Currency pair strength indicator in pure MQL5

We are going to develop a professional indicator for currency strength analysis in MQL5. This step-by-step guide will show you how to develop a powerful trading tool with a visual dashboard for MetaTrader 5. You will learn how to calculate the strength of currency pairs across multiple timeframes (H1, H4, D1), implement dynamic data updates, and create a user-friendly interface.

Building A Candlestick Trend Constraint Model (Part 9): Multiple Strategies Expert Advisor (I)

Today, we will explore the possibilities of incorporating multiple strategies into an Expert Advisor (EA) using MQL5. Expert Advisors provide broader capabilities than just indicators and scripts, allowing for more sophisticated trading approaches that can adapt to changing market conditions. Find, more in this article discussion.

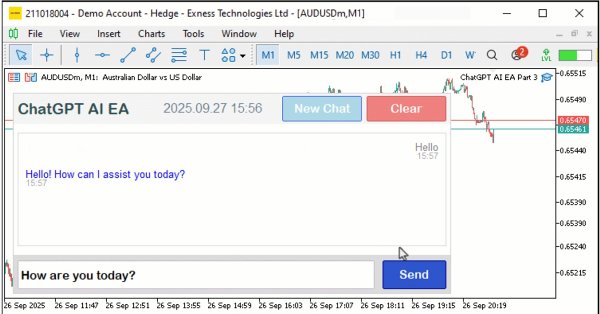

Building AI-Powered Trading Systems in MQL5 (Part 3): Upgrading to a Scrollable Single Chat-Oriented UI

In this article, we upgrade the ChatGPT-integrated program in MQL5 to a scrollable single chat-oriented UI, enhancing conversation history display with timestamps and dynamic scrolling. The system builds on JSON parsing to manage multi-turn messages, supporting customizable scrollbar modes and hover effects for improved user interaction.

Building a Custom Market Regime Detection System in MQL5 (Part 2): Expert Advisor

This article details building an adaptive Expert Advisor (MarketRegimeEA) using the regime detector from Part 1. It automatically switches trading strategies and risk parameters for trending, ranging, or volatile markets. Practical optimization, transition handling, and a multi-timeframe indicator are included.

Developing a trading Expert Advisor from scratch (Part 24): Providing system robustness (I)

In this article, we will make the system more reliable to ensure a robust and secure use. One of the ways to achieve the desired robustness is to try to re-use the code as much as possible so that it is constantly tested in different cases. But this is only one of the ways. Another one is to use OOP.

Developing a Replay System — Market simulation (Part 15): Birth of the SIMULATOR (V) - RANDOM WALK

In this article we will complete the development of a simulator for our system. The main goal here will be to configure the algorithm discussed in the previous article. This algorithm aims to create a RANDOM WALK movement. Therefore, to understand today's material, it is necessary to understand the content of previous articles. If you have not followed the development of the simulator, I advise you to read this sequence from the very beginning. Otherwise, you may get confused about what will be explained here.

Building AI-Powered Trading Systems in MQL5 (Part 4): Overcoming Multiline Input, Ensuring Chat Persistence, and Generating Signals

In this article, we enhance the ChatGPT-integrated program in MQL5 overcoming multiline input limitations with improved text rendering, introducing a sidebar for navigating persistent chat storage using AES256 encryption and ZIP compression, and generating initial trade signals through chart data integration.

Neural networks made easy (Part 75): Improving the performance of trajectory prediction models

The models we create are becoming larger and more complex. This increases the costs of not only their training as well as operation. However, the time required to make a decision is often critical. In this regard, let us consider methods for optimizing model performance without loss of quality.

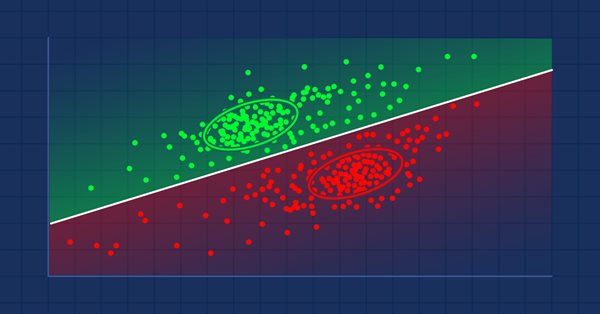

MQL5 Wizard techniques you should know (Part 04): Linear Discriminant Analysis

Todays trader is a philomath who is almost always looking up new ideas, trying them out, choosing to modify them or discard them; an exploratory process that should cost a fair amount of diligence. These series of articles will proposition that the MQL5 wizard should be a mainstay for traders in this effort.

Integrate Your Own LLM into EA (Part 1): Hardware and Environment Deployment

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Building a Trading System (Part 4): How Random Exits Influence Trading Expectancy

Many traders have experienced this situation, often stick to their entry criteria but struggle with trade management. Even with the right setups, emotional decision-making—such as panic exits before trades reach their take-profit or stop-loss levels—can lead to a declining equity curve. How can traders overcome this issue and improve their results? This article will address these questions by examining random win-rates and demonstrating, through Monte Carlo simulation, how traders can refine their strategies by taking profits at reasonable levels before the original target is reached.

Neural Networks in Trading: Models Using Wavelet Transform and Multi-Task Attention (Final Part)

In the previous article, we explored the theoretical foundations and began implementing the approaches of the Multitask-Stockformer framework, which combines the wavelet transform and the Self-Attention multitask model. We continue to implement the algorithms of this framework and evaluate their effectiveness on real historical data.

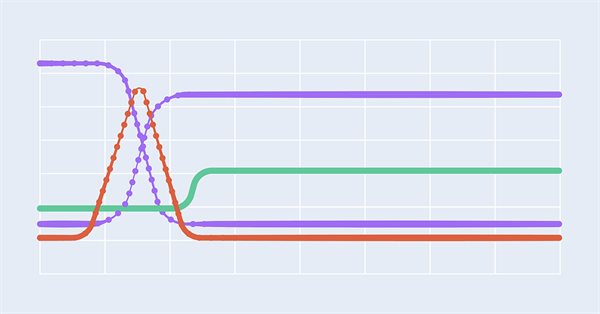

Neural networks made easy (Part 17): Dimensionality reduction

In this part we continue discussing Artificial Intelligence models. Namely, we study unsupervised learning algorithms. We have already discussed one of the clustering algorithms. In this article, I am sharing a variant of solving problems related to dimensionality reduction.

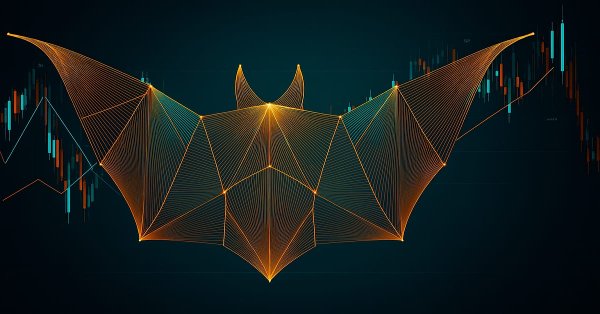

Automating Trading Strategies in MQL5 (Part 28): Creating a Price Action Bat Harmonic Pattern with Visual Feedback

In this article, we develop a Bat Pattern system in MQL5 that identifies bullish and bearish Bat harmonic patterns using pivot points and Fibonacci ratios, triggering trades with precise entry, stop loss, and take-profit levels, enhanced with visual feedback through chart objects

Neural Networks in Trading: An Ensemble of Agents with Attention Mechanisms (MASAAT)

We introduce the Multi-Agent Self-Adaptive Portfolio Optimization Framework (MASAAT), which combines attention mechanisms and time series analysis. MASAAT generates a set of agents that analyze price series and directional changes, enabling the identification of significant fluctuations in asset prices at different levels of detail.

Expert Advisors Based on Popular Trading Systems and Alchemy of Trading Robot Optimization (Part VII)

In this article, the author gives an example Expert Advisor meeting the requirements stated in the Rules of the Automated Trading Championship 2008

Multilayer perceptron and backpropagation algorithm (Part 3): Integration with the Strategy Tester - Overview (I).

The multilayer perceptron is an evolution of the simple perceptron which can solve non-linear separable problems. Together with the backpropagation algorithm, this neural network can be effectively trained. In Part 3 of the Multilayer Perceptron and Backpropagation series, we'll see how to integrate this technique into the Strategy Tester. This integration will allow the use of complex data analysis aimed at making better decisions to optimize your trading strategies. In this article, we will discuss the advantages and problems of this technique.

Neural Networks in Trading: A Multimodal, Tool-Augmented Agent for Financial Markets (FinAgent)

We invite you to explore FinAgent, a multimodal financial trading agent framework designed to analyze various types of data reflecting market dynamics and historical trading patterns.

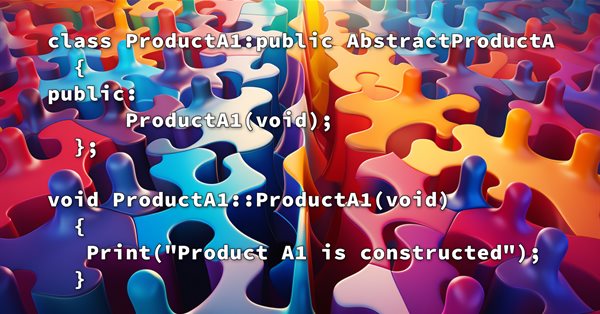

Design Patterns in software development and MQL5 (Part I): Creational Patterns

There are methods that can be used to solve many problems that can be repeated. Once understand how to use these methods it can be very helpful to create your software effectively and apply the concept of DRY ((Do not Repeat Yourself). In this context, the topic of Design Patterns will serve very well because they are patterns that provide solutions to well-described and repeated problems.

Creating an EA that works automatically (Part 07): Account types (II)

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode. The trader should always be aware of what the automatic EA is doing, so that if it "goes off the rails", the trader could remove it from the chart as soon as possible and take control of the situation.

Trading with the MQL5 Economic Calendar (Part 9): Elevating News Interaction with a Dynamic Scrollbar and Polished Display

In this article, we enhance the MQL5 Economic Calendar with a dynamic scrollbar for intuitive news navigation. We ensure seamless event display and efficient updates. We validate the responsive scrollbar and polished dashboard through testing.

Creating an Interactive Graphical User Interface in MQL5 (Part 2): Adding Controls and Responsiveness

Enhancing the MQL5 GUI panel with dynamic features can significantly improve the trading experience for users. By incorporating interactive elements, hover effects, and real-time data updates, the panel becomes a powerful tool for modern traders.

MQL5 Wizard Techniques you should know (Part 83): Using Patterns of Stochastic Oscillator and the FrAMA — Behavioral Archetypes

The Stochastic Oscillator and the Fractal Adaptive Moving Average are another indicator pairing that could be used for their ability to compliment each other within an MQL5 Expert Advisor. We look at the Stochastic for its ability to pinpoint momentum shifts, while the FrAMA is used to provide confirmation of the prevailing trends. In exploring this indicator pairing, as always, we use the MQL5 wizard to build and test out their potential.

MQL5 Trading Tools (Part 1): Building an Interactive Visual Pending Orders Trade Assistant Tool

In this article, we introduce the development of an interactive Trade Assistant Tool in MQL5, designed to simplify placing pending orders in Forex trading. We outline the conceptual design, focusing on a user-friendly GUI for setting entry, stop-loss, and take-profit levels visually on the chart. Additionally, we detail the MQL5 implementation and backtesting process to ensure the tool’s reliability, setting the stage for advanced features in the preceding parts.

Experiments with neural networks (Part 7): Passing indicators

Examples of passing indicators to a perceptron. The article describes general concepts and showcases the simplest ready-made Expert Advisor followed by the results of its optimization and forward test.

Object Approach in MQL

This article will be interesting first of all for programmers both beginners and professionals working in MQL environment. Also it would be useful if this article were read by MQL environment developers and ideologists, because questions that are analyzed here may become projects for future implementation of MetaTrader and MQL.

Timeseries in DoEasy library (part 51): Composite multi-period multi-symbol standard indicators

In the article, complete development of objects of multi-period multi-symbol standard indicators. Using Ichimoku Kinko Hyo standard indicator example, analyze creation of compound custom indicators which have auxiliary drawn buffers for displaying data on the chart.

Developing a Trading System Based on the Order Book (Part I): Indicator

Depth of Market is undoubtedly a very important element for executing fast trades, especially in High Frequency Trading (HFT) algorithms. In this series of articles, we will look at this type of trading events that can be obtained through a broker on many tradable symbols. We will start with an indicator, where you can customize the color palette, position and size of the histogram displayed directly on the chart. We will also look at how to generate BookEvent events to test the indicator under certain conditions. Other possible topics for future articles include how to store price distribution data and how to use it in a strategy tester.

Developing a Replay System (Part 53): Things Get Complicated (V)

In this article, we'll cover an important topic that few people understand: Custom Events. Dangers. Advantages and disadvantages of these elements. This topic is key for those who want to become a professional programmer in MQL5 or any other language. Here we will focus on MQL5 and MetaTrader 5.

Data Science and ML (Part 41): Forex and Stock Markets Pattern Detection using YOLOv8

Detecting patterns in financial markets is challenging because it involves seeing what's on the chart, something that's difficult to undertake in MQL5 due to image limitations. In this article, we are going to discuss a decent model made in Python that helps us detect patterns present on the chart with minimal effort.

Modified Grid-Hedge EA in MQL5 (Part III): Optimizing Simple Hedge Strategy (I)

In this third part, we revisit the Simple Hedge and Simple Grid Expert Advisors (EAs) developed earlier. Our focus shifts to refining the Simple Hedge EA through mathematical analysis and a brute force approach, aiming for optimal strategy usage. This article delves deep into the mathematical optimization of the strategy, setting the stage for future exploration of coding-based optimization in later installments.

Category Theory in MQL5 (Part 8): Monoids

This article continues the series on category theory implementation in MQL5. Here we introduce monoids as domain (set) that sets category theory apart from other data classification methods by including rules and an identity element.

Triangular arbitrage with predictions

This article simplifies triangular arbitrage, showing you how to use predictions and specialized software to trade currencies smarter, even if you're new to the market. Ready to trade with expertise?

Considering Orders in a Large Program

General principles of considering orders in a large and complex program are discussed.

Build Self Optimizing Expert Advisors in MQL5 (Part 2): USDJPY Scalping Strategy

Join us today as we challenge ourselves to build a trading strategy around the USDJPY pair. We will trade candlestick patterns that are formed on the daily time frame because they potentially have more strength behind them. Our initial strategy was profitable, which encouraged us to continue refining the strategy and adding extra layers of safety, to protect the capital gained.

Adaptive Smart Money Architecture (ASMA): Merging SMC Logic With Market Sentiment for Dynamic Strategy Switching

This topic explores how to build an Adaptive Smart Money Architecture (ASMA)—an intelligent Expert Advisor that merges Smart Money Concepts (Order Blocks, Break of Structure, Fair Value Gaps) with real-time market sentiment to automatically choose the best trading strategy depending on current market conditions.

Expert Advisors Based on Popular Trading Systems and Alchemy of Trading Robot Optimization (Part IV)

In this article the author continues to analyze implementation algorithms of simplest trading systems and introduces recording of optimization results in backtesting into one html file in the form of a table. The article will be useful for beginning traders and EA writers.

Creating Custom Indicators in MQL5 (Part 6): Evolving RSI Calculations with Smoothing, Hue Shifts, and Multi-Timeframe Support

In this article, we build a versatile RSI indicator in MQL5 supporting multiple variants, data sources, and smoothing methods for improved analysis. We add hue shifts for color visuals, dynamic boundaries for overbought/oversold zones, and notifications for trend alerts. It includes multi-timeframe support with interpolation, offering us a customizable RSI tool for diverse strategies.

SP500 Trading Strategy in MQL5 For Beginners

Discover how to leverage MQL5 to forecast the S&P 500 with precision, blending in classical technical analysis for added stability and combining algorithms with time-tested principles for robust market insights.

Building A Candlestick Trend Constraint Model(Part 3): Detecting changes in trends while using this system

This article explores how economic news releases, investor behavior, and various factors can influence market trend reversals. It includes a video explanation and proceeds by incorporating MQL5 code into our program to detect trend reversals, alert us, and take appropriate actions based on market conditions. This builds upon previous articles in the series.