Understanding Programming Paradigms (Part 1): A Procedural Approach to Developing a Price Action Expert Advisor

Introduction

In the world of software development, programming paradigms are the guiding blueprints for writing and organizing code. Much like choosing from different routes to reach a destination, different programming approaches or paradigms exist for accomplishing tasks using MQL5.

In two articles, we will explore the basic programming paradigms necessary to build trading tools with MQL5. My goal is to share effective and best-practice methods that produce great results with short and efficient code. I'll explain each programming style and demonstrate it by creating a fully functional Expert Advisor.Types of Programming Paradigms

There are three major programming paradigms that every MQL5 developer or programmer should be aware of:

- Procedural Programming: This article will focus on this paradigm.

- Functional Programming: This paradigm will also be discussed in this article, as it is very similar to procedural programming.

- Object-Oriented Programming (OOP): This paradigm will be discussed in the next article.

Understanding Procedural Programming

Procedural programming is a systematic, step-by-step approach to writing code. It involves breaking down any problem into a sequence of precise instructions, much like following a recipe. Programmers create a clear path for the computer, guiding it through each step line by line to achieve the desired result.

Whether you're new to programming or just curious about code organization, procedural programming provides a straightforward and intuitive entry point into the world of coding.

Main Properties Of Procedural Programming

Here are the main properties that characterize procedural programming:

- Functions:

At the core of procedural programming are functions. These are sets of instructions grouped together to perform a specific task. Functions encapsulate functionality, promoting modularity and code reuse. - Top-Down Design:

Procedural programming often employs a top-down design approach. Developers break down a problem into smaller, more manageable sub-tasks. Each sub-task is solved individually, contributing to the overall solution. - Imperative Style:

The imperative or command-style nature of procedural programming emphasizes the explicit statements that change a program's state. Developers specify how the program should achieve a task through a series of procedural commands. - Variables and Data:

Procedures or functions in procedural programming manipulate variables and data. These variables can hold values that change during the program's execution. State changes are a fundamental aspect of procedural programming. - Sequential Execution:

The program's execution follows a sequential flow. Statements are executed one after another, and control structures like loops and conditionals guide the flow of the program. - Modularity:

Procedural programming promotes modularity by organizing code into procedures or functions. Each module handles a specific aspect of the program's functionality, enhancing code organization and maintainability. - Reusability:

Code reusability is a key benefit of procedural programming. Once a function is written and tested, it can be used wherever that specific functionality is needed in the program, reducing redundancy and promoting efficiency. - Readability:

Procedural code tends to be more readable, especially for those accustomed to a step-by-step approach. The linear flow of execution makes it easy to follow the logic of the program.

Understanding Functional Programming

Functional programming revolves around the concept of functions as first-class citizens and immutability. It is similar to procedural programming except for the main principle of how it treats data and executes tasks.

Unlike procedural programming, where data can change its appearance and role during the program's execution, functional programming prefers a more stable environment. Once data is created, it stays as is. This commitment to immutability ensures a level of predictability and helps prevent unexpected side effects in your code.

Main Properties Of Functional Programming

Here are some key defining characteristics of functional programming:

- Immutability:

In functional programming, immutability is a core principle. Once data is created, it remains unchanged. Rather than modifying existing data, new data is created with the desired changes. This ensures predictability and helps avoid unintended side effects. - Functions as First-Class Citizens:

Functions are treated as first-class citizens, meaning they can be assigned to variables, passed as arguments to other functions, and returned as results from other functions. This flexibility allows for the creation of higher-order functions and promotes a more modular and expressive coding style. - Declarative Style:

Functional programming favors a declarative programming style, where the focus is on what the program should accomplish rather than how to achieve it. This contributes to more concise and readable code. - Avoidance of Mutable State:

A mutable state is minimized or eliminated in functional programming. Data is treated as immutable, and functions avoid modifying external state. This characteristic simplifies reasoning about the behavior of functions. - Recursion and Higher-Order Functions:

Recursion and higher-order functions, where functions take other functions as arguments or return them as results, are commonly employed in functional programming. This leads to more modular and reusable code.

The Procedural Approach To Developing a Price Action EA

Now that we've delved into the essence of the procedural and functional programming paradigms, let's put the theory into practice with a hands-on example: the creation of a price action-based expert advisor. First, I'll provide insights into the trading strategy we're set to automate. Later, we'll navigate through the various components of the code, unraveling their functionality and how they seamlessly work together.

Price Action Strategy with EMA Indicator

Our trading strategy relies on a single indicator known as the exponential moving average (EMA). This indicator is widely used in technical analysis and helps determine the market direction based on your chosen trading setup. You can easily find the moving average as a standard indicator on MQL5, making it straightforward to incorporate into our code.

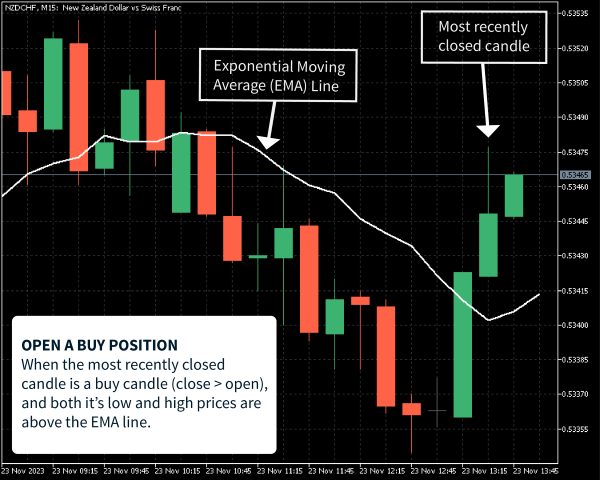

Buy Entry:

Open a buy position when the most recently closed candle is a buy candle, and both it's low and high prices are above the exponential moving average (EMA).

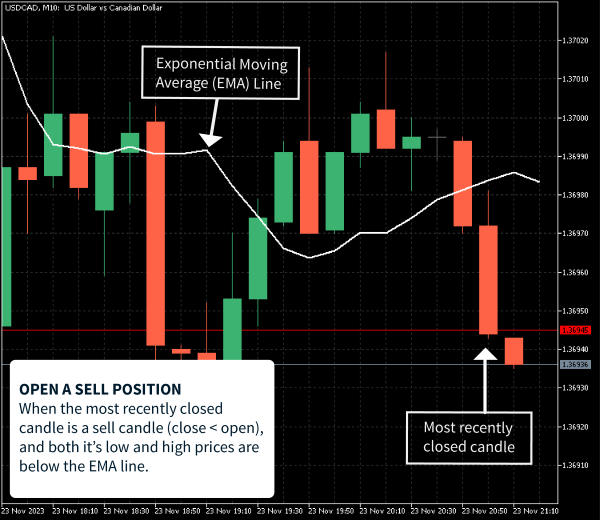

Sell Entry:

Open a sell position when the most recently closed candle is a sell candle, and both it's low and high prices are below the exponential moving average (EMA).

Exit:

Automatically close all open positions and realize the associated profit or loss when the user-specified percentage profit or loss for the account is achieved or use the traditional stop loss or take profit orders.

| Setup | Condition |

|---|---|

| Buy Entry | When the most recently closed candle is a buy candle (close > open), and both it's low and high prices are above the Exponential Moving Average (EMA). |

| Sell Entry | When the most recently closed candle is a sell candle (close < open), and both it's low and high prices are below the Exponential Moving Average (EMA). |

| Exit | Close all open positions and realize profit or loss when the user-specified percentage is reached or when the stop loss or take profit orders are triggered. |

Coding and Implementing The Trading Strategy

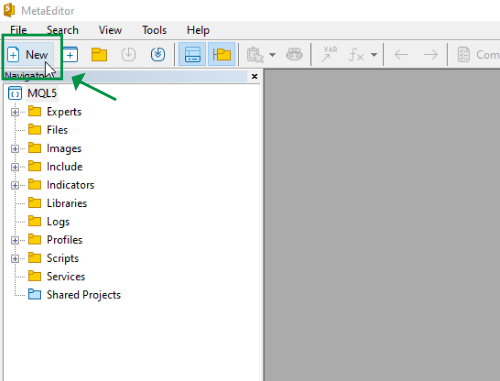

Now that we have established our trading rules and plan, let's bring our trading strategy to life by writing our MQL5 code in the MetaEditor IDE. Follow these steps to ensure that we start with a clean expert advisor template containing only the required mandatory functions:

Step 1: Open the MetaEditor IDE and launch 'MQL Wizard' using the 'New' menu item button.

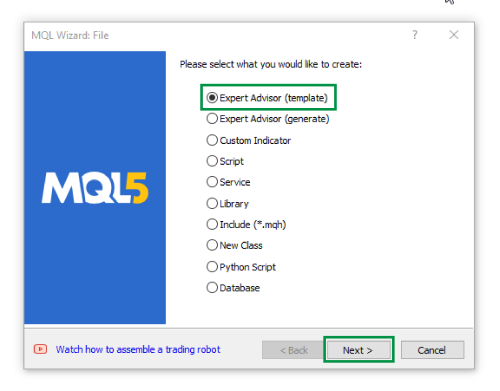

Step 2: Select the 'Expert Advisor (template)' option and click 'Next.'

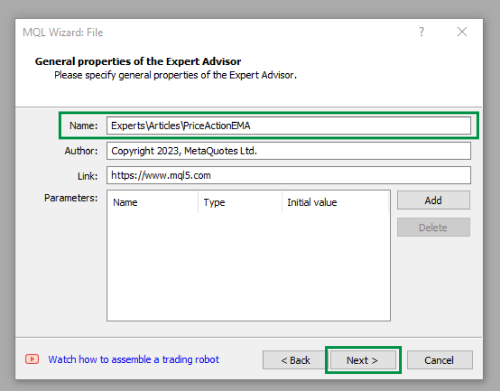

Step 3: In the 'General Properties' section, fill in the expert advisor name and proceed by clicking 'Next.'

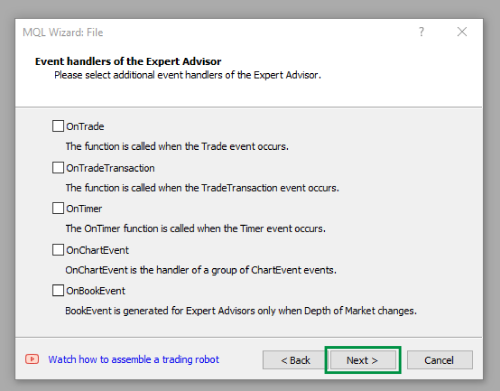

Step 4: In the 'Event Handlers' section, ensure no options are selected. Uncheck any options if they are selected, and then click 'Next.'

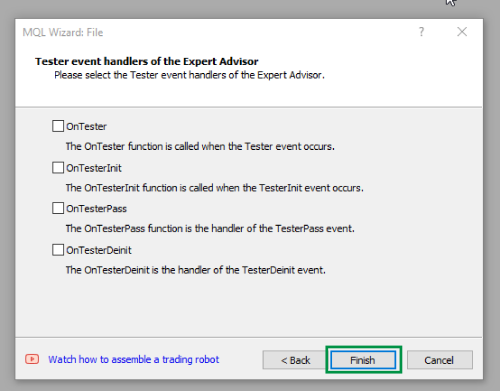

Step 5: In the 'Tester Event Handlers' section, ensure no options are selected. Uncheck any options if they are selected, and then click 'Finish' to generate our MQL5 expert advisor template.

We now have a clean MQL5 expert advisor template with only the mandatory functions (OnInit, OnDeinit, and OnTick). Remember to save the new file before you proceed.

Here is how our newly generated expert advisor code looks like:

//+------------------------------------------------------------------+ //| PriceActionEMA.mq5 | //| Copyright 2023, MetaQuotes Ltd. | //| https://www.mql5.com | //+------------------------------------------------------------------+ #property copyright "Copyright 2023, MetaQuotes Ltd." #property link "https://www.mql5.com" #property version "1.00" //+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { //--- //--- return(INIT_SUCCEEDED); } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { //--- } //+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { //--- } //+------------------------------------------------------------------+

First, let's write a brief description of the EA, declare and initialize the user input variables, and then declare all the global variables. Place this code right before the OnInit() function.

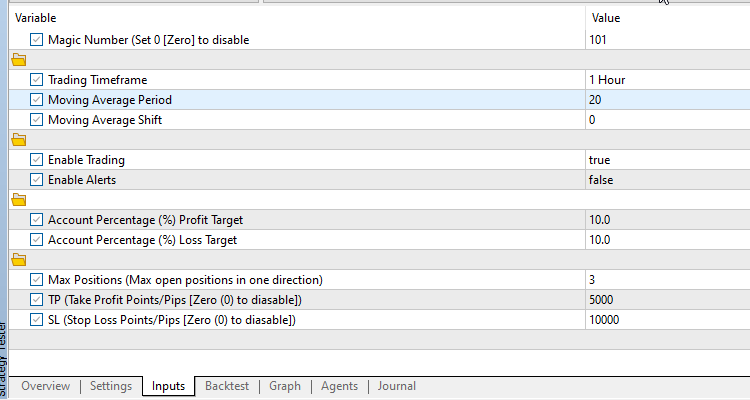

#property description "A price action EA to demonstrate how to " #property description "implement the procedural programming paradigm." //--User input variables input long magicNumber = 101;//Magic Number (Set 0 [Zero] to disable input group "" input ENUM_TIMEFRAMES tradingTimeframe = PERIOD_H1;//Trading Timeframe input int emaPeriod = 20;//Moving Average Period input int emaShift = 0;//Moving Average Shift input group "" input bool enableTrading = true;//Enable Trading input bool enableAlerts = false;//Enable Alerts input group "" input double accountPercentageProfitTarget = 10.0;//Account Percentage (%) Profit Target input double accountPercentageLossTarget = 10.0;//Account Percentage (%) Loss Target input group "" input int maxPositions = 3;//Max Positions (Max open positions in one direction) input int tp = 5000;//TP (Take Profit Points/Pips [Zero (0) to diasable]) input int sl = 10000;//SL (Stop Loss Points/Pips [Zero (0) to diasable])

As we learned earlier, "At the core of procedural programming are functions. These are sets of instructions grouped together to perform a specific task. Functions encapsulate functionality, promoting modularity and code reuse." We are going to implement this by creating our own custom functions.

GetInit function:

This function is responsible for initializing all global variables and performing any other tasks when the EA is loaded or initialized.

int GetInit() //Function to initialize the robot and all the variables { int returnVal = 1; //create the iMA indicator emaHandle = iMA(Symbol(), tradingTimeframe, emaPeriod, emaShift, MODE_EMA, PRICE_CLOSE); if(emaHandle < 0) { Print("Error creating emaHandle = ", INVALID_HANDLE); Print("Handle creation: Runtime error = ", GetLastError()); //force program termination if the handle is not properly set return(-1); } ArraySetAsSeries(movingAverage, true); //reset the count for positions totalOpenBuyPositions = 0; totalOpenSellPositions = 0; buyPositionsProfit = 0.0; sellPositionsProfit = 0.0; buyPositionsVol = 0.0; sellPositionsVol = 0.0; closedCandleTime = iTime(_Symbol, tradingTimeframe, 1); startingCapital = AccountInfoDouble(ACCOUNT_EQUITY);//used to calculate the account percentage profit if(enableAlerts) { Alert(MQLInfoString(MQL_PROGRAM_NAME), " has just been LOADED in the ", Symbol(), " ", EnumToString(Period()), " period chart."); } //structure our comment string commentString = "\n\n" + "Account No: " + IntegerToString(AccountInfoInteger(ACCOUNT_LOGIN)) + "\nAccount Type: " + EnumToString((ENUM_ACCOUNT_TRADE_MODE)AccountInfoInteger(ACCOUNT_TRADE_MODE)) + "\nAccount Leverage: " + IntegerToString(AccountInfoInteger(ACCOUNT_LEVERAGE)) + "\n-----------------------------------------------------------------------------------------------------"; return(returnVal); }

GetDeinit function:

This function is responsible for freeing any used memory, clearing chart comments, and handling other deinitialization tasks before the EA is shut down.

void GetDeinit() //De-initialize the robot on shutdown and clean everything up { IndicatorRelease(emaHandle); //delete the moving average handle and deallocate the memory spaces occupied ArrayFree(movingAverage); //free the dynamic arrays containing the moving average buffer data if(enableAlerts) { Alert(MQLInfoString(MQL_PROGRAM_NAME), " has just been REMOVED from the ", Symbol(), " ", EnumToString(Period()), " period chart."); } //delete and clear all chart displayed messages Comment(""); }

GetEma function:

This function retrieves the value of the exponential moving average and determines the market direction by comparing the EMA value with the open, close, high, and low prices of the recently closed candle. It saves the market direction value in global variables for further processing by other functions.

void GetEma() { //Get moving average direction if(CopyBuffer(emaHandle, 0, 0, 100, movingAverage) <= 0) { return; } movingAverageTrend = "FLAT"; buyOk = false; sellOk = false; if(movingAverage[1] > iHigh(_Symbol, tradingTimeframe, 1) && movingAverage[1] > iLow(_Symbol, tradingTimeframe, 1)) { movingAverageTrend = "SELL/SHORT"; if(iClose(_Symbol, tradingTimeframe, 1) < iOpen(_Symbol, tradingTimeframe, 1)) { sellOk = true; buyOk = false; } } if(movingAverage[1] < iHigh(_Symbol, tradingTimeframe, 1) && movingAverage[1] < iLow(_Symbol, tradingTimeframe, 1)) { movingAverageTrend = "BUY/LONG"; if(iClose(_Symbol, tradingTimeframe, 1) > iOpen(_Symbol, tradingTimeframe, 1)) { buyOk = true; sellOk = false; } } }

GetPositionsData function:

This function scans all open positions, saving their properties, such as profit amount, total number of positions opened, total buy and sell positions opened, and the total volume/lot of each position type. It excludes data for positions not opened by our EA or those that do not match the EA magic number.

void GetPositionsData() { //get the total number of all open positions and their status if(PositionsTotal() > 0) { //variables for storing position properties values ulong positionTicket; long positionMagic, positionType; string positionSymbol; int totalPositions = PositionsTotal(); //reset the count totalOpenBuyPositions = 0; totalOpenSellPositions = 0; buyPositionsProfit = 0.0; sellPositionsProfit = 0.0; buyPositionsVol = 0.0; sellPositionsVol = 0.0; //scan all the open positions for(int x = totalPositions - 1; x >= 0; x--) { positionTicket = PositionGetTicket(x);//gain access to other position properties by selecting the ticket positionMagic = PositionGetInteger(POSITION_MAGIC); positionSymbol = PositionGetString(POSITION_SYMBOL); positionType = PositionGetInteger(POSITION_TYPE); if(positionMagic == magicNumber && positionSymbol == _Symbol) { if(positionType == POSITION_TYPE_BUY) { ++totalOpenBuyPositions; buyPositionsProfit += PositionGetDouble(POSITION_PROFIT); buyPositionsVol += PositionGetDouble(POSITION_VOLUME); } if(positionType == POSITION_TYPE_SELL) { ++totalOpenSellPositions; sellPositionsProfit += PositionGetDouble(POSITION_PROFIT); sellPositionsVol += PositionGetDouble(POSITION_VOLUME); } } } //Get and save the account percentage profit accountPercentageProfit = ((buyPositionsProfit + sellPositionsProfit) * 100) / startingCapital; } else //if no positions are open then the account percentage profit should be zero { startingCapital = AccountInfoDouble(ACCOUNT_EQUITY); accountPercentageProfit = 0.0; //reset position counters too totalOpenBuyPositions = 0; totalOpenSellPositions = 0; } }

TradingIsAllowed function:

This function checks if the user, terminal, and broker have given the EA permission to trade.

bool TradingIsAllowed() { //check if trading is enabled if(enableTrading && MQLInfoInteger(MQL_TRADE_ALLOWED) && TerminalInfoInteger(TERMINAL_TRADE_ALLOWED) && AccountInfoInteger(ACCOUNT_TRADE_ALLOWED) && AccountInfoInteger(ACCOUNT_TRADE_EXPERT) ) { tradingStatus = "\n-----------------------------------------------------------------------------------------" + "\nTRADING IS FULLY ENABLED! *** SCANNING FOR ENTRY ***"; return(true); } else //trading is disabled { tradingStatus = "\n-----------------------------------------------------------------------------------------" + "\nTRADING IS NOT FULLY ENABLED! *** GIVE EA PERMISSION TO TRADE ***"; return(false); } }

TradeNow function:

Responsible for opening new positions when all required checks and signals indicate it's okay to proceed with a new trade initialization.

void TradeNow() { //Detect new candle formation and open a new position if(closedCandleTime != iTime(_Symbol, tradingTimeframe, 1)) //-- New candle found { //use the candle time as the position comment to prevent opening dublicate trades on one candle string positionComment = IntegerToString(iTime(_Symbol, tradingTimeframe, 1)); //open a buy position if(buyOk && totalOpenBuyPositions < maxPositions) { //Use the positionComment string to check if we had already have a position open on this candle if(!PositionFound(_Symbol, POSITION_TYPE_BUY, positionComment)) //no position has been openend on this candle, open a buy position now { BuySellPosition(POSITION_TYPE_BUY, positionComment); } } //open a sell position if(sellOk && totalOpenSellPositions < maxPositions) { //Use the positionComment string to check if we had already have a position open on this candle if(!PositionFound(_Symbol, POSITION_TYPE_SELL, positionComment)) //no position has been openend on this candle, open a sell position now { BuySellPosition(POSITION_TYPE_SELL, positionComment); } } //reset closedCandleTime value to prevent new entry orders from opening before a new candle is formed closedCandleTime = iTime(_Symbol, tradingTimeframe, 1); } }

ManageProfitAndLoss function:

This function checks if the user-inputted profit and loss thresholds are reached. If the conditions are met, it liquidates all profits or losses by closing all open positions.

void ManageProfitAndLoss() { //if the account percentage profit or loss target is hit, delete all positions double lossLevel = -accountPercentageLossTarget; if( (accountPercentageProfit >= accountPercentageProfitTarget || accountPercentageProfit <= lossLevel) || ((totalOpenBuyPositions >= maxPositions || totalOpenSellPositions >= maxPositions) && accountPercentageProfit > 0) ) { //delete all open positions if(PositionsTotal() > 0) { //variables for storing position properties values ulong positionTicket; long positionMagic, positionType; string positionSymbol; int totalPositions = PositionsTotal(); //scan all the open positions for(int x = totalPositions - 1; x >= 0; x--) { positionTicket = PositionGetTicket(x);//gain access to other position properties by selecting the ticket positionMagic = PositionGetInteger(POSITION_MAGIC); positionSymbol = PositionGetString(POSITION_SYMBOL); positionType = PositionGetInteger(POSITION_TYPE); int positionDigits= (int)SymbolInfoInteger(positionSymbol, SYMBOL_DIGITS); double positionVolume = PositionGetDouble(POSITION_VOLUME); ENUM_POSITION_TYPE positionType = (ENUM_POSITION_TYPE)PositionGetInteger(POSITION_TYPE); if(positionMagic == magicNumber && positionSymbol == _Symbol) { //print the position details Print("*********************************************************************"); PrintFormat( "#%I64u %s %s %.2f %s [%I64d]", positionTicket, positionSymbol, EnumToString(positionType), positionVolume, DoubleToString(PositionGetDouble(POSITION_PRICE_OPEN), positionDigits), positionMagic ); //reset the the tradeRequest and tradeResult values by zeroing them ZeroMemory(tradeRequest); ZeroMemory(tradeResult); //set the operation parameters tradeRequest.action = TRADE_ACTION_DEAL;//type of trade operation tradeRequest.position = positionTicket;//ticket of the position tradeRequest.symbol = positionSymbol;//symbol tradeRequest.volume = positionVolume;//volume of the position tradeRequest.deviation = SymbolInfoInteger(_Symbol, SYMBOL_SPREAD);//allowed deviation from the price tradeRequest.magic = magicNumber;//MagicNumber of the position //set the price and order type depending on the position type if(positionType == POSITION_TYPE_BUY) { tradeRequest.price = SymbolInfoDouble(positionSymbol, SYMBOL_BID); tradeRequest.type = ORDER_TYPE_SELL; } else { tradeRequest.price = SymbolInfoDouble(positionSymbol, SYMBOL_ASK); tradeRequest.type = ORDER_TYPE_BUY; } //print the position close details PrintFormat("Close #%I64d %s %s", positionTicket, positionSymbol, EnumToString(positionType)); //send the tradeRequest if(OrderSend(tradeRequest, tradeResult)) //trade tradeRequest success, position has been closed { if(enableAlerts) { Alert( _Symbol + " PROFIT LIQUIDATION: Just successfully closed POSITION (#" + IntegerToString(positionTicket) + "). Check the EA journal for more details." ); } PrintFormat("Just successfully closed position: #%I64d %s %s", positionTicket, positionSymbol, EnumToString(positionType)); PrintFormat("retcode=%u deal=%I64u order=%I64u", tradeResult.retcode, tradeResult.deal, tradeResult.order); } else //trade tradeRequest failed { //print the information about the operation if(enableAlerts) { Alert( _Symbol + " ERROR ** PROFIT LIQUIDATION: closing POSITION (#" + IntegerToString(positionTicket) + "). Check the EA journal for more details." ); } PrintFormat("Position clossing failed: #%I64d %s %s", positionTicket, positionSymbol, EnumToString(positionType)); PrintFormat("OrderSend error %d", GetLastError());//print the error code } } } } } }

PrintOnChart function:

Formats and displays the EA status on the chart, providing the user with a visual text representation of the account and EA status.

void PrintOnChart() { //update account status strings and display them on the chart accountStatus = "\nAccount Balance: " + DoubleToString(AccountInfoDouble(ACCOUNT_BALANCE), 2) + accountCurrency + "\nAccount Equity: " + DoubleToString(AccountInfoDouble(ACCOUNT_EQUITY), 2) + accountCurrency + "\nAccount Profit: " + DoubleToString(AccountInfoDouble(ACCOUNT_PROFIT), 2) + accountCurrency + "\nAccount Percentage Profit: " + DoubleToString(accountPercentageProfit, 2) + "%" + "\n-----------------------------------------------------------------------------------------" + "\nTotal Buy Positions Open: " + IntegerToString(totalOpenBuyPositions) + " Total Vol/Lots: " + DoubleToString(buyPositionsVol, 2) + " Profit: " + DoubleToString(buyPositionsProfit, 2) + accountCurrency + "\nTotal Sell Positions Open: " + IntegerToString(totalOpenSellPositions) + " Total Vol/Lots: " + DoubleToString(sellPositionsVol, 2) + " Profit: " + DoubleToString(sellPositionsProfit, 2) + accountCurrency + "\nPositionsTotal(): " + IntegerToString(PositionsTotal()) + "\n-----------------------------------------------------------------------------------------" + "\nJust Closed Candle: Open: " + DoubleToString(iOpen(_Symbol, tradingTimeframe, 1), _Digits) + " Close: " + DoubleToString(iClose(_Symbol, tradingTimeframe, 1), _Digits) + " High: " + DoubleToString(iHigh(_Symbol, tradingTimeframe, 1), _Digits) + " Low: " + DoubleToString(iLow(_Symbol, tradingTimeframe, 1), _Digits) + "\n-----------------------------------------------------------------------------------------" + "\nMovingAverage (EMA): " + DoubleToString(movingAverage[1], _Digits) + " movingAverageTrend = " + movingAverageTrend + "\nsellOk: " + IntegerToString(sellOk) + "\nbuyOk: " + IntegerToString(buyOk); //show comments on the chart Comment(commentString + accountStatus + tradingStatus); }

BuySellPosition function:

This function opens new buy and sell positions.

bool BuySellPosition(int positionType, string positionComment) { //reset the the tradeRequest and tradeResult values by zeroing them ZeroMemory(tradeRequest); ZeroMemory(tradeResult); //initialize the parameters to open a position tradeRequest.action = TRADE_ACTION_DEAL; tradeRequest.symbol = Symbol(); tradeRequest.deviation = SymbolInfoInteger(_Symbol, SYMBOL_SPREAD); tradeRequest.magic = magicNumber; tradeRequest.comment = positionComment; double volumeLot = NormalizeDouble(((SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_MIN) * AccountInfoDouble(ACCOUNT_EQUITY)) / 10000), 2); if(positionType == POSITION_TYPE_BUY) { if(sellPositionsVol > volumeLot && AccountInfoDouble(ACCOUNT_MARGIN_LEVEL) > 200) { volumeLot = NormalizeDouble((sellPositionsVol + volumeLot), 2); } if(volumeLot < 0.01) { volumeLot = SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_MIN); } if(volumeLot > SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_MAX)) { volumeLot = SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_MAX); } tradeRequest.volume = NormalizeDouble(volumeLot, 2); tradeRequest.type = ORDER_TYPE_BUY; tradeRequest.price = SymbolInfoDouble(_Symbol, SYMBOL_ASK); if(tp > 0) { tradeRequest.tp = NormalizeDouble(tradeRequest.price + (tp * _Point), _Digits); } if(sl > 0) { tradeRequest.sl = NormalizeDouble(tradeRequest.price - (sl * _Point), _Digits); } if(OrderSend(tradeRequest, tradeResult)) //successfully openend the position { if(enableAlerts) { Alert(_Symbol, " Successfully openend BUY POSITION #", tradeResult.order, ", Price: ", tradeResult.price); } PrintFormat("retcode=%u deal=%I64u order=%I64u", tradeResult.retcode, tradeResult.deal, tradeResult.order); return(true); } else { if(enableAlerts) { Alert(_Symbol, " ERROR opening a BUY POSITION at: ", SymbolInfoDouble(_Symbol, SYMBOL_ASK)); } PrintFormat("ERROR: Opening a BUY POSITION: ErrorCode = %d",GetLastError());//OrderSend failed, output the error code return(false); } } if(positionType == POSITION_TYPE_SELL) { if(buyPositionsVol > volumeLot && AccountInfoDouble(ACCOUNT_MARGIN_LEVEL) > 200) { volumeLot = NormalizeDouble((buyPositionsVol + volumeLot), 2); } if(volumeLot < 0.01) { volumeLot = SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_MIN); } if(volumeLot > SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_MAX)) { volumeLot = SymbolInfoDouble(_Symbol, SYMBOL_VOLUME_MAX); } tradeRequest.volume = NormalizeDouble(volumeLot, 2); tradeRequest.type = ORDER_TYPE_SELL; tradeRequest.price = SymbolInfoDouble(_Symbol, SYMBOL_BID); if(tp > 0) { tradeRequest.tp = NormalizeDouble(tradeRequest.price - (tp * _Point), _Digits); } if(sl > 0) { tradeRequest.sl = NormalizeDouble(tradeRequest.price + (sl * _Point), _Digits); } if(OrderSend(tradeRequest, tradeResult)) //successfully openend the position { if(enableAlerts) { Alert(_Symbol, " Successfully openend SELL POSITION #", tradeResult.order, ", Price: ", tradeResult.price); } PrintFormat("retcode=%u deal=%I64u order=%I64u", tradeResult.retcode, tradeResult.deal, tradeResult.order); return(true); } else { if(enableAlerts) { Alert(_Symbol, " ERROR opening a SELL POSITION at: ", SymbolInfoDouble(_Symbol, SYMBOL_ASK)); } PrintFormat("ERROR: Opening a SELL POSITION: ErrorCode = %d",GetLastError());//OrderSend failed, output the error code return(false); } } return(false); }

PositionFound function:

This function checks if a specified position exists so that the EA does’nt open multiple duplicate positions on one candle.

bool PositionFound(string symbol, int positionType, string positionComment) { if(PositionsTotal() > 0) { ulong positionTicket; int totalPositions = PositionsTotal(); //scan all the open positions for(int x = totalPositions - 1; x >= 0; x--) { positionTicket = PositionGetTicket(x);//gain access to other position properties by selecting the ticket if( PositionGetInteger(POSITION_MAGIC) == magicNumber && PositionGetString(POSITION_SYMBOL) == symbol && PositionGetInteger(POSITION_TYPE) == positionType && PositionGetString(POSITION_COMMENT) == positionComment ) { return(true);//a similar position exists, don't open another position on this candle break; } } } return(false); }

Now that we have defined our custom functions, let's call them to perform their intended tasks.

- Place and call the GetInit function in the OnInit function.

int OnInit() { //--- if(GetInit() <= 0) { return(INIT_FAILED); } //--- return(INIT_SUCCEEDED); }

- Place and call the GetDeinit function in the OnDeinit function.

void OnDeinit(const int reason) { //--- GetDeinit(); }

- Place and call the following functions in the OnTick function in the appropriate order. Since some functions modify global variables relied upon by other functions to make key decisions, we will ensure to call them first, ensuring data is processed and updated before being accessed by other functions.

void OnTick() { //--- GetEma(); GetPositionsData(); if(TradingIsAllowed()) { TradeNow(); ManageProfitAndLoss(); } PrintOnChart(); }

With the EA code complete, save and compile it. This allows you to access your EA directly from the trading terminal. The full code is attached at the bottom of the article.

Testing Our EA in the Strategy Tester

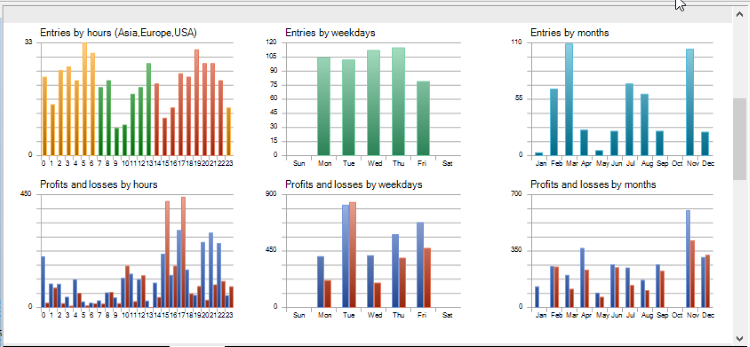

It's crucial to ensure that our EA operates according to our plan. We can achieve this by either loading it on an active symbol chart and trading it in a demo account or by utilizing the strategy tester for a comprehensive evaluation. While you can test it on a demo account, for now, we'll use the strategy tester to assess its performance.

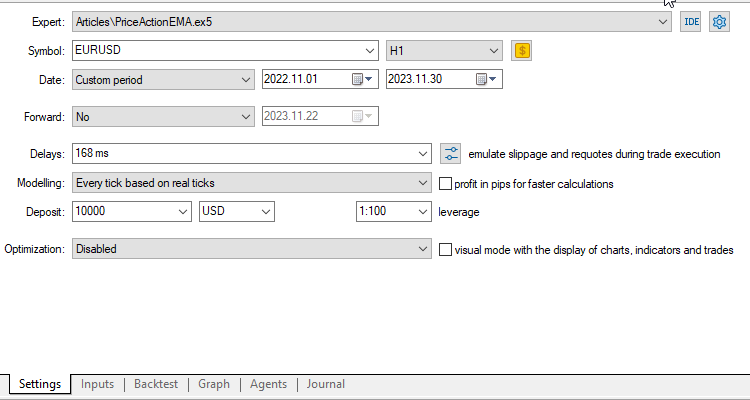

Here are the settings we'll apply in the strategy tester:

-

Broker: MT5 Metaquotes demo account (Automatically created upon MT5 installation)

-

Symbol: EURUSD

-

Testing Period (Date): 1 year (Nov 2022 to Nov 2023)

-

Modeling: Every tick based on real ticks

-

Deposit: $10,000 USD

-

Leverage: 1:100

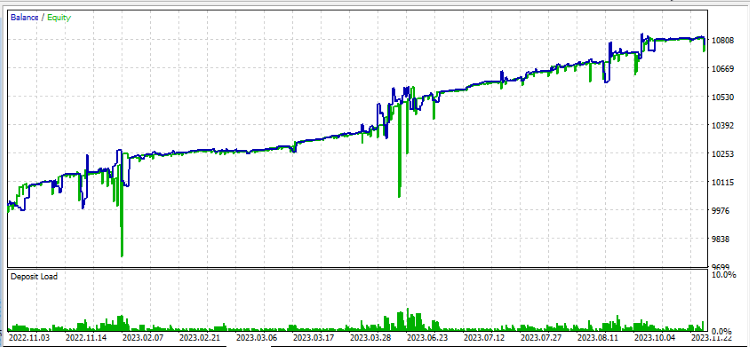

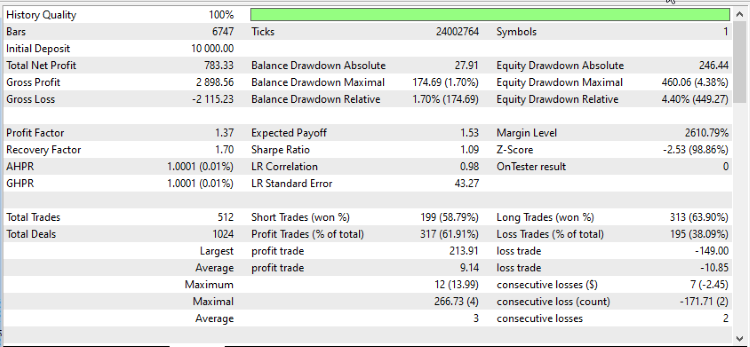

Reviewing our backtesting results, our EA not only generated a profit but also maintained a remarkably low drawdown. This strategy exhibits promise and can be further modified and optimized to yield even better results, especially when applied to multiple symbols simultaneously.

Conclusion

It's straightforward for even beginner MQL5 programmers to understand the procedural code of the EA we've just created above. This simplicity arises from the clear and direct nature of procedural programming, particularly when utilizing functions to organize the code based on specific tasks and global variables to pass modified data to different functions.

However, you may notice that a drawback of procedural code is its tendency to expand significantly as your EA becomes more complicated, rendering it suitable primarily for less complex projects. In cases where your project is highly complex, opting for the object-oriented programming approach proves more advantageous than procedural programming.

In our upcoming article, we'll introduce you to object-oriented programming and transform our recently created procedural price action EA code into object-oriented code. This will provide a distinct comparison between these paradigms, offering a clearer understanding of the differences.

Thank you for investing the time to read this article, I wish you the very best in your MQL5 development journey and trading endeavors.

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

Data Science and Machine Learning (Part 17): Money in the Trees? The Art and Science of Random Forests in Forex Trading

Data Science and Machine Learning (Part 17): Money in the Trees? The Art and Science of Random Forests in Forex Trading

MQL5 Wizard Techniques you should know (Part 09): Pairing K-Means Clustering with Fractal Waves

MQL5 Wizard Techniques you should know (Part 09): Pairing K-Means Clustering with Fractal Waves

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Very informative and interesting

Excellent Article on Procedural Programming!

Good article. I expected some procedural price action coding like ABCD waves structure or a conditional zigzag with steps like in step 1 find a peak, step 2 find a trough etc... I don't think a candle low high above or below EMA is procedural "price action" if we leave trading functions apart.