Creating Documentation Based on MQL5 Source Code

This article considers creation of documentation for MQL5 code starting with the automated markup of required tags. It also provides the description of how to use the Doxygen software, how to properly configure it and how to receive results in different formats, including html, HtmlHelp and PDF.

How to create a custom Donchian Channel indicator using MQL5

There are many technical tools that can be used to visualize a channel surrounding prices, One of these tools is the Donchian Channel indicator. In this article, we will learn how to create the Donchian Channel indicator and how we can trade it as a custom indicator using EA.

MQL5 — You too can become a master of this language

This article will be a kind of interview with myself, in which I will tell you how I took my first steps in the MQL5 language. I will show you how you can become a great MQL5 programmer. I will explain the necessary bases for you to achieve this feat. The only prerequisite is a willingness to learn.

Timeseries in DoEasy library (part 45): Multi-period indicator buffers

In this article, I will start the improvement of the indicator buffer objects and collection class for working in multi-period and multi-symbol modes. I am going to consider the operation of buffer objects for receiving and displaying data from any timeframe on the current symbol chart.

Graphical Interfaces XI: Refactoring the Library code (build 14.1)

As the library grows, its code must be optimized again in order to reduce its size. The version of the library described in this article has become even more object-oriented. This made the code easier to learn. A detailed description of the latest changes will allow the readers to develop the library independently based on their own needs.

Building a Spectrum Analyzer

This article is intended to get its readers acquainted with a possible variant of using graphical objects of the MQL5 language. It analyses an indicator, which implements a panel of managing a simple spectrum analyzer using the graphical objects. The article is meant for readers acquianted with basics of MQL5.

Creating an EA that works automatically (Part 12): Automation (IV)

If you think automated systems are simple, then you probably don't fully understand what it takes to create them. In this article, we will talk about the problem that kills a lot of Expert Advisors. The indiscriminate triggering of orders is a possible solution to this problem.

Algorithmic trading based on 3D reversal patterns

Discovering a new world of automated trading on 3D bars. What does a trading robot look like on multidimensional price bars? Are "yellow" clusters of 3D bars able to predict trend reversals? What does multidimensional trading look like?

Complex indicators made easy using objects

This article provides a method to create complex indicators while also avoiding the problems that arise when dealing with multiple plots, buffers and/or combining data from multiple sources.

Larry Williams Market Secrets (Part 4): Automating Short-Term Swing Highs and Lows in MQL5

Master the automation of Larry Williams’ short-term swing patterns using MQL5. In this guide, we develop a fully configurable Expert Advisor (EA) that leverages non-random market structures. We’ll cover how to integrate robust risk management and flexible exit logic, providing a solid foundation for systematic strategy development and backtesting.

Statistical Estimations

Estimation of statistical parameters of a sequence is very important, since most of mathematical models and methods are based on different assumptions. For example, normality of distribution law or dispersion value, or other parameters. Thus, when analyzing and forecasting of time series we need a simple and convenient tool that allows quickly and clearly estimating the main statistical parameters. The article shortly describes the simplest statistical parameters of a random sequence and several methods of its visual analysis. It offers the implementation of these methods in MQL5 and the methods of visualization of the result of calculations using the Gnuplot application.

Graphics in DoEasy library (Part 89): Programming standard graphical objects. Basic functionality

Currently, the library is able to track standard graphical objects on the client terminal chart, including their removal and modification of some of their parameters. At the moment, it lacks the ability to create standard graphical objects from custom programs.

Graphical Interfaces VIII: The Tree View Control (Chapter 2)

The previous chapter of part VIII on graphical interfaces has focused on the elements of static and drop-down calendar. The second chapter will be dedicated to an equally complex element — a tree view, that is included in every complete library used for creating graphical interfaces. A tree view implemented in this article contains multiple flexible settings and modes, thus allowing to adjust this element of control to your needs.

Library for easy and quick development of MetaTrader programs (part VI): Netting account events

In the previous articles, we started creating a large cross-platform library simplifying the development of programs for MetaTrader 5 and MetaTrader 4 platforms. In the fifth part of the article series, we created trading event classes and the event collection, from which the events are sent to the base object of the Engine library and the control program chart. In this part, we will let the library to work on netting accounts.

Implementing a Rapid-Fire Trading Strategy Algorithm with Parabolic SAR and Simple Moving Average (SMA) in MQL5

In this article, we develop a Rapid-Fire Trading Expert Advisor in MQL5, leveraging the Parabolic SAR and Simple Moving Average (SMA) indicators to create a responsive trading strategy. We detail the strategy’s implementation, including indicator usage, signal generation, and the testing and optimization process.

Developing a trading Expert Advisor from scratch (Part 31): Towards the future (IV)

We continue to remove separate parts from our EA. This is the last article within this series. And the last thing to be removed is the sound system. This can be a bit confusing if you haven't followed these article series.

Price Action Analysis Toolkit Development (Part 6): Mean Reversion Signal Reaper

While some concepts may seem straightforward at first glance, bringing them to life in practice can be quite challenging. In the article below, we'll take you on a journey through our innovative approach to automating an Expert Advisor (EA) that skillfully analyzes the market using a mean reversion strategy. Join us as we unravel the intricacies of this exciting automation process.

Creating an EA that works automatically (Part 06): Account types (I)

Today we'll see how to create an Expert Advisor that simply and safely works in automatic mode. Our EA in its current state can work in any situation but it is not yet ready for automation. We still have to work on a few points.

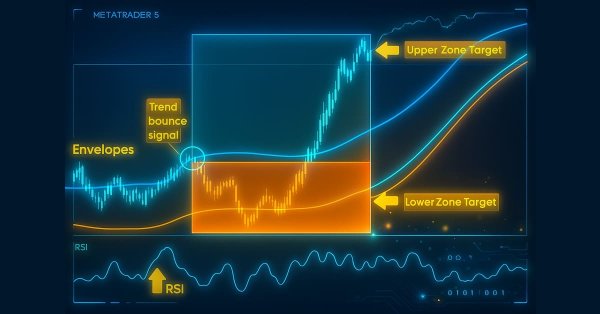

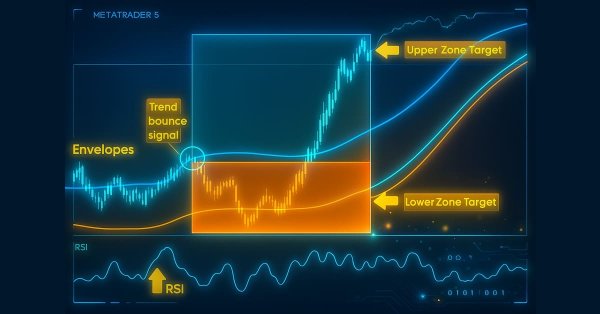

Automating Trading Strategies in MQL5 (Part 22): Creating a Zone Recovery System for Envelopes Trend Trading

In this article, we develop a Zone Recovery System integrated with an Envelopes trend-trading strategy in MQL5. We outline the architecture for using RSI and Envelopes indicators to trigger trades and manage recovery zones to mitigate losses. Through implementation and backtesting, we show how to build an effective automated trading system for dynamic markets

Neural networks made easy (Part 30): Genetic algorithms

Today I want to introduce you to a slightly different learning method. We can say that it is borrowed from Darwin's theory of evolution. It is probably less controllable than the previously discussed methods but it allows training non-differentiable models.

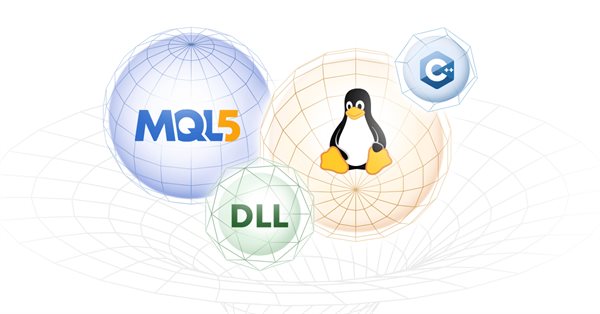

Develop a Proof-of-Concept DLL with C++ multi-threading support for MetaTrader 5 on Linux

We will begin the journey to explore the steps and workflow on how to base development for MetaTrader 5 platform solely on Linux system in which the final product works seamlessly on both Windows and Linux system. We will get to know Wine, and Mingw; both are the essential tools to make cross-platform development works. Especially Mingw for its threading implementations (POSIX, and Win32) that we need to consider in choosing which one to go with. We then build a proof-of-concept DLL and consume it in MQL5 code, finally compare the performance of both threading implementations. All for your foundation to expand further on your own. You should be comfortable building MT related tools on Linux after reading this article.

Learn how to design a trading system by Force Index

Welcome to a new article in our series about how to design a trading system by the most popular technical indicators. In this article, we will learn about a new technical indicator and how to create a trading system using the Force Index indicator.

Graphics in DoEasy library (Part 94): Moving and deleting composite graphical objects

In this article, I will start the development of various composite graphical object events. We will also partially consider moving and deleting a composite graphical object. In fact, here I am going to fine-tune the things I implemented in the previous article.

Automating Trading Strategies in MQL5 (Part 22): Creating a Zone Recovery System for Envelopes Trend Trading

In this article, we develop a Zone Recovery System integrated with an Envelopes trend-trading strategy in MQL5. We outline the architecture for using RSI and Envelopes indicators to trigger trades and manage recovery zones to mitigate losses. Through implementation and backtesting, we show how to build an effective automated trading system for dynamic markets

Developing a Replay System — Market simulation (Part 01): First experiments (I)

How about creating a system that would allow us to study the market when it is closed or even to simulate market situations? Here we are going to start a new series of articles in which we will deal with this topic.

Neural networks made easy (Part 13): Batch Normalization

In the previous article, we started considering methods aimed at improving neural network training quality. In this article, we will continue this topic and will consider another approach — batch data normalization.

Introduction to Connexus (Part 1): How to Use the WebRequest Function?

This article is the beginning of a series of developments for a library called “Connexus” to facilitate HTTP requests with MQL5. The goal of this project is to provide the end user with this opportunity and show how to use this helper library. I intended to make it as simple as possible to facilitate study and to provide the possibility for future developments.

Data Science and Machine Learning (Part 04): Predicting Current Stock Market Crash

In this article I am going to attempt to use our logistic model to predict the stock market crash based upon the fundamentals of the US economy, the NETFLIX and APPLE are the stocks we are going to focus on, Using the previous market crashes of 2019 and 2020 let's see how our model will perform in the current dooms and glooms.

Using Discriminant Analysis to Develop Trading Systems

When developing a trading system, there usually arises a problem of selecting the best combination of indicators and their signals. Discriminant analysis is one of the methods to find such combinations. The article gives an example of developing an EA for market data collection and illustrates the use of the discriminant analysis for building prognostic models for the FOREX market in Statistica software.

MQL5 Trading Tools (Part 3): Building a Multi-Timeframe Scanner Dashboard for Strategic Trading

In this article, we build a multi-timeframe scanner dashboard in MQL5 to display real-time trading signals. We plan an interactive grid interface, implement signal calculations with multiple indicators, and add a close button. The article concludes with backtesting and strategic trading benefits

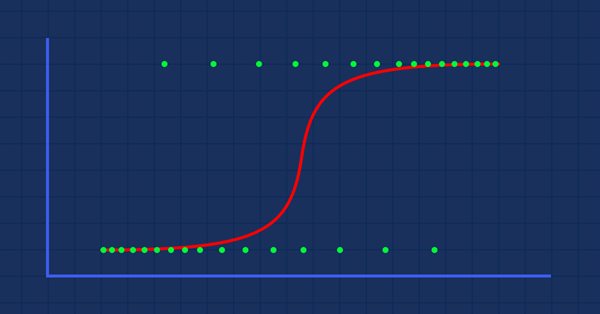

Data Science and Machine Learning (Part 02): Logistic Regression

Data Classification is a crucial thing for an algo trader and a programmer. In this article, we are going to focus on one of classification logistic algorithms that can probability help us identify the Yes's or No's, the Ups and Downs, Buys and Sells.

Growing Neural Gas: Implementation in MQL5

The article shows an example of how to develop an MQL5-program implementing the adaptive algorithm of clustering called Growing neural gas (GNG). The article is intended for the users who have studied the language documentation and have certain programming skills and basic knowledge in the area of neuroinformatics.

DIY technical indicator

In this article, I will consider the algorithms allowing you to create your own technical indicator. You will learn how to obtain pretty complex and interesting results with very simple initial assumptions.

Learn how to design a trading system by DeMarker

Here is a new article in our series about how to design a trading system by the most popular technical indicators. In this article, we will present how to create a trading system by the DeMarker indicator.

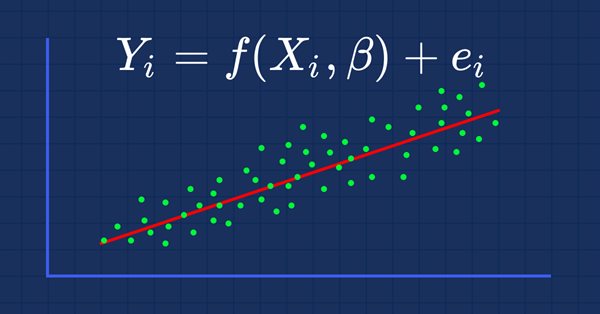

MQL5 Wizard techniques you should know (Part 01): Regression Analysis

Todays trader is a philomath who is almost always (either consciously or not...) looking up new ideas, trying them out, choosing to modify them or discard them; an exploratory process that should cost a fair amount of diligence. This clearly places a premium on the trader's time and the need to avoid mistakes. These series of articles will proposition that the MQL5 wizard should be a mainstay for traders. Why? Because not only does the trader save time by assembling his new ideas with the MQL5 wizard, and greatly reduce mistakes from duplicate coding; he is ultimately set-up to channel his energy on the few critical areas of his trading philosophy.

Formulating Dynamic Multi-Pair EA (Part 5): Scalping vs Swing Trading Approaches

This part explores how to design a Dynamic Multi-Pair Expert Advisor capable of adapting between Scalping and Swing Trading modes. It covers the structural and algorithmic differences in signal generation, trade execution, and risk management, allowing the EA to intelligently switch strategies based on market behavior and user input.

Brute force approach to pattern search (Part II): Immersion

In this article we will continue discussing the brute force approach. I will try to provide a better explanation of the pattern using the new improved version of my application. I will also try to find the difference in stability using different time intervals and timeframes.

Building a Trading System (Part 2): The Science of Position Sizing

Even with a positive-expectancy system, position sizing determines whether you thrive or collapse. It’s the pivot of risk management—translating statistical edges into real-world results while safeguarding your capital.

Trading with the MQL5 Economic Calendar (Part 1): Mastering the Functions of the MQL5 Economic Calendar

In this article, we explore how to use the MQL5 Economic Calendar for trading by first understanding its core functionalities. We then implement key functions of the Economic Calendar in MQL5 to extract relevant news data for trading decisions. Finally, we conclude by showcasing how to utilize this information to enhance trading strategies effectively.

Building A Candlestick Trend Constraint Model(Part 2): Merging Native Indicators

This article focuses on taking advantage of in-built meta trader 5 indicators to screen out off-trend signals. Advancing from the previous article we will explore how to do it using MQL5 code to communicate our idea to the final program.