ML Adaptive SuperTrend MT5

- Indicators

- Duc Hoan Nguyen

- Version: 2.10

- Updated: 27 February 2025

- Activations: 10

New tools will be $30 for the first week or the first 3 purchases!

Trading Tools Channel on MQL5: Join my MQL5 channel to update the latest news from me

Unlock the power of advanced machine learning with the Machine Learning Adaptive SuperTrend, a cutting-edge indicator designed to seamlessly adapt to changing market conditions. By integrating k-means clustering with the SuperTrend methodology, this indicator enables precise trend identification and volatility assessment, giving traders an invaluable advantage in dynamic markets.

See more MT4 version at: Machine Learning Adaptive SuperTrend MT4

See more products at: All Products

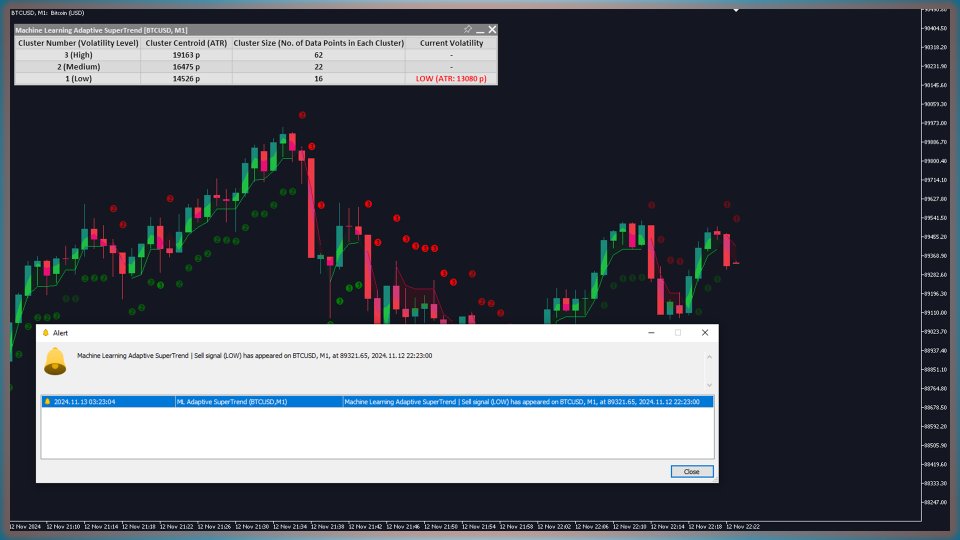

Precision with Machine Learning and Adaptive SuperTrendThis indicator is engineered to adapt based on real-time market data, categorizing volatility into three levels—high, medium, and low. Using k-means clustering, it classifies ATR (Average True Range) values into clusters, allowing for a more responsive and tailored SuperTrend calculation that aligns with current market sentiment.

Key Features- Customizable Visuals: Adjust colors for bullish and bearish trends to enhance chart readability and focus.

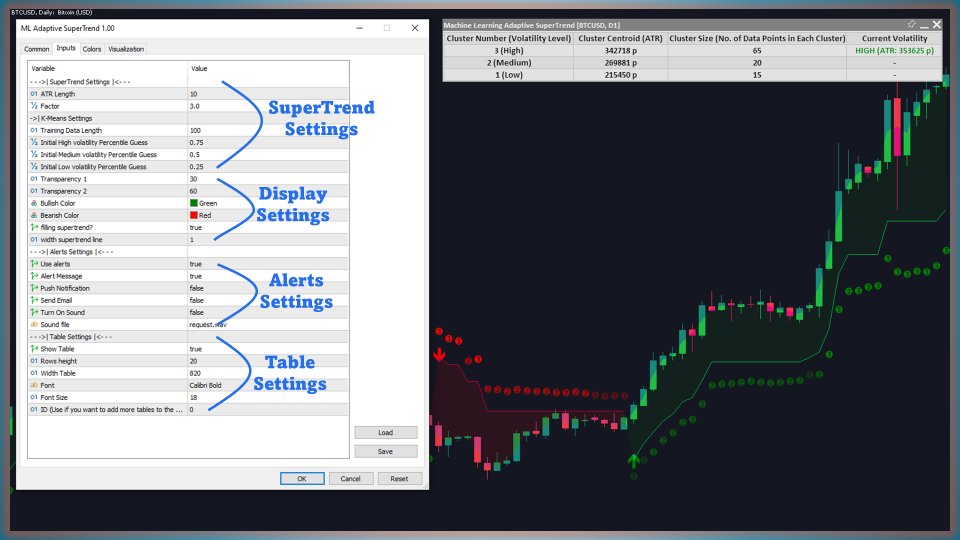

- Flexible Parameter Settings: Control ATR length, SuperTrend factor, and initial volatility estimates to suit specific trading strategies.

- Adaptive Volatility Clustering: Dynamically categorizes volatility to optimize SuperTrend calculations in real-time.

- Alerts: Set notifications for trend shifts and volatility changes, enabling proactive trade management.

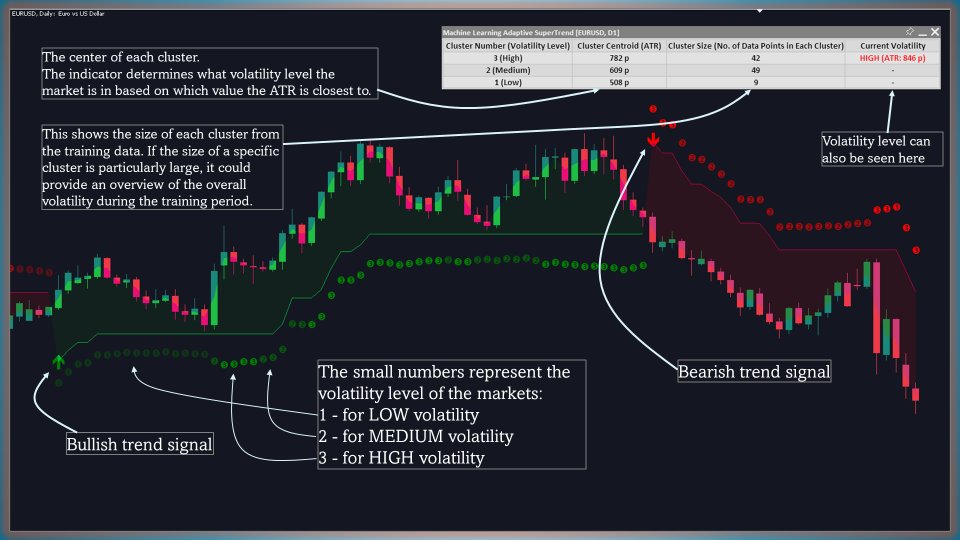

- Data Table Insights: View real-time data on cluster centroids, sizes, and current volatility levels directly on the chart, providing essential information at a glance.

- Setup and Personalization: Add the indicator and configure settings such as ATR length and SuperTrend factors. Adjust volatility percentiles to align with specific trading preferences.

- Market Monitoring: Observe color changes and SuperTrend line movements to identify trend reversals. The data table displays real-time volatility clusters, offering clear insights into market conditions.

- Stay Notified: Enable alerts for trend shifts and volatility changes, allowing for prompt responses without needing constant chart observation.

The indicator starts by calculating ATR values over a defined training period to assess market volatility. Using initial estimates for high, medium, and low volatility levels, the k-means clustering algorithm iteratively refines these categories, enabling accurate volatility classification. As market conditions evolve, the indicator continuously adjusts, providing up-to-date insights on trend and volatility. The data table also presents vital details, including cluster centroids and sizes, to support informed trading decisions.

The Machine Learning Adaptive SuperTrend offers a sophisticated approach to trend analysis, designed to adapt dynamically to market changes and provide deeper insights for traders aiming to refine their strategies.