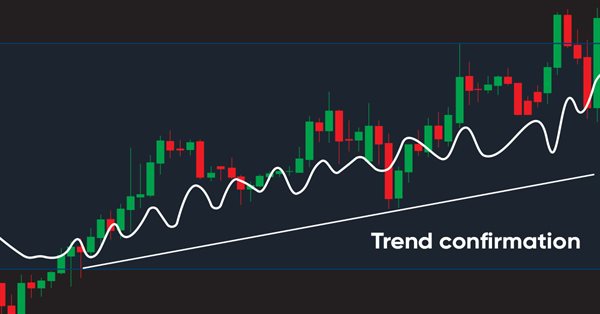

Building A Candlestick Trend Constraint Model(Part 2): Merging Native Indicators

This article focuses on taking advantage of in-built meta trader 5 indicators to screen out off-trend signals. Advancing from the previous article we will explore how to do it using MQL5 code to communicate our idea to the final program.

Implementing a Rapid-Fire Trading Strategy Algorithm with Parabolic SAR and Simple Moving Average (SMA) in MQL5

In this article, we develop a Rapid-Fire Trading Expert Advisor in MQL5, leveraging the Parabolic SAR and Simple Moving Average (SMA) indicators to create a responsive trading strategy. We detail the strategy’s implementation, including indicator usage, signal generation, and the testing and optimization process.

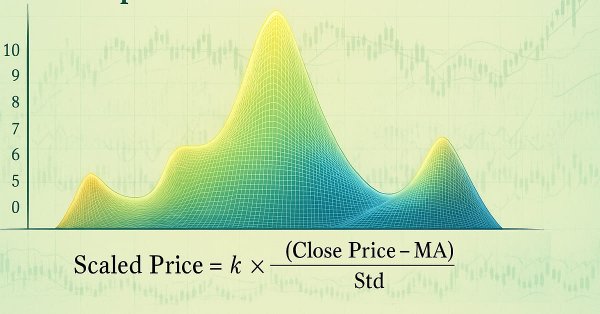

Price Action Analysis Toolkit Development (Part 6): Mean Reversion Signal Reaper

While some concepts may seem straightforward at first glance, bringing them to life in practice can be quite challenging. In the article below, we'll take you on a journey through our innovative approach to automating an Expert Advisor (EA) that skillfully analyzes the market using a mean reversion strategy. Join us as we unravel the intricacies of this exciting automation process.

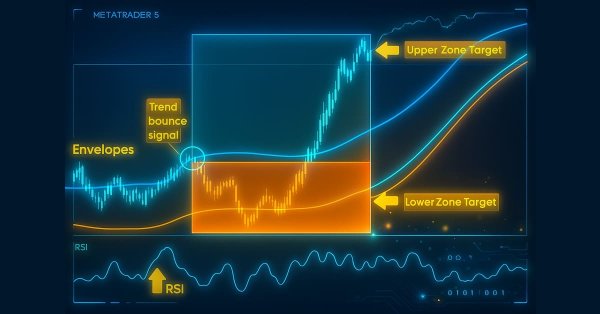

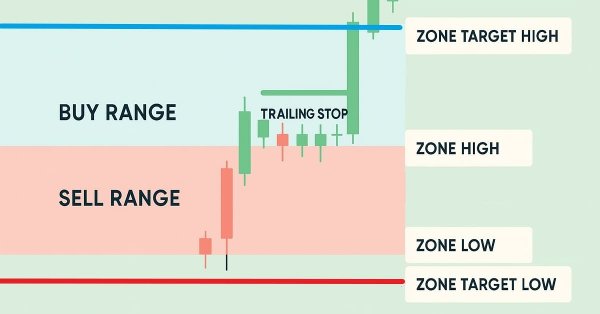

Automating Trading Strategies in MQL5 (Part 22): Creating a Zone Recovery System for Envelopes Trend Trading

In this article, we develop a Zone Recovery System integrated with an Envelopes trend-trading strategy in MQL5. We outline the architecture for using RSI and Envelopes indicators to trigger trades and manage recovery zones to mitigate losses. Through implementation and backtesting, we show how to build an effective automated trading system for dynamic markets

How to Develop a Reliable and Safe Trade Robot in MQL 4

The article deals with the most common errors that occur in developing and using of an Expert Advisor. An exemplary safe automated trading system is described, as well.

Universal regression model for market price prediction (Part 2): Natural, technological and social transient functions

This article is a logical continuation of the previous one. It highlights the facts that confirm the conclusions made in the first article. These facts were revealed within ten years after its publication. They are centered around three detected dynamic transient functions describing the patterns in market price changes.

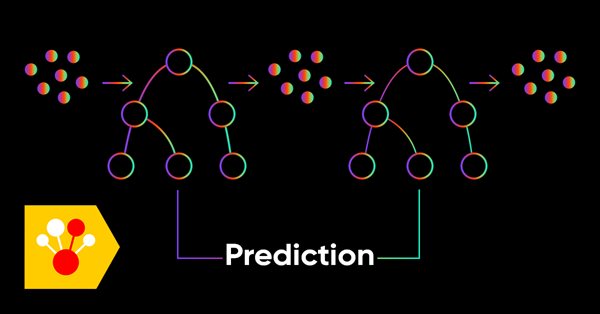

Experiments with neural networks (Part 6): Perceptron as a self-sufficient tool for price forecast

The article provides an example of using a perceptron as a self-sufficient price prediction tool by showcasing general concepts and the simplest ready-made Expert Advisor followed by the results of its optimization.

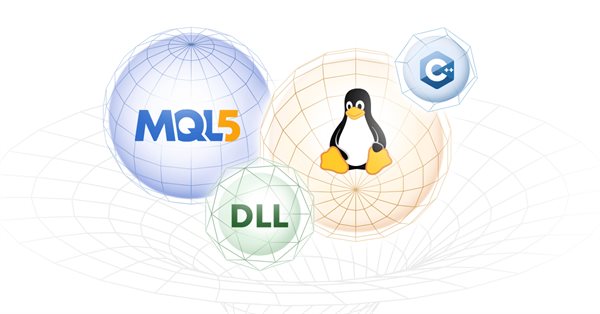

Develop a Proof-of-Concept DLL with C++ multi-threading support for MetaTrader 5 on Linux

We will begin the journey to explore the steps and workflow on how to base development for MetaTrader 5 platform solely on Linux system in which the final product works seamlessly on both Windows and Linux system. We will get to know Wine, and Mingw; both are the essential tools to make cross-platform development works. Especially Mingw for its threading implementations (POSIX, and Win32) that we need to consider in choosing which one to go with. We then build a proof-of-concept DLL and consume it in MQL5 code, finally compare the performance of both threading implementations. All for your foundation to expand further on your own. You should be comfortable building MT related tools on Linux after reading this article.

Learn how to design a trading system by Accumulation/Distribution (AD)

Welcome to the new article from our series about learning how to design trading systems based on the most popular technical indicators. In this article, we will learn about a new technical indicator called Accumulation/Distribution indicator and find out how to design an MQL5 trading system based on simple AD trading strategies.

Automating Trading Strategies in MQL5 (Part 19): Envelopes Trend Bounce Scalping — Trade Execution and Risk Management (Part II)

In this article, we implement trade execution and risk management for the Envelopes Trend Bounce Scalping Strategy in MQL5. We implement order placement and risk controls like stop-loss and position sizing. We conclude with backtesting and optimization, building on Part 18’s foundation.

Filtering Signals Based on Statistical Data of Price Correlation

Is there any correlation between the past price behavior and its future trends? Why does the price repeat today the character of its previous day movement? Can the statistics be used to forecast the price dynamics? There is an answer, and it is positive. If you have any doubt, then this article is for you. I'll tell how to create a working filter for a trading system in MQL5, revealing an interesting pattern in price changes.

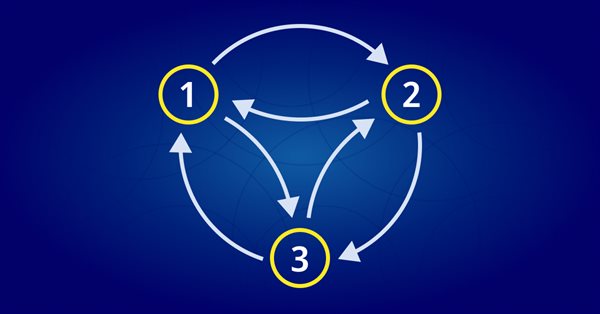

MQL5 Wizard techniques you should know (Part 05): Markov Chains

Markov chains are a powerful mathematical tool that can be used to model and forecast time series data in various fields, including finance. In financial time series modelling and forecasting, Markov chains are often used to model the evolution of financial assets over time, such as stock prices or exchange rates. One of the main advantages of Markov chain models is their simplicity and ease of use.

Expert Advisors Based on Popular Trading Systems and Alchemy of Trading Robot Optimization (Part II)

In this article the author continues to analyze implementation algorithms of simplest trading systems and describes some relevant details of using optimization results. The article will be useful for beginning traders and EA writers.

Library for easy and quick development of MetaTrader programs (part IX): Compatibility with MQL4 - Preparing data

In the previous articles, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. In the eighth part, we implemented the class for tracking order and position modification events. Here, we will improve the library by making it fully compatible with MQL4.

Building a Trading System (Part 2): The Science of Position Sizing

Even with a positive-expectancy system, position sizing determines whether you thrive or collapse. It’s the pivot of risk management—translating statistical edges into real-world results while safeguarding your capital.

Creating an EA that works automatically (Part 03): New functions

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode. In the previous article, we started to develop an order system that we will use in our automated EA. However, we have created only one of the necessary functions.

Price Action Analysis Toolkit Development (Part 38): Tick Buffer VWAP and Short-Window Imbalance Engine

In Part 38, we build a production-grade MT5 monitoring panel that converts raw ticks into actionable signals. The EA buffers tick data to compute tick-level VWAP, a short-window imbalance (flow) metric, and ATR-based position sizing. It then visualizes spread, ATR, and flow with low-flicker bars. The system calculates a suggested lot size and a 1R stop, and issues configurable alerts for tight spreads, strong flow, and edge conditions. Auto-trading is intentionally disabled; the focus remains on robust signal generation and a clean user experience.

Developing a trading robot in Python (Part 3): Implementing a model-based trading algorithm

We continue the series of articles on developing a trading robot in Python and MQL5. In this article, we will create a trading algorithm in Python.

Gradient boosting in transductive and active machine learning

In this article, we will consider active machine learning methods utilizing real data, as well discuss their pros and cons. Perhaps you will find these methods useful and will include them in your arsenal of machine learning models. Transduction was introduced by Vladimir Vapnik, who is the co-inventor of the Support-Vector Machine (SVM).

MQL5 Trading Tools (Part 3): Building a Multi-Timeframe Scanner Dashboard for Strategic Trading

In this article, we build a multi-timeframe scanner dashboard in MQL5 to display real-time trading signals. We plan an interactive grid interface, implement signal calculations with multiple indicators, and add a close button. The article concludes with backtesting and strategic trading benefits

Learn how to design a trading system by Chaikin Oscillator

Welcome to our new article from our series about learning how to design a trading system by the most popular technical indicator. Through this new article, we will learn how to design a trading system by the Chaikin Oscillator indicator.

Formulating Dynamic Multi-Pair EA (Part 5): Scalping vs Swing Trading Approaches

This part explores how to design a Dynamic Multi-Pair Expert Advisor capable of adapting between Scalping and Swing Trading modes. It covers the structural and algorithmic differences in signal generation, trade execution, and risk management, allowing the EA to intelligently switch strategies based on market behavior and user input.

Understanding functions in MQL5 with applications

Functions are critical things in any programming language, it helps developers apply the concept of (DRY) which means do not repeat yourself, and many other benefits. In this article, you will find much more information about functions and how we can create our own functions in MQL5 with simple applications that can be used or called in any system you have to enrich your trading system without complicating things.

Larry Williams Market Secrets (Part 4): Automating Short-Term Swing Highs and Lows in MQL5

Master the automation of Larry Williams’ short-term swing patterns using MQL5. In this guide, we develop a fully configurable Expert Advisor (EA) that leverages non-random market structures. We’ll cover how to integrate robust risk management and flexible exit logic, providing a solid foundation for systematic strategy development and backtesting.

Automating Trading Strategies in MQL5 (Part 23): Zone Recovery with Trailing and Basket Logic

In this article, we enhance our Zone Recovery System by introducing trailing stops and multi-basket trading capabilities. We explore how the improved architecture uses dynamic trailing stops to lock in profits and a basket management system to handle multiple trade signals efficiently. Through implementation and backtesting, we demonstrate a more robust trading system tailored for adaptive market performance.

Automated Trading Championship: The Reverse of the Medal

Automated Trading Championship based on online trading platform MetaTrader 4 is being conducted for the third time and accepted by many people as a matter-of-course yearly event being waited for with impatience. However, this competition specifies strict requirements to the Participants. This is precisely the topic we're going to discuss in this article.

Alan Andrews and his methods of time series analysis

Alan Andrews is one of the most famous "educators" of the modern world in the field of trading. His "pitchfork" is included in almost all modern quote analysis programs. But most traders do not use even a fraction of the opportunities that this tool provides. Besides, Andrews' original training course includes a description not only of the pitchfork (although it remains the main tool), but also of some other useful constructions. The article provides an insight into the marvelous chart analysis methods that Andrews taught in his original course. Beware, there will be a lot of images.

Trading with the MQL5 Economic Calendar (Part 1): Mastering the Functions of the MQL5 Economic Calendar

In this article, we explore how to use the MQL5 Economic Calendar for trading by first understanding its core functionalities. We then implement key functions of the Economic Calendar in MQL5 to extract relevant news data for trading decisions. Finally, we conclude by showcasing how to utilize this information to enhance trading strategies effectively.

How to choose an Expert Advisor: Twenty strong criteria to reject a trading bot

This article tries to answer the question: how can we choose the right expert advisors? Which are the best for our portfolio, and how can we filter the large trading bots list available on the market? This article will present twenty clear and strong criteria to reject an expert advisor. Each criterion will be presented and well explained to help you make a more sustained decision and build a more profitable expert advisor collection for your profits.

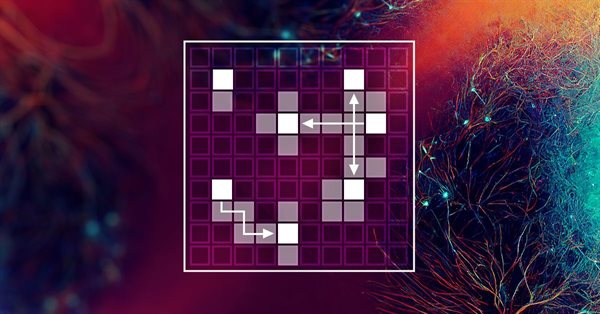

Neural networks made easy (Part 36): Relational Reinforcement Learning

In the reinforcement learning models we discussed in previous article, we used various variants of convolutional networks that are able to identify various objects in the original data. The main advantage of convolutional networks is the ability to identify objects regardless of their location. At the same time, convolutional networks do not always perform well when there are various deformations of objects and noise. These are the issues which the relational model can solve.

Jeremy Scott - Successful MQL5 Market Seller

Jeremy Scott who is better known under Johnnypasado nickname at MQL5.community became famous offering products in our MQL5 Market service. Jeremy has already made several thousands of dollars in the Market and that is not the limit. We decided to take a closer look at the future millionaire and receive some pieces of advice for MQL5 Market sellers.

Prices in DoEasy library (part 62): Updating tick series in real time, preparation for working with Depth of Market

In this article, I will implement updating tick data in real time and prepare the symbol object class for working with Depth of Market (DOM itself is to be implemented in the next article).

Creating an MQL5 Expert Advisor Based on the PIRANHA Strategy by Utilizing Bollinger Bands

In this article, we create an Expert Advisor (EA) in MQL5 based on the PIRANHA strategy, utilizing Bollinger Bands to enhance trading effectiveness. We discuss the key principles of the strategy, the coding implementation, and methods for testing and optimization. This knowledge will enable you to deploy the EA in your trading scenarios effectively

Price Action Analysis Toolkit Development (Part 49): Integrating Trend, Momentum, and Volatility Indicators into One MQL5 System

Simplify your MetaTrader 5 charts with the Multi Indicator Handler EA. This interactive dashboard merges trend, momentum, and volatility indicators into one real‑time panel. Switch instantly between profiles to focus on the analysis you need most. Declutter with one‑click Hide/Show controls and stay focused on price action. Read on to learn step‑by‑step how to build and customize it yourself in MQL5.

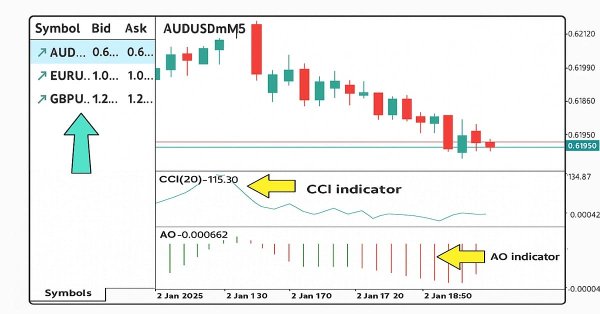

Automating Trading Strategies in MQL5 (Part 20): Multi-Symbol Strategy Using CCI and AO

In this article, we create a multi-symbol trading strategy using CCI and AO indicators to detect trend reversals. We cover its design, MQL5 implementation, and backtesting process. The article concludes with tips for performance improvement.

Automating Trading Strategies with Parabolic SAR Trend Strategy in MQL5: Crafting an Effective Expert Advisor

In this article, we will automate the trading strategies with Parabolic SAR Strategy in MQL5: Crafting an Effective Expert Advisor. The EA will make trades based on trends identified by the Parabolic SAR indicator.

Developing a Trading Strategy: The Triple Sine Mean Reversion Method

This article introduces the Triple Sine Mean Reversion Method, a trading strategy built upon a new mathematical indicator — the Triple Sine Oscillator (TSO). The TSO is derived from the sine cube function, which oscillates between –1 and +1, making it suitable for identifying overbought and oversold market conditions. Overall, the study demonstrates how mathematical functions can be transformed into practical trading tools.

Lite_EXPERT2.mqh: Functional Kit for Developers of Expert Advisors

This article continues the series of articles "Expert Advisors Based on Popular Trading Systems and Alchemy of Trading Robot Optimization". It familiarizes the readers with a more universal function library of the Lite_EXPERT2.mqh file.

Creating an EA that works automatically (Part 15): Automation (VII)

To complete this series of articles on automation, we will continue discussing the topic of the previous article. We will see how everything will fit together, making the EA run like clockwork.

Introduction to MQL5 (Part 17): Building Expert Advisors for Trend Reversals

This article teaches beginners how to build an Expert Advisor (EA) in MQL5 that trades based on chart pattern recognition using trend line breakouts and reversals. By learning how to retrieve trend line values dynamically and compare them with price action, readers will be able to develop EAs capable of identifying and trading chart patterns such as ascending and descending trend lines, channels, wedges, triangles, and more.