Markets Positioning Codex in MQL5 (Part 1): Bitwise Learning for Nvidia

We commence a new article series that builds upon our earlier efforts laid out in the MQL5 Wizard series, by taking them further as we step up our approach to systematic trading and strategy testing. Within these new series, we’ll concentrate our focus on Expert Advisors that are coded to hold only a single type of position - primarily longs. Focusing on just one market trend can simplify analysis, lessen strategy complexity and expose some key insights, especially when dealing in assets beyond forex. Our series, therefore, will investigate if this is effective in equities and other non-forex assets, where long only systems usually correlate well with smart money or institution strategies.

Statistical Arbitrage Through Cointegrated Stocks (Part 8): Rolling Windows Eigenvector Comparison for Portfolio Rebalancing

This article proposes using Rolling Windows Eigenvector Comparison for early imbalance diagnostics and portfolio rebalancing in a mean-reversion statistical arbitrage strategy based on cointegrated stocks. It contrasts this technique with traditional In-Sample/Out-of-Sample ADF validation, showing that eigenvector shifts can signal the need for rebalancing even when IS/OOS ADF still indicates a stationary spread. While the method is intended mainly for live trading monitoring, the article concludes that eigenvector comparison could also be integrated into the scoring system—though its actual contribution to performance remains to be tested.

Overcoming The Limitation of Machine Learning (Part 9): Correlation-Based Feature Learning in Self-Supervised Finance

Self-supervised learning is a powerful paradigm of statistical learning that searches for supervisory signals generated from the observations themselves. This approach reframes challenging unsupervised learning problems into more familiar supervised ones. This technology has overlooked applications for our objective as a community of algorithmic traders. Our discussion, therefore, aims to give the reader an approachable bridge into the open research area of self-supervised learning and offers practical applications that provide robust and reliable statistical models of financial markets without overfitting to small datasets.

Causal inference in time series classification problems

In this article, we will look at the theory of causal inference using machine learning, as well as the custom approach implementation in Python. Causal inference and causal thinking have their roots in philosophy and psychology and play an important role in our understanding of reality.

Data Science and ML (Part 44): Forex OHLC Time series Forecasting using Vector Autoregression (VAR)

Explore how Vector Autoregression (VAR) models can forecast Forex OHLC (Open, High, Low, and Close) time series data. This article covers VAR implementation, model training, and real-time forecasting in MetaTrader 5, helping traders analyze interdependent currency movements and improve their trading strategies.

MQL5 Wizard Techniques you should know (Part 52): Accelerator Oscillator

The Accelerator Oscillator is another Bill Williams Indicator that tracks price momentum's acceleration and not just its pace. Although much like the Awesome oscillator we reviewed in a recent article, it seeks to avoid the lagging effects by focusing more on acceleration as opposed to just speed. We examine as always what patterns we can get from this and also what significance each could have in trading via a wizard assembled Expert Advisor.

Neural Networks in Trading: Reducing Memory Consumption with Adam-mini Optimization

One of the directions for increasing the efficiency of the model training and convergence process is the improvement of optimization methods. Adam-mini is an adaptive optimization method designed to improve on the basic Adam algorithm.

Developing a Replay System (Part 52): Things Get Complicated (IV)

In this article, we will change the mouse pointer to enable the interaction with the control indicator to ensure reliable and stable operation.

Neural Networks in Trading: Hierarchical Dual-Tower Transformer (Final Part)

We continue to build the Hidformer hierarchical dual-tower transformer model designed for analyzing and forecasting complex multivariate time series. In this article, we will bring the work we started earlier to its logical conclusion — we will test the model on real historical data.

Category Theory in MQL5 (Part 11): Graphs

This article is a continuation in a series that look at Category Theory implementation in MQL5. In here we examine how Graph-Theory could be integrated with monoids and other data structures when developing a close-out strategy to a trading system.

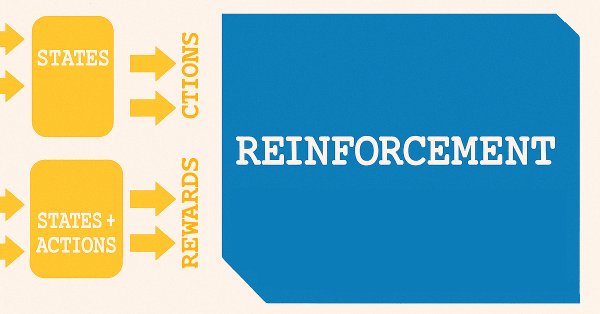

Neural Networks in Trading: Memory Augmented Context-Aware Learning for Cryptocurrency Markets (Final Part)

The MacroHFT framework for high-frequency cryptocurrency trading uses context-aware reinforcement learning and memory to adapt to dynamic market conditions. At the end of this article, we will test the implemented approaches on real historical data to assess their effectiveness.

MQL5 Wizard Techniques you should know (Part 20): Symbolic Regression

Symbolic Regression is a form of regression that starts with minimal to no assumptions on what the underlying model that maps the sets of data under study would look like. Even though it can be implemented by Bayesian Methods or Neural Networks, we look at how an implementation with Genetic Algorithms can help customize an expert signal class usable in the MQL5 wizard.

Neural networks made easy (Part 63): Unsupervised Pretraining for Decision Transformer (PDT)

We continue to discuss the family of Decision Transformer methods. From previous article, we have already noticed that training the transformer underlying the architecture of these methods is a rather complex task and requires a large labeled dataset for training. In this article we will look at an algorithm for using unlabeled trajectories for preliminary model training.

Implementing Practical Modules from Other Languages in MQL5 (Part 01): Building the SQLite3 Library, Inspired by Python

The sqlite3 module in Python offers a straightforward approach for working with SQLite databases, it is fast and convenient. In this article, we are going to build a similar module on top of built-in MQL5 functions for working with databases to make it easier to work with SQLite3 databases in MQL5 as in Python.

Developing a Replay System (Part 30): Expert Advisor project — C_Mouse class (IV)

Today we will learn a technique that can help us a lot in different stages of our professional life as a programmer. Often it is not the platform itself that is limited, but the knowledge of the person who talks about the limitations. This article will tell you that with common sense and creativity you can make the MetaTrader 5 platform much more interesting and versatile without resorting to creating crazy programs or anything like that, and create simple yet safe and reliable code. We will use our creativity to modify existing code without deleting or adding a single line to the source code.

MQL5 Wizard Techniques you should know (Part 35): Support Vector Regression

Support Vector Regression is an idealistic way of finding a function or ‘hyper-plane’ that best describes the relationship between two sets of data. We attempt to exploit this in time series forecasting within custom classes of the MQL5 wizard.

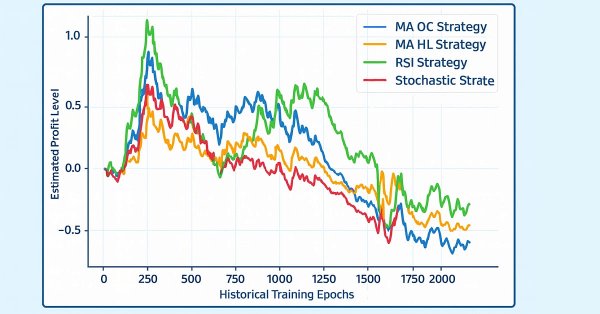

MQL5 Wizard Techniques you should know (Part 60): Inference Learning (Wasserstein-VAE) with Moving Average and Stochastic Oscillator Patterns

We wrap our look into the complementary pairing of the MA & Stochastic oscillator by examining what role inference-learning can play in a post supervised-learning & reinforcement-learning situation. There are clearly a multitude of ways one can choose to go about inference learning in this case, our approach, however, is to use variational auto encoders. We explore this in python before exporting our trained model by ONNX for use in a wizard assembled Expert Advisor in MetaTrader.

News Trading Made Easy (Part 4): Performance Enhancement

This article will dive into methods to improve the expert's runtime in the strategy tester, the code will be written to divide news event times into hourly categories. These news event times will be accessed within their specified hour. This ensures that the EA can efficiently manage event-driven trades in both high and low-volatility environments.

Overcoming The Limitation of Machine Learning (Part 7): Automatic Strategy Selection

This article demonstrates how to automatically identify potentially profitable trading strategies using MetaTrader 5. White-box solutions, powered by unsupervised matrix factorization, are faster to configure, more interpretable, and provide clear guidance on which strategies to retain. Black-box solutions, while more time-consuming, are better suited for complex market conditions that white-box approaches may not capture. Join us as we discuss how our trading strategies can help us carefully identify profitable strategies under any circumstance.

Example of Causality Network Analysis (CNA) and Vector Auto-Regression Model for Market Event Prediction

This article presents a comprehensive guide to implementing a sophisticated trading system using Causality Network Analysis (CNA) and Vector Autoregression (VAR) in MQL5. It covers the theoretical background of these methods, provides detailed explanations of key functions in the trading algorithm, and includes example code for implementation.

MQL5 Trading Toolkit (Part 5): Expanding the History Management EX5 Library with Position Functions

Discover how to create exportable EX5 functions to efficiently query and save historical position data. In this step-by-step guide, we will expand the History Management EX5 library by developing modules that retrieve key properties of the most recently closed position. These include net profit, trade duration, pip-based stop loss, take profit, profit values, and various other important details.

Artificial Showering Algorithm (ASHA)

The article presents the Artificial Showering Algorithm (ASHA), a new metaheuristic method developed for solving general optimization problems. Based on simulation of water flow and accumulation processes, this algorithm constructs the concept of an ideal field, in which each unit of resource (water) is called upon to find an optimal solution. We will find out how ASHA adapts flow and accumulation principles to efficiently allocate resources in a search space, and see its implementation and test results.

Statistical Arbitrage Through Cointegrated Stocks (Part 9): Backtesting Portfolio Weights Updates

This article describes the use of CSV files for backtesting portfolio weights updates in a mean-reversion-based strategy that uses statistical arbitrage through cointegrated stocks. It goes from feeding the database with the results of a Rolling Windows Eigenvector Comparison (RWEC) to comparing the backtest reports. In the meantime, the article details the role of each RWEC parameter and its impact in the overall backtest result, showing how the comparison of the relative drawdown can help us to further improve those parameters.

MQL5 Wizard Techniques you should know (Part 10). The Unconventional RBM

Restrictive Boltzmann Machines are at the basic level, a two-layer neural network that is proficient at unsupervised classification through dimensionality reduction. We take its basic principles and examine if we were to re-design and train it unorthodoxly, we could get a useful signal filter.

Implementing Practical Modules from Other Languages in MQL5 (Part 04): time, date, and datetime modules from Python

Unlike MQL5, Python programming language offers control and flexibility when it comes to dealing with and manipulating time. In this article, we will implement similar modules for better handling of dates and time in MQL5 as in Python.

Arithmetic Optimization Algorithm (AOA): From AOA to SOA (Simple Optimization Algorithm)

In this article, we present the Arithmetic Optimization Algorithm (AOA) based on simple arithmetic operations: addition, subtraction, multiplication and division. These basic mathematical operations serve as the foundation for finding optimal solutions to various problems.

MQL5 Wizard Techniques you should know (Part 40): Parabolic SAR

The Parabolic Stop-and-Reversal (SAR) is an indicator for trend confirmation and trend termination points. Because it is a laggard in identifying trends its primary purpose has been in positioning trailing stop losses on open positions. We, however, explore if indeed it could be used as an Expert Advisor signal, thanks to custom signal classes of wizard assembled Expert Advisors.

Neural networks made easy (Part 77): Cross-Covariance Transformer (XCiT)

In our models, we often use various attention algorithms. And, probably, most often we use Transformers. Their main disadvantage is the resource requirement. In this article, we will consider a new algorithm that can help reduce computing costs without losing quality.

Introduction to MQL5 (Part 32): Mastering API and WebRequest Function in MQL5 (VI)

This article will show you how to visualize candle data obtained via the WebRequest function and API in candle format. We'll use MQL5 to read the candle data from a CSV file and display it as custom candles on the chart, since indicators cannot directly use the WebRequest function.

Neural networks made easy (Part 70): Closed-Form Policy Improvement Operators (CFPI)

In this article, we will get acquainted with an algorithm that uses closed-form policy improvement operators to optimize Agent actions in offline mode.

Developing a Replay System (Part 57): Understanding a Test Service

One point to note: although the service code is not included in this article and will only be provided in the next one, I'll explain it since we'll be using that same code as a springboard for what we're actually developing. So, be attentive and patient. Wait for the next article, because every day everything becomes more interesting.

Atmosphere Clouds Model Optimization (ACMO): Theory

The article is devoted to the metaheuristic Atmosphere Clouds Model Optimization (ACMO) algorithm, which simulates the behavior of clouds to solve optimization problems. The algorithm uses the principles of cloud generation, movement and propagation, adapting to the "weather conditions" in the solution space. The article reveals how the algorithm's meteorological simulation finds optimal solutions in a complex possibility space and describes in detail the stages of ACMO operation, including "sky" preparation, cloud birth, cloud movement, and rain concentration.

MQL5 Trading Toolkit (Part 6): Expanding the History Management EX5 Library with the Last Filled Pending Order Functions

Learn how to create an EX5 module of exportable functions that seamlessly query and save data for the most recently filled pending order. In this comprehensive step-by-step guide, we will enhance the History Management EX5 library by developing dedicated and compartmentalized functions to retrieve essential properties of the last filled pending order. These properties include the order type, setup time, execution time, filling type, and other critical details necessary for effective pending orders trade history management and analysis.

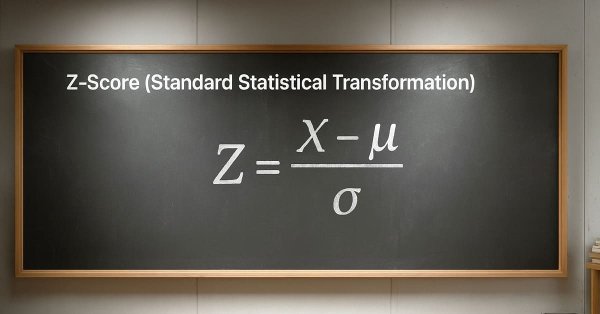

Self Optimizing Expert Advisors in MQL5 (Part 14): Viewing Data Transformations as Tuning Parameters of Our Feedback Controller

Preprocessing is a powerful yet quickly overlooked tuning parameter. It lives in the shadows of its bigger brothers: optimizers and shiny model architectures. Small percentage improvements here can have disproportionately large, compounding effects on profitability and risk. Too often, this largely unexplored science is boiled down to a simple routine, seen only as a means to an end, when in reality it is where signal can be directly amplified, or just as easily destroyed.

Neural networks made easy (Part 69): Density-based support constraint for the behavioral policy (SPOT)

In offline learning, we use a fixed dataset, which limits the coverage of environmental diversity. During the learning process, our Agent can generate actions beyond this dataset. If there is no feedback from the environment, how can we be sure that the assessments of such actions are correct? Maintaining the Agent's policy within the training dataset becomes an important aspect to ensure the reliability of training. This is what we will talk about in this article.

Neural Networks in Trading: Multi-Task Learning Based on the ResNeXt Model (Final Part)

We continue exploring a multi-task learning framework based on ResNeXt, which is characterized by modularity, high computational efficiency, and the ability to identify stable patterns in data. Using a single encoder and specialized "heads" reduces the risk of model overfitting and improves the quality of forecasts.

Developing a Replay System (Part 45): Chart Trade Project (IV)

The main purpose of this article is to introduce and explain the C_ChartFloatingRAD class. We have a Chart Trade indicator that works in a rather interesting way. As you may have noticed, we still have a fairly small number of objects on the chart, and yet we get the expected functionality. The values present in the indicator can be edited. The question is, how is this possible? This article will start to make things clearer.

Developing a Replay System (Part 55): Control Module

In this article, we will implement a control indicator so that it can be integrated into the message system we are developing. Although it is not very difficult, there are some details that need to be understood about the initialization of this module. The material presented here is for educational purposes only. In no way should it be considered as an application for any purpose other than learning and mastering the concepts shown.

Neural Networks in Trading: Hyperbolic Latent Diffusion Model (HypDiff)

The article considers methods of encoding initial data in hyperbolic latent space through anisotropic diffusion processes. This helps to more accurately preserve the topological characteristics of the current market situation and improves the quality of its analysis.

Forex Arbitrage Trading: Relationship Assessment Panel

This article presents the development of an arbitrage analysis panel in MQL5. How to get fair exchange rates on Forex in different ways? Create an indicator to obtain deviations of market prices from fair exchange rates, as well as to assess the benefits of arbitrage ways of exchanging one currency for another (as in triangular arbitrage).