature, ensuring that when one pending order is triggered, the opposite order is automatically canceled.

This keeps you from holding two conflicting trades, ensuring only the most optimal trade is executed.

This EA includes an advanced Trailing Stop feature that moves your stop loss dynamically as the market moves in your favor.

Whether you’re in a Buy or Sell position, the Trailing Stop ensures that profits are locked in as the price moves in your direction.

With a simple input to set the distance, you can sit back and relax as the EA manages your stop loss, automatically locking in more profit as the market moves!

- Customizable Distance: Set the trailing stop distance in pips that fits your strategy.

Automatic Adjustment: As the price moves, the stop loss adjusts automatically, reducing your risk.

The trailing stop offers traders an automated way of securing profits without needing to manually adjust stop loss levels. It's perfect for capturing larger market moves while ensuring that you don’t give back too much of your profits if the market reverses unexpectedly. It provides peace of mind while letting trades run as long as the trend continues in the favorable direction.

Smart Inverse Mode: Trade Breakouts and Pullbacks with One Setting

This EA features an Inverse Mode that dynamically switches between breakout and pullback trading strategies.

How It Works

Standard Mode (Inverse = false)

Places Buy Stop orders above price and Sell Stop orders below price to capture breakouts.

Inverse Mode (Inverse = true)

Switches to Buy Limit orders below price and Sell Limit orders above price to trade pullbacks and reversals.

What Does the ATR Filter

Measures Market Volatility – Uses the Average True Range (ATR) indicator to assess price movement.

Avoids Low-Volatility Trades – Automatically blocks trades if market conditions are too stagnant.

Improves Trade Accuracy – Only executes orders when volatility meets your specified threshold.

Key Benefits

Reduces False Signals – Prevents entries in choppy or sideways markets.

Adapts to Market Conditions – Adjustable ATR period and threshold for optimal filtering.

After each open trade is closed, TriggerGuard resets the cycle, automatically placing new buy stop and sell stop orders based on your defined criteria. This continuous loop ensures that your strategy is always active and ready for the next market opportunity.

How It Works:- Set Your Parameters: Define your Lot Size, pending order distance, Stop Loss, and Take Profit levels.

- Configure Entry Levels: Choose the exact price points at which your buy stop and sell stop orders will be placed.

- Activate TriggerGuard: Let the EA work in the background, automatically placing your orders and managing risk.

- Automatic Execution: When one of your pending orders is triggered, the other order is automatically canceled, ensuring no conflicting positions.

- Cycle Reset: Once a trade is closed (whether manually or automatically), TriggerGuard resets the cycle and places new pending orders, keeping your strategy active and your trades continuously managed.

Bug report

Given the complexity of this EA. Some bugs may not have been discovered yet.

If you think you've found a bug in the Williams Percent Range EA.

Do not rush the process.

- Write a precise description of the context.

- Write a description of the error as precise as possible.

- Attach the logs of the expert tab for the corresponding date.

- Attach the logs from the log tab for the corresponding date