Library for easy and quick development of MetaTrader programs (part II). Collection of historical orders and deals

In the first part, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. We created the COrder abstract object which is a base object for storing data on history orders and deals, as well as on market orders and positions. Now we will develop all the necessary objects for storing account history data in collections.

Design Patterns in software development and MQL5 (Part 4): Behavioral Patterns 2

In this article, we will complete our series about the Design Patterns topic, we mentioned that there are three types of design patterns creational, structural, and behavioral. We will complete the remaining patterns of the behavioral type which can help set the method of interaction between objects in a way that makes our code clean.

MQL5 Integration: Python

Python is a well-known and popular programming language with many features, especially in the fields of finance, data science, Artificial Intelligence, and Machine Learning. Python is a powerful tool that can be useful in trading as well. MQL5 allows us to use this powerful language as an integration to get our objectives done effectively. In this article, we will share how we can use Python as an integration in MQL5 after learning some basic information about Python.

Combination scalping: analyzing trades from the past to increase the performance of future trades

The article provides the description of the technology aimed at increasing the effectiveness of any automated trading system. It provides a brief explanation of the idea, as well as its underlying basics, possibilities and disadvantages.

Universal Expert Advisor: the Event Model and Trading Strategy Prototype (Part 2)

This article continues the series of publications on a universal Expert Advisor model. This part describes in detail the original event model based on centralized data processing, and considers the structure of the CStrategy base class of the engine.

Timeseries in DoEasy library (part 35): Bar object and symbol timeseries list

This article starts a new series about the creation of the DoEasy library for easy and fast program development. In the current article, we will implement the library functionality for accessing and working with symbol timeseries data. We are going to create the Bar object storing the main and extended timeseries bar data, and place bar objects to the timeseries list for convenient search and sorting of the objects.

Prices and Signals in DoEasy library (Part 65): Depth of Market collection and the class for working with MQL5.com Signals

In this article, I will create the collection class of Depths of Market of all symbols and start developing the functionality for working with the MQL5.com Signals service by creating the signal object class.

Simulink: a Guide for the Developers of Expert Advisors

I am not a professional programmer. And thus, the principle of "going from the simple to the complex" is of primary importance to me when I am working on trading system development. What exactly is simple for me? First of all, it is the visualization of the process of creating the system, and the logic of its work. Also, it is a minimum of handwritten code. In this article, I will attempt to create and test the trading system, based on a Matlab package, and then write an Expert Advisor for MetaTrader 5. The historical data from MetaTrader 5 will be used for the testing process.

Another MQL5 OOP Class

This article shows you how to build an Object-Oriented Expert Advisor from scratch, from conceiving a theoretical trading idea to programming a MQL5 EA that makes that idea real in the empirical world. Learning by doing is IMHO a solid approach to succeed, so I am showing a practical example in order for you to see how you can order your ideas to finally code your Forex robots. My goal is also to invite you to adhere the OO principles.

Liquid Chart

Would you like to see an hourly chart with bars opening from the second and the fifth minute of the hour? What does a redrawn chart look like when the opening time of bars is changing every minute? What advantages does trading on such charts have? You will find answers to these questions in this article.

Can Heiken-Ashi Combined With Moving Averages Provide Good Signals Together?

Combinations of strategies may offer better opportunities. We can combine indicators or patterns together, or even better, indicators with patterns, so that we get an extra confirmation factor. Moving averages help us confirm and ride the trend. They are the most known technical indicators and this is because of their simplicity and their proven track record of adding value to analyses.

Applying OLAP in trading (part 3): Analyzing quotes for the development of trading strategies

In this article we will continue dealing with the OLAP technology applied to trading. We will expand the functionality presented in the first two articles. This time we will consider the operational analysis of quotes. We will put forward and test the hypotheses on trading strategies based on aggregated historical data. The article presents Expert Advisors for studying bar patterns and adaptive trading.

Automating Trading Strategies in MQL5 (Part 9): Building an Expert Advisor for the Asian Breakout Strategy

In this article, we build an Expert Advisor in MQL5 for the Asian Breakout Strategy by calculating the session's high and low and applying trend filtering with a moving average. We implement dynamic object styling, user-defined time inputs, and robust risk management. Finally, we demonstrate backtesting and optimization techniques to refine the program.

Finding seasonal patterns in the forex market using the CatBoost algorithm

The article considers the creation of machine learning models with time filters and discusses the effectiveness of this approach. The human factor can be eliminated now by simply instructing the model to trade at a certain hour of a certain day of the week. Pattern search can be provided by a separate algorithm.

Using MetaTrader 5 as a Signal Provider for MetaTrader 4

Analyse and examples of techniques how trading analysis can be performed on MetaTrader 5 platform, but executed by MetaTrader 4. Article will show you how to create simple signal provider in your MetaTrader 5, and connect to it with multiple clients, even running MetaTrader 4. Also you will find out how you can follow participants of Automated Trading Championship in your real MetaTrader 4 account.

Analyzing charts using DeMark Sequential and Murray-Gann levels

Thomas DeMark Sequential is good at showing balance changes in the price movement. This is especially evident if we combine its signals with a level indicator, for example, Murray levels. The article is intended mostly for beginners and those who still cannot find their "Grail". I will also display some features of building levels that I have not seen on other forums. So, the article will probably be useful for advanced traders as well... Suggestions and reasonable criticism are welcome...

Neural networks made easy (Part 10): Multi-Head Attention

We have previously considered the mechanism of self-attention in neural networks. In practice, modern neural network architectures use several parallel self-attention threads to find various dependencies between the elements of a sequence. Let us consider the implementation of such an approach and evaluate its impact on the overall network performance.

Learn how to design a trading system by MFI

The new article from our series about designing a trading system based on the most popular technical indicators considers a new technical indicator - the Money Flow Index (MFI). We will learn it in detail and develop a simple trading system by means of MQL5 to execute it in MetaTrader 5.

Risk and capital management using Expert Advisors

This article is about what you can not see in a backtest report, what you should expect using automated trading software, how to manage your money if you are using expert advisors, and how to cover a significant loss to remain in the trading activity when you are using automated procedures.

Trade Events in MetaTrader 5

A monitoring of the current state of a trade account implies controlling open positions and orders. Before a trade signal becomes a deal, it should be sent from the client terminal as a request to the trade server, where it will be placed in the order queue awaiting to be processed. Accepting of a request by the trade server, deleting it as it expires or conducting a deal on its basis - all those actions are followed by trade events; and the trade server informs the terminal about them.

Creating an EA that works automatically (Part 02): Getting started with the code

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode. In the previous article, we discussed the first steps that anyone needs to understand before proceeding to creating an Expert Advisor that trades automatically. We considered the concepts and the structure.

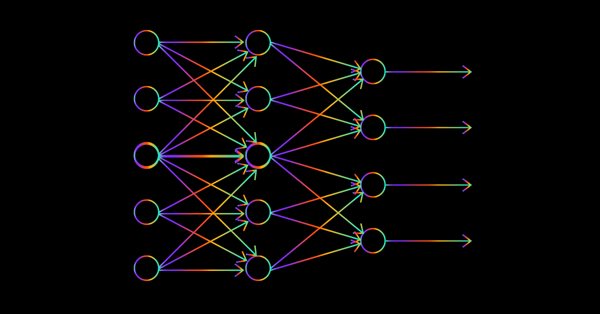

Data Science and Machine Learning — Neural Network (Part 01): Feed Forward Neural Network demystified

Many people love them but a few understand the whole operations behind Neural Networks. In this article I will try to explain everything that goes behind closed doors of a feed-forward multi-layer perception in plain English.

Testing patterns that arise when trading currency pair baskets. Part I

We begin testing the patterns and trying the methods described in the articles about trading currency pair baskets. Let's see how oversold/overbought level breakthrough patterns are applied in practice.

Creating a comprehensive Owl trading strategy

My strategy is based on the classic trading fundamentals and the refinement of indicators that are widely used in all types of markets. This is a ready-made tool allowing you to follow the proposed new profitable trading strategy.

Creating an MQL5-Telegram Integrated Expert Advisor (Part 1): Sending Messages from MQL5 to Telegram

In this article, we create an Expert Advisor (EA) in MQL5 to send messages to Telegram using a bot. We set up the necessary parameters, including the bot's API token and chat ID, and then perform an HTTP POST request to deliver the messages. Later, we handle the response to ensure successful delivery and troubleshoot any issues that arise in case of failure. This ensures we send messages from MQL5 to Telegram via the created bot.

Scalping Orderflow for MQL5

This MetaTrader 5 Expert Advisor implements a Scalping OrderFlow strategy with advanced risk management. It uses multiple technical indicators to identify trading opportunities based on order flow imbalances. Backtesting shows potential profitability but highlights the need for further optimization, especially in risk management and trade outcome ratios. Suitable for experienced traders, it requires thorough testing and understanding before live deployment.

Universal Expert Advisor: Trading in a Group and Managing a Portfolio of Strategies (Part 4)

In the last part of the series of articles about the CStrategy trading engine, we will consider simultaneous operation of multiple trading algorithms, will learn to load strategies from XML files, and will present a simple panel for selecting Expert Advisors from a single executable module, and managing their trading modes.

CatBoost machine learning algorithm from Yandex with no Python or R knowledge required

The article provides the code and the description of the main stages of the machine learning process using a specific example. To obtain the model, you do not need Python or R knowledge. Furthermore, basic MQL5 knowledge is enough — this is exactly my level. Therefore, I hope that the article will serve as a good tutorial for a broad audience, assisting those interested in evaluating machine learning capabilities and in implementing them in their programs.

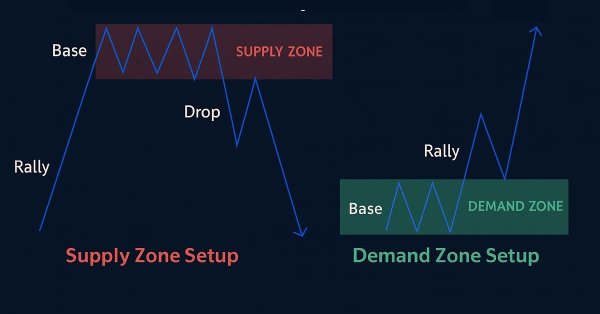

Automating Trading Strategies in MQL5 (Part 36): Supply and Demand Trading with Retest and Impulse Model

In this article, we create a supply and demand trading system in MQL5 that identifies supply and demand zones through consolidation ranges, validates them with impulsive moves, and trades retests with trend confirmation and customizable risk parameters. The system visualizes zones with dynamic labels and colors, supporting trailing stops for risk management.

Creating an MQL5 Expert Advisor Based on the Daily Range Breakout Strategy

In this article, we create an MQL5 Expert Advisor based on the Daily Range Breakout strategy. We cover the strategy’s key concepts, design the EA blueprint, and implement the breakout logic in MQL5. In the end, we explore techniques for backtesting and optimizing the EA to maximize its effectiveness.

How to create a custom indicator (Heiken Ashi) using MQL5

In this article, we will learn how to create a custom indicator using MQL5 based on our preferences, to be used in MetaTrader 5 to help us read charts or to be used in automated Expert Advisors.

Data Science and Machine Learning — Neural Network (Part 02): Feed forward NN Architectures Design

There are minor things to cover on the feed-forward neural network before we are through, the design being one of them. Let's see how we can build and design a flexible neural network to our inputs, the number of hidden layers, and the nodes for each of the network.

Neural networks made easy (Part 11): A take on GPT

Perhaps one of the most advanced models among currently existing language neural networks is GPT-3, the maximal variant of which contains 175 billion parameters. Of course, we are not going to create such a monster on our home PCs. However, we can view which architectural solutions can be used in our work and how we can benefit from them.

Learn how to design a trading system by Awesome Oscillator

In this new article in our series, we will learn about a new technical tool that may be useful in our trading. It is the Awesome Oscillator (AO) indicator. We will learn how to design a trading system by this indicator.

Using the TesterWithdrawal() Function for Modeling the Withdrawals of Profit

This article describes the usage of the TesterWithDrawal() function for estimating risks in trade systems which imply the withdrawing of a certain part of assets during their operation. In addition, it describes the effect of this function on the algorithm of calculation of the drawdown of equity in the strategy tester. This function is useful when optimizing parameter of your Expert Advisors.

Universal Regression Model for Market Price Prediction

The market price is formed out of a stable balance between demand and supply which, in turn, depend on a variety of economic, political and psychological factors. Differences in nature as well as causes of influence of these factors make it difficult to directly consider all the components. This article sets forth an attempt to predict the market price on the basis of an elaborated regression model.

Library for easy and quick development of MetaTrader programs (part XVI): Symbol collection events

In this article, we will create a new base class of all library objects adding the event functionality to all its descendants and develop the class for tracking symbol collection events based on the new base class. We will also change account and account event classes for developing the new base object functionality.

Python-MetaTrader 5 Strategy Tester (Part 01): Trade Simulator

The MetaTrader 5 module offered in Python provides a convenient way of opening trades in the MetaTrader 5 app using Python, but it has a huge problem, it doesn't have the strategy tester capability present in the MetaTrader 5 app, In this article series, we will build a framework for back testing your trading strategies in Python environments.

Using JSON Data API in your MQL projects

Imagine that you can use data that is not found in MetaTrader, you only get data from indicators by price analysis and technical analysis. Now imagine that you can access data that will take your trading power steps higher. You can multiply the power of the MetaTrader software if you mix the output of other software, macro analysis methods, and ultra-advanced tools through the API data. In this article, we will teach you how to use APIs and introduce useful and valuable API data services.

How to build and optimize a cycle-based trading system (Detrended Price Oscillator - DPO)

This article explains how to design and optimise a trading system using the Detrended Price Oscillator (DPO) in MQL5. It outlines the indicator's core logic, demonstrating how it identifies short-term cycles by filtering out long-term trends. Through a series of step-by-step examples and simple strategies, readers will learn how to code it, define entry and exit signals, and conduct backtesting. Finally, the article presents practical optimization methods to enhance performance and adapt the system to changing market conditions.