Using PatchTST Machine Learning Algorithm for Predicting Next 24 Hours of Price Action

Introduction

I first encountered an algorithm called PatchTST when I started to dig into the AI advancements associated with time series predictions on Huggingface.co. As anyone who has worked with large language models (LLMs) would know, the invention of transformers has been a game changer for developing tools for natural language, image, and video processing. But what about time series? Is it something that's just left behind? Or is most of the research simply behind closed doors? It turns out there are many newer models that apply transformers successfully for predicting time series. In this article, we will look at one such implementation.

What's impressive about PatchTST is how quick it is to train a model and how easy it is to use the trained model with MQL. I admit openly that I am new to the concept of neural networks. But going through this process and tackling the implementation of PatchTST outlined in this article for MQL5, I felt like I took a giant leap forward in my learning and understanding of how these complex neural networks are developed, troubleshot, trained, and used. It is like taking a child, who is barely learning to walk, and putting him on a professional soccer team, expecting him to score the winning goal in the World Cup final.

PatchTST Overview

After discovering PatchTST, I started to look into the paper that explains its design: "A Time Series is Worth 64 Words: Long-term Forecasting with Transformers". The title was interesting. As I started to read more into the paper, I thought wow this looks like an fascinating structure - it has many elements that I have always wanted to learn about. So naturally, I wanted to try it out and see how the predictions work. Here is what made me even more interested in this algorithm:

- You can predict open, high, low, and close using PatchTST. With PatchTST, I felt that you couldfeed it the entire data as it comes - open, high, low, close, and even volume. You can expect it to find the patterns in the data because all the data is converted to something called "patches". More on what patches are a little later in this article. For now, it is just important to know that patches are appealing and help make predictions better.

- Minimal data-preprocessing requirements with PatchTST. As I started to dig into the algorithm further, I realized that the authors use something called "RevIn", which is reverse instance normalization. RevIn comes from a paper titled: "REVERSIBLE INSTANCE NORMALIZATION FOR ACCURATE TIME-SERIES FORECASTING AGAINST DISTRIBUTION SHIFT". RevIn attempts to tackle the problem of distribution shift in time-series forecasting. As algorithmic traders, we are all too familiar with the feeling when our trained EA no longer seems to predict the market, and we are forced to re-optimize and update our parameters. Consider RevIn to be a way to do the same thing.

- This is method basically takes the data passed into it and normalizes it using the following formula:

x = (x - mean) / std

Then, when the model has to make a prediction, it denormalizes the data using the opposite property:

x = x * std + mean

RevIn also has another property called affine_bias. In the simplest possible terms, this is a learnable parameter that takes care of the skewness, kurtosis etc. that may be present in the dataset.

x = x * affine_weight + affine_bias

The structure of PatchTST can be summarized as follows:

Input Data -> RevIn -> Series Decomposition -> Trend Component -> PatchTST Backbone -> TSTiEncoder -> Flatten_Head -> Trend Forecaster -> Residual Component -> Add Trend and Residual -> Final Forecast

We understand that our data will be pulled using MT5. We have also discussed how RevIn works.

Here is how PatchTST works: say you pull 80,000 bars of EURUSD data for the H1 timeframe. That is just around 13 years’ worth of data. With PatchTST, you segment the data into something called “patches”. As an analogy, think of patches as being similar to how Vision Transformers (ViTs) work for images but adapted for time series data. So, for example, if the patch length is 16, then each patch would contain 16 consecutive price values. This is like looking at small chunks of the time series at a time, which helps the model to focus on local patterns before considering the global pattern.

Next, the patches include positional encoding to preserve the sequence order, which assists the model in remembering the position of each patch in the sequence.

The transformer passes the normalized and encoded patches through a stack of encoder layers. Each encoder layer contains a multi-head attention layer and a feed-forward layer. The multi-head attention layer allows the model to attend to different parts of the input sequence, while the feed-forward layer allows the model to learn complex non-linear transformations of the data.

Lastly, we have the trend and the residual components. The same patching, normalization, positional encoding, and transformer layers are applied to both the trend component and the residual component. Then, we add together the outputs of the trend and residual components to produce the final forecast.

PatchTST Official Repository Issues

The official repository for PatchTST can be found on GitHub at the following link: PatchTST (ICLR 2023). There are two different versions available - supervised and unsupervised. For this article, we will use the supervised learning approach. As we know, in order to use any model with MQL5, we need a way to convert it to ONNX format. However, the authors of PatchTST did not take this into account. I had to make the following modifications to their base code to make the model work with MQL5:

Original Code:

class PatchTST_backbone(nn.Module): def __init__(self, c_in:int, context_window:int, target_window:int, patch_len:int, stride:int, max_seq_len:Optional[int]=1024, n_layers:int=3, d_model=128, n_heads=16, d_k:Optional[int]=None, d_v:Optional[int]=None, d_ff:int=256, norm:str='BatchNorm', attn_dropout:float=0., dropout:float=0., act:str="gelu", key_padding_mask:bool='auto', padding_var:Optional[int]=None, attn_mask:Optional[Tensor]=None, res_attention:bool=True, pre_norm:bool=False, store_attn:bool=False, pe:str='zeros', learn_pe:bool=True, fc_dropout:float=0., head_dropout = 0, padding_patch = None, pretrain_head:bool=False, head_type = 'flatten', individual = False, revin = True, affine = True, subtract_last = False, verbose:bool=False, **kwargs): super().__init__() # RevIn self.revin = revin if self.revin: self.revin_layer = RevIN(c_in, affine=affine, subtract_last=subtract_last) # Patching self.patch_len = patch_len self.stride = stride self.padding_patch = padding_patch patch_num = int((context_window - patch_len)/stride + 1) if padding_patch == 'end': # can be modified to general case self.padding_patch_layer = nn.ReplicationPad1d((0, stride)) patch_num += 1 # Backbone self.backbone = TSTiEncoder(c_in, patch_num=patch_num, patch_len=patch_len, max_seq_len=max_seq_len, n_layers=n_layers, d_model=d_model, n_heads=n_heads, d_k=d_k, d_v=d_v, d_ff=d_ff, attn_dropout=attn_dropout, dropout=dropout, act=act, key_padding_mask=key_padding_mask, padding_var=padding_var, attn_mask=attn_mask, res_attention=res_attention, pre_norm=pre_norm, store_attn=store_attn, pe=pe, learn_pe=learn_pe, verbose=verbose, **kwargs) # Head self.head_nf = d_model * patch_num self.n_vars = c_in self.pretrain_head = pretrain_head self.head_type = head_type self.individual = individual if self.pretrain_head: self.head = self.create_pretrain_head(self.head_nf, c_in, fc_dropout) # custom head passed as a partial func with all its kwargs elif head_type == 'flatten': self.head = Flatten_Head(self.individual, self.n_vars, self.head_nf, target_window, head_dropout=head_dropout) def forward(self, z): # z: [bs x nvars x seq_len] # norm if self.revin: z = z.permute(0,2,1) z = self.revin_layer(z, 'norm') z = z.permute(0,2,1) # do patching if self.padding_patch == 'end': z = self.padding_patch_layer(z) z = z.unfold(dimension=-1, size=self.patch_len, step=self.stride) # z: [bs x nvars x patch_num x patch_len] z = z.permute(0,1,3,2) # z: [bs x nvars x patch_len x patch_num] # model z = self.backbone(z) # z: [bs x nvars x d_model x patch_num] z = self.head(z) # z: [bs x nvars x target_window] # denorm if self.revin: z = z.permute(0,2,1) z = self.revin_layer(z, 'denorm') z = z.permute(0,2,1) return z

Code above is the main backbone. As you can see, the code uses a function called Unfold in the line:

z = z.unfold(dimension=-1, size=self.patch_len, step=self.stride) # z: [bs x nvars x patch_num x patch_len]

The conversion of Unfold is not supported by ONNX. You will receive an error like:

Unsupported: ONNX export of operator Unfold, input size not accessible. Please feel free to request support or submit a pull request on PyTorch GitHub: https://github.com/pytorch/pytorch/issues

So I had to replace this section of the code with:

# Manually unfold the input tensor batch_size, n_vars, seq_len = z.size() patches = [] for i in range(0, seq_len - self.patch_len + 1, self.stride): patches.append(z[:, :, i:i+self.patch_len])

Note that the above replacement is a little less efficient because it uses a for loop for training a Neural Network. The inefficiencies can add up over many epochs and over large datasets. But this is necessary because otherwise, the model will simply fail to convert, and we will not be able to use it with MQL5.

I specifically addressed this issue. Doing this took the longest. I then put everything together in a file called patchTST.py, which can be found in the zip file attached to this article. This is the file that we will be using for our model training.

Requirements to Work with PatchTST in Python

In this section, I will give you the requirements for working with PatchTST in Python. These requirements can be summarized below:

Create a virtual environment:

python -m venv myenv

Activate the virtual environment (Windows)

.\myenv\Scripts\activate

Install the requirements.txt file included in the zip file attached to this article:

pip install -r requirements.txt

Specifically, the requirements to run this project are:

MetaTrader5

pandas

numpy

torch

plotly

datetime Model Training Code Development Step-By-Step

For the following code, you can follow along with me using a Jupyter notebook that I have included in the zip file: PatchTST Step-By-Step.ipynb. We will summarize the steps below:

-

Import Necessary Libraries: Importing the required libraries, including MetaTrader 5, Pandas, Numpy, Torch, and the PatchTST model.

# Step 1: Import necessary libraries import MetaTrader5 as mt5 import pandas as pd import numpy as np import torch from torch.utils.data import TensorDataset, DataLoader from patchTST import Model as PatchTST

-

Initialize and Fetch Data from MetaTrader 5: Function fetch_mt5_data initializes MT5, fetches the data for the given symbol, timeframe, and number of bars, then returns a data frame with the open, high, low, and close columns.

# Step 2: Initialize and fetch data from MetaTrader 5 def fetch_mt5_data(symbol, timeframe, bars): if not mt5.initialize(): print("MT5 initialization failed") return None timeframe_dict = { 'M1': mt5.TIMEFRAME_M1, 'M5': mt5.TIMEFRAME_M5, 'M15': mt5.TIMEFRAME_M15, 'H1': mt5.TIMEFRAME_H1, 'D1': mt5.TIMEFRAME_D1 } rates = mt5.copy_rates_from_pos(symbol, timeframe_dict[timeframe], 0, bars) mt5.shutdown() df = pd.DataFrame(rates) df['time'] = pd.to_datetime(df['time'], unit='s') df.set_index('time', inplace=True) return df[['open', 'high', 'low', 'close']] # Fetch data data = fetch_mt5_data('EURUSD', 'H1', 80000)

-

Prepare Forecasting Data Using Sliding Window: The function prepare_forecasting_data creates the dataset using a sliding window approach, generating sequences of historical data (X) and the corresponding future data (y).

# Step 3: Prepare forecasting data using sliding window def prepare_forecasting_data(data, seq_length, pred_length): X, y = [], [] for i in range(len(data) - seq_length - pred_length): X.append(data.iloc[i:(i + seq_length)].values) y.append(data.iloc[(i + seq_length):(i + seq_length + pred_length)].values) return np.array(X), np.array(y) seq_length = 168 # 1 week of hourly data pred_length = 24 # Predict next 24 hours X, y = prepare_forecasting_data(data, seq_length, pred_length)

-

Split Data into Training and Testing Sets: Splitting the data into training and testing sets, with 80% for training and 20% for testing.

# Step 4: Split data into training and testing sets split = int(len(X) * 0.8) X_train, X_test = X[:split], X[split:] y_train, y_test = y[:split], y[split:]

-

Convert Data to PyTorch Tensors: Converting the NumPy arrays into PyTorch tensors, which are required for training with PyTorch. Sets a manual seed for torch, for reproducibility of results.

# Step 5: Convert data to PyTorch tensors X_train = torch.tensor(X_train, dtype=torch.float32) y_train = torch.tensor(y_train, dtype=torch.float32) X_test = torch.tensor(X_test, dtype=torch.float32) y_test = torch.tensor(y_test, dtype=torch.float32) torch.manual_seed(42)

-

Set Device for Computation: Setting the device to CUDA if available, otherwise using the CPU. This is essential for leveraging GPU acceleration during training, especially if it is available.

# Step 6: Set device for computation device = torch.device("cuda" if torch.cuda.is_available() else "cpu") print(f"Using device: {device}")

-

Create Data Loader for Training Data: Creating a data loader to handle the batching and shuffling of the training data.

# Step 7: Create DataLoader for training data train_dataset = TensorDataset(X_train, y_train) train_loader = DataLoader(train_dataset, batch_size=32, shuffle=True)

-

Define the Configuration Class for the Model: Defining a configuration class Config to store all the hyperparameters and settings required for the PatchTST model.

# Step 8: Define the configuration class for the model class Config: def __init__(self): self.enc_in = 4 # Adjusted for 4 columns (open, high, low, close) self.seq_len = seq_length self.pred_len = pred_length self.e_layers = 3 self.n_heads = 4 self.d_model = 64 self.d_ff = 256 self.dropout = 0.1 self.fc_dropout = 0.1 self.head_dropout = 0.1 self.individual = False self.patch_len = 24 self.stride = 24 self.padding_patch = True self.revin = True self.affine = False self.subtract_last = False self.decomposition = True self.kernel_size = 25 configs = Config()

-

Initialize the PatchTST Model: Initializing the PatchTST model with the defined configuration and moving it to the selected device.

# Step 9: Initialize the PatchTST model model = PatchTST( configs=configs, max_seq_len=1024, d_k=None, d_v=None, norm='BatchNorm', attn_dropout=0.1, act="gelu", key_padding_mask='auto', padding_var=None, attn_mask=None, res_attention=True, pre_norm=False, store_attn=False, pe='zeros', learn_pe=True, pretrain_head=False, head_type='flatten', verbose=False ).to(device)

-

Define Optimizer and Loss Function: Setting up the optimizer (Adam) and the loss function (Mean Squared Error) for training the model.

# Step 10: Define optimizer and loss function optimizer = torch.optim.Adam(model.parameters(), lr=0.001) loss_fn = torch.nn.MSELoss() num_epochs = 100

-

Train the Model: Training the model over the specified number of epochs. For each batch of data, the model performs a forward pass, calculates the loss, performs a backward pass to compute gradients, and updates the model parameters.

# Step 11: Train the model for epoch in range(num_epochs): model.train() total_loss = 0 for batch_X, batch_y in train_loader: optimizer.zero_grad() batch_X = batch_X.to(device) batch_y = batch_y.to(device) outputs = model(batch_X) outputs = outputs[:, -pred_length:, :4] loss = loss_fn(outputs, batch_y) loss.backward() optimizer.step() total_loss += loss.item() print(f"Epoch {epoch+1}/{num_epochs}, Loss: {total_loss/len(train_loader):.10f}")

-

Save the Model in PyTorch Format: Saving the trained model's state dictionary to a file. We can use this file to make predictions directly in python.

# Step 12: Save the model in PyTorch format torch.save(model.state_dict(), 'patchtst_model.pth')

-

Prepare a Dummy Input for ONNX Export: Creating a dummy input tensor to use for exporting the model to ONNX format.

# Step 13: Prepare a dummy input for ONNX export dummy_input = torch.randn(1, seq_length, 4).to(device)

-

Export the Model to ONNX Format: Exporting the trained model to the ONNX format. We will need this file to make predictions with MQL5.

# Step 14: Export the model to ONNX format torch.onnx.export(model, dummy_input, "patchtst_model.onnx", opset_version=13, input_names=['input'], output_names=['output'], dynamic_axes={'input': {0: 'batch_size'}, 'output': {0: 'batch_size'}}) print("Model trained and saved in PyTorch and ONNX formats.")

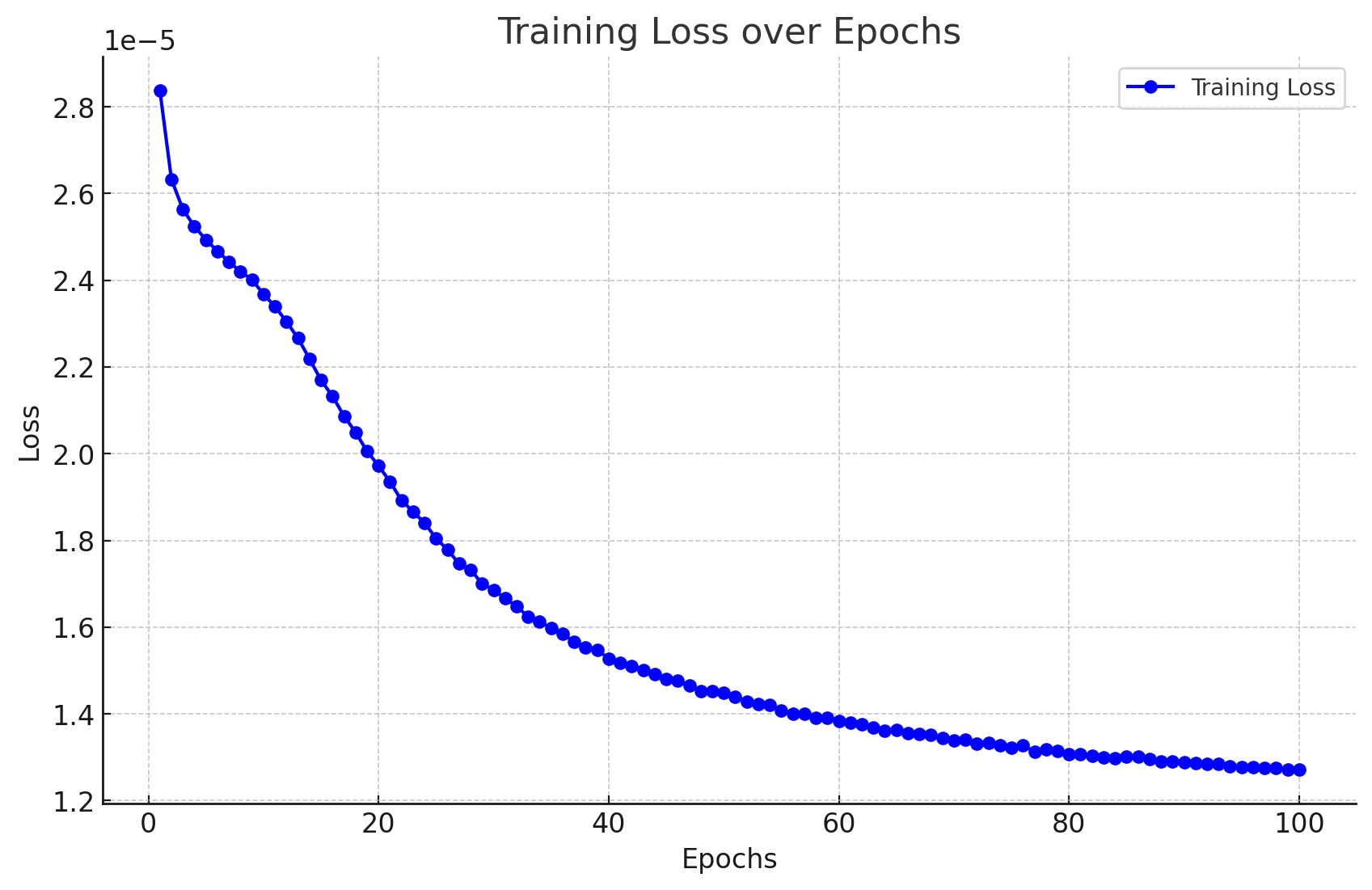

Model Training Results

Here are the results I obtained from training the model.

Epoch 1/100, Loss: 0.0000283705 Epoch 2/100, Loss: 0.0000263274 Epoch 3/100, Loss: 0.0000256321 Epoch 4/100, Loss: 0.0000252389 Epoch 5/100, Loss: 0.0000249340 Epoch 6/100, Loss: 0.0000246715 Epoch 7/100, Loss: 0.0000244293 Epoch 8/100, Loss: 0.0000241942 Epoch 9/100, Loss: 0.0000240157 Epoch 10/100, Loss: 0.0000236776 Epoch 11/100, Loss: 0.0000233954 Epoch 12/100, Loss: 0.0000230437 Epoch 13/100, Loss: 0.0000226635 Epoch 14/100, Loss: 0.0000221875 Epoch 15/100, Loss: 0.0000216960 Epoch 16/100, Loss: 0.0000213242 Epoch 17/100, Loss: 0.0000208693 Epoch 18/100, Loss: 0.0000204956 Epoch 19/100, Loss: 0.0000200573 Epoch 20/100, Loss: 0.0000197222 Epoch 21/100, Loss: 0.0000193516 Epoch 22/100, Loss: 0.0000189223 Epoch 23/100, Loss: 0.0000186635 Epoch 24/100, Loss: 0.0000184025 Epoch 25/100, Loss: 0.0000180468 Epoch 26/100, Loss: 0.0000177854 Epoch 27/100, Loss: 0.0000174621 Epoch 28/100, Loss: 0.0000173247 Epoch 29/100, Loss: 0.0000170032 Epoch 30/100, Loss: 0.0000168594 Epoch 31/100, Loss: 0.0000166609 Epoch 32/100, Loss: 0.0000164818 Epoch 33/100, Loss: 0.0000162424 Epoch 34/100, Loss: 0.0000161265 Epoch 35/100, Loss: 0.0000159775 Epoch 36/100, Loss: 0.0000158510 Epoch 37/100, Loss: 0.0000156571 Epoch 38/100, Loss: 0.0000155327 Epoch 39/100, Loss: 0.0000154742 Epoch 40/100, Loss: 0.0000152778 Epoch 41/100, Loss: 0.0000151757 Epoch 42/100, Loss: 0.0000151083 Epoch 43/100, Loss: 0.0000150182 Epoch 44/100, Loss: 0.0000149140 Epoch 45/100, Loss: 0.0000148057 Epoch 46/100, Loss: 0.0000147672 Epoch 47/100, Loss: 0.0000146499 Epoch 48/100, Loss: 0.0000145281 Epoch 49/100, Loss: 0.0000145298 Epoch 50/100, Loss: 0.0000144795 Epoch 51/100, Loss: 0.0000143969 Epoch 52/100, Loss: 0.0000142840 Epoch 53/100, Loss: 0.0000142294 Epoch 54/100, Loss: 0.0000142159 Epoch 55/100, Loss: 0.0000140837 Epoch 56/100, Loss: 0.0000140005 Epoch 57/100, Loss: 0.0000139986 Epoch 58/100, Loss: 0.0000139122 Epoch 59/100, Loss: 0.0000139010 Epoch 60/100, Loss: 0.0000138351 Epoch 61/100, Loss: 0.0000138050 Epoch 62/100, Loss: 0.0000137636 Epoch 63/100, Loss: 0.0000136853 Epoch 64/100, Loss: 0.0000136191 Epoch 65/100, Loss: 0.0000136272 Epoch 66/100, Loss: 0.0000135552 Epoch 67/100, Loss: 0.0000135439 Epoch 68/100, Loss: 0.0000135200 Epoch 69/100, Loss: 0.0000134461 Epoch 70/100, Loss: 0.0000133950 Epoch 71/100, Loss: 0.0000133979 Epoch 72/100, Loss: 0.0000133059 Epoch 73/100, Loss: 0.0000133242 Epoch 74/100, Loss: 0.0000132816 Epoch 75/100, Loss: 0.0000132145 Epoch 76/100, Loss: 0.0000132803 Epoch 77/100, Loss: 0.0000131212 Epoch 78/100, Loss: 0.0000131809 Epoch 79/100, Loss: 0.0000131538 Epoch 80/100, Loss: 0.0000130786 Epoch 81/100, Loss: 0.0000130651 Epoch 82/100, Loss: 0.0000130255 Epoch 83/100, Loss: 0.0000129917 Epoch 84/100, Loss: 0.0000129804 Epoch 85/100, Loss: 0.0000130086 Epoch 86/100, Loss: 0.0000130156 Epoch 87/100, Loss: 0.0000129557 Epoch 88/100, Loss: 0.0000129013 Epoch 89/100, Loss: 0.0000129018 Epoch 90/100, Loss: 0.0000128864 Epoch 91/100, Loss: 0.0000128663 Epoch 92/100, Loss: 0.0000128411 Epoch 93/100, Loss: 0.0000128514 Epoch 94/100, Loss: 0.0000127915 Epoch 95/100, Loss: 0.0000127778 Epoch 96/100, Loss: 0.0000127787 Epoch 97/100, Loss: 0.0000127623 Epoch 98/100, Loss: 0.0000127452 Epoch 99/100, Loss: 0.0000127141 Epoch 100/100, Loss: 0.0000127229

The results can be visualized as follows:

We also get the following output without any errors and warnings, indicating that our model has successfully been converted to ONNX format.

Model trained and saved in PyTorch and ONNX formats.

Generating Predictions using Python Step-By-Step

Now let us look at the prediction code:

- Step 1. Import Required Libraries: we start by importing all the necessary libraries.

# Import required libraries import MetaTrader5 as mt5 import pandas as pd import numpy as np import torch from datetime import datetime, timedelta import plotly.graph_objects as go from plotly.subplots import make_subplots from patchTST import Model as PatchTST

- Step 2. Fetch Data from Metatrader 5: we define a function to fetch data from MetaTrader 5 and convert it into a DataFrame. We fetch 168 prior bars because that is what is required to get a prediction with our model.

# Function to fetch data from MetaTrader 5 def fetch_mt5_data(symbol, timeframe, bars): if not mt5.initialize(): print("MT5 initialization failed") return None timeframe_dict = { 'M1': mt5.TIMEFRAME_M1, 'M5': mt5.TIMEFRAME_M5, 'M15': mt5.TIMEFRAME_M15, 'H1': mt5.TIMEFRAME_H1, 'D1': mt5.TIMEFRAME_D1 } rates = mt5.copy_rates_from_pos(symbol, timeframe_dict[timeframe], 0, bars) mt5.shutdown() df = pd.DataFrame(rates) df['time'] = pd.to_datetime(df['time'], unit='s') df.set_index('time', inplace=True) return df[['open', 'high', 'low', 'close']] # Fetch the latest week of data historical_data = fetch_mt5_data('EURUSD', 'H1', 168)

- Step 3. Prepare Input Data: we define a function to prepare the input data for the model by taking the last seq_length rows of data. When pulling data, we only require the last 168 hours of 1h data to make predictions for the next 24 hours. This is because that is how we trained the model.

# Function to prepare input data def prepare_input_data(data, seq_length): X = [] X.append(data.iloc[-seq_length:].values) return np.array(X) # Prepare the input data seq_length = 168 # 1 week of hourly data input_data = prepare_input_data(historical_data, seq_length)

- Step 4. Define Configuration: we define a configuration class to set up the parameters for the model. These settings are the same as the ones we use for training the model.

# Define the configuration class class Config: def __init__(self): self.enc_in = 4 # Adjusted for 4 columns (open, high, low, close) self.seq_len = seq_length self.pred_len = 24 # Predict next 24 hours self.e_layers = 3 self.n_heads = 4 self.d_model = 64 self.d_ff = 256 self.dropout = 0.1 self.fc_dropout = 0.1 self.head_dropout = 0.1 self.individual = False self.patch_len = 24 self.stride = 24 self.padding_patch = True self.revin = True self.affine = False self.subtract_last = False self.decomposition = True self.kernel_size = 25 # Initialize the configuration config = Config()

- Step 5. Load The Trained Model: we define a function to load the trained PatchTST model. These are the same settings as we used for training the model.

# Function to load the trained model def load_model(model_path, config): model = PatchTST( configs=config, max_seq_len=1024, d_k=None, d_v=None, norm='BatchNorm', attn_dropout=0.1, act="gelu", key_padding_mask='auto', padding_var=None, attn_mask=None, res_attention=True, pre_norm=False, store_attn=False, pe='zeros', learn_pe=True, pretrain_head=False, head_type='flatten', verbose=False ) model.load_state_dict(torch.load(model_path)) model.eval() return model # Load the trained model model_path = 'patchtst_model.pth' device = torch.device("cuda" if torch.cuda.is_available() else "cpu") model = load_model(model_path, config).to(device)

- Step 6. Make Predictions: we define a function to make predictions using the loaded model and input data.

# Function to make predictions def predict(model, input_data, device): with torch.no_grad(): input_data = torch.tensor(input_data, dtype=torch.float32).to(device) output = model(input_data) return output.cpu().numpy() # Make predictions predictions = predict(model, input_data, device)

- Step 7. Post-Processing and Visualization: we process the predictions, create a data frame, and visualize the historical and predicted data using Plotly.

# Ensure predictions have the correct shape if predictions.shape[2] != 4: predictions = predictions[:, :, :4] # Adjust based on actual number of columns required # Check the shape of predictions print("Shape of predictions:", predictions.shape) # Create a DataFrame for predictions pred_index = pd.date_range(start=historical_data.index[-1] + pd.Timedelta(hours=1), periods=24, freq='H') pred_df = pd.DataFrame(predictions[0], columns=['open', 'high', 'low', 'close'], index=pred_index) # Combine historical data and predictions combined_df = pd.concat([historical_data, pred_df]) # Create the plot fig = make_subplots(rows=1, cols=1, shared_xaxes=True, vertical_spacing=0.03, subplot_titles=('EURUSD OHLC')) # Add historical candlestick fig.add_trace(go.Candlestick(x=historical_data.index, open=historical_data['open'], high=historical_data['high'], low=historical_data['low'], close=historical_data['close'], name='Historical')) # Add predicted candlestick fig.add_trace(go.Candlestick(x=pred_df.index, open=pred_df['open'], high=pred_df['high'], low=pred_df['low'], close=pred_df['close'], name='Predicted')) # Add a vertical line to separate historical data from predictions fig.add_vline(x=historical_data.index[-1], line_dash="dash", line_color="gray") # Update layout fig.update_layout(title='EURUSD OHLC Chart with Predictions', yaxis_title='Price', xaxis_rangeslider_visible=False) # Show the plot fig.show() # Print predictions (optional) print("Predicted prices for the next 24 hours:", predictions)

Training and Prediction Code in Python

If you are not interested in running the code base in a Jupyter notebook, I have provided a couple of files you can run directly in the attachments:

- model_training.py

- model_prediction.py

You can configure the model as you desire and run it without using Jupyter.

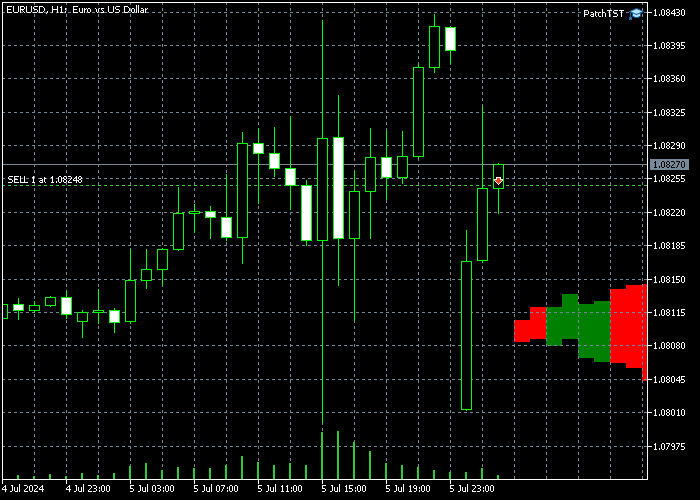

Prediction Results

After training the model and running the prediction code in Python, I got the following chart. The predictions were created right at around 12:30 AM (CEST + 3) time on 7/8/2024. This is right at the Sunday Night/Monday Morning Open. We can see a gap in the chart because EURUSD opened with a gap. The model predicts that EURUSD should experience an uptrend for most of the possibly filling this gap. After the gap has been filled, the price action should turn downwards near the end of the day.

We also printed out the raw value of the results, which can be seen below:

Predicted prices for the next 24 hours: [[[1.0789319 1.08056 1.0789403 1.0800443] [1.0791171 1.080738 1.0791024 1.0802013] [1.0792702 1.0807946 1.0792127 1.0802455] [1.0794896 1.0809869 1.07939 1.0804181] [1.0795166 1.0809793 1.0793561 1.0803629] [1.0796498 1.0810834 1.079427 1.0804263] [1.0798903 1.0813211 1.0795883 1.0805805] [1.0800778 1.081464 1.0796818 1.0806502] [1.0801392 1.0815498 1.0796598 1.0806476] [1.0802988 1.0817037 1.0797216 1.0807337] [1.080521 1.0819166 1.079835 1.08086 ] [1.0804708 1.0818571 1.079683 1.0807351] [1.0805807 1.0819991 1.079669 1.0807738] [1.0806456 1.0820425 1.0796478 1.0807805] [1.080733 1.0821087 1.0796758 1.0808226] [1.0807986 1.0822101 1.0796862 1.08086 ] [1.0808219 1.0821983 1.0796905 1.0808747] [1.0808604 1.082247 1.0797052 1.0808727] [1.0808146 1.082188 1.0796149 1.0807893] [1.0809066 1.0822624 1.0796828 1.0808471] [1.0809724 1.0822903 1.0797662 1.0808889] [1.0810378 1.0823163 1.0797914 1.0809084] [1.0810691 1.0823379 1.0798224 1.0809308] [1.0810966 1.0822875 1.0797993 1.0808865]]]

Bringing the Pretrained Model to MQL5

In this section, we will create a precursor to an indicator that will help us visualize the predicted price action on our charts. I have deliberately made the script rudimentary and open-ended because our readers may have different goals and different strategies for how to use these complex neural networks. The indicator is developed in the MQL5 Expert Advisor Format. Here is the full script:

//+------------------------------------------------------------------+ //| PatchTST Predictor | //| Copyright 2024 | //+------------------------------------------------------------------+ #property copyright "Copyright 2024" #property link "https://www.mql5.com" #property version "1.00" #resource "\\PatchTST\\patchtst_model.onnx" as uchar PatchTSTModel[] #define SEQ_LENGTH 168 #define PRED_LENGTH 24 #define INPUT_FEATURES 4 long ModelHandle = INVALID_HANDLE; datetime ExtNextBar = 0; //+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { // Load the ONNX model ModelHandle = OnnxCreateFromBuffer(PatchTSTModel, ONNX_DEFAULT); if (ModelHandle == INVALID_HANDLE) { Print("Error creating ONNX model: ", GetLastError()); return(INIT_FAILED); } // Set input shape const long input_shape[] = {1, SEQ_LENGTH, INPUT_FEATURES}; if (!OnnxSetInputShape(ModelHandle, ONNX_DEFAULT, input_shape)) { Print("Error setting input shape: ", GetLastError()); return(INIT_FAILED); } // Set output shape const long output_shape[] = {1, PRED_LENGTH, INPUT_FEATURES}; if (!OnnxSetOutputShape(ModelHandle, 0, output_shape)) { Print("Error setting output shape: ", GetLastError()); return(INIT_FAILED); } return(INIT_SUCCEEDED); } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { if (ModelHandle != INVALID_HANDLE) { OnnxRelease(ModelHandle); ModelHandle = INVALID_HANDLE; } } //+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { if (TimeCurrent() < ExtNextBar) return; ExtNextBar = TimeCurrent(); ExtNextBar -= ExtNextBar % PeriodSeconds(); ExtNextBar += PeriodSeconds(); // Prepare input data float input_data[]; if (!PrepareInputData(input_data)) { Print("Error preparing input data"); return; } // Make prediction float predictions[]; if (!MakePrediction(input_data, predictions)) { Print("Error making prediction"); return; } // Draw hypothetical future bars DrawFutureBars(predictions); } //+------------------------------------------------------------------+ //| Prepare input data for the model | //+------------------------------------------------------------------+ bool PrepareInputData(float &input_data[]) { MqlRates rates[]; ArraySetAsSeries(rates, true); int copied = CopyRates(_Symbol, PERIOD_H1, 0, SEQ_LENGTH, rates); if (copied != SEQ_LENGTH) { Print("Failed to copy rates data. Copied: ", copied); return false; } ArrayResize(input_data, SEQ_LENGTH * INPUT_FEATURES); for (int i = 0; i < SEQ_LENGTH; i++) { input_data[i * INPUT_FEATURES + 0] = (float)rates[SEQ_LENGTH - 1 - i].open; input_data[i * INPUT_FEATURES + 1] = (float)rates[SEQ_LENGTH - 1 - i].high; input_data[i * INPUT_FEATURES + 2] = (float)rates[SEQ_LENGTH - 1 - i].low; input_data[i * INPUT_FEATURES + 3] = (float)rates[SEQ_LENGTH - 1 - i].close; } return true; } //+------------------------------------------------------------------+ //| Make prediction using the ONNX model | //+------------------------------------------------------------------+ bool MakePrediction(const float &input_data[], float &output_data[]) { ArrayResize(output_data, PRED_LENGTH * INPUT_FEATURES); if (!OnnxRun(ModelHandle, ONNX_NO_CONVERSION, input_data, output_data)) { Print("Error running ONNX model: ", GetLastError()); return false; } return true; } //+------------------------------------------------------------------+ //| Draw hypothetical future bars | //+------------------------------------------------------------------+ void DrawFutureBars(const float &predictions[]) { datetime current_time = TimeCurrent(); for (int i = 0; i < PRED_LENGTH; i++) { datetime bar_time = current_time + PeriodSeconds(PERIOD_H1) * (i + 1); double open = predictions[i * INPUT_FEATURES + 0]; double high = predictions[i * INPUT_FEATURES + 1]; double low = predictions[i * INPUT_FEATURES + 2]; double close = predictions[i * INPUT_FEATURES + 3]; string obj_name = "FutureBar_" + IntegerToString(i); ObjectCreate(0, obj_name, OBJ_RECTANGLE, 0, bar_time, low, bar_time + PeriodSeconds(PERIOD_H1), high); ObjectSetInteger(0, obj_name, OBJPROP_COLOR, close > open ? clrGreen : clrRed); ObjectSetInteger(0, obj_name, OBJPROP_FILL, true); ObjectSetInteger(0, obj_name, OBJPROP_BACK, true); } ChartRedraw(); }

To run the script above, please take note of how the following line is defined:

#resource "\\PatchTST\\patchtst_model.onnx" as uchar PatchTSTModel[]

This means that inside the Expert Advisor Folder, we will need to create a sub-folder titled PatchTST. Inside the PatchTST sub-folder, we will need to save the ONNX file from model training. However, the main EA will be stored in the root folder itself.

The parameters we used to train our model are also defined at the top of the script:

#define SEQ_LENGTH 168 #define PRED_LENGTH 24 #define INPUT_FEATURES 4

In our case, we want to use 168 previous bars, feed them into the ONNX model, and get a prediction for the next 24 bars in the future. We have 4 input features: open, high, low, and close.

Also, please note the following code inside the OnTick() function:

if (TimeCurrent() < ExtNextBar) return; ExtNextBar = TimeCurrent(); ExtNextBar -= ExtNextBar % PeriodSeconds(); ExtNextBar += PeriodSeconds();

Since ONNX models are intensive on the processing power of a computer, this code will ensure that a new prediction will only be generated once per bar. In our case, since we are working with hourly bars, predictions will be updated once an hour.

Finally, in this code, we will be drawing the futures bars on the screen, through the use of the MQL5 drawing features:

void DrawFutureBars(const float &predictions[]) { datetime current_time = TimeCurrent(); for (int i = 0; i < PRED_LENGTH; i++) { datetime bar_time = current_time + PeriodSeconds(PERIOD_H1) * (i + 1); double open = predictions[i * INPUT_FEATURES + 0]; double high = predictions[i * INPUT_FEATURES + 1]; double low = predictions[i * INPUT_FEATURES + 2]; double close = predictions[i * INPUT_FEATURES + 3]; string obj_name = "FutureBar_" + IntegerToString(i); ObjectCreate(0, obj_name, OBJ_RECTANGLE, 0, bar_time, low, bar_time + PeriodSeconds(PERIOD_H1), high); ObjectSetInteger(0, obj_name, OBJPROP_COLOR, close > open ? clrGreen : clrRed); ObjectSetInteger(0, obj_name, OBJPROP_FILL, true); ObjectSetInteger(0, obj_name, OBJPROP_BACK, true); } ChartRedraw(); }

After implementing this code in MQL5, compiling the model, and placing the resulting EA on the H1 timeframe, you should see some extra bars added in the future on your chart. In my case, this looks as follows:

Please note that if you do not see the newly drawn bars to the right, you may need to click the "Shift end of chart from right border" button. ![]()

Conclusion

In this article, we took a step-by-step approach to training the PatchTST model, which was introduced in 2023. We got a general sense of how the PatchTST algorithm works. The base code had some issues, related to ONNX conversion. Specifically, the "Unfold" operator is not supported, so we resolved this issue to make the code more ONNX-friendly. We also kept the purpose of the article trader-friendly by focusing on the basics of the model, pulling the data, training the model, and getting a prediction for the next 24 hours. Then we implemented the prediction in MQL5, so we can use the fully trained model with our favorite indicators and expert advisors. I am delighted to share all my code with the MQL community in the attached zip file. Please let me know if you have any questions or comments.Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

MQL5 Wizard Techniques you should know (Part 27): Moving Averages and the Angle of Attack

MQL5 Wizard Techniques you should know (Part 27): Moving Averages and the Angle of Attack

Eigenvectors and eigenvalues: Exploratory data analysis in MetaTrader 5

Eigenvectors and eigenvalues: Exploratory data analysis in MetaTrader 5

Using JSON Data API in your MQL projects

Using JSON Data API in your MQL projects

How to Integrate Smart Money Concepts (BOS) Coupled with the RSI Indicator into an EA

How to Integrate Smart Money Concepts (BOS) Coupled with the RSI Indicator into an EA

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I often find that the predicted results of this model are not quite consistent with the actual situation. I haven't made any changes to the code of this model. Could you please give me some guidance? Thank you.

Thank you for sharing your experience with the model. You raise a valid point about prediction consistency. The PatchTST model works best when integrated into a comprehensive trading approach that considers multiple market factors. Here's how I recommend using the model's predictions more effectively:

Some Additional Personal Observations:

The model's predictions should be used as one component of your analysis rather than the sole decision-maker. By incorporating these elements, you can potentially improve the consistency of your trading results when using the PatchTST model.

I hope this helps.

Fair Value Gap (FVG) Script that I mentioned (these gaps work very much like supply and demand zones, in my experience):

Thank you for your interest! Yes, those changes to the parameters would work in principle, but there are a few important considerations when switching to M1 data:

1. Data Volume: Training with 10080 minutes (1 week) of M1 data means handling significantly more data points than with H1. This will:

2. Model Architecture Adjustments: In Step 8 of model training and Step 4 of prediction code, you might want to adjust other parameters to accommodate the larger input sequence:

3. Prediction Quality: While you'll get more granular predictions, be aware that M1 data typically contains more noise. You might want to experiment with different sequence lengths and prediction windows to find the optimal balance.Thanks for the insight. My computer is reasonably capable, with 256GB and 64 physical cores. It could do with a better GPU though.

Once I've updated the GPU, I will try the updated config settings.

Thank you for sharing your experience with the model. You raise a valid point about prediction consistency. The PatchTST model works best when integrated into a comprehensive trading approach that considers multiple market factors. Here's how I recommend using the model's predictions more effectively:

Some Additional Personal Observations:

The model's predictions should be used as one component of your analysis rather than the sole decision-maker. By incorporating these elements, you can potentially improve the consistency of your trading results when using the PatchTST model.

I hope this helps.

Fair Value Gap (FVG) Script that I mentioned (these gaps work very much like supply and demand zones, in my experience):

Thank you very much for your patient answer and selfless sharing. I have never seen such detailed and professional answers before. I will read your article repeatedly. These knowledge are particularly valuable to me. Best wishes to you.

Thank you. Your kind words mean a lot!! Please reach out if you need any more assistance!