Reversing: Formalizing the entry point and developing a manual trading algorithm

This is the last article within the series devoted to the Reversing trading strategy. Here we will try to solve the problem, which caused the testing results instability in previous articles. We will also develop and test our own algorithm for manual trading in any market using the reversing strategy.

Universal Expert Advisor Template

The article will help newbies in trading to create flexibly adjustable Expert Advisors.

Library for easy and quick development of MetaTrader programs (part XXXIII): Pending trading requests - closing positions under certain conditions

We continue the development of the library functionality featuring trading using pending requests. We have already implemented sending conditional trading requests for opening positions and placing pending orders. In the current article, we will implement conditional position closure – full, partial and closing by an opposite position.

Dealing with Time (Part 2): The Functions

Determing the broker offset and GMT automatically. Instead of asking the support of your broker, from whom you will probably receive an insufficient answer (who would be willing to explain a missing hour), we simply look ourselves how they time their prices in the weeks of the time changes — but not cumbersome by hand, we let a program do it — why do we have a PC after all.

Evaluating the ability of Fractal index and Hurst exponent to predict financial time series

Studies related to search for the fractal behavior of financial data suggest that behind the seemingly chaotic behavior of economic time series there are hidden stable mechanisms of participants' collective behavior. These mechanisms can lead to the emergence of price dynamics on the exchange, which can define and describe specific properties of price series. When applied to trading, one could benefit from the indicators which can efficiently and reliably estimate the fractal parameters in the scale and time frame, which are relevant in practice.

Neural networks made easy (Part 7): Adaptive optimization methods

In previous articles, we used stochastic gradient descent to train a neural network using the same learning rate for all neurons within the network. In this article, I propose to look towards adaptive learning methods which enable changing of the learning rate for each neuron. We will also consider the pros and cons of this approach.

Manual charting and trading toolkit (Part II). Chart graphics drawing tools

This is the next article within the series, in which I show how I created a convenient library for manual application of chart graphics by utilizing keyboard shortcuts. The tools used include straight lines and their combinations. In this part, we will view how the drawing tools are applied using the functions described in the first part. The library can be connected to any Expert Advisor or indicator which will greatly simplify the charting tasks. This solution DOES NOT use external dlls, while all the commands are implemented using built-in MQL tools.

Mastering Market Dynamics: Creating a Support and Resistance Strategy Expert Advisor (EA)

A comprehensive guide to developing an automated trading algorithm based on the Support and Resistance strategy. Detailed information on all aspects of creating an expert advisor in MQL5 and testing it in MetaTrader 5 – from analyzing price range behaviors to risk management.

Evaluating the effectiveness of trading systems by analyzing their components

This article explores the effectiveness of complex trading systems by analyzing the efficiency of its individual components. Any analysis, whether it is graphic, based on indicators, or any other, is one of the key components of successful trading in financial markets. This article is to some extent a research of few simple and independent trading systems for analyzing their effectiveness and usefulness of the joint application.

Neural networks made easy (Part 2): Network training and testing

In this second article, we will continue to study neural networks and will consider an example of using our created CNet class in Expert Advisors. We will work with two neural network models, which show similar results both in terms of training time and prediction accuracy.

Library for easy and quick development of MetaTrader programs (part XXIV): Base trading class - auto correction of invalid parameters

In this article, we will have a look at the handler of invalid trading order parameters and improve the trading event class. Now all trading events (both single ones and the ones occurred simultaneously within one tick) will be defined in programs correctly.

Neural networks made easy (Part 4): Recurrent networks

We continue studying the world of neural networks. In this article, we will consider another type of neural networks, recurrent networks. This type is proposed for use with time series, which are represented in the MetaTrader 5 trading platform by price charts.

Charts and diagrams in HTML

Today it is difficult to find a computer that does not have an installed web-browser. For a long time browsers have been evolving and improving. This article discusses the simple and safe way to create of charts and diagrams, based on the the information, obtained from MetaTrader 5 client terminal for displaying them in the browser.

Automating Trading Strategies in MQL5 (Part 45): Inverse Fair Value Gap (IFVG)

In this article, we create an Inverse Fair Value Gap (IFVG) detection system in MQL5 that identifies bullish/bearish FVGs on recent bars with minimum gap size filtering, tracks their states as normal/mitigated/inverted based on price interactions (mitigation on far-side breaks, retracement on re-entry, inversion on close beyond far side from inside), and ignores overlaps while limiting tracked FVGs.

Library for easy and quick development of MetaTrader programs (part XXVII): Working with trading requests - placing pending orders

In this article, we will continue the development of trading requests, implement placing pending orders and eliminate detected shortcomings of the trading class operation.

Timeseries in DoEasy library (part 37): Timeseries collection - database of timeseries by symbols and periods

The article deals with the development of the timeseries collection of specified timeframes for all symbols used in the program. We are going to develop the timeseries collection, the methods of setting collection's timeseries parameters and the initial filling of developed timeseries with historical data.

Layman's Notes: ZigZag…

Surely, a fey thought to trade closely to extremums visited every apprentice trader when he/she saw "enigmatic" polyline for the first time. It's so simple, indeed. Here is the maximum. And there is the minimum. A beautiful picture on the history. And what is in practice? A ray is drawn. It should seem, that is it, the peak! It is time to sell. And now we go down. But hell no! The price is treacherously moving upwards. Haw! It's a trifle, not an indicator. And you throw it out!

Fast Testing of Trading Ideas on the Chart

The article describes the method of fast visual testing of trading ideas. The method is based on the combination of a price chart, a signal indicator and a balance calculation indicator. I would like to share my method of searching for trading ideas, as well as the method I use for fast testing of these ideas.

Library for easy and quick development of MetaTrader programs (part XVII): Interactivity of library objects

In this article, we are going to finish the development of the base object of all library objects, so that any library object based on it is able to interact with a user. For example, users will be able to set the maximum acceptable size of a spread for opening a position and a price level, upon reaching which an event from a symbol object is sent to the program with the spread or price level-based signal.

Data Science and Machine Learning (Part 01): Linear Regression

It's time for us as traders to train our systems and ourselves to make decisions based on what number says. Not on our eyes, and what our guts make us believe, this is where the world is heading so, let us move perpendicular to the direction of the wave.

Larry Williams Market Secrets (Part 2): Automating a Market Structure Trading System

Learn how to automate Larry Williams market structure concepts in MQL5 by building a complete Expert Advisor that reads swing points, generates trade signals, manages risk, and applies a dynamic trailing stop strategy.

What you can do with Moving Averages

The article considers several methods of applying the Moving Average indicator. Each method involving a curve analysis is accompanied by indicators visualizing the idea. In most cases, the ideas shown here belong to their respected authors. My sole task was to bring them together to let you see the main approaches and, hopefully, make more reasonable trading decisions. MQL5 proficiency level — basic.

Bi-Directional Trading and Hedging of Positions in MetaTrader 5 Using the HedgeTerminal API, Part 2

This article describes a new approach to hedging of positions and draws the line in the debates between users of MetaTrader 4 and MetaTrader 5 about this matter. It is a continuation of the first part: "Bi-Directional Trading and Hedging of Positions in MetaTrader 5 Using the HedgeTerminal Panel, Part 1". In the second part, we discuss integration of custom Expert Advisors with HedgeTerminalAPI, which is a special visualization library designed for bi-directional trading in a comfortable software environment providing tools for convenient position management.

Manual charting and trading toolkit (Part III). Optimization and new tools

In this article, we will further develop the idea of drawing graphical objects on charts using keyboard shortcuts. New tools have been added to the library, including a straight line plotted through arbitrary vertices, and a set of rectangles that enable the evaluation of the reversal time and level. Also, the article shows the possibility to optimize code for improved performance. The implementation example has been rewritten, allowing the use of Shortcuts alongside other trading programs. Required code knowledge level: slightly higher than a beginner.

Practical application of neural networks in trading (Part 2). Computer vision

The use of computer vision allows training neural networks on the visual representation of the price chart and indicators. This method enables wider operations with the whole complex of technical indicators, since there is no need to feed them digitally into the neural network.

Deep Learning Forecast and ordering with Python and MetaTrader5 python package and ONNX model file

The project involves using Python for deep learning-based forecasting in financial markets. We will explore the intricacies of testing the model's performance using key metrics such as Mean Absolute Error (MAE), Mean Squared Error (MSE), and R-squared (R2) and we will learn how to wrap everything into an executable. We will also make a ONNX model file with its EA.

Learn how to deal with date and time in MQL5

A new article about a new important topic which is dealing with date and time. As traders or programmers of trading tools, it is very crucial to understand how to deal with these two aspects date and time very well and effectively. So, I will share some important information about how we can deal with date and time to create effective trading tools smoothly and simply without any complicity as much as I can.

Learn how to design a trading system by Alligator

In this article, we'll complete our series about how to design a trading system based on the most popular technical indicator. We'll learn how to create a trading system based on the Alligator indicator.

Developing a cross-platform grider EA (part II): Range-based grid in trend direction

In this article, we will develop a grider EA for trading in a trend direction within a range. Thus, the EA is to be suited mostly for Forex and commodity markets. According to the tests, our grider showed profit since 2018. Unfortunately, this is not true for the period of 2014-2018.

A Few Tips for First-Time Customers

A proverbial wisdom often attributed to various famous people says: "He who makes no mistakes never makes anything." Unless you consider idleness itself a mistake, this statement is hard to argue with. But you can always analyze the past mistakes (your own and of others) to minimize the number of your future mistakes. We are going to attempt to review possible situations arising when executing jobs in the same-name service.

Exploring options for creating multicolored candlesticks

In this article I will address the possibilities of creating customized indicators with candlesticks, pointing out their advantages and disadvantages.

Matrices and vectors in MQL5

By using special data types 'matrix' and 'vector', it is possible to create code which is very close to mathematical notation. With these methods, you can avoid the need to create nested loops or to mind correct indexing of arrays in calculations. Therefore, the use of matrix and vector methods increases the reliability and speed in developing complex programs.

The RSI Deep Three Move Trading Technique

Presenting the RSI Deep Three Move Trading Technique in MetaTrader 5. This article is based on a new series of studies that showcase a few trading techniques based on the RSI, a technical analysis indicator used to measure the strength and momentum of a security, such as a stock, currency, or commodity.

Self-adapting algorithm (Part IV): Additional functionality and tests

I continue filling the algorithm with the minimum necessary functionality and testing the results. The profitability is quite low but the articles demonstrate the model of the fully automated profitable trading on completely different instruments traded on fundamentally different markets.

The correct way to choose an Expert Advisor from the Market

In this article, we will consider some of the essential points you should pay attention to when purchasing an Expert Advisor. We will also look for ways to increase profit, to spend money wisely, and to earn from this spending. Also, after reading the article, you will see that it is possible to earn even using simple and free products.

MetaTrader 4 and MetaTrader 5 Trading Signals Widgets

Recently MetaTrader 4 and MetaTrader 5 user received an opportunity to become a Signals Provider and earn additional profit. Now, you can display your trading success on your web site, blog or social network page using the new widgets. The benefits of using widgets are obvious: they increase the Signals Providers' popularity, establish their reputation as successful traders, as well as attract new Subscribers. All traders placing widgets on other web sites can enjoy these benefits.

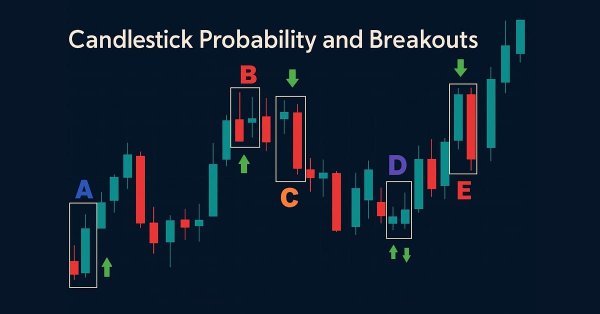

Price Action Analysis Toolkit Development (Part 43): Candlestick Probability and Breakouts

Enhance your market analysis with the MQL5-native Candlestick Probability EA, a lightweight tool that transforms raw price bars into real-time, instrument-specific probability insights. It classifies Pinbars, Engulfing, and Doji patterns at bar close, uses ATR-aware filtering, and optional breakout confirmation. The EA calculates raw and volume-weighted follow-through percentages, helping you understand each pattern's typical outcome on specific symbols and timeframes. On-chart markers, a compact dashboard, and interactive toggles allow easy validation and focus. Export detailed CSV logs for offline testing. Use it to develop probability profiles, optimize strategies, and turn pattern recognition into a measurable edge.

Learn how to design a trading system by Bear's Power

Welcome to a new article in our series about learning how to design a trading system by the most popular technical indicator here is a new article about learning how to design a trading system by Bear's Power technical indicator.

Modified Grid-Hedge EA in MQL5 (Part I): Making a Simple Hedge EA

We will be creating a simple hedge EA as a base for our more advanced Grid-Hedge EA, which will be a mixture of classic grid and classic hedge strategies. By the end of this article, you will know how to create a simple hedge strategy, and you will also get to know what people say about whether this strategy is truly 100% profitable.

What is a trend and is the market structure based on trend or flat?

Traders often talk about trends and flats but very few of them really understand what a trend/flat really is and even fewer are able to clearly explain these concepts. Discussing these basic terms is often beset by a solid set of prejudices and misconceptions. However, if we want to make profit, we need to understand the mathematical and logical meaning of these concepts. In this article, I will take a closer look at the essence of trend and flat, as well as try to define whether the market structure is based on trend, flat or something else. I will also consider the most optimal strategies for making profit on trend and flat markets.