Simple Mean Reversion Trading Strategy

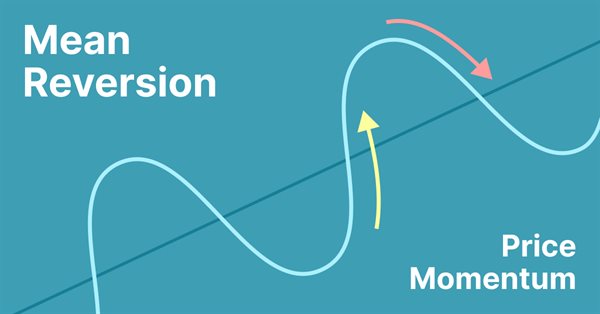

Mean reversion is a type of contrarian trading where the trader expects the price to return to some form of equilibrium which is generally measured by a mean or another central tendency statistic.

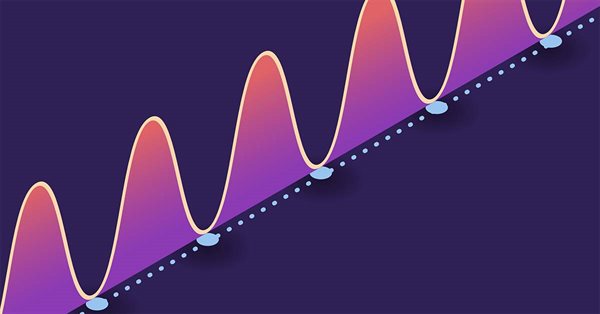

Automating Trading Strategies in MQL5 (Part 43): Adaptive Linear Regression Channel Strategy

In this article, we implement an adaptive Linear Regression Channel system in MQL5 that automatically calculates the regression line and standard deviation channel over a user-defined period, only activates when the slope exceeds a minimum threshold to confirm a clear trend, and dynamically recreates or extends the channel when the price breaks out by a configurable percentage of channel width.

Brute force approach to pattern search (Part IV): Minimal functionality

The article presents an improved brute force version, based on the goals set in the previous article. I will try to cover this topic as broadly as possible using Expert Advisors with settings obtained using this method. A new program version is attached to this article.

Automating Trading Strategies in MQL5 (Part 24): London Session Breakout System with Risk Management and Trailing Stops

In this article, we develop a London Session Breakout System that identifies pre-London range breakouts and places pending orders with customizable trade types and risk settings. We incorporate features like trailing stops, risk-to-reward ratios, maximum drawdown limits, and a control panel for real-time monitoring and management.

The Inverse Fair Value Gap Trading Strategy

An inverse fair value gap(IFVG) occurs when price returns to a previously identified fair value gap and, instead of showing the expected supportive or resistive reaction, fails to respect it. This failure can signal a potential shift in market direction and offer a contrarian trading edge. In this article, I'm going to introduce my self-developed approach to quantifying and utilizing inverse fair value gap as a strategy for MetaTrader 5 expert advisors.

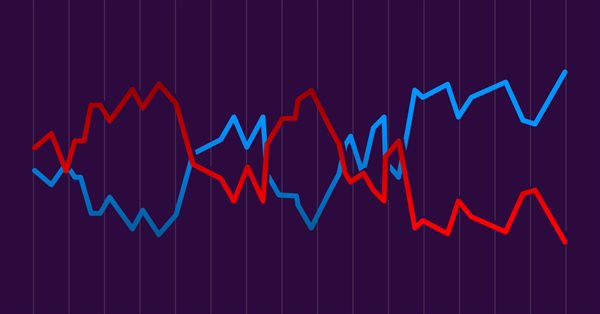

Pair trading

In this article, we will consider pair trading, namely what its principles are and if there are any prospects for its practical application. We will also try to create a pair trading strategy.

Developing Zone Recovery Martingale strategy in MQL5

The article discusses, in a detailed perspective, the steps that need to be implemented towards the creation of an expert advisor based on the Zone Recovery trading algorithm. This helps aotomate the system saving time for algotraders.

Building a Professional Trading System with Heikin Ashi (Part 1): Developing a custom indicator

This article is the first installment in a two-part series designed to impart practical skills and best practices for writing custom indicators in MQL5. Using Heikin Ashi as a working example, the article explores the theory behind Heikin Ashi charts, explains how Heikin Ashi candlesticks are calculated, and demonstrates their application in technical analysis. The centerpiece is a step-by-step guide to developing a fully functional Heikin Ashi indicator from scratch, with clear explanations to help readers understand what to code and why. This foundational knowledge sets the stage for Part Two, where we will build an expert advisor that trades based on Heikin Ashi logic.

MVC design pattern and its possible application

The article discusses a popular MVC pattern, as well as the possibilities, pros and cons of its usage in MQL programs. The idea is to split an existing code into three separate components: Model, View and Controller.

Learn how to design a trading system by Williams PR

A new article in our series about learning how to design a trading system by the most popular technical indicators by MQL5 to be used in the MetaTrader 5. In this article, we will learn how to design a trading system by the Williams' %R indicator.

How to deal with lines using MQL5

In this article, you will find your way to deal with the most important lines like trendlines, support, and resistance by MQL5.

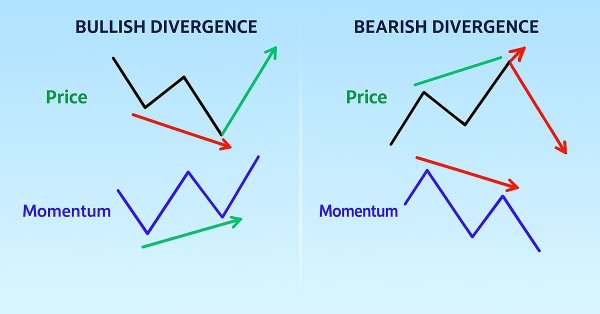

Automating Trading Strategies in MQL5 (Part 37): Regular RSI Divergence Convergence with Visual Indicators

In this article, we build an MQL5 EA that detects regular RSI divergences using swing points with strength, bar limits, and tolerance checks. It executes trades on bullish or bearish signals with fixed lots, SL/TP in pips, and optional trailing stops. Visuals include colored lines on charts and labeled swings for better strategy insights.

Trader-friendly stop loss and take profit

Stop loss and take profit can have a significant impact on trading results. In this article, we will look at several ways to find optimal stop order values.

Price Action Analysis Toolkit Development (Part 44): Building a VWMA Crossover Signal EA in MQL5

This article introduces a VWMA crossover signal tool for MetaTrader 5, designed to help traders identify potential bullish and bearish reversals by combining price action with trading volume. The EA generates clear buy and sell signals directly on the chart, features an informative panel, and allows for full user customization, making it a practical addition to your trading strategy.

Other classes in DoEasy library (Part 66): MQL5.com Signals collection class

In this article, I will create the signal collection class of the MQL5.com Signals service with the functions for managing signals. Besides, I will improve the Depth of Market snapshot object class for displaying the total DOM buy and sell volumes.

Brute force approach to pattern search

In this article, we will search for market patterns, create Expert Advisors based on the identified patterns, and check how long these patterns remain valid, if they ever retain their validity.

Building AI-Powered Trading Systems in MQL5 (Part 7): Further Modularization and Automated Trading

In this article, we enhance the AI-powered trading system's modularity by separating UI components into a dedicated include file. The system now automates trade execution based on AI-generated signals, parsing JSON responses for BUY/SELL/NONE with entry/SL/TP, visualizing patterns like engulfing or divergences on charts with arrows, lines, and labels, and optional auto-signal checks on new bars.

Indicator Taichi - a Simple Idea of Formalizing the Values of Ichimoku Kinko Hyo

Hard to interpret Ichimoku signals? This article introduces some principles of formalizing values and signals of Ichimoku Kinko Hyo. For visualization of its usage the author chose the currency pair EURUSD based on his own preferences. However, the indicator can be used on any currency pair.

Library for easy and quick development of MetaTrader programs (part XI). Compatibility with MQL4 - Position closure events

We continue the development of a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. In the tenth part, we resumed our work on the library compatibility with MQL4 and defined the events of opening positions and activating pending orders. In this article, we will define the events of closing positions and get rid of the unused order properties.

Experiments with neural networks (Part 1): Revisiting geometry

In this article, I will use experimentation and non-standard approaches to develop a profitable trading system and check whether neural networks can be of any help for traders.

Research of Statistical Recurrences of Candle Directions

Is it possible to predict the behavior of the market for a short upcoming interval of time, based on the recurring tendencies of candle directions, at specific times throughout the day? That is, If such an occurrence is found in the first place. This question has probably arisen in the mind of every trader. The purpose of this article is to attempt to predict the behavior of the market, based on the statistical recurrences of candle directions during specific intervals of time.

Controlling the Slope of Balance Curve During Work of an Expert Advisor

Finding rules for a trade system and programming them in an Expert Advisor is a half of the job. Somehow, you need to correct the operation of the Expert Advisor as it accumulates the results of trading. This article describes one of approaches, which allows improving performance of an Expert Advisor through creation of a feedback that measures slope of the balance curve.

Learn how to design a trading system by OBV

This is a new article to continue our series for beginners about how to design a trading system based on some of the popular indicators. We will learn a new indicator that is On Balance Volume (OBV), and we will learn how we can use it and design a trading system based on it.

Library for easy and quick development of MetaTrader programs (part III). Collection of market orders and positions, search and sorting

In the first part, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. Further on, we implemented the collection of history orders and deals. Our next step is creating a class for a convenient selection and sorting of orders, deals and positions in collection lists. We are going to implement the base library object called Engine and add collection of market orders and positions to the library.

Developing a trading Expert Advisor from scratch (Part 19): New order system (II)

In this article, we will develop a graphical order system of the "look what happens" type. Please note that we are not starting from scratch this time, but we will modify the existing system by adding more objects and events on the chart of the asset we are trading.

How to Integrate Smart Money Concepts (BOS) Coupled with the RSI Indicator into an EA

Smart Money Concept (Break Of Structure) coupled with the RSI Indicator to make informed automated trading decisions based on the market structure.

Learn how to design a trading system by Accelerator Oscillator

A new article from our series about how to create simple trading systems by the most popular technical indicators. We will learn about a new one which is the Accelerator Oscillator indicator and we will learn how to design a trading system using it.

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 2): Indicator Signals: Multi Timeframe Parabolic SAR Indicator

The Multi-Currency Expert Advisor in this article is Expert Advisor or trading robot that can trade (open orders, close orders and manage orders for example: Trailing Stop Loss and Trailing Profit) for more than 1 symbol pair only from one symbol chart. This time we will use only 1 indicator, namely Parabolic SAR or iSAR in multi-timeframes starting from PERIOD_M15 to PERIOD_D1.

Swaps (Part I): Locking and Synthetic Positions

In this article I will try to expand the classic concept of swap trading methods. I will explain why I have come to the conclusion that this concept deserves special attention and is absolutely recommended for study.

An Example of Developing a Spread Strategy for Moscow Exchange Futures

The MetaTrader 5 platform allows developing and testing trading robots that simultaneously trade multiple financial instruments. The built-in Strategy Tester automatically downloads required tick history from the broker's server taking into account contract specifications, so the developer does not need to do anything manually. This makes it possible to easily and reliably reproduce trading environment conditions, including even millisecond intervals between the arrival of ticks on different symbols. In this article we will demonstrate the development and testing of a spread strategy on two Moscow Exchange futures.

Developing an Expert Advisor (EA) based on the Consolidation Range Breakout strategy in MQL5

This article outlines the steps to create an Expert Advisor (EA) that capitalizes on price breakouts after consolidation periods. By identifying consolidation ranges and setting breakout levels, traders can automate their trading decisions based on this strategy. The Expert Advisor aims to provide clear entry and exit points while avoiding false breakouts

Timeseries in DoEasy library (part 36): Object of timeseries for all used symbol periods

In this article, we will consider combining the lists of bar objects for each used symbol period into a single symbol timeseries object. Thus, each symbol will have an object storing the lists of all used symbol timeseries periods.

Automating Trading Strategies in MQL5 (Part 10): Developing the Trend Flat Momentum Strategy

In this article, we develop an Expert Advisor in MQL5 for the Trend Flat Momentum Strategy. We combine a two moving averages crossover with RSI and CCI momentum filters to generate trade signals. We also cover backtesting and potential enhancements for real-world performance.

Contest of Expert Advisors inside an Expert Advisor

Using virtual trading, you can create an adaptive Expert Advisor, which will turn on and off trades at the real market. Combine several strategies in a single Expert Advisor! Your multisystem Expert Advisor will automatically choose a trade strategy, which is the best to trade with at the real market, on the basis of profitability of virtual trades. This kind of approach allows decreasing drawdown and increasing profitability of your work at the market. Experiment and share your results with others! I think many people will be interested to know about your portfolio of strategies.

Build Self Optimizing Expert Advisors in MQL5 (Part 4): Dynamic Position Sizing

Successfully employing algorithmic trading requires continuous, interdisciplinary learning. However, the infinite range of possibilities can consume years of effort without yielding tangible results. To address this, we propose a framework that gradually introduces complexity, allowing traders to refine their strategies iteratively rather than committing indefinite time to uncertain outcomes.

Automating Trading Strategies in MQL5 (Part 1): The Profitunity System (Trading Chaos by Bill Williams)

In this article, we examine the Profitunity System by Bill Williams, breaking down its core components and unique approach to trading within market chaos. We guide readers through implementing the system in MQL5, focusing on automating key indicators and entry/exit signals. Finally, we test and optimize the strategy, providing insights into its performance across various market scenarios.

A scientific approach to the development of trading algorithms

The article considers the methodology for developing trading algorithms, in which a consistent scientific approach is used to analyze possible price patterns and to build trading algorithms based on these patterns. Development ideals are demonstrated using examples.

Automating Trading Strategies in MQL5 (Part 16): Midnight Range Breakout with Break of Structure (BoS) Price Action

In this article, we automate the Midnight Range Breakout with Break of Structure strategy in MQL5, detailing code for breakout detection and trade execution. We define precise risk parameters for entries, stops, and profits. Backtesting and optimization are included for practical trading.

Automating Trading Strategies in MQL5 (Part 44): Change of Character (CHoCH) Detection with Swing High/Low Breaks

In this article, we develop a Change of Character (CHoCH) detection system in MQL5 that identifies swing highs and lows over a user-defined bar length, labels them as HH/LH for highs or LL/HL for lows to determine trend direction, and triggers trades on breaks of these swing points, indicating a potential reversal, and trades the breaks when the structure changes.