Rebuy algorithm: Math model for increasing efficiency

In this article, we will use the rebuy algorithm for a deeper understanding of the efficiency of trading systems and start working on the general principles of improving trading efficiency using mathematics and logic, as well as apply the most non-standard methods of increasing efficiency in terms of using absolutely any trading system.

Price Action Analysis Toolkit Development (Part 47): Tracking Forex Sessions and Breakouts in MetaTrader 5

Global market sessions shape the rhythm of the trading day, and understanding their overlap is vital to timing entries and exits. In this article, we’ll build an interactive trading sessions EA that brings those global hours to life directly on your chart. The EA automatically plots color‑coded rectangles for the Asia, Tokyo, London, and New York sessions, updating in real time as each market opens or closes. It features on‑chart toggle buttons, a dynamic information panel, and a scrolling ticker headline that streams live status and breakout messages. Tested on different brokers, this EA combines precision with style—helping traders see volatility transitions, identify cross‑session breakouts, and stay visually connected to the global market’s pulse.

Automating Trading Strategies in MQL5 (Part 26): Building a Pin Bar Averaging System for Multi-Position Trading

In this article, we develop a Pin Bar Averaging system in MQL5 that detects pin bar patterns to initiate trades and employs an averaging strategy for multi-position management, enhanced by trailing stops and breakeven adjustments. We incorporate customizable parameters with a dashboard for real-time monitoring of positions and profits.

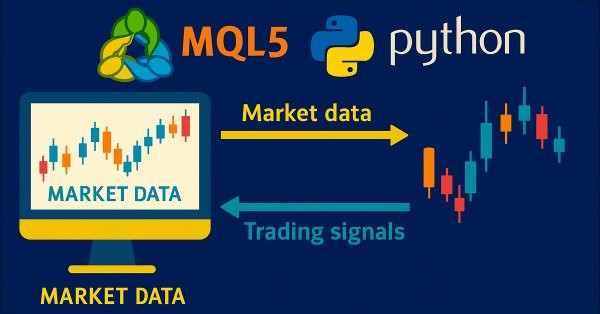

Price Action Analysis Toolkit Development (Part 36): Unlocking Direct Python Access to MetaTrader 5 Market Streams

Harness the full potential of your MetaTrader 5 terminal by leveraging Python’s data-science ecosystem and the official MetaTrader 5 client library. This article demonstrates how to authenticate and stream live tick and minute-bar data directly into Parquet storage, apply sophisticated feature engineering with Ta and Prophet, and train a time-aware Gradient Boosting model. We then deploy a lightweight Flask service to serve trade signals in real time. Whether you’re building a hybrid quant framework or enhancing your EA with machine learning, you’ll walk away with a robust, end-to-end pipeline for data-driven algorithmic trading.

Timeseries in DoEasy library (part 55): Indicator collection class

The article continues developing indicator object classes and their collections. For each indicator object create its description and correct collection class for error-free storage and getting indicator objects from the collection list.

Data Science and Machine Learning (Part 05): Decision Trees

Decision trees imitate the way humans think to classify data. Let's see how to build trees and use them to classify and predict some data. The main goal of the decision trees algorithm is to separate the data with impurity and into pure or close to nodes.

Developing a trading Expert Advisor from scratch (Part 12): Times and Trade (I)

Today we will create Times & Trade with fast interpretation to read the order flow. It is the first part in which we will build the system. In the next article, we will complete the system with the missing information. To implement this new functionality, we will need to add several new things to the code of our Expert Advisor.

Category Theory in MQL5 (Part 16): Functors with Multi-Layer Perceptrons

This article, the 16th in our series, continues with a look at Functors and how they can be implemented using artificial neural networks. We depart from our approach so far in the series, that has involved forecasting volatility and try to implement a custom signal class for setting position entry and exit signals.

Introduction to MQL5 (Part 26): Building an EA Using Support and Resistance Zones

This article teaches you how to build an MQL5 Expert Advisor that automatically detects support and resistance zones and executes trades based on them. You’ll learn how to program your EA to identify these key market levels, monitor price reactions, and make trading decisions without manual intervention.

Using cryptography with external applications

In this article, we consider encryption/decryption of objects in MetaTrader and in external applications. Our purpose is to determine the conditions under which the same results will be obtained with the same initial data.

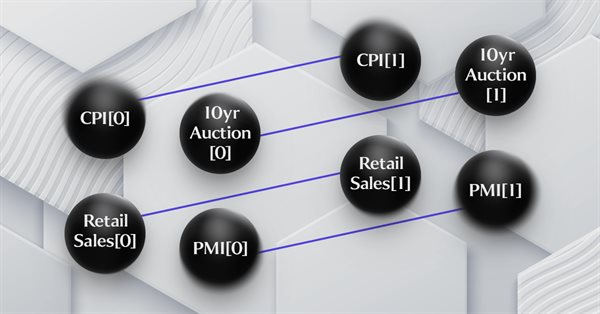

Rebuy algorithm: Multicurrency trading simulation

In this article, we will create a mathematical model for simulating multicurrency pricing and complete the study of the diversification principle as part of the search for mechanisms to increase the trading efficiency, which I started in the previous article with theoretical calculations.

What about Hedging Daily?

A trading strategy using hedging system created for trading the intra-day style of GBPJPY / EURJPY and for daily trading.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 5): Bollinger Bands On Keltner Channel — Indicators Signal

The Multi-Currency Expert Advisor in this article is an Expert Advisor or Trading Robot that can trade (open orders, close orders and manage orders for example: Trailing Stop Loss and Trailing Profit) for more than one symbol pair from only one symbol chart. In this article we will use signals from two indicators, in this case Bollinger Bands® on Keltner Channel.

Analytical Volume Profile Trading (AVPT): Liquidity Architecture, Market Memory, and Algorithmic Execution

Analytical Volume Profile Trading (AVPT) explores how liquidity architecture and market memory shape price behavior, enabling more profound insight into institutional positioning and volume-driven structure. By mapping POC, HVNs, LVNs, and Value Areas, traders can identify acceptance, rejection, and imbalance zones with precision.

Creating an EA that works automatically (Part 04): Manual triggers (I)

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode.

Timeseries in DoEasy library (part 56): Custom indicator object, get data from indicator objects in the collection

The article considers creation of the custom indicator object for the use in EAs. Let’s slightly improve library classes and add methods to get data from indicator objects in EAs.

Using MetaTrader 4 for a Time Based Pattern Analysis

Time based pattern analysis can be used in the currency market to determine a better time to enter a trade or time in which trading should be avoided at all.

Here we use MetaTrader 4 to analyze history market data and produce optimization results that can be useful for application in mechanical trading systems.

Multibot in MetaTrader (Part II): Improved dynamic template

Developing the theme of the previous article, I decided to create a more flexible and functional template that has greater capabilities and can be effectively used both in freelancing and as a base for developing multi-currency and multi-period EAs with the ability to integrate with external solutions.

Backpropagation Neural Networks using MQL5 Matrices

The article describes the theory and practice of applying the backpropagation algorithm in MQL5 using matrices. It provides ready-made classes along with script, indicator and Expert Advisor examples.

Understanding Programming Paradigms (Part 1): A Procedural Approach to Developing a Price Action Expert Advisor

Learn about programming paradigms and their application in MQL5 code. This article explores the specifics of procedural programming, offering hands-on experience through a practical example. You'll learn how to develop a price action expert advisor using the EMA indicator and candlestick price data. Additionally, the article introduces you to the functional programming paradigm.

Creating a Daily Drawdown Limiter EA in MQL5

The article discusses, from a detailed perspective, how to implement the creation of an Expert Advisor (EA) based on the trading algorithm. This helps to automate the system in the MQL5 and take control of the Daily Drawdown.

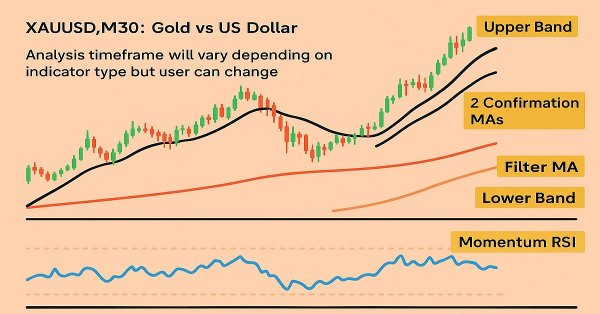

Automating Trading Strategies in MQL5 (Part 18): Envelopes Trend Bounce Scalping - Core Infrastructure and Signal Generation (Part I)

In this article, we build the core infrastructure for the Envelopes Trend Bounce Scalping Expert Advisor in MQL5. We initialize envelopes and other indicators for signal generation. We set up backtesting to prepare for trade execution in the next part.

Trading strategy based on the improved Doji candlestick pattern recognition indicator

The metabar-based indicator detected more candles than the conventional one. Let's check if this provides real benefit in the automated trading.

Understanding MQL5 Object-Oriented Programming (OOP)

As developers, we need to learn how to create and develop software that can be reusable and flexible without duplicated code especially if we have different objects with different behaviors. This can be smoothly done by using object-oriented programming techniques and principles. In this article, we will present the basics of MQL5 Object-Oriented programming to understand how we can use principles and practices of this critical topic in our software.

Using PatchTST Machine Learning Algorithm for Predicting Next 24 Hours of Price Action

In this article, we apply a relatively complex neural network algorithm released in 2023 called PatchTST for predicting the price action for the next 24 hours. We will use the official repository, make slight modifications, train a model for EURUSD, and apply it to making future predictions both in Python and MQL5.

Automating Trading Strategies in MQL5 (Part 29): Creating a price action Gartley Harmonic Pattern system

In this article, we develop a Gartley Pattern system in MQL5 that identifies bullish and bearish Gartley harmonic patterns using pivot points and Fibonacci ratios, executing trades with precise entry, stop loss, and take-profit levels. We enhance trader insight with visual feedback through chart objects like triangles, trendlines, and labels to clearly display the XABCD pattern structure.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 4): Triangular moving average — Indicator Signals

The Multi-Currency Expert Advisor in this article is Expert Advisor or trading robot that can trade (open orders, close orders and manage orders for example: Trailing Stop Loss and Trailing Profit) for more than one symbol pair only from one symbol chart. This time we will use only 1 indicator, namely Triangular moving average in multi-timeframes or single timeframe.

Creating an EA that works automatically (Part 08): OnTradeTransaction

In this article, we will see how to use the event handling system to quickly and efficiently process issues related to the order system. With this system the EA will work faster, so that it will not have to constantly search for the required data.

Developing a trading Expert Advisor from scratch (Part 10): Accessing custom indicators

How to access custom indicators directly in an Expert Advisor? A trading EA can be truly useful only if it can use custom indicators; otherwise, it is just a set of codes and instructions.

Creating an EA that works automatically (Part 09): Automation (I)

Although the creation of an automated EA is not a very difficult task, however, many mistakes can be made without the necessary knowledge. In this article, we will look at how to build the first level of automation, which consists in creating a trigger to activate breakeven and a trailing stop level.

Mastering Fair Value Gaps: Formation, Logic, and Automated Trading with Breakers and Market Structure Shifts

This is an article that I have written aimed to expound and explain Fair Value Gaps, their formation logic for occurring, and automated trading with breakers and market structure shifts.

The price movement model and its main provisions. (Part 3): Calculating optimal parameters of stock exchange speculations

Within the framework of the engineering approach developed by the author based on the probability theory, the conditions for opening a profitable position are found and the optimal (profit-maximizing) take profit and stop loss values are calculated.

Automating Trading Strategies in MQL5 (Part 21): Enhancing Neural Network Trading with Adaptive Learning Rates

In this article, we enhance a neural network trading strategy in MQL5 with an adaptive learning rate to boost accuracy. We design and implement this mechanism, then test its performance. The article concludes with optimization insights for algorithmic trading.

Exploring Advanced Machine Learning Techniques on the Darvas Box Breakout Strategy

The Darvas Box Breakout Strategy, created by Nicolas Darvas, is a technical trading approach that spots potential buy signals when a stock’s price rises above a set "box" range, suggesting strong upward momentum. In this article, we will apply this strategy concept as an example to explore three advanced machine learning techniques. These include using a machine learning model to generate signals rather than to filter trades, employing continuous signals rather than discrete ones, and using models trained on different timeframes to confirm trades.

From Novice to Expert: Demystifying Hidden Fibonacci Retracement Levels

In this article, we explore a data-driven approach to discovering and validating non-standard Fibonacci retracement levels that markets may respect. We present a complete workflow tailored for implementation in MQL5, beginning with data collection and bar or swing detection, and extending through clustering, statistical hypothesis testing, backtesting, and integration into an MetaTrader 5 Fibonacci tool. The goal is to create a reproducible pipeline that transforms anecdotal observations into statistically defensible trading signals.

MQL5 Wizard techniques you should know (Part 02): Kohonen Maps

These series of articles will proposition that the MQL5 Wizard should be a mainstay for traders. Why? Because not only does the trader save time by assembling his new ideas with the MQL5 Wizard, and greatly reduce mistakes from duplicate coding; he is ultimately set-up to channel his energy on the few critical areas of his trading philosophy.

Build Self Optimizing Expert Advisors in MQL5 (Part 6): Self Adapting Trading Rules (II)

This article explores optimizing RSI levels and periods for better trading signals. We introduce methods to estimate optimal RSI values and automate period selection using grid search and statistical models. Finally, we implement the solution in MQL5 while leveraging Python for analysis. Our approach aims to be pragmatic and straightforward to help you solve potentially complicated problems, with simplicity.

Non-standard Automated Trading

Successful and comfortable trading using MT4 platform without detailed market analysis - is it possible? Can such trading be implemented in practice? I suppose, yes. Especially in terms of the automated trading!

Introduction to MQL5 (Part 10): A Beginner's Guide to Working with Built-in Indicators in MQL5

This article introduces working with built-in indicators in MQL5, focusing on creating an RSI-based Expert Advisor (EA) using a project-based approach. You'll learn to retrieve and utilize RSI values, handle liquidity sweeps, and enhance trade visualization using chart objects. Additionally, the article emphasizes effective risk management, including setting percentage-based risk, implementing risk-reward ratios, and applying risk modifications to secure profits.

Automating Trading Strategies in MQL5 (Part 31): Creating a Price Action 3 Drives Harmonic Pattern System

In this article, we develop a 3 Drives Pattern system in MQL5 that identifies bullish and bearish 3 Drives harmonic patterns using pivot points and Fibonacci ratios, executing trades with customizable entry, stop loss, and take-profit levels based on user-selected options. We enhance trader insight with visual feedback through chart objects.