Developing a trading Expert Advisor from scratch (Part 7): Adding Volume at Price (I)

This is one of the most powerful indicators currently existing. Anyone who trades trying to have a certain degree of confidence must have this indicator on their chart. Most often the indicator is used by those who prefer “tape reading” while trading. Also, this indicator can be utilized by those who use only Price Action while trading.

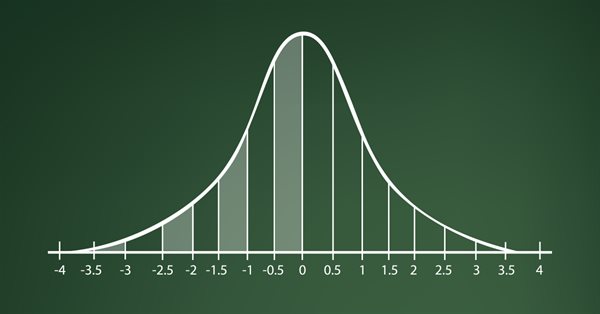

Statistical Carry Trade Strategy

An algorithm of statistical protection of open positive swap positions from unwanted price movements. This article features a variant of the carry trade protection strategy that allows to compensate for potential risk of the price movement in the direction opposite to that of the open position.

Synthetic Bars - A New Dimension to Displaying Graphical Information on Prices

The main drawback of traditional methods for displaying price information using bars and Japanese candlesticks is that they are bound to the time period. It was perhaps optimal at the time when these methods were created but today when the market movements are sometimes too rapid, prices displayed in a chart in this way do not contribute to a prompt response to the new movement. The proposed price chart display method does not have this drawback and provides a quite familiar layout.

Neural Networks in Trading: A Multi-Agent Self-Adaptive Model (MASA)

I invite you to get acquainted with the Multi-Agent Self-Adaptive (MASA) framework, which combines reinforcement learning and adaptive strategies, providing a harmonious balance between profitability and risk management in turbulent market conditions.

The Last Crusade

Take a look at your trading terminal. What means of price presentation can you see? Bars, candlesticks, lines. We are chasing time and prices whereas we only profit from prices. Shall we only give attention to prices when analyzing the market? This article proposes an algorithm and a script for point and figure charting ("naughts and crosses") Consideration is given to various price patterns whose practical use is outlined in recommendations provided.

Developing a cross-platform grider EA (part III): Correction-based grid with martingale

In this article, we will make an attempt to develop the best possible grid-based EA. As usual, this will be a cross-platform EA capable of working both with MetaTrader 4 and MetaTrader 5. The first EA was good enough, except that it could not make a profit over a long period of time. The second EA could work at intervals of more than several years. Unfortunately, it was unable to yield more than 50% of profit per year with a maximum drawdown of less than 50%.

The Magic of Filtration

Most of the automated trading systems developers use some form of trading signals filtration. In this article, we explore the creation and implementation of bandpass and discrete filters for Expert Advisors, to improve the characteristics of the automated trading system.

Modified Grid-Hedge EA in MQL5 (Part II): Making a Simple Grid EA

In this article, we explored the classic grid strategy, detailing its automation using an Expert Advisor in MQL5 and analyzing initial backtest results. We highlighted the strategy's need for high holding capacity and outlined plans for optimizing key parameters like distance, takeProfit, and lot sizes in future installments. The series aims to enhance trading strategy efficiency and adaptability to different market conditions.

Neural networks made easy (Part 12): Dropout

As the next step in studying neural networks, I suggest considering the methods of increasing convergence during neural network training. There are several such methods. In this article we will consider one of them entitled Dropout.

Visualizing trading strategy optimization in MetaTrader 5

The article implements an MQL application with a graphical interface for extended visualization of the optimization process. The graphical interface applies the last version of EasyAndFast library. Many users may ask why they need graphical interfaces in MQL applications. This article demonstrates one of multiple cases where they can be useful for traders.

Learn how to design a trading system by VIDYA

Welcome to a new article from our series about learning how to design a trading system by the most popular technical indicators, in this article we will learn about a new technical tool and learn how to design a trading system by Variable Index Dynamic Average (VIDYA).

Automating Trading Strategies in MQL5 (Part 8): Building an Expert Advisor with Butterfly Harmonic Patterns

In this article, we build an MQL5 Expert Advisor to detect Butterfly harmonic patterns. We identify pivot points and validate Fibonacci levels to confirm the pattern. We then visualize the pattern on the chart and automatically execute trades when confirmed.

Library for easy and quick development of MetaTrader programs (part XII): Account object class and collection of account objects

In the previous article, we defined position closure events for MQL4 in the library and got rid of the unused order properties. Here we will consider the creation of the Account object, develop the collection of account objects and prepare the functionality for tracking account events.

Automating Trading Strategies in MQL5 (Part 7): Building a Grid Trading EA with Dynamic Lot Scaling

In this article, we build a grid trading expert advisor in MQL5 that uses dynamic lot scaling. We cover the strategy design, code implementation, and backtesting process. Finally, we share key insights and best practices for optimizing the automated trading system.

Creating an Interactive Graphical User Interface in MQL5 (Part 1): Making the Panel

This article explores the fundamental steps in crafting and implementing a Graphical User Interface (GUI) panel using MetaQuotes Language 5 (MQL5). Custom utility panels enhance user interaction in trading by simplifying common tasks and visualizing essential trading information. By creating custom panels, traders can streamline their workflow and save time during trading operations.

Extending Strategy Builder Functionality

In the previous two articles, we discussed the application of Merrill patterns to various data types. An application was developed to test the presented ideas. In this article, we will continue working with the Strategy Builder, to improve its efficiency and to implement new features and capabilities.

Testing patterns that arise when trading currency pair baskets. Part II

We continue testing the patterns and trying the methods described in the articles about trading currency pair baskets. Let's consider in practice, whether it is possible to use the patterns of the combined WPR graph crossing the moving average. If the answer is yes, we should consider the appropriate usage methods.

Building a Social Technology Startup, Part II: Programming an MQL5 REST Client

Let's now shape the PHP-based Twitter idea which was introduced in the first part of this article. We are assembling the different parts of the SDSS. Regarding the client side of the system architecture, we are relying on the new MQL5 WebRequest() function for sending trading signals via HTTP.

Learn how to design a trading system by Relative Vigor Index

A new article in our series about how to design a trading system by the most popular technical indicator. In this article, we will learn how to do that by the Relative Vigor Index indicator.

Improve Your Trading Charts With Interactive GUI's in MQL5 (Part III): Simple Movable Trading GUI

Join us in Part III of the "Improve Your Trading Charts With Interactive GUIs in MQL5" series as we explore the integration of interactive GUIs into movable trading dashboards in MQL5. This article builds on the foundations set in Parts I and II, guiding readers to transform static trading dashboards into dynamic, movable ones.

Decoding Opening Range Breakout Intraday Trading Strategies

Opening Range Breakout (ORB) strategies are built on the idea that the initial trading range established shortly after the market opens reflects significant price levels where buyers and sellers agree on value. By identifying breakouts above or below a certain range, traders can capitalize on the momentum that often follows as the market direction becomes clearer. In this article, we will explore three ORB strategies adapted from the Concretum Group.

Gradient Boosting (CatBoost) in the development of trading systems. A naive approach

Training the CatBoost classifier in Python and exporting the model to mql5, as well as parsing the model parameters and a custom strategy tester. The Python language and the MetaTrader 5 library are used for preparing the data and for training the model.

Learn how to design a trading system by Parabolic SAR

In this article, we will continue our series about how to design a trading system using the most popular indicators. In this article, we will learn about the Parabolic SAR indicator in detail and how we can design a trading system to be used in MetaTrader 5 using some simple strategies.

Automating Trading Strategies in MQL5 (Part 5): Developing the Adaptive Crossover RSI Trading Suite Strategy

In this article, we develop the Adaptive Crossover RSI Trading Suite System, which uses 14- and 50-period moving average crossovers for signals, confirmed by a 14-period RSI filter. The system includes a trading day filter, signal arrows with annotations, and a real-time dashboard for monitoring. This approach ensures precision and adaptability in automated trading.

Dr. Tradelove or How I Stopped Worrying and Created a Self-Training Expert Advisor

Just over a year ago joo, in his article "Genetic Algorithms - It's Easy!", gave us a tool for implementation of the genetic algorithm in MQL5. Now utilizing the tool we will create an Expert Advisor that will genetically optimize its own parameters upon certain boundary conditions...

How to create a simple Multi-Currency Expert Advisor using MQL5 (Part 1): Indicator Signals based on ADX in combination with Parabolic SAR

The Multi-Currency Expert Advisor in this article is Expert Advisor or trading robot that can trade (open orders, close orders and manage orders an more) for more than 1 symbol pair only from one symbol chart.

Implementing a Bollinger Bands Trading Strategy with MQL5: A Step-by-Step Guide

A step-by-step guide to implementing an automated trading algorithm in MQL5 based on the Bollinger Bands trading strategy. A detailed tutorial based on creating an Expert Advisor that can be useful for traders.

A Pause between Trades

The article deals with the problem of how to arrange pauses between trade operations when a number of experts work on one МТ 4 Client Terminal. It is intended for users who have basic skills in both working with the terminal and programming in MQL 4.

Library for easy and quick development of MetaTrader programs (part X): Compatibility with MQL4 - Events of opening a position and activating pending orders

In the previous articles, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. In the ninth part, we started improving the library classes for working with MQL4. Here we will continue improving the library to ensure its full compatibility with MQL4.

Developing multi-module Expert Advisors

MQL programming language allows implementing the concept of modular development of trading strategies. The article shows an example of developing a multi-module Expert Advisor consisting of separately compiled file modules.

The market and the physics of its global patterns

In this article, I will try to test the assumption that any system with even a small understanding of the market can operate on a global scale. I will not invent any theories or patterns, but I will only use known facts, gradually translating these facts into the language of mathematical analysis.

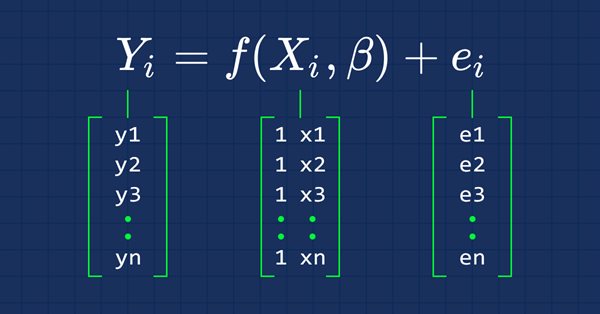

Data Science and Machine Learning (Part 03): Matrix Regressions

This time our models are being made by matrices, which allows flexibility while it allows us to make powerful models that can handle not only five independent variables but also many variables as long as we stay within the calculations limits of a computer, this article is going to be an interesting read, that's for sure.

The Prototype of a Trading Robot

This article summarizes and systematizes the principles of creating algorithms and elements of trading systems. The article considers designing of expert algorithm. As an example the CExpertAdvisor class is considered, which can be used for quick and easy development of trading systems.

Freelance Jobs on MQL5.com - Developer's Favorite Place

Developers of trading robots no longer need to market their services to traders that require Expert Advisors - as now they will find you. Already, thousands of traders place orders to MQL5 freelance developers, and pay for work in on MQL5.com. For 4 years, this service facilitated three thousand traders to pay for more than 10 000 jobs performed. And the activity of traders and developers is constantly growing!

Developing a Trading Strategy: The Butterfly Oscillator Method

In this article, we demonstrated how the fascinating mathematical concept of the Butterfly Curve can be transformed into a practical trading tool. We constructed the Butterfly Oscillator and built a foundational trading strategy around it. The strategy effectively combines the oscillator's unique cyclical signals with traditional trend confirmation from moving averages, creating a systematic approach for identifying potential market entries.

Automating Trading Strategies in MQL5 (Part 25): Trendline Trader with Least Squares Fit and Dynamic Signal Generation

In this article, we develop a trendline trader program that uses least squares fit to detect support and resistance trendlines, generating dynamic buy and sell signals based on price touches and open positions based on generated signals.

Separate optimization of a strategy on trend and flat conditions

The article considers applying the separate optimization method during various market conditions. Separate optimization means defining trading system's optimal parameters by optimizing for an uptrend and downtrend separately. To reduce the effect of false signals and improve profitability, the systems are made flexible, meaning they have some specific set of settings or input data, which is justified because the market behavior is constantly changing.

Library for easy and quick development of MetaTrader programs (part VIII): Order and position modification events

In the previous articles, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. In the seventh part, we added tracking StopLimit orders activation and prepared the functionality for tracking other events involving orders and positions. In this article, we will develop the class for tracking order and position modification events.

Neural networks made easy (Part 3): Convolutional networks

As a continuation of the neural network topic, I propose considering convolutional neural networks. This type of neural network are usually applied to analyzing visual imagery. In this article, we will consider the application of these networks in the financial markets.

Learn how to design a trading system by Standard Deviation

Here is a new article in our series about how to design a trading system by the most popular technical indicators in MetaTrader 5 trading platform. In this new article, we will learn how to design a trading system by Standard Deviation indicator.