From Basic to Intermediate: Variables (III)

Today we will look at how to use predefined MQL5 language variables and constants. In addition, we will analyze another special type of variables: functions. Knowing how to properly work with these variables can mean the difference between an application that works and one that doesn't. In order to understand what is presented here, it is necessary to understand the material that was discussed in previous articles.

Developing a Replay System — Market simulation (Part 22): FOREX (III)

Although this is the third article on this topic, I must explain for those who have not yet understood the difference between the stock market and the foreign exchange market: the big difference is that in the Forex there is no, or rather, we are not given information about some points that actually occurred during the course of trading.

Connexus Helper (Part 5): HTTP Methods and Status Codes

In this article, we will understand HTTP methods and status codes, two very important pieces of communication between client and server on the web. Understanding what each method does gives you the control to make requests more precisely, informing the server what action you want to perform and making it more efficient.

Developing a Replay System (Part 73): An Unusual Communication (II)

In this article, we will look at how to transmit information in real time between the indicator and the service, and also understand why problems may arise when changing the timeframe and how to solve them. As a bonus, you will get access to the latest version of the replay /simulation app.

MQL5 Trading Tools (Part 13): Creating a Canvas-Based Price Dashboard with Graph and Stats Panels

In this article, we develop a canvas-based price dashboard in MQL5 using the CCanvas class to create interactive panels for visualizing recent price graphs and account statistics, with support for background images, fog effects, and gradient fills. The system includes draggable and resizable features via mouse event handling, theme toggling between dark and light modes with dynamic color adjustments, and minimize/maximize controls for efficient chart space management.

Neural Networks in Trading: A Complex Trajectory Prediction Method (Traj-LLM)

In this article, I would like to introduce you to an interesting trajectory prediction method developed to solve problems in the field of autonomous vehicle movements. The authors of the method combined the best elements of various architectural solutions.

Risk-Based Trade Placement EA with On-Chart UI (Part 2): Adding Interactivity and Logic

Learn how to build an interactive MQL5 Expert Advisor with an on-chart control panel. Know how to compute risk-based lot sizes and place trades directly from the chart.

How can century-old functions update your trading strategies?

This article considers the Rademacher and Walsh functions. We will explore ways to apply these functions to financial time series analysis and also consider various applications for them in trading.

Propensity score in causal inference

The article examines the topic of matching in causal inference. Matching is used to compare similar observations in a data set. This is necessary to correctly determine causal effects and get rid of bias. The author explains how this helps in building trading systems based on machine learning, which become more stable on new data they were not trained on. The propensity score plays a central role and is widely used in causal inference.

Evolutionary trading algorithm with reinforcement learning and extinction of feeble individuals (ETARE)

In this article, I introduce an innovative trading algorithm that combines evolutionary algorithms with deep reinforcement learning for Forex trading. The algorithm uses the mechanism of extinction of inefficient individuals to optimize the trading strategy.

Reusing Invalidated Orderblocks As Mitigation Blocks (SMC)

In this article, we explore how previously invalidated orderblocks can be reused as mitigation blocks within Smart Money Concepts (SMC). These zones reveal where institutional traders re-enter the market after a failed orderblock, providing high-probability areas for trade continuation in the dominant trend.

Example of CNA (Causality Network Analysis), SMOC (Stochastic Model Optimal Control) and Nash Game Theory with Deep Learning

We will add Deep Learning to those three examples that were published in previous articles and compare results with previous. The aim is to learn how to add DL to other EA.

Self Optimizing Expert Advisors in MQL5 (Part 8): Multiple Strategy Analysis (2)

Join us for our follow-up discussion, where we will merge our first two trading strategies into an ensemble trading strategy. We shall demonstrate the different schemes possible for combining multiple strategies and also how to exercise control over the parameter space, to ensure that effective optimization remains possible even as our parameter size grows.

Example of Stochastic Optimization and Optimal Control

This Expert Advisor, named SMOC (likely standing for Stochastic Model Optimal Control), is a simple example of an advanced algorithmic trading system for MetaTrader 5. It uses a combination of technical indicators, model predictive control, and dynamic risk management to make trading decisions. The EA incorporates adaptive parameters, volatility-based position sizing, and trend analysis to optimize its performance across varying market conditions.

Developing a Replay System (Part 37): Paving the Path (I)

In this article, we will finally begin to do what we wanted to do much earlier. However, due to the lack of "solid ground", I did not feel confident to present this part publicly. Now I have the basis to do this. I suggest that you focus as much as possible on understanding the content of this article. I mean not simply reading it. I want to emphasize that if you do not understand this article, you can completely give up hope of understanding the content of the following ones.

Gain An Edge Over Any Market (Part IV): CBOE Euro And Gold Volatility Indexes

We will analyze alternative data curated by the Chicago Board Of Options Exchange (CBOE) to improve the accuracy of our deep neural networks when forecasting the XAUEUR symbol.

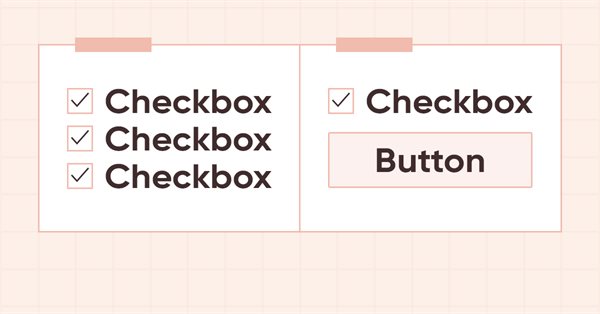

DoEasy. Controls (Part 11): WinForms objects — groups, CheckedListBox WinForms object

The article considers grouping WinForms objects and creation of the CheckBox objects list object.

From Basic to Intermediate: Variables (I)

Many beginning programmers have a hard time understanding why their code doesn't work as they expect. There are many things that make code truly functional. It's not just a bunch of different functions and operations that make the code work. Today I invite you to learn how to properly create real code, rather than copy and paste fragments of it. The materials presented here are for didactic purposes only. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

From Novice to Expert: Animated News Headline Using MQL5 (X)—Multiple Symbol Chart View for News Trading

Today we will develop a multi-chart view system using chart objects. The goal is to enhance news trading by applying MQL5 algorithms that help reduce trader reaction time during periods of high volatility, such as major news releases. In this case, we provide traders with an integrated way to monitor multiple major symbols within a single all-in-one news trading tool. Our work is continuously advancing with the News Headline EA, which now features a growing set of functions that add real value both for traders using fully automated systems and for those who prefer manual trading assisted by algorithms. Explore more knowledge, insights, and practical ideas by clicking through and joining this discussion.

Developing a Replay System — Market simulation (Part 19): Necessary adjustments

Here we will prepare the ground so that if we need to add new functions to the code, this will happen smoothly and easily. The current code cannot yet cover or handle some of the things that will be necessary to make meaningful progress. We need everything to be structured in order to enable the implementation of certain things with the minimal effort. If we do everything correctly, we can get a truly universal system that can very easily adapt to any situation that needs to be handled.

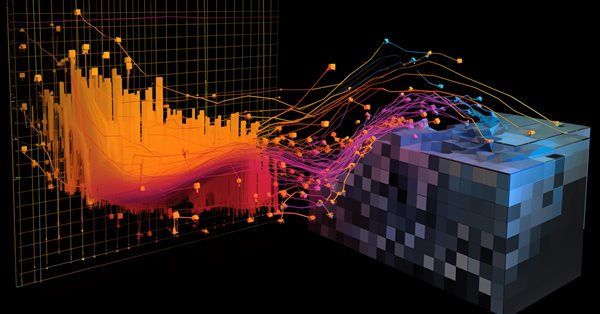

Data Science and ML (Part 43): Hidden Patterns Detection in Indicators Data Using Latent Gaussian Mixture Models (LGMM)

Have you ever looked at the chart and felt that strange sensation… that there’s a pattern hidden just beneath the surface? A secret code that might reveal where prices are headed if only you could crack it? Meet LGMM, the Market’s Hidden Pattern Detector. A machine learning model that helps identify those hidden patterns in the market.

Developing a Replay System (Part 51): Things Get Complicated (III)

In this article, we will look into one of the most difficult issues in the field of MQL5 programming: how to correctly obtain a chart ID, and why objects are sometimes not plotted on the chart. The materials presented here are for didactic purposes only. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Developing a multi-currency Expert Advisor (Part 18): Automating group selection considering forward period

Let's continue to automate the steps we previously performed manually. This time we will return to the automation of the second stage, that is, the selection of the optimal group of single instances of trading strategies, supplementing it with the ability to take into account the results of instances in the forward period.

MQL5 Wizard Techniques you should know (Part 28): GANs Revisited with a Primer on Learning Rates

The Learning Rate, is a step size towards a training target in many machine learning algorithms’ training processes. We examine the impact its many schedules and formats can have on the performance of a Generative Adversarial Network, a type of neural network that we had examined in an earlier article.

Neural Networks in Trading: Controlled Segmentation

In this article. we will discuss a method of complex multimodal interaction analysis and feature understanding.

Neural Networks in Trading: Directional Diffusion Models (DDM)

In this article, we discuss Directional Diffusion Models that exploit data-dependent anisotropic and directed noise in a forward diffusion process to capture meaningful graph representations.

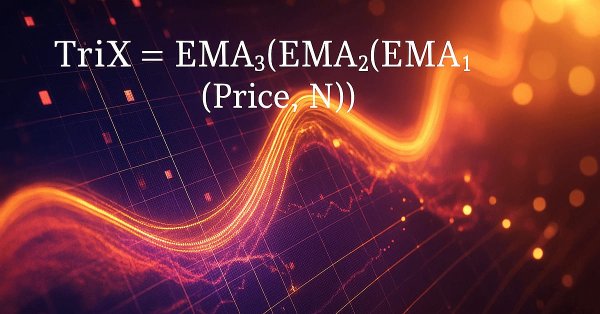

MQL5 Wizard Techniques you should know (Part 67): Using Patterns of TRIX and the Williams Percent Range

The Triple Exponential Moving Average Oscillator (TRIX) and the Williams Percentage Range Oscillator are another pair of indicators that could be used in conjunction within an MQL5 Expert Advisor. This indicator pair, like those we’ve covered recently, is also complementary given that TRIX defines the trend while Williams Percent Range affirms support and Resistance levels. As always, we use the MQL5 wizard to prototype any potential these two may have.

Trading with the MQL5 Economic Calendar (Part 8): Optimizing News-Driven Backtesting with Smart Event Filtering and Targeted Logs

In this article, we optimize our economic calendar with smart event filtering and targeted logging for faster, clearer backtesting in live and offline modes. We streamline event processing and focus logs on critical trade and dashboard events, enhancing strategy visualization. These improvements enable seamless testing and refinement of news-driven trading strategies.

From Novice to Expert: Backend Operations Monitor using MQL5

Using a ready-made solution in trading without concerning yourself with the internal workings of the system may sound comforting, but this is not always the case for developers. Eventually, an upgrade, misperformance, or unexpected error will arise, and it becomes essential to trace exactly where the issue originates to diagnose and resolve it quickly. Today’s discussion focuses on uncovering what normally happens behind the scenes of a trading Expert Advisor, and on developing a custom dedicated class for displaying and logging backend processes using MQL5. This gives both developers and traders the ability to quickly locate errors, monitor behavior, and access diagnostic information specific to each EA.

Integrating Computer Vision into Trading in MQL5 (Part 1): Creating Basic Functions

The EURUSD forecasting system with the use of computer vision and deep learning. Learn how convolutional neural networks can recognize complex price patterns in the foreign exchange market and predict exchange rate movements with up to 54% accuracy. The article shares the methodology for creating an algorithm that uses artificial intelligence technologies for visual analysis of charts instead of traditional technical indicators. The author demonstrates the process of transforming price data into "images", their processing by a neural network, and a unique opportunity to peer into the "consciousness" of AI through activation maps and attention heatmaps. Practical Python code using the MetaTrader 5 library allows readers to reproduce the system and apply it in their own trading.

Codex Pipelines, from Python to MQL5, for Indicator Selection: A Multi-Quarter Analysis of the XLF ETF with Machine Learning

We continue our look at how the selection of indicators can be pipelined when facing a ‘none-typical’ MetaTrader asset. MetaTrader 5 is primarily used to trade forex, and that is good given the liquidity on offer, however the case for trading outside of this ‘comfort-zone’, is growing bolder with not just the overnight rise of platforms like Robinhood, but also the relentless pursuit of an edge for most traders. We consider the XLF ETF for this article and also cap our revamped pipeline with a simple MLP.

Introduction to MQL5 (Part 42): Beginner Guide to File Handling in MQL5 (IV)

This article shows how to build an MQL5 indicator that reads a CSV trading history, extracts Profit($) values and total trades, and computes a cumulative balance progression. We plot the curve in a separate indicator window, auto-scale the Y-axis, and draw horizontal and vertical axes for alignment. The indicator updates on a timer and redraws only when new trades appear. Optional labels display per-trade profit and loss to help assess performance and drawdowns directly on the chart.

Category Theory in MQL5 (Part 10): Monoid Groups

This article continues the series on category theory implementation in MQL5. Here we look at monoid-groups as a means normalising monoid sets making them more comparable across a wider span of monoid sets and data types..

Developing a Replay System (Part 54): The Birth of the First Module

In this article, we will look at how to put together the first of a number of truly functional modules for use in the replay/simulator system that will also be of general purpose to serve other purposes. We are talking about the mouse module.

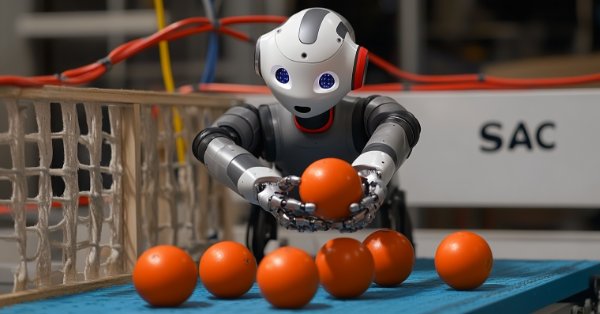

MQL5 Wizard Techniques you should know (Part 51): Reinforcement Learning with SAC

Soft Actor Critic is a Reinforcement Learning algorithm that utilizes 3 neural networks. An actor network and 2 critic networks. These machine learning models are paired in a master slave partnership where the critics are modelled to improve the forecast accuracy of the actor network. While also introducing ONNX in these series, we explore how these ideas could be put to test as a custom signal of a wizard assembled Expert Advisor.

Reimagining Classic Strategies in MQL5 (Part III): FTSE 100 Forecasting

In this series of articles, we will revisit well-known trading strategies to inquire, whether we can improve the strategies using AI. In today's article, we will explore the FTSE 100 and attempt to forecast the index using a portion of the individual stocks that make up the index.

From Novice to Expert: Animated News Headline Using MQL5 (VIII) — Quick Trade Buttons for News Trading

While algorithmic trading systems manage automated operations, many news traders and scalpers prefer active control during high-impact news events and fast-paced market conditions, requiring rapid order execution and management. This underscores the need for intuitive front-end tools that integrate real-time news feeds, economic calendar data, indicator insights, AI-driven analytics, and responsive trading controls.

Neural networks made easy (Part 72): Trajectory prediction in noisy environments

The quality of future state predictions plays an important role in the Goal-Conditioned Predictive Coding method, which we discussed in the previous article. In this article I want to introduce you to an algorithm that can significantly improve the prediction quality in stochastic environments, such as financial markets.

Implementing Practical Modules from Other Languages in MQL5 (Part 03): Schedule Module from Python, the OnTimer Event on Steroids

The schedule module in Python offers a simple way to schedule repeated tasks. While MQL5 lacks a built-in equivalent, in this article we’ll implement a similar library to make it easier to set up timed events in MetaTrader 5.

Category Theory in MQL5 (Part 23): A different look at the Double Exponential Moving Average

In this article we continue with our theme in the last of tackling everyday trading indicators viewed in a ‘new’ light. We are handling horizontal composition of natural transformations for this piece and the best indicator for this, that expands on what we just covered, is the double exponential moving average (DEMA).